Article | Jun 2020

Is Distressed M&A Deal Activity on the Horizon?

Advisors are predicting a surge in opportunistic or distressed company M&A activity; here’s how to prepare for a change-in-control.

Get Your Compensation Plans Ready for a Change-in-Control

The global COVID-19 pandemic has put tremendous strains on businesses, financial markets, and merger and acquisitions (M&A) activity. For the first quarter of 2020, Dealogic reported a 35.5% decrease in year-over-year deal volume, the lowest Q1 volume since 2013. While deal activity declined sharply in the early months, a growing number of legal and investment advisors are now predicting a surge in opportunistic or distressed company M&A activity in 2020 and early 2021.

If this prediction holds, compensation committees of the most vulnerable companies should be gearing up to address a broad array of executive compensation issues now, before a formal sale process has begun or an unsolicited takeover offer has been received. Once a company is in play, things move at lightning speed and it can be difficult to implement new programs or make changes to existing agreements.

The following are some critical activities that at-risk companies should begin to address now.

Identify and Inventory Change-in-Control (CIC) and Severance Protections

Identifying and understanding the terms of the company’s current CIC and severance entitlements is a necessary initial step in the overall M&A process. Standard due diligence procedures require disclosure to a potential buyer(s) of all relevant executive and non-executive CIC and severance arrangements. In due diligence, the purpose is to identify potential liabilities that might crater a deal or require an adjustment to the purchase price. For the compensation committee and human resources team, these entitlements should serve as the starting point for assessing whether key employee retention is a significant concern. Companies need their talent to remain sharply focused on maintaining and growing the existing business, while simultaneously handling the increased responsibilities of working through difficult economic times and a potential transaction.

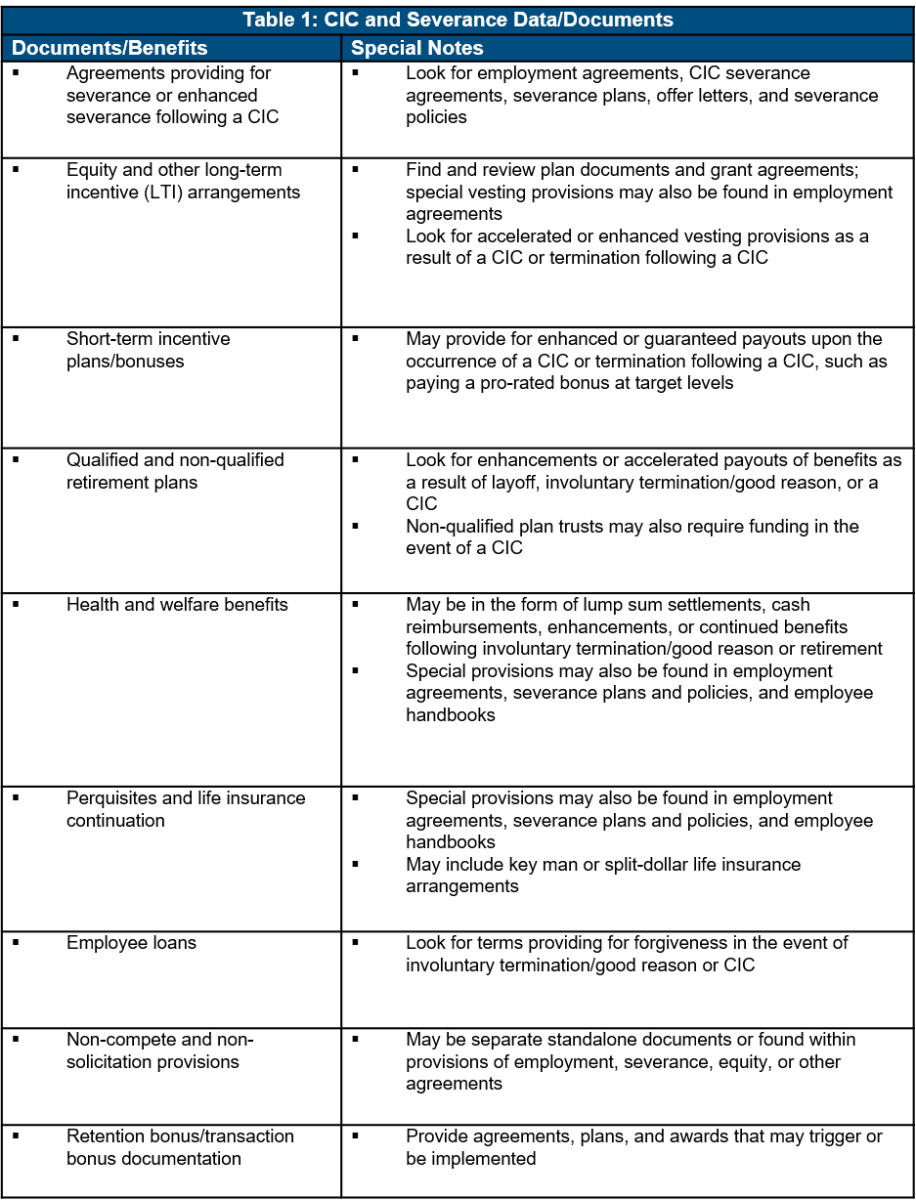

Time required shouldn’t be underestimated. The company must be comprehensive in its search. CIC and severance benefits can be found in a myriad of compensatory documents, plans, and programs including the obvious and not so obvious ones such as those listed in Table 1 below. Review the documents thoroughly. Legal counsel should help work through any legal, tax, regulatory, and contract interpretation issues that come to the surface in the process.

CIC Payment/280G Quantifications and Review

The next critical step is for the company to estimate the potential dollar amounts of benefits and payments triggered—in the aggregate and by person—and as an overall percentage of the deal value. This exercise may require running alternative scenarios, such as using a range of potential transaction values and post-CIC employment outcomes. The company may also need compensation consultants, actuaries, and/or accountants at this stage to help button down expected costs and payouts and begin assessing retention risks.

Part of this exercise should be to not only understand the aggregate costs, but also whether there are risks that the application of the golden parachute rules under Internal Revenue Code (IRC) Sections 280G and 4999 will significantly erode intended economic benefits. Under the rules, if the present value of the CIC payments to an executive exceeds his/her “safe harbor”—meaning three times the executive’s average taxable compensation over the five most recent calendar years preceding the CIC (or “base amount”), less $1—the company loses tax deductions for the amounts considered “excess parachute payments.” Additionally, the executive is required to pay a 20 percent excise tax on excess payments.

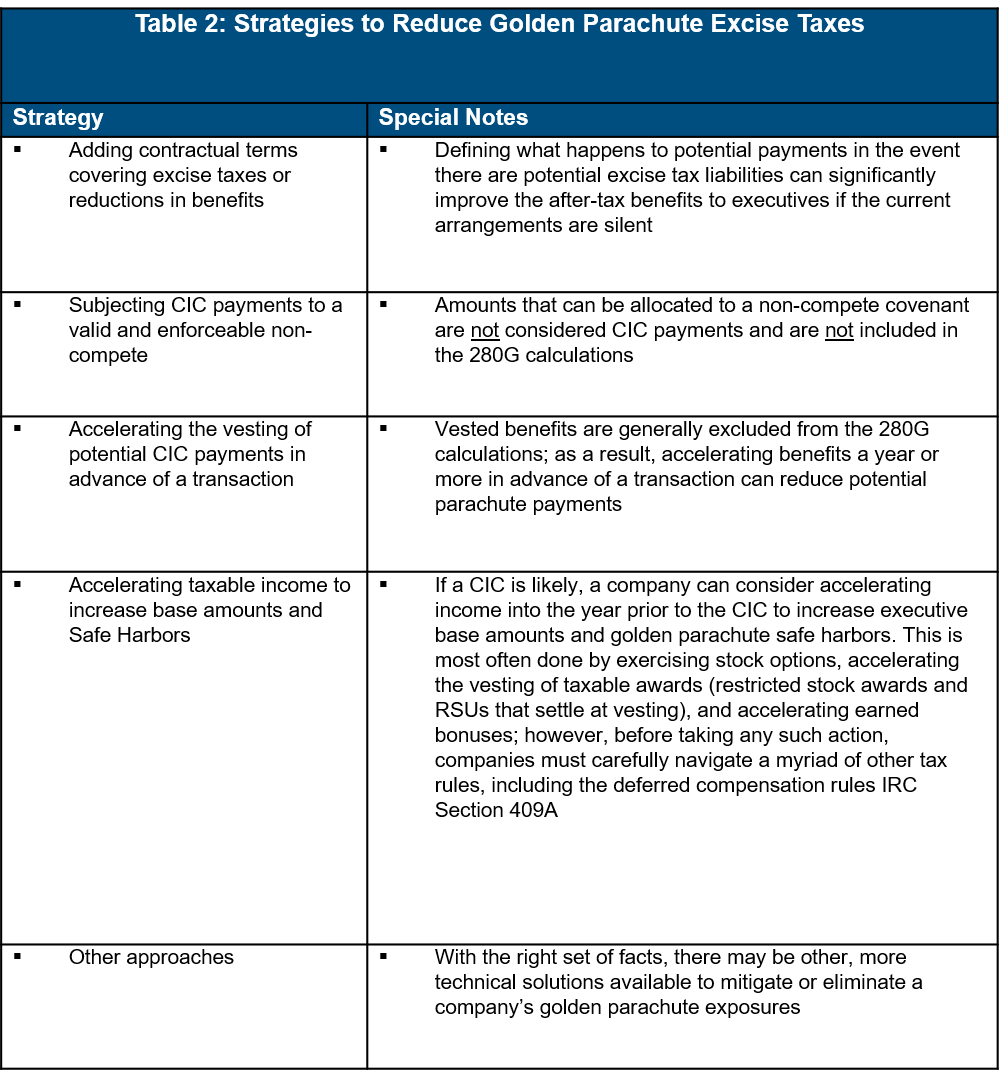

Since golden parachute quantification is driven by complex tax rules, boards and executives cannot rely on sheer logic to get through the process. Involving experienced advisors can help get an accurate picture of company costs, lost tax deductions and executive excise taxes. While the golden parachute limitations may appear relatively straightforward, there are numerous complexities inherent in most 280G calculations. Issues can emerge when least expected—but solutions may be available with the right set of facts. Approaches for mitigating an executive’s excise tax is highly dependent on transaction timing, post-employment status outcomes, and each executive’s individual facts and circumstances. Strategies to consider for reducing the sting are listed in Table 2.

Identify Retention Risks/Develop Retention Alternatives

Will the company’s overall compensation programs, including its current CIC and severance plans hold senior leadership and key talent through the entire M&A process as needed? When CIC, severance, and benefits costs in existing arrangements are better understood, the company can begin to identify the potential gaps and employees that may be potential flight risks.

Factors influencing efficacy of the programs can be heavily impacted by the type of transaction (asset sale, stock sale, spin-off, etc.), buyer involved (strategic buyer versus private equity, etc.), and components of CIC benefits (for example, single-trigger benefits versus double trigger benefits). Nevertheless, even when businesses are not yet in a formal M&A process, it is appropriate to begin doing the legwork to retain talent.

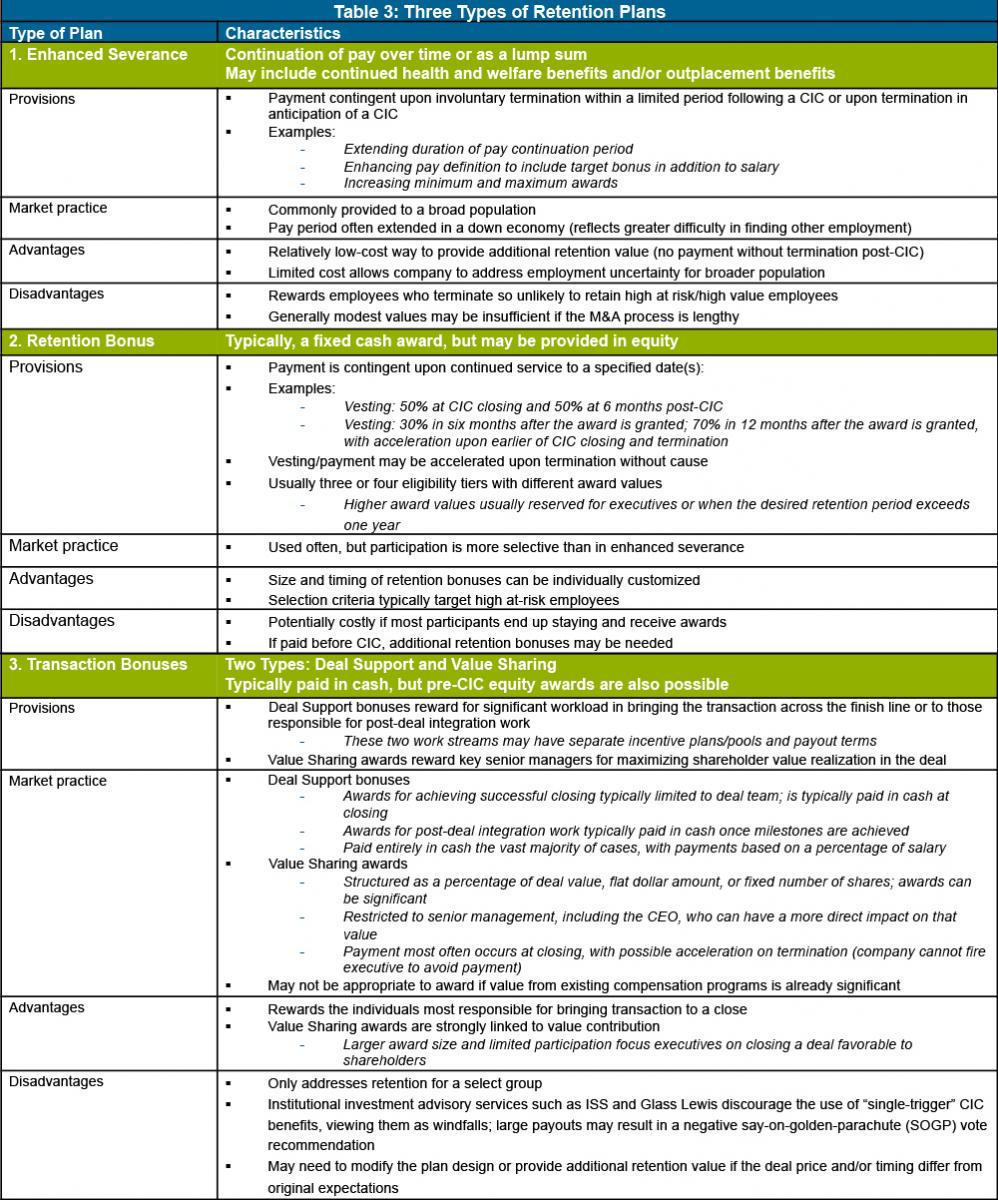

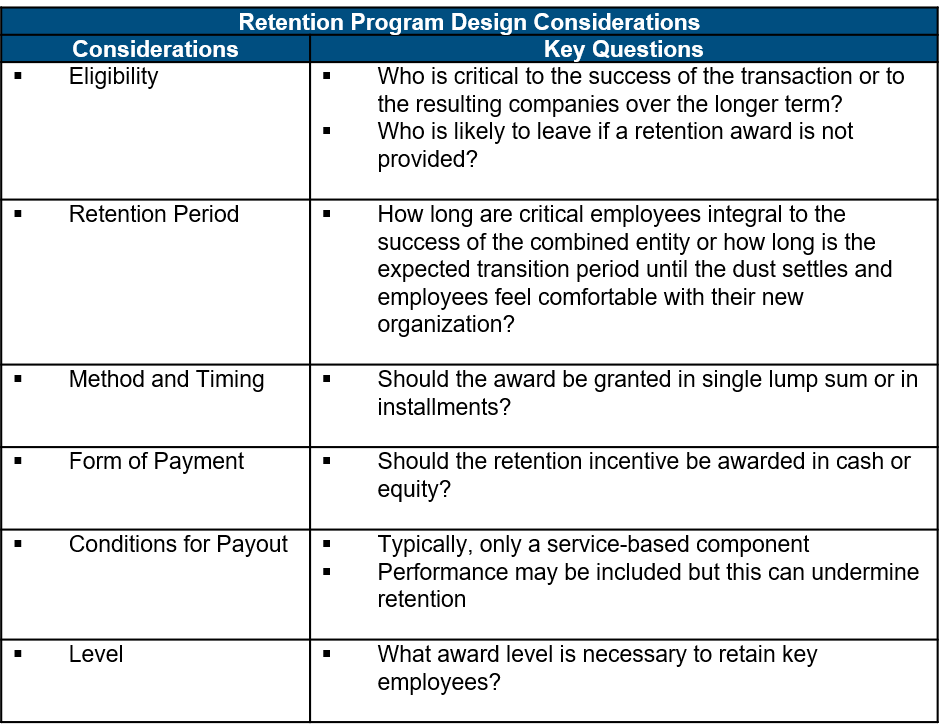

Retention programs are designed to help deliver the business in a form and value that will be expected by sellers and buyers by motivating employees to stay and do the job required. Typical retention program alternatives include enhanced severance, retention bonuses and transaction bonuses which are further discussed in table 3.

Many organizations reserve a pool to fund CIC related retention incentives. While retention pools are common, they are less likely to include executive officers, who are more often protected by existing CIC and severance protections.

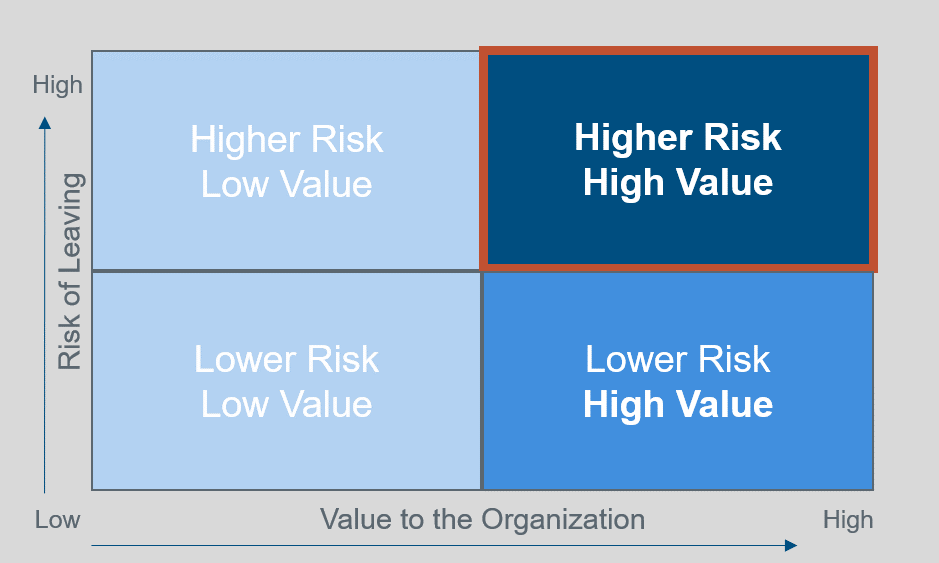

Companies often create a scorecard to determine eligibility for retention awards, and to calculate retention award values. The default approach is to have participation of retention programs focused on employees critical to the success of the business and who are also most at risk. True risk of flight should be assessed, as illustrated below.

When developing a retention framework, the following are key questions to consider.

Adjust/Implement Compensation Arrangements

A deep dive into the company’s existing compensation plans and agreements and a review of retention risk very often uncovers matters that are better addressed prior to a transaction occurring.

For example, it may be appropriate to increase the number of executives covered under the current CIC severance plan or that are eligible for accelerated vesting upon a CIC, or it may be necessary to clear up confusing contractual language to reflect the original intent.

Also, adjustments to existing incentive programs are commonly needed in advance of a CIC. Compensation committees frequently struggle with how to determine performance results for short-term and long-term incentive plans given an impending transaction will interrupt the original performance cycle. Agreements and plans are not always written with enough specificity so that results can be determined in all occurrences; these types of issues require judgement and use of discretion based on the facts and circumstances for each company.

Furthermore, based on the work described above, it may be appropriate to approve retention vehicle frameworks or address 280G golden parachute issues. Companies should always be mindful of the optics of all changes made, along with the costs of any adjustments made (in absolute dollars and in relation to overall deal value).

Conclusions

With a growing number of investment advisors predicting a surge in opportunistic or distressed company M&A activity in 2020 and early 2021, compensation committees of at-risk companies should get a head start by addressing the many compensation issues that are certain to arise once the company is in play. Employees need to remain focused on maintaining/increasing business once a transaction is on the horizon, but the reality is they can be distracted by the uncertainties that lie ahead. Developing a plan to maintain key talent through the M&A process in advance will prove to be invaluable.