Article | Apr 2021

The State of Compensation in Seniors Housing

Industry-specific survey data and analysis points to an improving outlook with respect to compensation and human capital in 2021.

Optimism and Opportunism in the Face of a Long and Challenging Recovery

The seniors housing industry is in a continued perilous situation. While the COVID-19 vaccine is finally here and being administered to staff and residents alike, the pandemic-based spike in operational costs combined with the dramatic drop in new “move-ins” has led to record reductions in census and tremendous capital constraints. Furthermore, it has become nearly impossible to project the timing of a potential lasting turnaround, making executive compensation an increasingly difficult issue to confront.

Pearl Meyer, with the support of the American Seniors Housing Association (ASHA), released an industry-specific compensation survey in the fall of 2020 that shed light on how many in the industry were looking to address their compensation and human capital-related issues. This paper summarizes these findings and offers guidance on trends that have emerged since the survey was completed. Together, these results offer insight on where the industry is headed with respect to compensation and human capital decisions in 2021.

Survey Findings

The annual Seniors Housing Industry Compensation Survey provides current information on key organization metrics, compensation program structure and design characteristics, and competitive compensation levels for 162 positions. The survey is conducted annually between May and September, with this year’s data effective as of 5/1/2020. A total of 60 companies participated in the 2020 survey, allowing Pearl Meyer to provide the ASHA community with a valuable benchmarking resource to compare company compensation programs and pay practices to the market.

Industry Projections

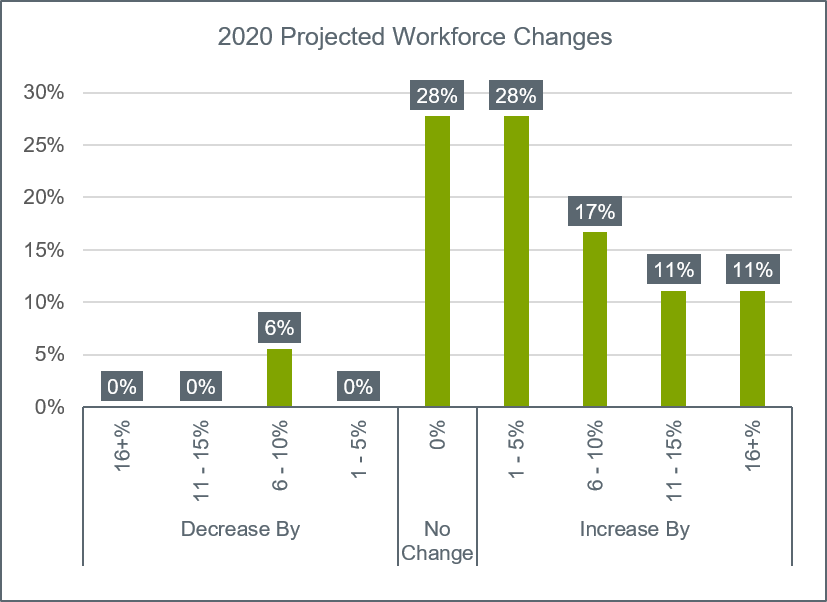

Despite the setbacks of 2020, there is broad industry consensus that COVID-19 will be only a temporary setback in the industry’s growth. In defiance to the year’s crisis, 67% of survey participants expected to expand their workforce, only a slightly smaller rate than in 2019 (69%). In fact, fewer companies (6%) projected a decrease in their workforce compared to 2019 (10%), signaling long-term confidence in the strength of the industry.

Likewise, expectations of short-term financial performance remain optimistic, albeit tempered. A plurality of survey respondents expected a growth in FY2020 revenue of 6% to 10%, compared to 11% to 15% in FY2019. Only 8% of respondents expected revenue to remain unchanged and none reported expectations of decreased revenue for FY2020. Similarly, participants expected growth in total assets to continue with a majority reporting expected growth between 1% and 5% and no participants expecting a decrease in total assets.

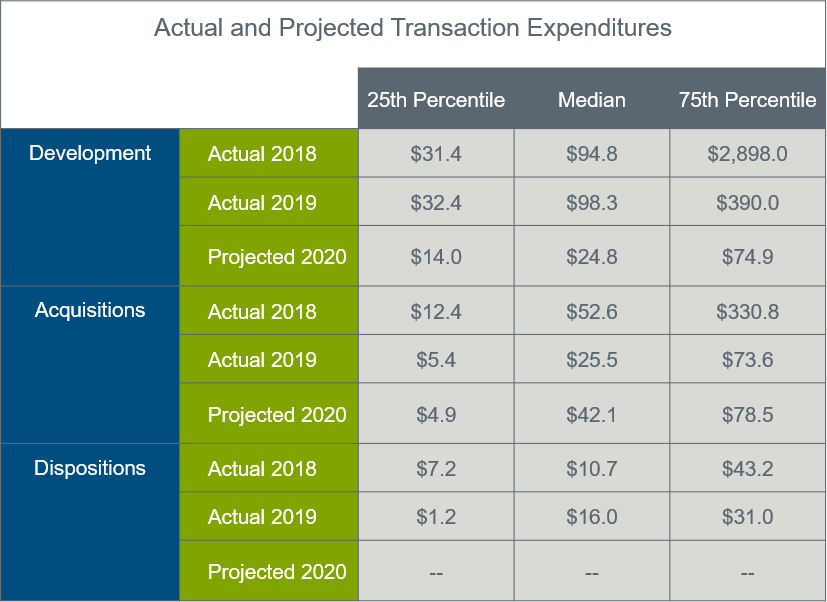

Like past economic crises, development pipelines have slowed dramatically. Among participants, median expected expenditures on development fell from $98.3M in 2019 to $24.8M expected in 2020. While it appears that moderate portfolio growth from acquisitions will continue, firms have reset the year’s growth expectations and have signaled a desire to hold onto existing assets and focus on solidifying past gains to ride out the current economic uncertainty.

Compensation Trends

Base Salaries

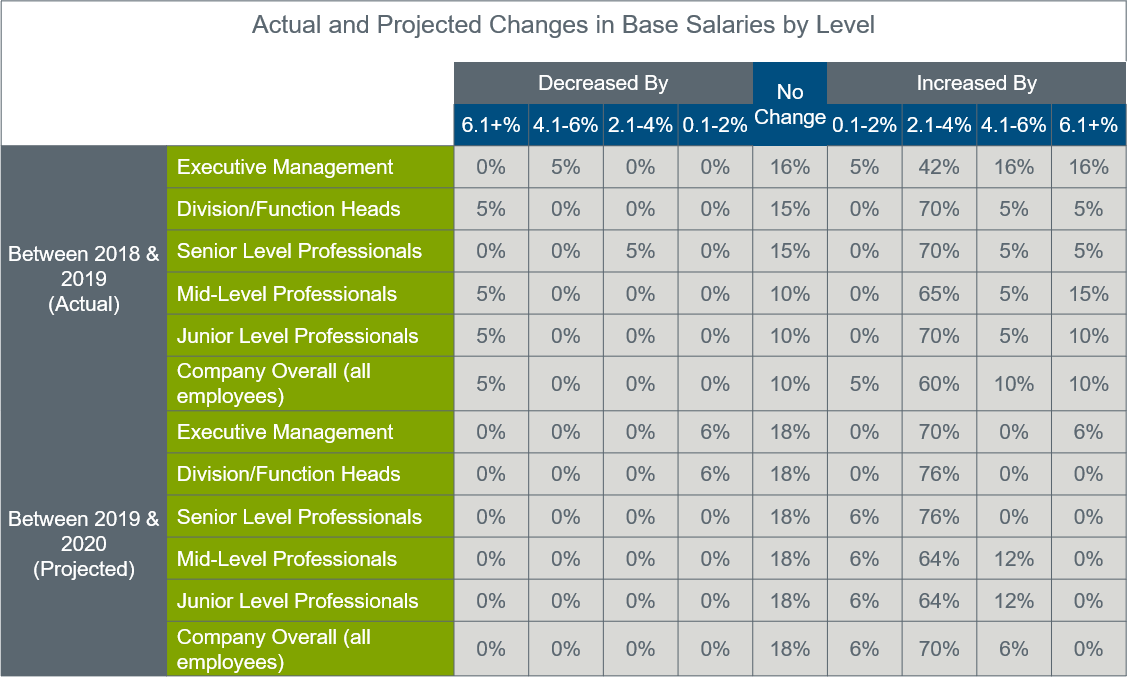

As of the survey date, there continued to be industry optimism, with the majority of respondents projecting organization-wide increases to base salaries for 2020 although these increases were expected to be more conservative than in 2019. Overall, 82% of employees were expected to receive an increase to their base salary as opposed to 90% in the previous fiscal year. At the function-head level and below, increases were expected to fall in the 2% to 4% range, consistent with past increases. Unlike prior years, 70% of respondents also projected 2% to 4% salary increases for executives in 2020. By comparison, in 2019 only 42% of companies projected salary increases in the modest 2% to 4% range, while 32% expected executive increases to be greater than 4%. Six percent of firms expected salary decreases at the executive management and function-head levels, likely representing voluntary decreases to base salary in response to the uncertainty caused by COVID-19. We expect that this percentage rose after our 2020 data was compiled.

Short-Term Incentives

Over three-quarters of participants (76%) reported maintaining a short-term incentive (cash bonus) program, of which 13% were solely discretionary. Participation in such programs tend to be concentrated among the senior management ranks of respondents with 100% and 88% of executive managers and function heads participating, respectively. However, increasingly, bonus programs are reaching the lower levels of organizations with over half of mid-level and 38% of junior-level professionals eligible for a short-term incentive (STI) opportunity.

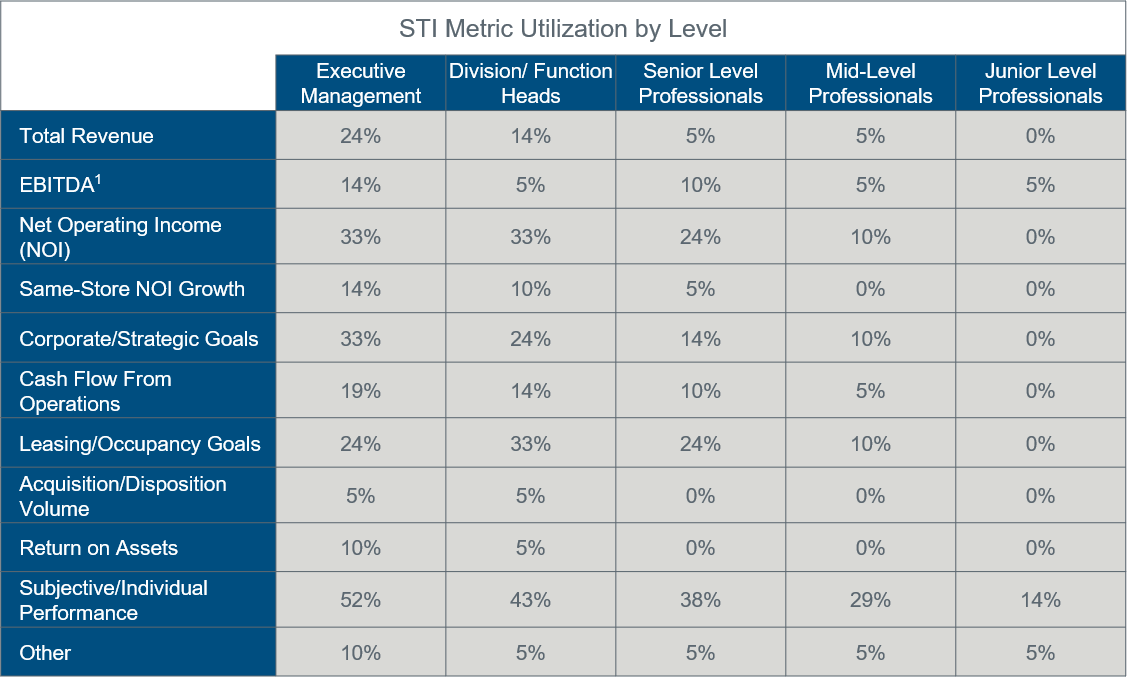

In implementing short-term incentive plans, organizations commonly use a mix of financial and strategic/subjective metrics. While individual performance represents the most common plan metric at all levels of participating organizations, the use of company- or business unit-wide metrics is common at the senior professional level and above. At these levels, occupancy goals, Net Operating Income (NOI), and other strategic objectives represent the most prevalent metrics.

Projected 2020 STI payouts provide one of the clearest examples of the expected effect of COVID-19 on executive pay within the seniors housing industry. Among participating organizations, 25% of firms expect decreased incentive payouts as compared to FY2019. Only 9% of firms reported decreases between FY2018 and FY2019. While 50% of firms still expect increased payouts, these increases are expected to be minimal, with 84% falling in the 1% to 5% percent range. Increased payouts may represent the presence of increased discretionary bonuses to recognize employees for continued performance under the COVID-19 environment.

Long-Term Incentives

Among public companies, the inclusion of time- and performance-based long-term incentives (LTI) is commonplace; however, among private firms, the inclusion of long-term awards in compensation is less common-place. In recent years, the broader real estate industry has continued to implement long-term plans to attract and retain key executives and, at times, extend these opportunities to mid- and junior-level staff. The seniors housing industry, however, has been slower to respond with few firms outside the largest industry players offering equity-based incentives. As the market for talent within senior housing continues to heat up, these incentives offer a distinct retention tool to attract top performers to firms willing to go the extra mile.

Positional Data

In a same-store analysis of participating companies from our 2019 and 2020 surveys, we observe a clear indication of increasing pay competitiveness in the seniors housing market. Between 2019 and 2020, base pay across all positions rose 7.8%, over double the approximate 3% increase we observed across all industries.

The strongest growth was among functions where industry-specific knowledge was crucial to job performance such as development and executive leadership, rather than more generalized functions such as accounting/finance and human resources, where growth in pay competitiveness was still strong but more closely aligned with broader market trends. In our same-store analysis, asset and executive management positions led the way in base pay growth at 12.7% and 12.1%, respectively. For construction and development positions, while base pay increased at a more conservative 6.7%, strong growth in short-term incentive (cash bonus) opportunities led to an 11.3% increase in total cash compensation.

By level, the strongest growth in pay competitiveness was seen at the two extremes: at the executive management and entry levels of participating organizations. Signaling the increasing competition for top executive talent in the industry, base pay for the top three leadership positions (CEO, COO, and CFO) grew a combined 13.9% while combined increase for the executive team members outside the top three grew at a slightly slower 10.2%. Growth was more reserved among function heads and senior (director) level professionals with base salary growth of 6.9% and 6.1%, respectively. However, we also saw low double-digit growth at the mid- and junior levels indicating increased competition for talent at these levels.

Top Five Trends for 2021

Goal- and Performance Cycle-Setting

The current widespread economic uncertainty has left firms struggling to implement realistic and achievable goals as related to their short-term incentive plans. In the first half of 2020 we observed many organizations resetting their annual goals to ensure their executives and employees would maintain realistic bonus opportunities despite the extreme downturn. Likewise, several firms, expecting the pandemic to be largely over by the second half of the year, chose to ignore Q1 and Q2 performance and structure incentive payouts based solely on the Q3 and Q4 performance. Neither of these tactics offered perfect solutions as economic uncertainty continued into the second half of the year and setting realistic projections more than six months in advance continued to be difficult. As a result, firms have begun to adopt shortened performance cycles, commonly six-month periods, to provide for more grounded performance expectations and frequent reassessment of goals. We see a continued trend of firms shortening performance cycles and offering mid-year and even quarterly bonus opportunities until the industry stabilizes into a “post-pandemic” norm.

Executive Salary Freezes

With a slow rollout of vaccines beginning to take shape, the end of the pandemic looks to be in sight. This leaves companies who implemented discretionary compensation actions early on to reckon with the lifting of some of their most extreme measures such as pay cuts, especially among top executives and directors. With seniors housing firms among the hardest hit during the pandemic, such cuts were common; however, as the pandemic recedes and competition for talent continues to be high, we recommend a cautious response. In past crises, there is precedent for executives who voluntarily accepted pay decreases to receive one-time cash or equity grants once the crisis had receded as recompense. In the current competitive market such awards may be helpful in retaining top talent, although caution should be observed. Firms should not only ensure that they are financially stable enough to grant such a payout, but also that their operations have returned to “normal enough” including the reinstatement for furloughed workers, so that they will not be seen as taking advantage of a situation in which the jobs of employees throughout the organization have been eliminated. Likewise, any company that accepted money from various government COVID-19 programs should carefully consider the “optics” of making extraordinary grants to executives.

Topgrading

A growing industry trend expected to gain even more traction throughout 2021 is topgrading. In short, topgrading is the act of replacing incumbent “average” performers with “A-level” caliber talent whenever possible. In addition to improving efficiencies, upgrading the talent at every level that is practically and fiscally feasible is simply good business. It can improve profitability, create more efficient organizations by doing more with less overall head count, and dramatically improve company morale when “under-performers” are removed.

Opportunistic firms, seeing base salaries frozen and/or cut and bonus opportunities reduced and/or eliminated within the industry, are being increasingly proactive with respect to strategic hiring in 2021. For firms looking at a talent upgrade at one or more positions in their company, the time may never be better to acquire difference-making talent at below-market pricing. It is a unique window of opportunity in the fight for top-tier industry talent and a trend that will continue to build in 2021.

Discretionary Bonuses

In a typical business climate, just 13% of firms with a short-term incentive plan rely only on discretion in determining payouts. Now, discretion plays a much more critical role in COVID-19-era compensation practices. A number of organizations used negative discretion in 2020 to limit cash payouts in order to avoid more extreme staffing cutbacks. At the same time, given the proper conditions, other firms used additional discretionary bonuses to help retain and reward employees for their continued dedication throughout the pandemic. While not realistic at many of the hardest hit companies, firms who have survived the pandemic relatively unscathed recognize the benefits of additional discretionary payouts on both retention and firm morale and are implementing more payouts this year.

Compensation Strategy Alignment

The pandemic has transformed the way almost every company conducts their business. Whether that has been a wholesale strategic realignment or simply implementing a more flexible work environment, the world of work has changed and firms must adapt their compensation strategies to keep up with this new reality. Organizations should see this as an opportunity to assess their compensation and broader HR strategies and ask several key questions: Do our STI and LTI performance metrics still represent key drivers of growth? Should our virtual environment change how we look at recruiting talent, and do we have the right leadership in place to lead that talent? Have the needs of employees changed and is our compensation and benefits structure reflective of that change?

The coming post-COVID era provides firms with the opportunity to assess their practices from the ground up and implement plan changes that may be long overdue. Forward-thinking firms are already taking these steps in 2021.

Conclusion

In summary, the unprecedented challenges faced by the seniors housing industry in 2020 persists into 2021. While there is hope for all firms, looking especially to Q3 2021, companies continue to grapple with the material rise in cost of operations, lack of new sales, and an overburdened workforce that continues to perform heroically in the most trying and even dangerous health environments.

That said, forward-thinking firms are working to get stronger and executing creative solutions to selectively add talent while retaining and motivating current staffs. Human capital is the life-blood of the industry. In the end, companies that have strong leadership and carefully structure compensation programs in order to hold and improve their teams will benefit and continue to outperform their peers. In 2021, they already are.