Article | Feb 2023

Recent and Planned Compensation Practices for Life Sciences Companies

Despite a slowing economy and increased prevalence of job cuts, the market for talent in life sciences remains strong, as does wage inflation.

Responding to Ongoing Tight Labor Markets and Other Competitive Pressures

Despite a slowing economy and increased prevalence of job cuts (especially among large high-tech companies), the market for talent within the life sciences sector remains strong, as does wage inflation. Compensation practices for life sciences companies continue to evolve in response to ongoing market pressures and macroeconomic challenges, as evidenced by findings from Pearl Meyer’s “Looking Ahead to Executive Pay Practices in 2023” survey. This survey, published in the fourth quarter of 2022, found that most respondents within the life sciences sector took one or more actions during 2022 to enhance executive pay opportunities and key employee retention. All respondents expect at least some incentive payouts for performance cycles ending in 2022 and virtually all plan to increase salaries in 2023, with average percentage increase projections tracking above broader-market levels for executives as well as other employees. Many are looking at performance more holistically, both in terms of incentive plan metrics and mix, while also maintaining broad-based long-term incentive participation levels through a combination of award vehicles. Additional details are discussed below, including comparisons vs. broader market pay practices.

Macroeconomic Challenges and Compensation-Related Actions Taken in 2022

The top three macroeconomic factors noted by life sciences companies as having the biggest impact on their organization and executive pay practices include economic uncertainty, wage/other inflationary pressures, and a tight labor market. The most commonly cited executive pay actions taken in 2022 in response to these challenges are listed below.

Pay Component | Top Three Actions Taken | Prevalence |

Base Salary | Paid higher-than-normal merit increases Increased targeted pay positioning Made additional off-cycle salary adjustments | 35% 18% 18% |

Short-Term Incentives (STI) | Increased award opportunities Awarded cash retention bonuses Changed originally established goals | 24% 21% 15% |

Long-Term Incentives (LTI) | Provided one-time retention grants Increased award opportunities Expanded participation levels | 30% 27% 18% |

Most life sciences respondents (91%) in the Pearl Meyer survey are publicly traded. Compared with all public company respondents, prevalence was notably higher for retention awards (broader market prevalence was 11% for cash awards and 19% for equity retention grants) and generally comparable for other pay actions.

Executive Pay Philosophy

Most life sciences companies target executive pay at the market 50th percentile, especially for base salaries (75%), but also for short-term and long-term incentives (approximately two-thirds of respondents). This is not surprising, given that most survey respondents are publicly traded with higher levels of external scrutiny vs. privately held companies. Life sciences respondents had a higher prevalence of increases in targeted pay positioning (18%) vs. all public companies (10%), reflecting strong competitive pressures within the sector. Most respondents, both within the life sciences sector and broader market, focus on industry and company size as primary criteria for developing peer groups and conducting market benchmarking. However, life sciences respondents were considerably more likely than the broader market (45% vs. 25%) to place emphasize external market competitiveness when making executive pay determinations as opposed to the broader market norm of a balance between external competitiveness and internal equity (67% all respondents vs. 42% for life sciences companies).

Pay Projections for Incentive Cycles Ending in 2022 and 2023 Salary Increases

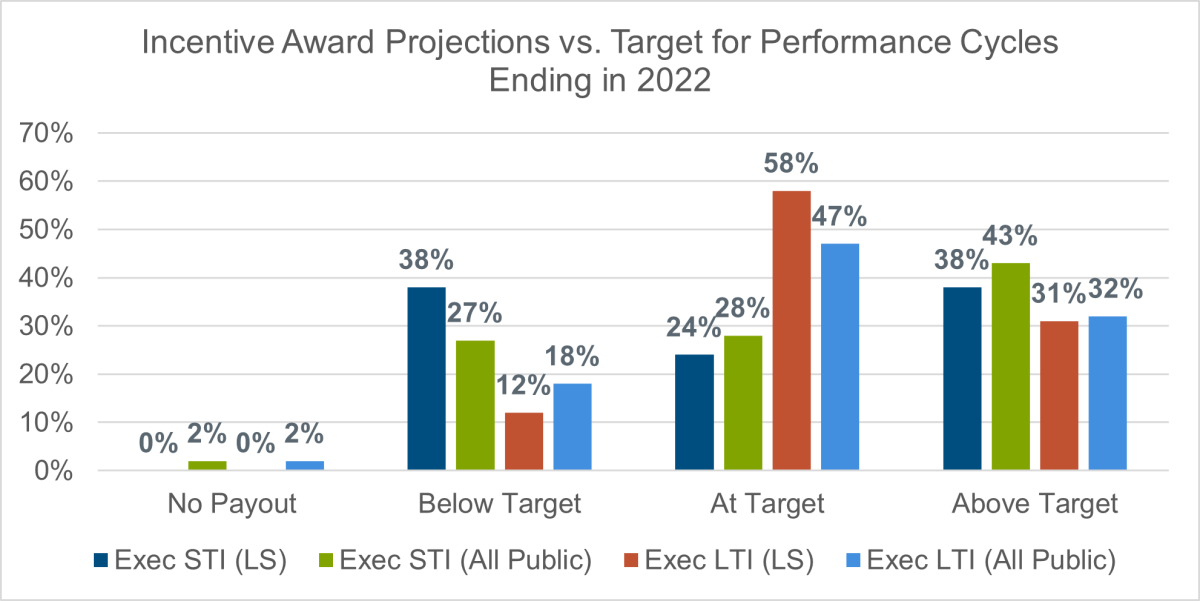

Most respondents anticipated at least some payouts for short-term incentives (STI) and long-term incentive (LTI) cycles ending in 2022, in most cases at or above target award levels. Compared with broader market expectations, life sciences (LS) sector award funding projections were slightly more optimistic for LTI and slightly less favorable for STI. At the time the survey was conducted, many respondents had not yet determined whether any discretion would be applied to award funding outcomes. Only a small minority of respondents (18% for life sciences, approximately 10% within general industry) were already planning to use positive discretion, while prevalence of no anticipated discretion was higher within the broader market (approximately 50% of all public companies) than within the life sciences sector (33% of respondents). The following chart summarizes award funding projections as of the third quarter of 2022, with most forecasts within a range of +/- 25% of target.

All respondents within the life sciences sector plan to provide salary increases in 2023, with average projected values higher than for general industry, where salary freeze prevalence was equal to 22% for CEO and 14% for other senior executives. Median (50th percentile or P50) and 75th percentile (P75) projected increases were generally the same for both comparator groups across employee categories, with approximately 40% of respondents in each case expecting higher year over year percentage increases.

Salary Increase Projections for 2023 | ||||||

| Employee Category | Life Sciences Respondents | All Public Companies | ||||

Average | P50 | P75 | Average | P50 | P75 | |

| CEO | 4.5% | 4.0% | 5.0% | 3.5% | 4.0% | 5.0% |

| Direct Reports | 4.3% | 4.0% | 5.0% | 3.7% | 4.0% | 5.0% |

| Other Employees | 4.7% | 4.0% | 5.0% | 4.1% | 4.0% | 4.8% |

Short-Term Incentive (STI) Designs and Performance Mix

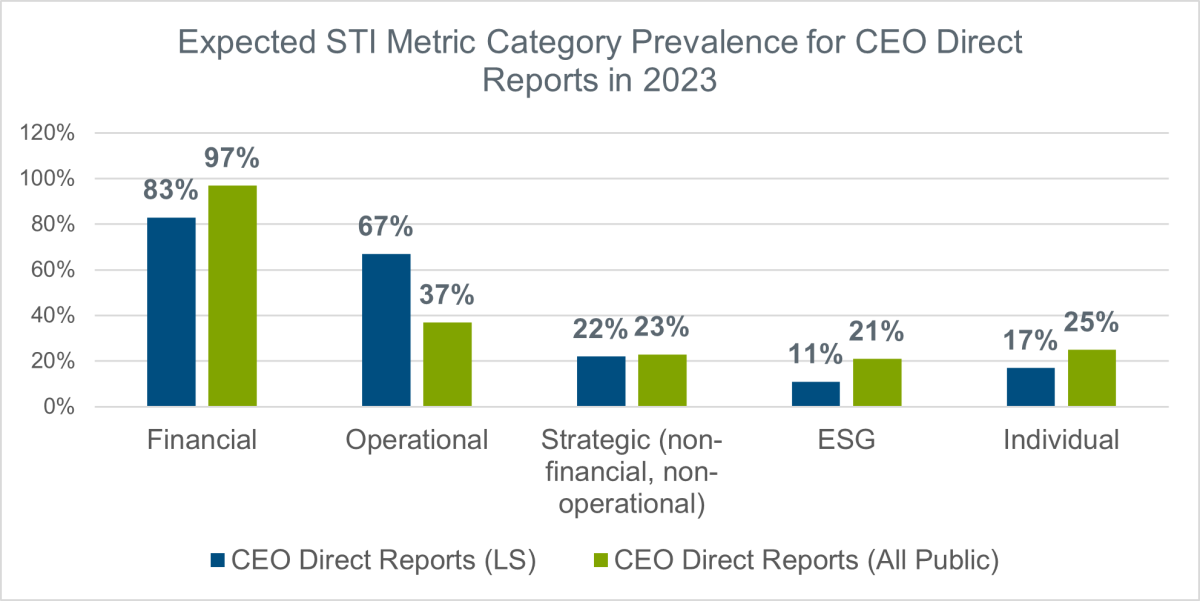

Many life sciences companies are adding more structure to their STI plans, with nearly 80% of survey respondents using pre-established award opportunities and assigned weightings for performance metrics, slightly below broader market prevalence (85% of public companies). Metrics often include a combination of quantitative and qualitative goals. Most life sciences sector respondents tie at least a portion of executive STI awards to objective financial goals, as do most broader market publicly traded companies, with considerably higher prevalence of operational metrics and somewhat lower use of individual performance and ESG (environmental, social, and governance) criteria (although we expect ESG metric prevalence to increase going forward). Similar to the broader market, approximately 60% of life sciences respondents link executive STI awards to multiple performance metric categories. Additionally, approximately 20% of life sciences respondents plan to add new financial and/or operational metrics in 2023, with 15% planning to add new strategic metrics, allowing for more holistic performance assessments. Broader market prevalence for adding new metrics in 2023 ranged from 7% to 13% for most categories other than ESG (18% across all public companies).

The survey sample for life sciences sector respondents includes a blend of commercial and pre-commercial companies. Pre-commercial organizations tend to make relatively greater use of operational metrics (especially those tied to R&D and business development goals), which have historically included qualitative/discretionary goals, although many respondents anticipate using a combination of operational and financial goals in the future. The trend towards more structured designs for executives helps to improve the STI plan’s motivational impact as well as shareholder optics, especially with the new pay vs. performance disclosure requirements for most publicly traded companies (excluding those in the emerging growth category).

Long-Term Incentive (LTI) Designs and Performance Mix

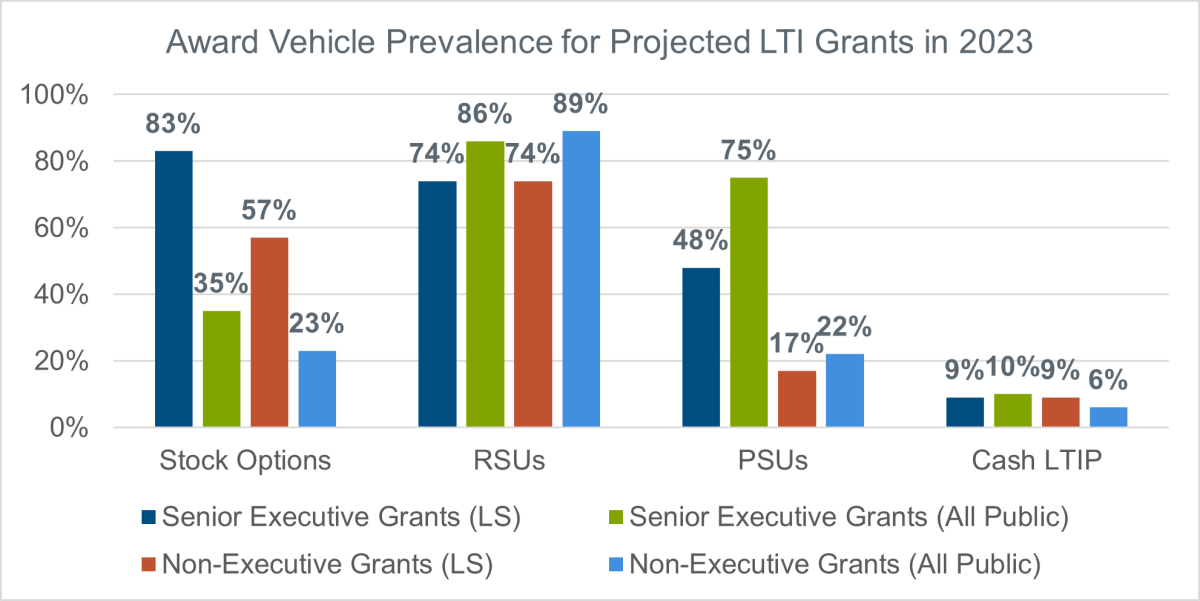

Broad-based equity grants remain far more common within the life sciences sector (62% of respondents make grants to most or all employees) than the broader market (only 18% of all public company respondents, most of which do not make grants below the employee director level). While most life sciences companies grant stock options, prevalence of service-based restricted stock units (RSUs) continues to increase, with many survey respondents providing multiple types of award vehicles, especially for executives (including nearly 75% of life sciences and 82% of all public companies).

Based on planned LTI grants for 2023, most life sciences respondents expect to use a combination of stock options and RSUs for executives while RSUs will be most prevalent for non-executives. Nearly half of life sciences companies expect to provide some form of performance-based equity (PSUs) to senior executives, which is lower than projected broader market prevalence for all publicly traded respondents. For 2023 grants, most life sciences respondents anticipate an equal or greater emphasis on RSUs vs. stock options, as companies seek to further enhance retention and manage equity plan share usage and dilution.

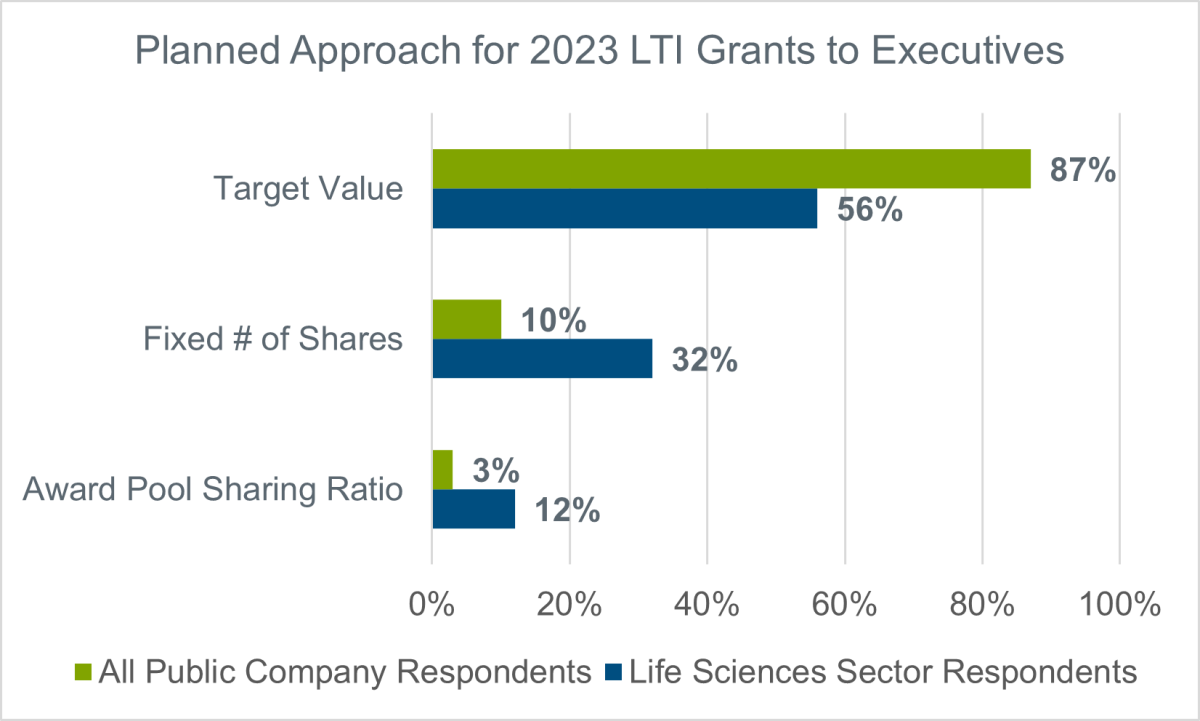

Compared with the broader market, life sciences sector respondents are less likely to use a target value approach for executive LTI awards and more likely to base grants on a fixed number of shares or sharing ratio percentage. However, prevalence of target value grants has increased over time, especially for larger-sized organizations, with approximately half of life sciences respondents planning a value-based approach for 2023 grants.

Most survey respondents did not anticipate material LTI design changes for 2023, although many took one or more actions in 2022, as previously noted. Virtually none of the respondents across all industry sectors anticipated changes to LTI grant determination practices for 2023. This is somewhat surprising, given the ongoing market downturn and volatility. We expect some companies will consider actions to mitigate these challenges, such as fixed share guidelines, use of longer-term average stock prices for grant determinations, changes to award vehicle mix, or increased grant frequency, at least on a temporary basis.

Go-Forward Considerations

The market for talent in the life sciences sector remains strong, and as discussed above, many companies recently took or plan to take actions to enhance executive pay levels and retention. Compensation practices will continue to evolve, along with strategic priorities, but it is important to not overreact to short-term pressures and to ensure pay actions are sustainable. For example, base salaries are a fixed cost and companies should not feel pressured to match salary increase budgets with current inflation levels (which will eventually moderate). Additionally, rigid adherence to target value-based grant determinations (when applicable) during the current market downturn can result in excessive share usage (and potential windfall grants), accelerating the depletion of plan reserves. Companies should maintain a long-term perspective, especially in the case of stock options and other long-term incentive vehicles, ensuring that equity stakes are competitive and reasonable.

We expect the trend towards more structured short-term incentive plans with multiple types of metrics to continue, to allow for a more holistic assessment of performance and to further improve the motivational impact of incentive plans. This can be accomplished through a combination of financial (when feasible), operational, and strategic goals, including metrics tied to ESG that can help enhance employee engagement and corporate social responsibility as well as shareholder optics. Similarly, a combination of long-term incentive award vehicles, such as stock options or performance shares, along with service-based restricted stock, allows for continued focus on long-term value creation and enhanced retention, while also helping to manage equity plan dilution levels.

Navigating these current turbulent times can be challenging and may prompt some companies to consider drastic changes in terms of pay actions and program designs. Our advice is to focus on ensuring compensation programs align with business and talent management strategies and an organization’s corporate culture. This starts with periodically revisiting the compensation philosophy and assessing desired objectives to help guide program design and administration. A customized program that aligns with an organization’s specific needs, is straightforward in design, and regularly communicated to participants can help promote competitive advantage by facilitating attraction and retention of talented employees and focusing them on key strategic priorities in support of long-term value creation.