Article | Dec 2025 | ASHA

Seniors Housing Recalibrates Compensation Standards Amid Stabilizing Inflation and Renewed Growth

ASHA 2025 compensation survey takeaways.

Introduction

After years of inflation-driven cost pressures and continued labor shortages, the seniors housing industry is at an inflection point as we head into 2026. Stabilizing macroeconomic indicators and improving occupancy trends have created a more favorable and predictable—but still highly competitive—labor market. The 2025 Pearl Meyer–ASHA Seniors Housing Industry Compensation Survey reveals a maturing compensation environment marked by more selective base pay growth, broader incentive eligibility, and continued expansion of long-term incentive (LTI) offerings.

This year’s survey provides data for more than 150 positions across every organizational tier—from junior professionals to the executive suite—and offers a comprehensive view of how compensation philosophies are adapting as the sector seeks sustainable profitability through 2026.

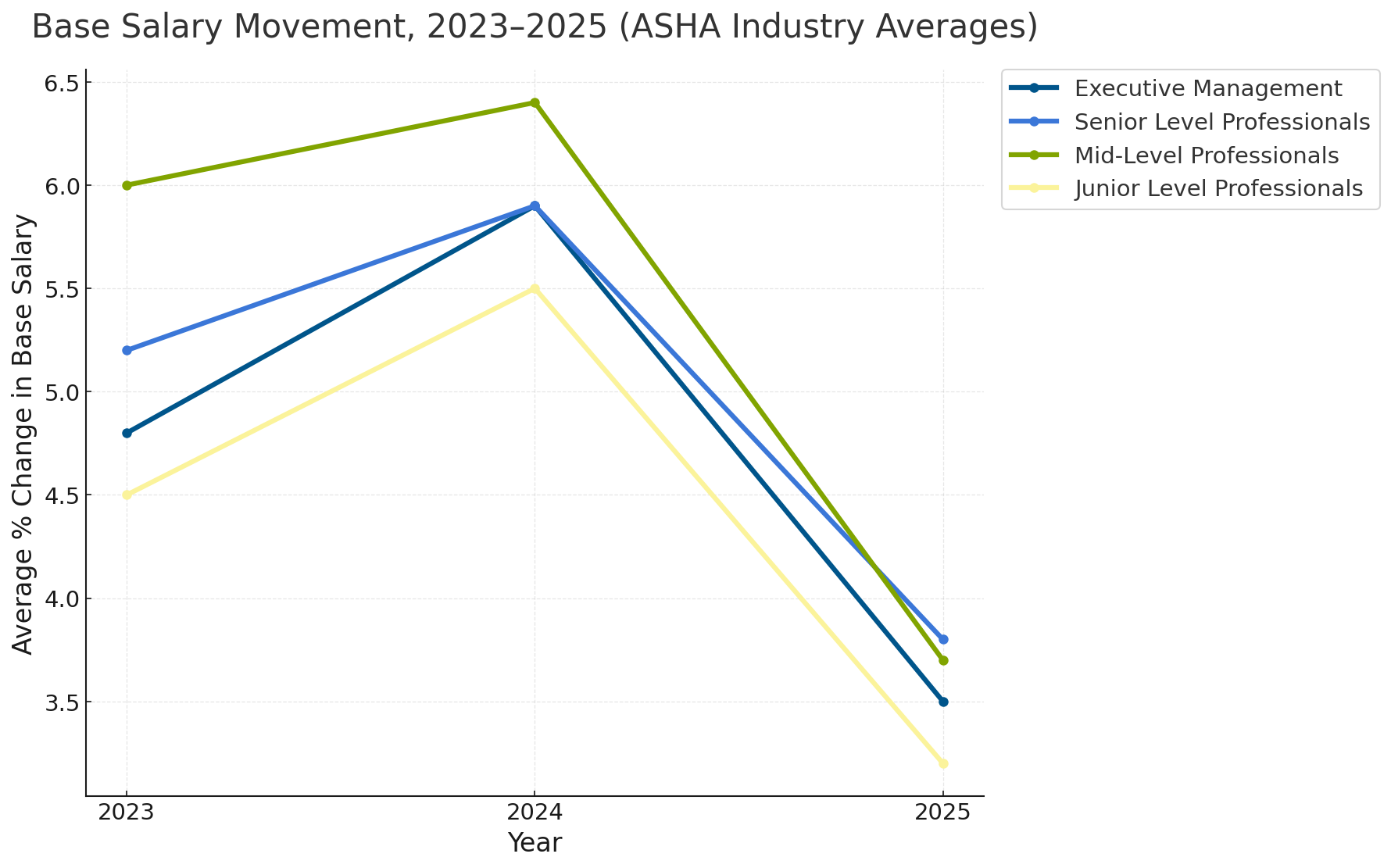

Base Salaries Moderate After Two Years of Aggressive Growth

In contrast to the steep increases seen in 2023 and 2024, base salary growth in 2025 has slowed but remains positive across most organization levels. Executive management saw increases in the 2–6% range, with similar trends at the senior and mid-levels. Junior-level professionals continued to experience competitive increases of around 3% as the pressure to produce outsized base salary increases at this level has largely abated.

This moderation signals a move toward equilibrium—balancing retention needs with cost containment. Importantly, no major declines were reported, underscoring the continued tightness of the labor market.

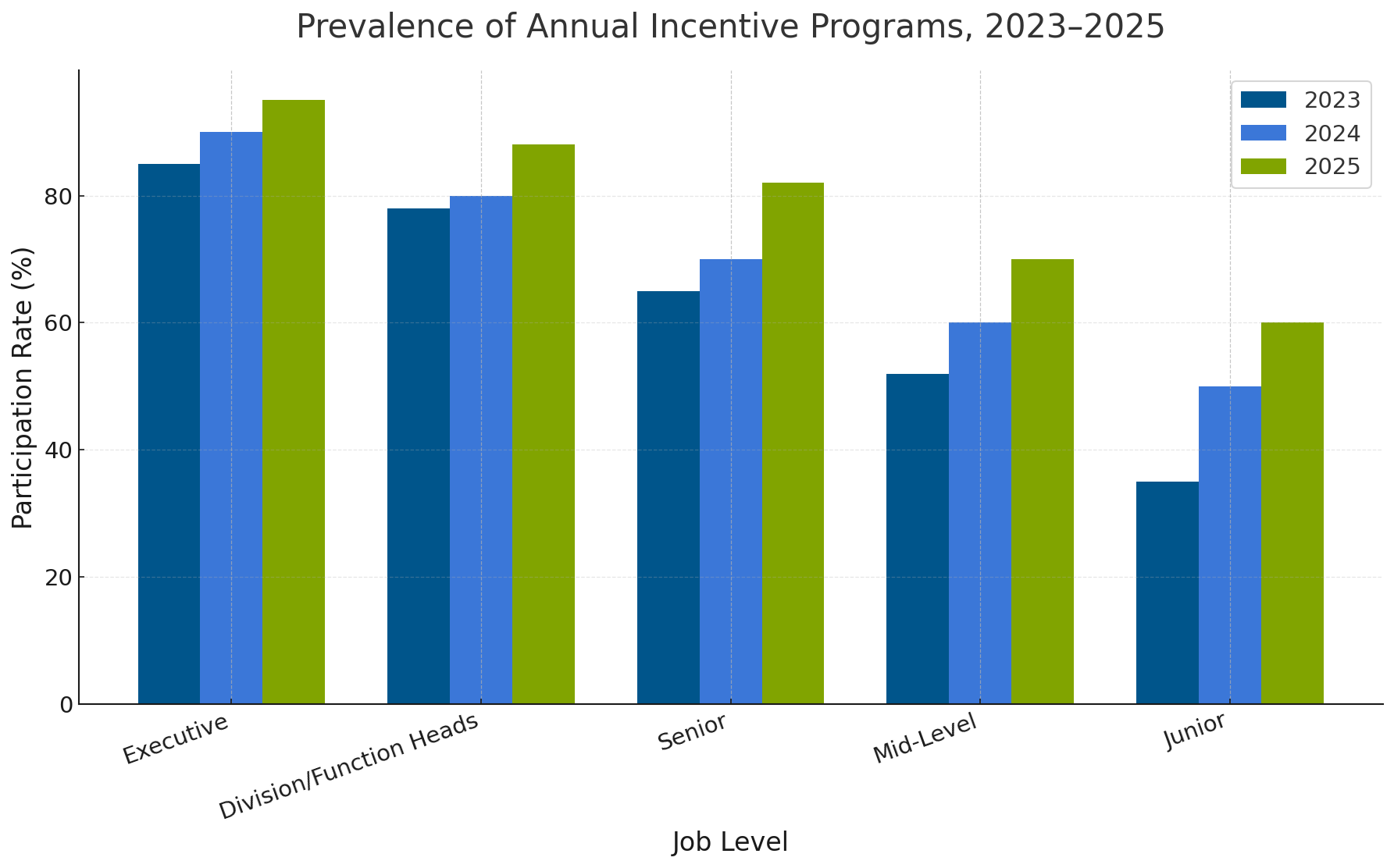

Annual Bonuses Now a Fixture of the Pay Mix

Short-term incentive (STI) programs continue to expand, with over 83% of companies now offering annual bonuses to at least one employee level-up from 75% in 2024. Executive and senior management participation remains nearly universal, while mid-level eligibility climbed to 70% and junior-level eligibility reached 60%.

Increased use of structured, metrics-driven bonuses reflects the industry’s alignment with broader commercial real estate practices and recognition that variable pay can be a key lever for motivation and retention as base growth normalizes.

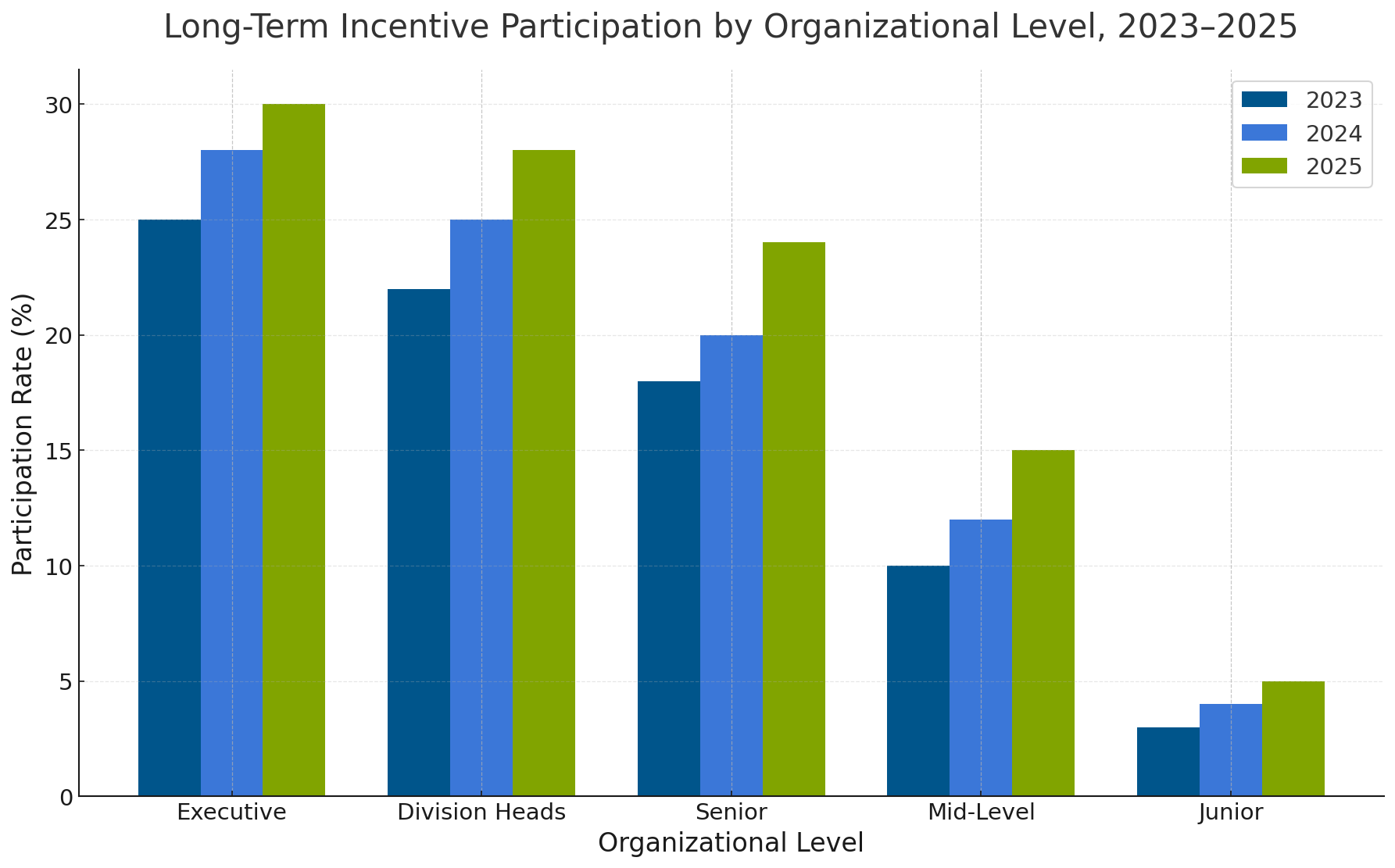

Long-Term Incentives Gain Momentum

The most notable development is the continued rise of long-term incentive participation, particularly among division heads and senior professionals. Nearly 30% of ASHA participants now offer LTI programs, up from 28% in 2024 and 25% in 2023. Restricted stock, performance units and phantom equity remain the most common vehicles.

This evolution underscores a growing understanding of the retention value of deferred and performance-based equity; especially as younger leaders rise and investors demand stronger pay-for-performance alignment.

Looking Ahead to 2026

The 2025 ASHA survey data indicate that compensation practices in the seniors housing sector are maturing alongside a stabilizing and improving operational business environment. As organizations head into 2026, the focus will continue to shift from recovery to optimization—emphasizing strategic, performance-based pay design that balances competitiveness, sustainability, and retention.

In summary, firms that increasingly tie performance-based metrics into compensation design will see improvement in operations as well as in retention, ensuring a stronger and more dedicated workforce committed to reaching performance targets.