Article | May 2022 | NACD Governance Challenges

The Compensation Committee’s Guide to Evaluating, Structuring, and Communicating Executive Incentives and Climate Issues

How do you structure a framework to include climate-related incentives in an executive compensation plan?

Editor's note: The following is Pearl Meyer's contribution to the annual National Association of Corporate Directors' Governance Challenges report.

Introduction

It’s an increasingly frequent inquiry from compensation committees: how do you structure a framework to include climate-related incentives in an executive compensation plan? As has been the case recently with diversity, equity, and inclusion, organizations and the boards that guide them are feeling intense pressure from investors and other stakeholders to make meaningful progress against long-term climate goals. Often, it is assumed that executive incentive compensation plans are an “easy” way to make progress, and we all know that the signaling effect of incentive plan metrics is powerful.

However, while DE&I is something that almost all organizations—and their management teams—can actively address in some clearly measurable way (albeit over the long term), climate-related issues are often a result of how the company conducts its business. And the climate impact of companies varies significantly, especially by industry. Further, any attempt to mitigate environmental impacts via the compensation plan may require unpalatable trade-offs (for example, adding an environmental goal for the CEO means some other previously important goal must be de-emphasized), and measuring progress can be problematic.

Companies are, therefore, coming at climate issues from very different points. Some are just beginning an exploration phase, working to understand how their business affects the environment and what actions might be achievable. Others are very far along: they have already determined what can and should be done to provide a meaningful result and they are doing the work to construct measurable, long-term, climate-related, executive incentive plan goals. Many are somewhere in between, and all can likely benefit from a robust, stakeholder-specific communication strategy that explains what they are doing, what they are not doing, and how these decisions have been made.

What can we learn from companies in certain high-impact industries that have already been addressing environmental goals in their compensation plans? We know from progress on DE&I issues that a scorecard approach to tracking and measuring progress can be very effective. In fact, such a scorecard can be an informational dashboard for management to review with the board, even in cases where it is not directly tied to the executive incentive compensation plan. Companies in industries like energy and utilities have historically incorporated employee health and safety measures into their incentive plans due to the inherent characteristics of their operations. In many of those cases, adding other nonfinancial metrics tied to reductions in emissions, addressing water usage, or other climate-based actions has not been a far leap.

Case Study #1: Incentive Plan Goals for a Company with Clear Industry Ties to Climate Change

A leading waste management company has implemented an aggressive, multiyear sustainability scorecard that includes various ESG factors: workplace safety, talent management (including diversity among the leadership team), giving back to the communities in which they operate, and taking a lead on reducing climate impact. The scorecard reflects a baseline measure for each of the goals, which are tracked annually and expected to demonstrate ongoing progress toward aggressive, long-term goals for 2030.

Taking a step further, the board has selected three key metrics from the scorecard to factor directly into the executive compensation plan. Progress toward these goals can be accurately measured over time—a critical point for any effective incentive plan. Further, they are directly tied to the business strategy, are in line with investors’ expectations, can be influenced by the executive team, and are consistent with the practices of the company’s peer group.

Are Climate-Based Executive Incentives Right for Your Company?

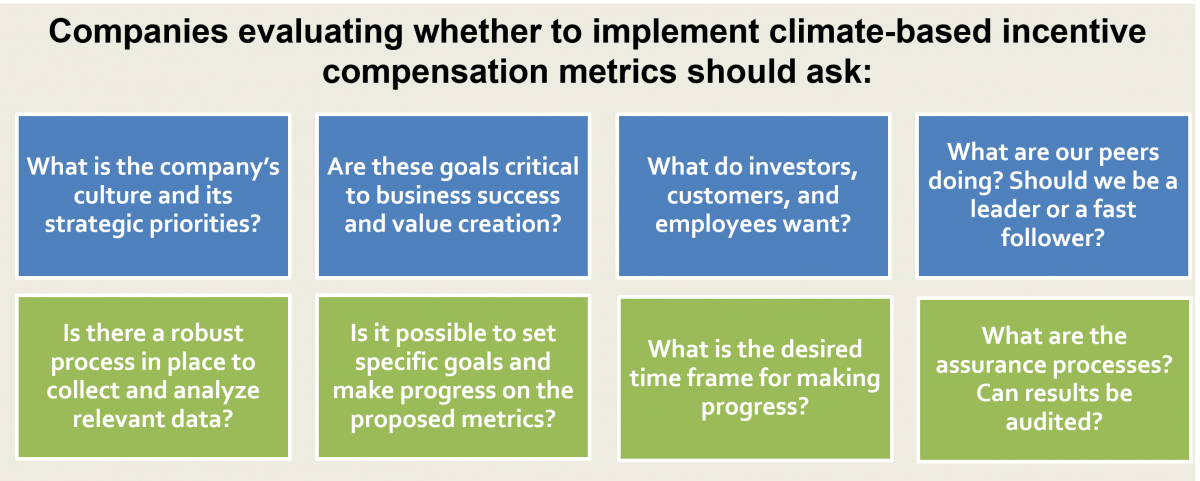

Despite stakeholder interest, companies do have to ask if climate incentives are the right path at this time for their circumstances. The board and the compensation committee should carefully determine if there may be other, more appropriate and impactful avenues for addressing climate issues. While shareholders are interested in pursuing climate-based initiatives and holding management responsible, the nature of an incentive program means that to include such factors in the plan naturally decreases at least some emphasis from financial-based, value creation-oriented goals. A clear example of this challenge is the emerging trend of some ESG-focused investment funds, previously sold at a premium, to begin to lose luster based on lower returns.

What Makes for Effective Incentive Plan Goals?

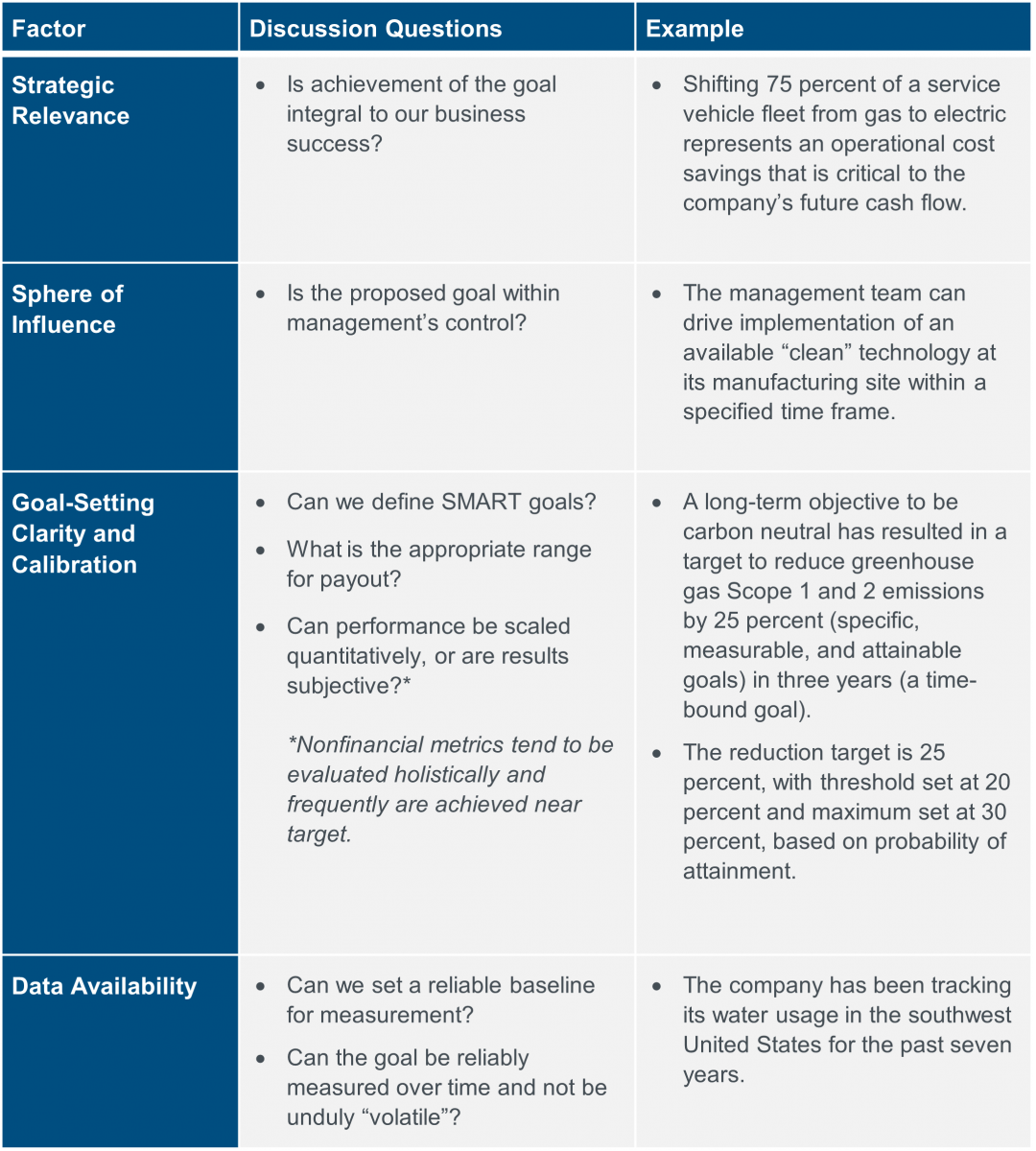

For those companies that determine executive incentives do represent a viable way to reinforce efforts on climate-related initiatives, there are several key factors for the compensation committee to use in evaluating the specific metrics.

One option to consider as an interim measure is the implementation of “shadow” goals. Shadow performance goals follow the same design and measurement process as actual performance goals, but the degree of goal attainment does not impact the incentive plan. In other words, metrics are selected, goals are set, and performance is measured, but only as a learning exercise with no direct impact on incentive payouts.

Case Study #2: Taking a Test Drive with "Shadow" Goals

A large consumer goods manufacturer wanted to proactively incorporate ESG metrics into their annual incentive program. In discussions with shareholders, it was clear that these metrics should support long-term value creation and be within management’s control to influence.

The decision was made to incorporate a combination of DE&I and environmental goals. The board felt confident that they were far enough along on the DE&I path to set specific and measurable goals, but did not feel that they were yet ready to do the same for their environmental objectives, which would seek to improve sustainability through reductions in the company’s carbon footprint.

For the first year of this initiative, the compensation committee implemented two specific DE&I goals: to increase the percentage of underrepresented populations in leadership roles and to increase spend with diverse suppliers. For the environmental element, they elected to adopt “shadow” goals focused on the reduction of plastic in packaging. Following the year in which the environmental shadow goal was in effect, the company modified the goal from a 10 percent reduction, which it found was readily achieved, to a more aggressive goal of 15 percent.

Shadow goals can be an effective way to introduce a new performance measurement concept. Management teams have an opportunity to become familiar with a new direction and learn how they can influence results, with the understanding that the board is expecting and tracking progress. At the same time, the compensation committee can better assess its ability to set appropriate goals and measure outcomes. All learning takes place without the risks that can come with actual goals.

Appropriately Balancing and Explaining the Concerns

There are conflicting issues to consider that warrant clear communication of the board and compensation committee’s thinking. (See “Communications Tools for Talking About Pay” below.)

Outline the need to balance the costs of long-term climate-related actions and investments with near- and long-term financial returns. Boards and management teams should be aligned in their understanding of the cost of shifting focus away from financial results in favor of nonfinancial metrics. They must collectively be able to articulate this cost and how the expected results have long-term benefits that outweigh the short-term impact to shareholder returns. Or they should carefully explain why this is not in the company’s best interest and what is being done in other areas to improve the company’s position relative to climate issues.

If incentives are put in place, have actions and answers ready for a scenario in which the plan as constructed pays out for climate-related performance, but financial performance is poor or doesn’t achieve threshold. Likewise communicate how the metrics will be quantitatively evaluated, so that payouts aren’t too easily achieved and therefore perceived as an entitlement.

Conclusion

In both the short and long term, stakeholders across the spectrum are expecting to see progress. Companies must determine how they will pursue the climate-related goals that are relevant for their operations and meaningful within the context of their business strategy. Clearly communicating these choices and outlining how the organization will be held accountable and in what timeframes is a must. Whether these choices include goals specific to the executive incentive plan should be determined based on the individual company’s facts and circumstances.

Case Study #3: Boldly Elevating the Importance of Sustainability

A global electronics distributor shook up its annual incentive plan, historically based on a mix of 70 percent financial performance and 30 percent individual and/or strategic goals. The compensation committee made a bold move to recognize and respond to the growing demand from investors and other stakeholders to demonstrate the importance of sustainability. It moved the 30 percent piece of the pie from individual efforts into corporate, ESG-related goals, including reduction in carbon emissions at its facilities.

In addition to a radical shift in how and against what measures executives are incentivized to perform, the board expanded the role and changed the title of the chief human resource officer. Today, the chief sustainability and human resource officer is focused on two increasingly important and intertwined facets of organizational health.

Communications Tools for Talking About Pay

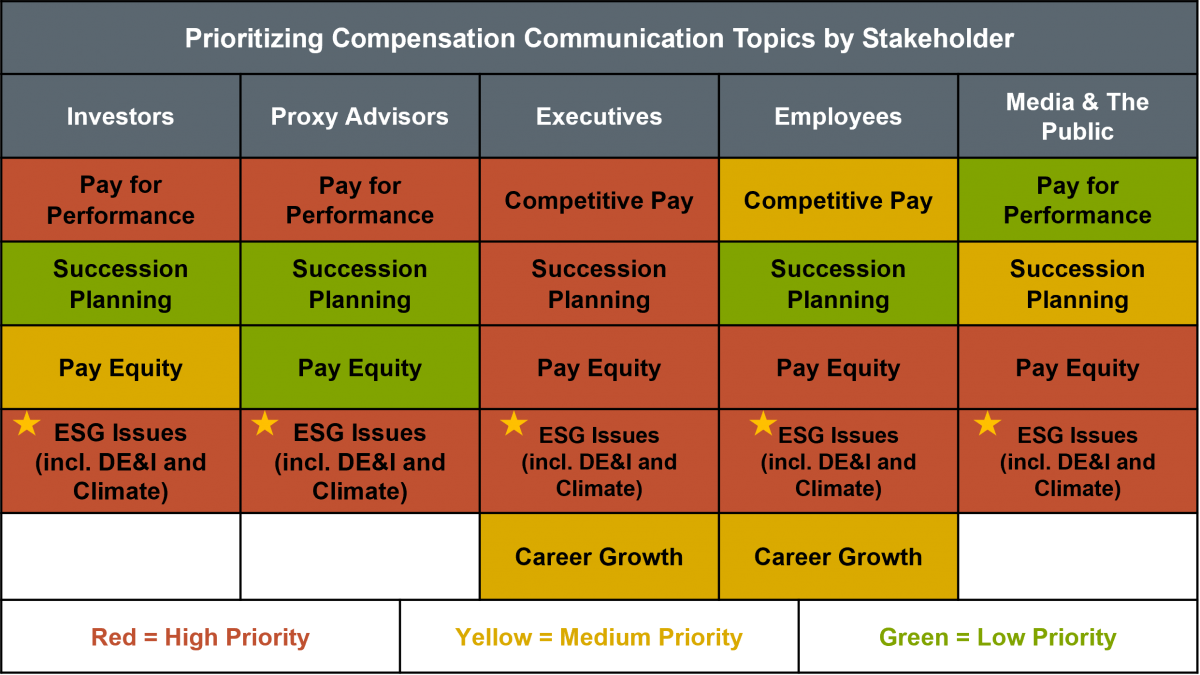

Understand your company’s various constituencies and what they are most concerned about when it comes to compensation and structure your plans for pay communications accordingly. The current general emphasis among primary stakeholder groups varies by topic (see matrix above), but all are currently broadly concerned with ESG issues and their relationship to corporate strategy and executive pay.

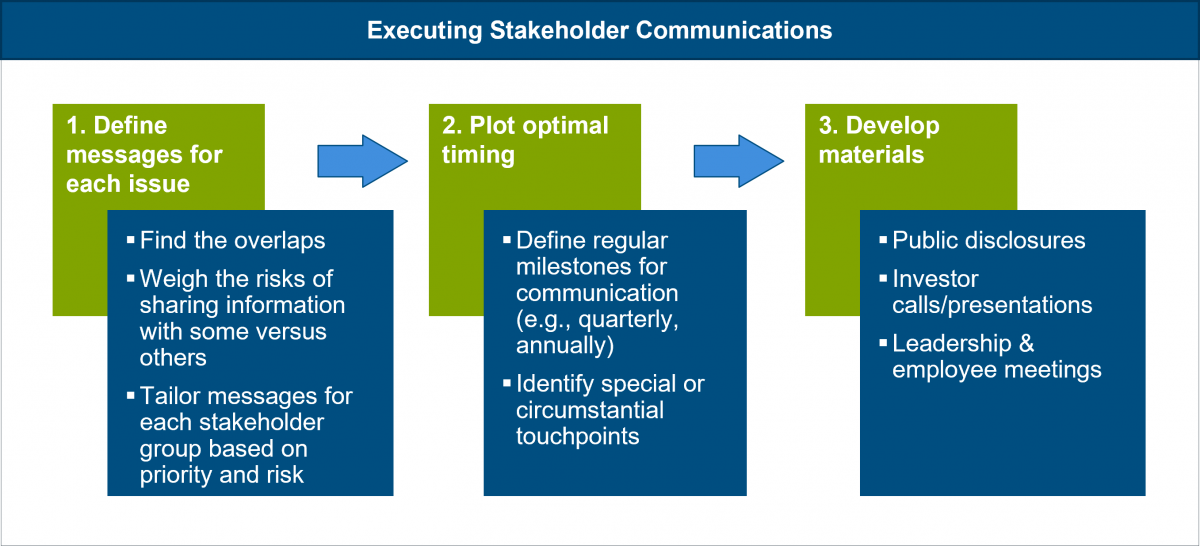

- Similar to the cadence outlined in the graphic below, develop a plan that includes specific messages to address the concerns of individual groups.

- Where you have constituencies that are specifically concerned about climate, ensure that aspect of ESG is addressed in detail—outline why it is included in an executive compensation plan and what the expected outcome is, or explain in clear detail why it is not included in the plan design and point to other areas where the company is addressing climate (e.g., hiring a chief sustainability officer, setting and tracking goals as a component of the broader corporate social responsibility efforts, etc.)

- Consider each audience individually, taking care to share enough—but not too much—information, and do so in the right time frame for each.

- Ensure that you’re taking advantage of multiple opportunities to communicate—it cannot be a “one and done” exercise.

- While tailoring communications, do so in a cohesive, complimentary way that avoids mixed or conflicting messages.