Article | Mar 2025

Executive Compensation Highlights: First 100 S&P 500 Proxy Filers in 2025

Notable findings from public companies on CEO pay, LTI design, security perquisites, and diversity metrics in incentive plans.

Introduction

Pearl Meyer examined executive compensation disclosures from the first 100 S&P 500 shareholder proxy statements filed in 2025. Notable findings include the following:

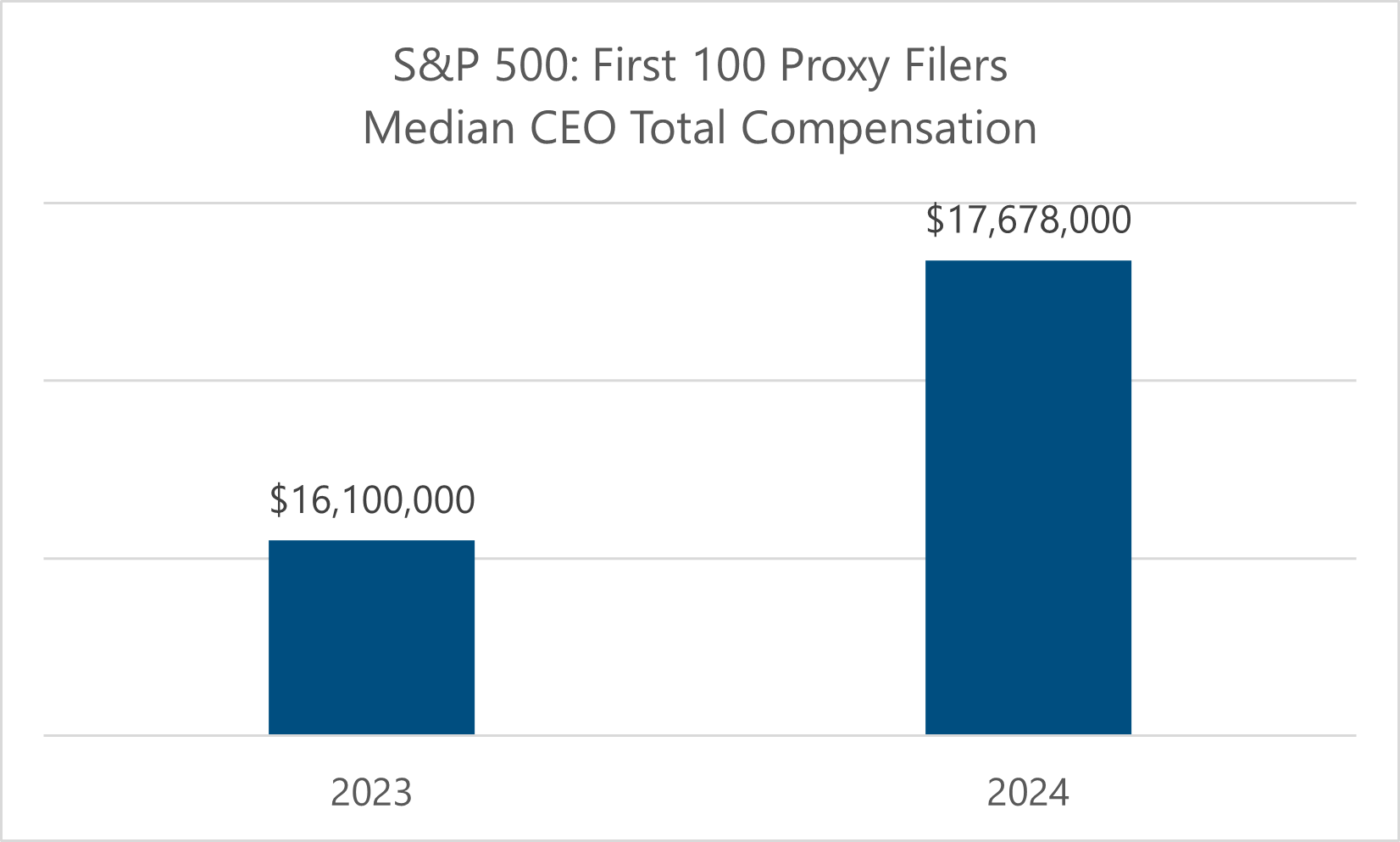

- Median CEO total compensation was $17.7 million in 2024 reflecting a 9.8% rise over 2023, mostly driven by increases in short- and long-term incentive values

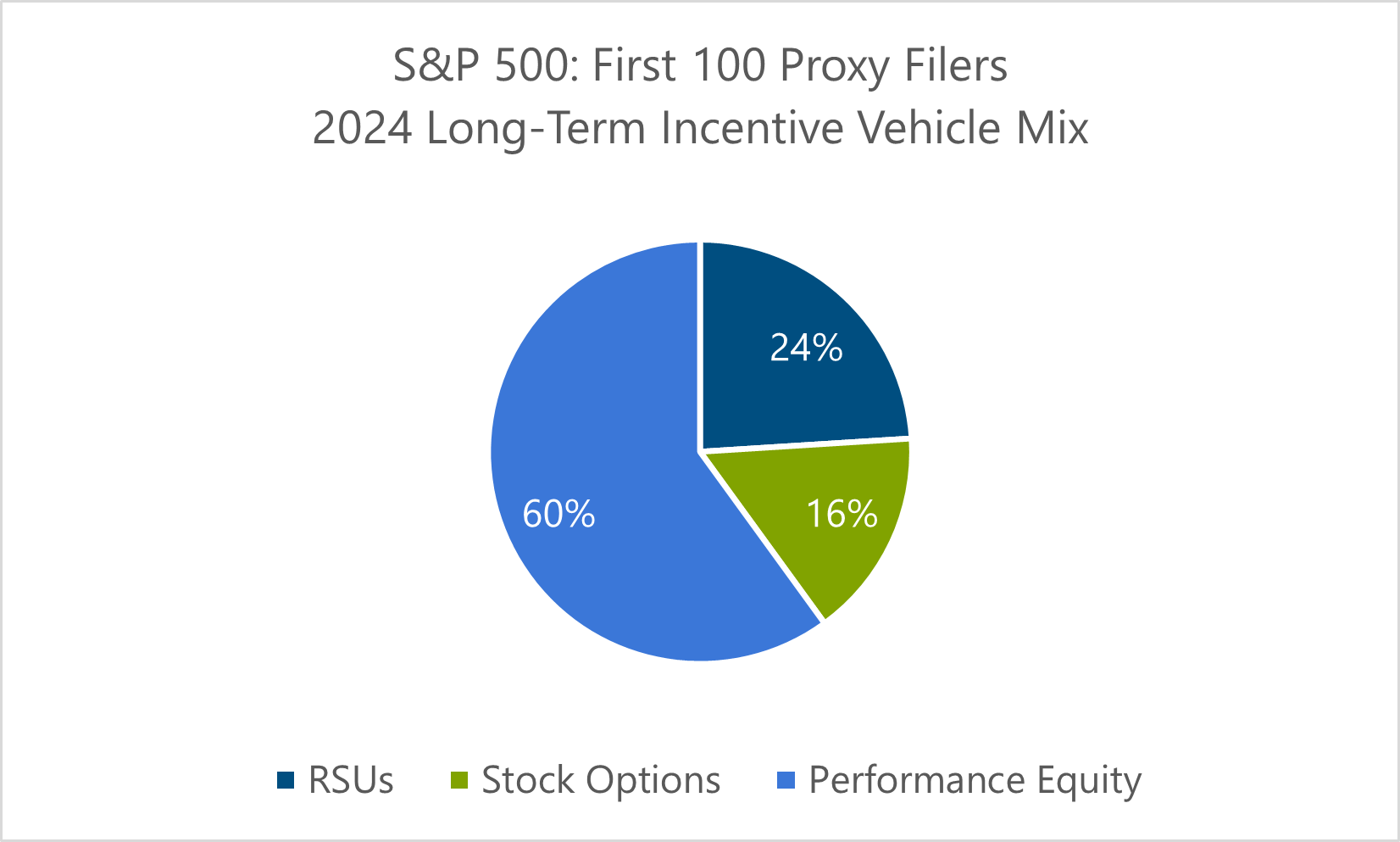

- Performance-based stock awards continue to be the predominant long-term incentive vehicle

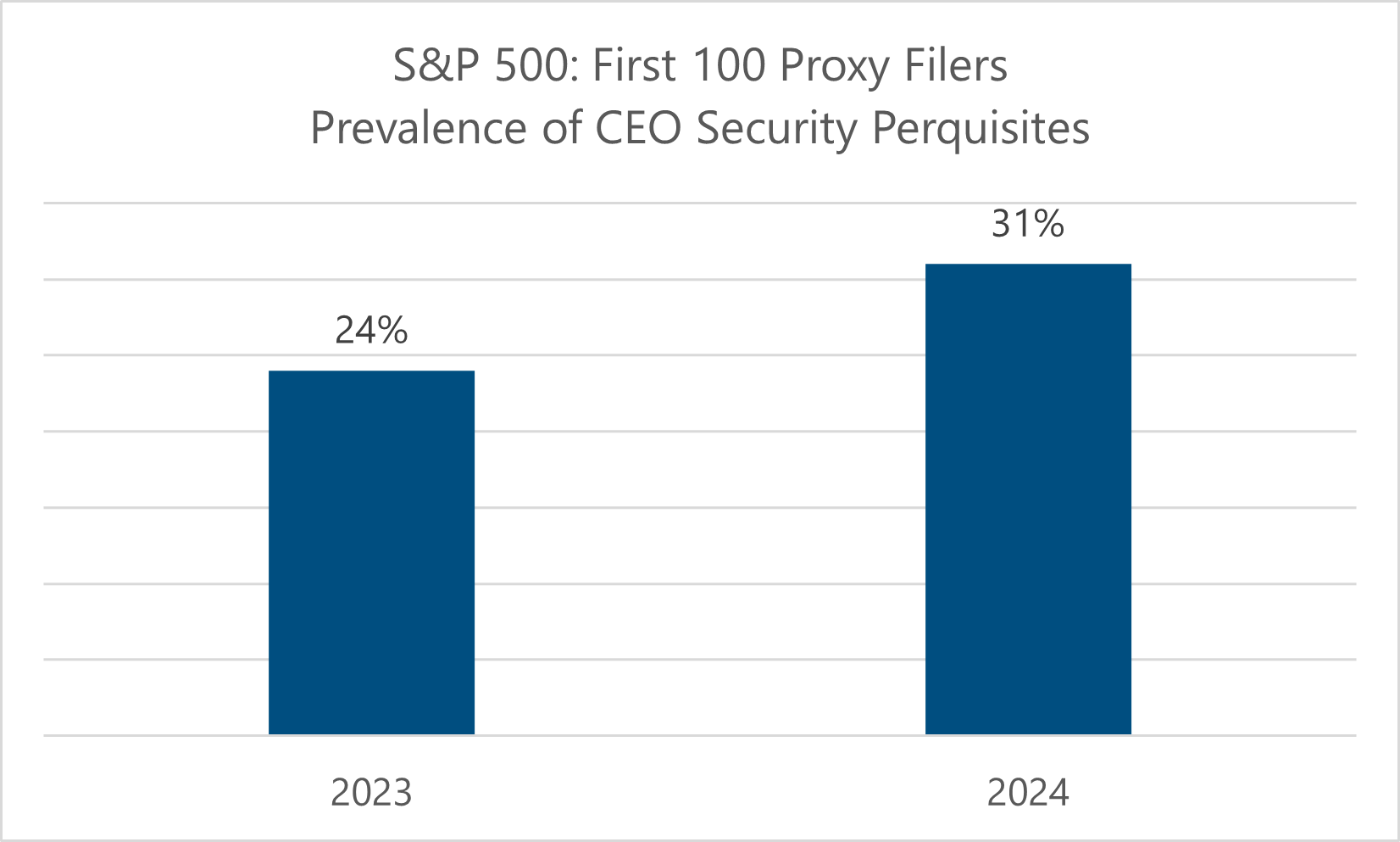

- Security-related perquisites increased in prevalence likely reflecting heightened board concerns over executive safety

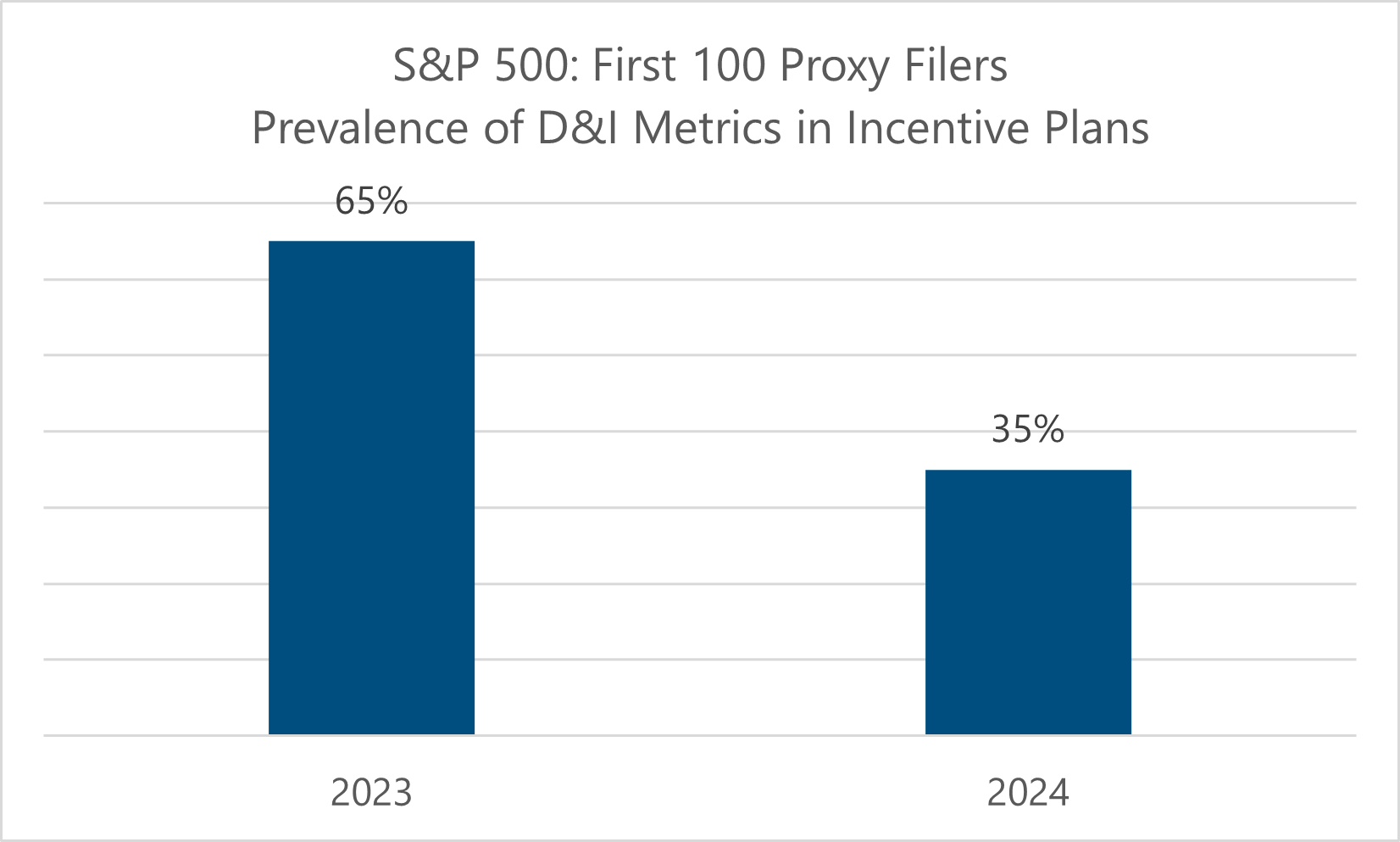

- Diversity-related incentive measures significantly decreased in prevalence as companies increased focus on financial and strategic measures of performance

CEO Compensation

Among the first 100 S&P 500 proxy filers in 2025, same-incumbent 2024 median CEO total compensation was $17.7 million, reflecting a near 10% increase over same-incumbent 2023 median CEO total compensation of $16.1 million.

Contributing elements to the year-over-year increase in same incumbent median CEO total compensation are:

- Median base salary of $1,300,000 for 2024 versus $1,250,000 for 2023, reflecting a 4% increase

- Median paid annual cash bonus of $2,410,000 for 2024 versus $2,126,000 for 2023, reflecting a 13% increase

- Median long-term incentive value of $12,490,000 for 2024 versus $11,718,000 for 2023, reflecting a 7% increase

While the median CEO salary increased by 4%, approximately half of the first 100 S&P 500 proxy filers did not provide the CEO with an annual base salary increase. This is consistent with what we have seen in prior years as it has become increasingly common to not provide CEOs with annual merit adjustments and, instead, place greater focus on at-risk, performance-based compensation.

Long-Term Incentive Design

Among the first 100 S&P 500 proxy filers in 2025, performance-based equity continues to represent the bulk of long-term incentive awards, representing 60% of the total, on average, followed by time-based restricted stock units (RSUs) at 24% prevalence and stock options at 16% prevalence. This 2024 long-term incentive vehicle mix is essentially the same mix as seen in 2023.

Relative Total Shareholder Return (rTSR) continues to be the most prevalent performance-based equity award measure with 64% of the first 100 S&P 500 proxy filers using that measure in 2024. The prevalence of rTSR is up 1% versus 2023. Most companies (72%) use rTSR as a weighted metric as compared to a modifier (28%), which is essentially the same as in 2023.

Although the use of rTSR avoids the challenges of setting multi-year goals in an uncertain environment, it remains important to identify those financial performance measures that drive value creation and consider such measures for inclusion in the long-term incentive program. For that reason, we encourage combining rTSR with a financial measure or alternatively, use rTSR as a modifier to a financial measure, rather than a weighted metric.

Security-Related Perquisites

Among the first 100 S&P 500 proxy filers in 2025, there is early evidence of an increase in executive security-related perquisites. We found the prevalence of disclosed security perquisites for CEOs increased from 24% in 2023 to 31% in 2024.

Following the United Healthcare murder late in 2024, boards are increasingly concerned as to the safety of CEOs and senior leadership. We expect the prevalence to increase further in 2025 as several companies prospectively disclosed adoptions of security programs in 2025 that don’t yet show up as perquisites for 2024.

Prevalence of Diversity Measures in Incentives

The significant increase in recent years in the use of ESG and, more specifically, diversity and inclusion measures in executive incentives appears to be reversing course, at least in part due to the current political and social environment. Among the first 100 S&P 500 proxy filers, the prevalence of diversity measures in incentive programs sharply declined from 65% in 2023 to 35% in 2024. We expect a further decline in prevalence in 2025 as several companies proactively disclosed discontinuation for 2025.

Conclusion

While it’s very important to understand how your company compares to its peers and market norms on the whole, ultimately your executive compensation program needs to achieve objectives that are unique to your business. Keep an eye on the data to inform, but not dictate, the compensation levers that will drive value for your organization.

Data Source: Main Data Group