Article | Dec 2022

Human Capital and Compensation Trends in Affordable Housing

As individual affordable housing organizations struggle, there is a benefit to understanding compensation levels and trends in the broader industry.

2022 has not been a year for the faint of heart in the affordable housing industry. In the aftermath of the pandemic, the industry has faced a daunting shortage of talent across multiple levels, including professional teams. Further, inflation has posed an increasingly critical challenge, requiring firms to make difficult decisions with respect to their compensation and award philosophy.

Given the current struggle of individual organizations, there is a benefit to understanding compensation levels and trends in the broader industry and how the related human capital issues are also impacting operations. The 2022 Pearl Meyer Annual Affordable Housing Compensation Survey, sponsored by NAHMA, provides critically important information to guide budgeting and decision-making with respect to organizational strategy for 2023.

Based on that data, we outline three main takeaways pertaining to base salaries, short-term incentive compensation (also known as “annual bonuses” or “STI”), and long-term incentive compensation (LTI). We’ll also explore four leading issues impacting human capital in the affordable housing industry.

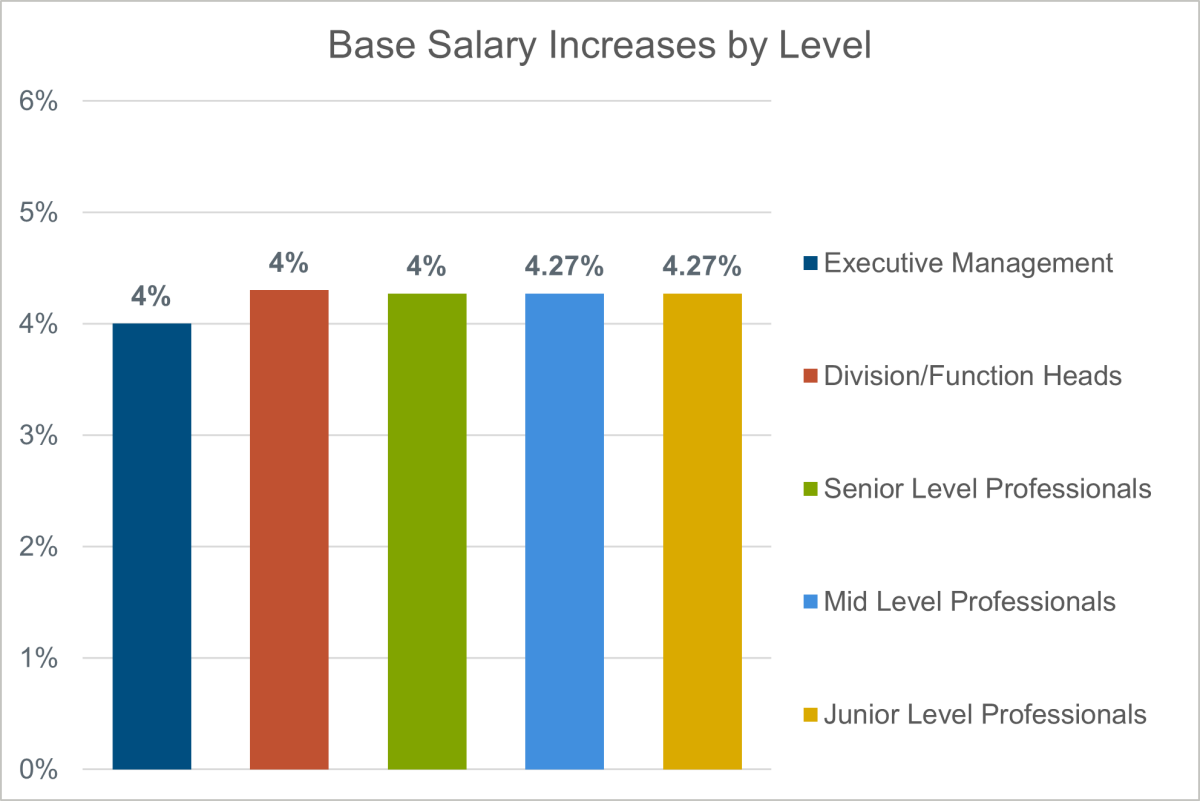

First, some findings from our survey with respect to base salaries. Traditionally we have seen base salary annual raises settling at between 2.5 percent and 3 percent across all levels of affordable housing-focused companies. Data indicate a larger jump across the board in 2022, with a range between 4 percent and just under 4.5 percent in year-over-year increases. This is chiefly due to the competitive pressure of retaining talent.

Mid- to junior-level talent, on average, has received a larger year-over-year boost in base salary as compared to the senior- and executive-level ranks. This is a trend not just within affordable housing, but also throughout the greater real estate industry in general, as a general lack of incoming talent continues to be an ongoing problem nationally. As an additional complication, the industry remains in a very employee-friendly job climate where packages offered or currently enjoyed are being “shopped.” (A trend with employees proactively engaging in recruiting conversations with peer group companies to obtain compensation offers higher than their current package, then returning to their current organization to request a match of the competing package in order to remain with the firm.)

While “throwing money” at the issue is not a sustainable solution, for the short term, firms are tending to use compensation to retain existing staff. It may be a wise approach, as the loss of production and morale of the team that stays behind when talented individuals leave can lead to an even costlier task of replacement hiring and training. Nevertheless, over the long term, it will take more than moving aggressively on augmenting year-over-year compensation in order to build and maintain a talent pipeline.

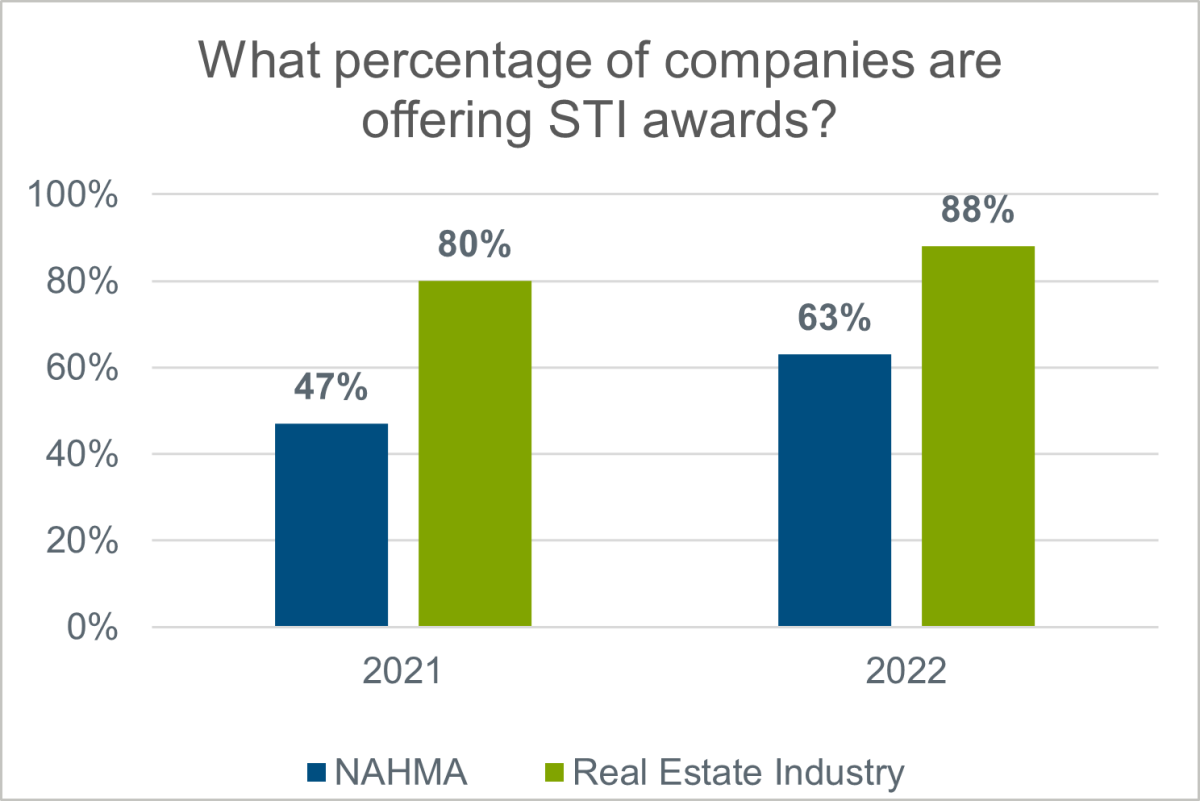

After base salary, you want to look at short-term incentive awards. In 2022, the affordable housing industry took major strides with respect to STI awards. This year’s survey shows a year-over-year increase of 16 percent of firms in the industry now offering short-term incentive awards to their professional and support teams.

In short, the market reality and competitive environment is impacting affordable housing firms, and boards and management teams are responding in kind by doing what they can to match the broader real estate industry in the ongoing battle for difference-making talent.

Sixty-three percent of affordable housing firms are now offering short-term incentive awards as part of their total compensation package. While they still trail the broader real estate industry by 25 percent, progress is being made, as in 2021 the gap was 33 percent. The 37 percent (or just over one third of companies in the affordable firms in the industry) who do not offer annual bonus awards are increasingly running against the tide of the marketplace and their ability to retain teams and/or key personnel may become increasingly compromised. They will need some combination of halo effect from a culture or mission perspective, be willing to offer other material inducements to create a retention vehicle with real value, and/or paying materially over market in base salary. Many notable firms in the industry that have one or more of these qualities do not currently have retention issues.

For companies that find themselves in this bottom third of the industry and who feel that they cannot afford to pay out annual bonuses, there can be a more creative solution. For example, an annual bonus can be paid out over time—perhaps over a 12- to 18-month period to lower the otherwise “all-at-once” capital outlay.

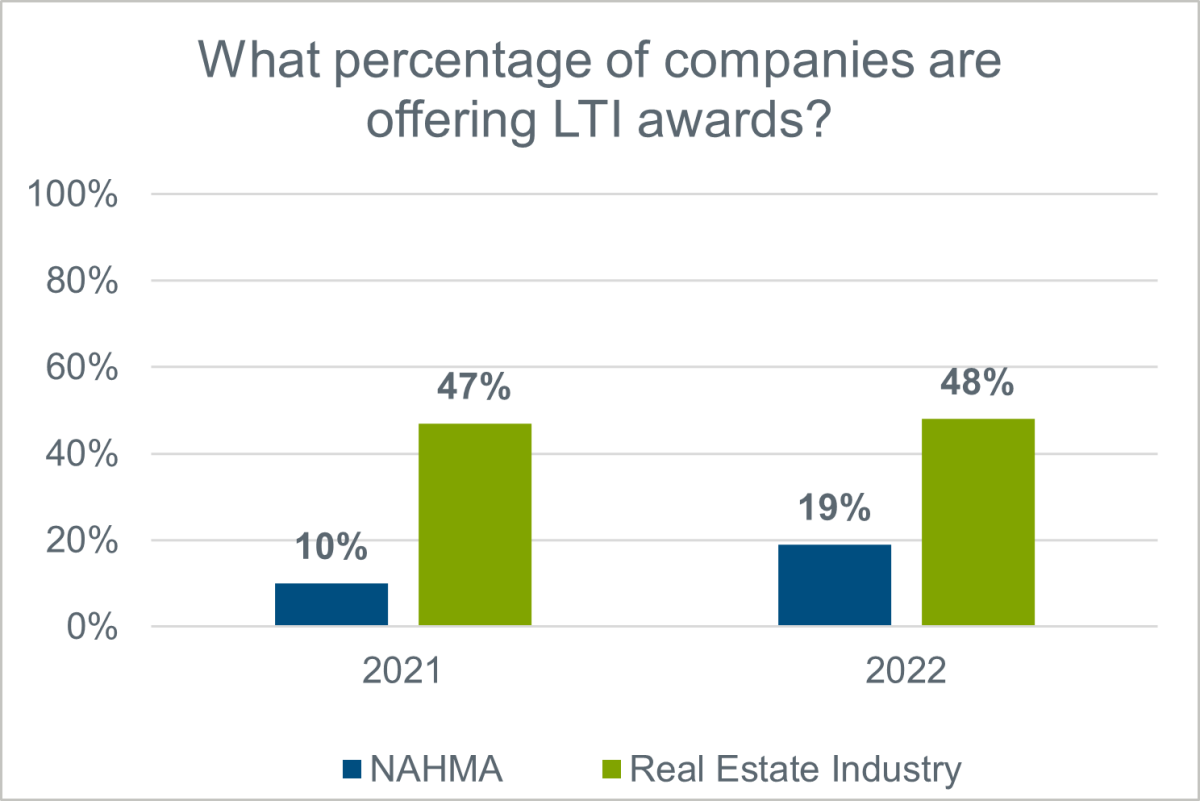

A third tool in the kit helps you plan for the future: long-term incentive awards. Here, as with STI, there has been a major move year-over-year in the affordable housing industry, with a single year jump from 10 percent of firms utilizing LTI in compensation design to 19 percent. This is further evidence that affordable housing firms are acknowledging the fact that they are competing against the broader real estate industry for talent and must attempt, where possible, to provide a like-kind financial arrangement to their professionals. With an LTI plan in place, there is a retention hook that spans multiple years, as well as incentive for your executive team to achieve multiple strategic and financial milestones for the organization.

A noteworthy point is that the gap between affordable housing and the general real estate industry is materially shrinking; the national real estate sector only grew LTI participation by one percent. The gap has shrunk from 37 to 29 percent.

Once a decision is made to implement LTI, the next decision is who is eligible. Most often, executive management and frequently division and/or functional heads participate in LTI plans. However, there is a small but growing trend year-over-year that shows increasingly, companies are pushing LTI awards further down in the organization to more junior-level professionals. Approximately 15 percent of firms in the broader real estate sector currently offer LTI to all members of their respective professional teams and it is expected this will also be a growing trend within the affordable housing sector.

In addition to these important survey results specific to compensation vehicles, there are four broader trends impacting human capital within affordable housing firms that boards and management teams should be discussing in the coming year.

Reassessing your compensation philosophy remains critical.

As companies struggle with recruiting and retention challenges and explore new ideas, such as STI and LTI programs, don’t lose sight of the big picture. In order to create maximum and long-lasting impact, comprehensive design changes, not just spot bonuses, need to be implemented to boost their impact as retention and performance-driving tools.

While no firm should be paying beyond its capacity and all should be mindful of creating a “mercenary” culture through outsized market adjustments and seemingly endless spot bonuses that create unrealistic expectations and are not sustainable, companies are at an increasing disadvantage in the marketplace if they are paying teams materially below the market median. It will likewise be increasingly problematic for companies that don’t offer an annual bonus.

Review your compensation ideology in the context of what your competitors are doing and think about structuring a plan that supports the specific talent profile you want to attract and keep. Do this in the context of your overall business plan and the people needed to make it happen.

The pandemic is waning, but the era of the remote worker is here to stay.

Companies concerned with retention need to accept this fact and adapt their way of working to accommodate this permanent reality. A separate Pearl Meyer survey indicated that over one-third of the total US-based work force was expected to work remote, post-pandemic. Yet, many firms are still struggling to accommodate this growing trend. Working from home and maintaining flexible schedules is the new normal, as employees continue to grapple with personal health issues, elderly parent as well as childcare concerns, and the enticement of rival firms that offer superior compensation and/or greater flexibility with work from home policies.

Firms need to continue to define and refine the scope and parameters of this new remote employee corporate practice. Within this balance, it becomes more critical than ever to ensure that employees have a unified vision, corporate mindset, and shared objectives that will continue to unite them despite a change in geography. Forward-thinking firms are developing strategies and emphasizing engagement at all levels to combat any compromises to firm culture and training efforts that arise without a full, vibrant, and centrally located workforce.

One thing is abundantly clear in the current labor-constrained climate: it is unwise to make any changes that will be perceived as a “takeaway.” Finding ways to provide a level of geographic flexibility that works for the organization’s operating environment will remain an advantage in attracting and retaining talent.

Takeaways are an increasing problem.

In the current volatile state of the labor market, with professionals (particularly at the junior to mid-level) demonstrating less loyalty than in recent memory, removing a valued benefit is fraught with risk. This applies to health benefits, 401k matching, paid time off, and other programs. As noted, the concept also applies to remote work policies as many are resisting the call to return to the office.

If for cost or other reasons, there is a need to modify the current set of benefits, consider finding alternatives that can help mitigate the fallout, for example, replace aggressive 401k matching with continuing education credit. Be prepared to think creatively about the appropriate benefit mix that is cost effective, yet valued by your employees.

Finally, now more than ever, employee professional development is critical to the overall short- and long-term health of your company.

As many companies have experienced over the last few turbulent years, the overall price tag for replacing talent is incalculable. Combined with decreases in productivity, the hit to remaining employee morale, and the forfeiture of institutional knowledge that can take years to acquire, losing employees comes at a tremendous cost.

One way to mitigate this risk is to stay in front of and ahead of junior to mid-level staff. Companies need to work doubly hard to retain, mentor, and develop the talent that has come through the door. Young employees are far more likely to remain loyal when the firm demonstrates commitment to their professional development.

The combination of developing strategic compensation programs combined with a strong focus on human capital-related issues can ensure the viability and long-term performance of an organization. Firms that keep current with market trends and tailor programs to their unique circumstances can win the current battle for talent and be poised for both short- and long-term success.