Article | Jun 2020 | NACD Governance Challenges 2020

Analyzing Strategy to Drive Compensation Plan Design

Processes boards can implement to successfully align strategic business goals and executive compensation plans.

Is there any business strategy that can’t be supported at least in part by executive compensation plans?

In the last six years, there has been a major shift in how companies think about the progression from their stated approach to value creation, the plans they develop to achieve it, and how the team tasked with steering the ship is motivated and rewarded. A focus on long-range outcomes is becoming more common, and at the same time, the concepts around executive pay have matured beyond simply satisfying Human Resources’ requirements and meeting compliance mandates. We now know that when executive compensation is carefully designed and implemented, it functions as a strategic tool that helps the board to communicate priorities and shape a course of action. This is true under a “normal” economic and operating environment, and it is still true in times of extreme crisis—times such as much of the world is facing right now.

Consider several common, pre-pandemic business challenges:

- A company turnaround;

- Maximizing the opportunity in an industry transformation;

- Ensuring seamless business continuity with a planned CEO succession;

- Taking a company public;

- Incorporating environmental, social, and governance principles and practices at the behest of investors; and/or

- Volatile market conditions.

In each of these cases, boards can successfully move strategic business goals forward with corresponding compensation plans.

Yet there is no one-size-fits-all formula for what can admittedly be a highly detailed, time-consuming effort. The compensation committee has to dig deeply into the strategy, outline what it will take to execute the strategy, and then determine how to spur the management team to take the right actions to implement the plan.

In times of duress, whether it is a market disruption or a pandemic, this additional effort may feel like a speed bump that unnecessarily slows the process down. It may even be perceived as a luxury your company just can’t afford. However, there are tools and repeatable processes that have proven effective. They can help compensation committees, in a step-by-step way, to arrive at the right plan for the right time to solve for their unique company circumstances.

To achieve an alignment of strategy and compensation that will deliver results, the compensation committee must be able to make four important determinations:

- The desired business outcome over three, five, and 10 years;

- The short- and long-term actions needed to achieve that outcome;

- How to pivot temporarily (if necessary) due to an urgent situation, without losing sight of the long-range objective; and

- Whether progress is being made.

What Does Alignment Look Like?

Outside influencers and so-called best practices are rightfully taken into account, but these factors only inform your compensation program design. Similarly, market intelligence and data should be incorporated into decision making, but that alone cannot form the basis of an effective plan. It is especially important to remain focused on the strategic endgame, if and when new regulations introduce complexity.

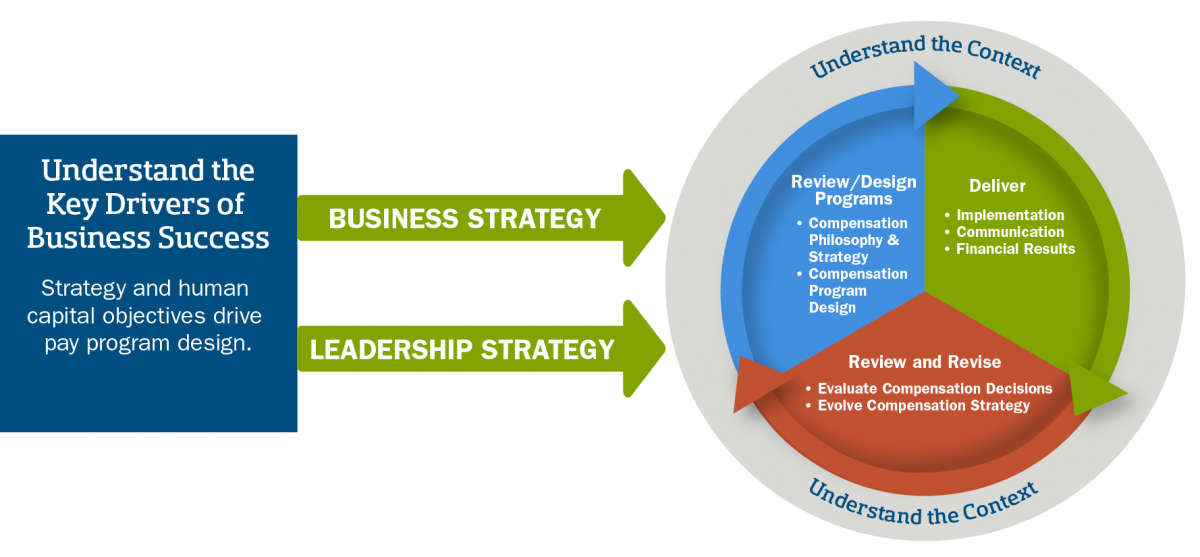

Ultimately, you want to strive for a balance where the company’s business and leadership strategies are the driving force, and together, your strategy and pay programs form a virtuous cycle of aligned actions and ongoing performance. This endeavor for overall balance doesn’t necessarily change, even if in extremely difficult or complicated situations there needs to be a stronger focus in one area. For instance, in the short term, human-capital objectives may temporarily have a strong and necessary emphasis.

What is Your Desired Outcome?

As Yogi Berra said, “If you don’t know where you’re going, you’ll end up someplace else.” The right mix of short- and long-term goals is a requirement for success. Outlining clear objectives is the first step, and no compensation program will be successful unless the strategy and the plan to achieve it are carefully thought out. To do this, the compensation committee must assess both the annual and long-range business plans.

Consider incorporating key milestones for long-term success into the annual incentive plan as a way to balance both the current and future needs of the business. Recognize that your annual plan may need to be more reactionary at times, but make those adjustments with an eye to a consistent, long-range view.

Take a few minutes to answer these questions:

- Where are we going, and how will we get there?

- What characteristics define our organization and culture?

- Are we a hierarchical company or are we entrepreneurial?

- Are we risk-takers or risk adverse?

- Are these characteristics consistent with our business strategy?

- How do we want our company to differ in the future from the way it is today?

- What are we going to do differently to get there?

- Is our annual business plan independent of our long-term business strategy, or does it outline incremental milestones that will help us to move forward on the path to our long-term goals?

- Are there industry or broader-market concerns that we see on the horizon that may impact our goals?

- Have we considered exogenous events that could alter or derail our short-term plans?

- What talents will the management team require in the future to successfully execute the strategy?

- What are our nonfinancial goals, and how do they support the strategy?

Answering these questions as an ongoing exercise can inform more than just your executive compensation plans; this exercise will benefit many other board and management decisions, such as investment strategy or leadership development and succession planning.

What Will Lead to the Achievement of the Desired Outcome?

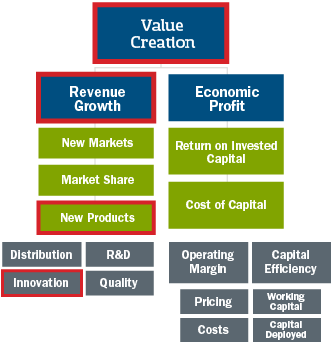

After exploring the desired outcomes of the business strategy, the board and management together need to uncover exactly what combination of actions, activities, and investments are going to result in value creation for the company. In other words, what is your company’s unique set of “value drivers”? This exercise will not only take into account business strategy, but also financial goals, industry considerations, competitive positioning, general market economics, and other similar influences.

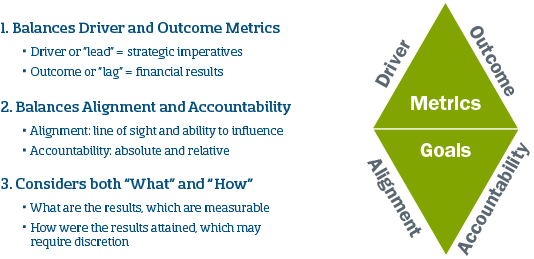

While there can be many indicators of success, boards should focus only on those performance metrics that are truly indicative of value creation. The board and management can use a number of tools to validate assumptions. The incentive measures put in place should ideally balance several perspectives and considerations.

In the example above, the company has highlighted revenue growth as its road to long-term value creation. That revenue growth, according to the business strategy, is based on new products, which are the result of highly innovative teams within the company that are properly funded and supported. Each of these identified drivers will have very different performance metrics, both in the short and the long term. There are additional factors to weigh as you evaluate your value drivers:

- Coordinating Effort: The measures themselves and the goal-setting process should accommodate the inevitable trade-offs between maximizing short-term performance and investing in long-term growth opportunities.

- Leading Versus Lagging Indicators: Avoid overemphasizing what has already occurred. Instead, focus on new initiatives that the management team is attempting to implement. Often, incentive measures are tied to financial statement results. These measures are largely lagging indicators, because they look at the results of past actions and decisions. While more challenging to define and track, appropriate leading indicators in the incentive plan can focus an organization on the activities that will improve the quality and sustainability of financial results.

- Line of Sight: While shareholders may prefer incentives that are tied to overall organizational results, committees need to consider the motivational aspects of incentive metrics. Incentive plans are most effective as management tools when they are tied to actions, decisions, and results that are within the control of participants.

- Caution With TSR: Total Shareholder Return is a great alignment tool and an excellent way to measure long-term value, but as an incentive, it cannot drive a management team to take the steps necessary to achieve long-term value creation.

How Do You Know If You're Making Progress?

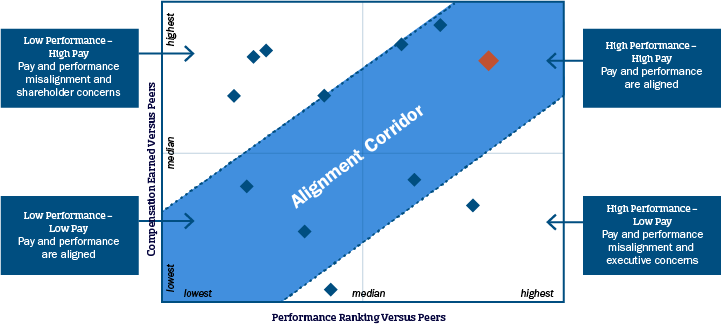

There are many ways to measure the link between business strategy and compensation. These analyses do not have to be conceptual or abstract; they can be achieved methodically and quantitatively. Three reliable tools and models that provide a solid framework for analysis include metrics correlation analysis, probability of achievement analysis, and pay-for-performance analysis.

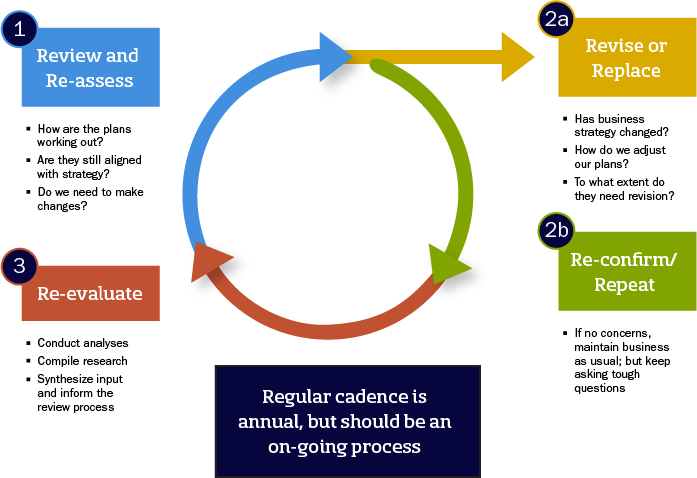

A year-end review of actual incentive plan results can help to inform future incentive plan design. New plans are then structured at the beginning of the year based on the company’s best estimation of the right measures and the degree of performance required to create shareholder value. These estimations should take into consideration the company’s historical performance, the performance of its industry peers, and the market as a whole. Look at actual results to evaluate which estimations were on target, and to determine what adjustments, if any, need to be made as a way to continue to refine the alignment of pay and performance.

Periodically review the goal-setting process itself, and consider whether the resulting payout curves accurately reflect the long-term expectations of stakeholders.

There are quantitative analyses that can add depth to a discussion about the degree of difficulty embedded in the current goal-setting process, and these can assess the extent to which internal budgets are aligned with market expectations for future growth.

Returning to the refrain of tailored design and evaluation, ideally, the measurement of performance will be taking place over a time span that roughly matches the company’s typical business cycle. Program designs can change each year as the company’s priorities change, or they can remain stable for many years, gradually evolving as the execution of the company’s strategy unfolds.

Conclusion

We have said many times that companies must “escape the conformity trap.” Do not allow your company’s approach to be defined by what other companies do or by what they want you to do. The link between strategy and compensation is unique for each firm and requires ongoing confirmation and revision.

If you consistently analyze your value drivers and design your compensation plans accordingly, you will have taken a huge step toward helping achieve strategy execution. And in many cases, you will have just set your firm apart from your rivals in terms of laying a foundation for success.

That’s a competitive advantage you don’t want to leave on the table.