Advisor Blog | Feb 2022

Private Company Compensation Committees Are Following Public Firms’ Lead

While the way public and private companies have traditionally approached executive compensation has varied, data show there’s beneficial convergence taking place.

Private companies are often in competition with public companies for executive talent, yet the way each type of company approaches executive pay can vary meaningfully. Historically, public companies have focused on more formulaic incentive plans, with a heavy emphasis on quantitative financial goals and equity-based long-term incentives, while private companies have tended to make greater use of subjective plan components, discretion, and cash-based awards.

For public companies, this is partially a function of the old tax-deduction rules under Internal Revenue Code Section 162(m), as well as of external disclosure requirements, shareholder scrutiny, and shareholder advisory group policies.

For example, a recent survey of directors and senior management shows that public company respondents (59%) are much more likely to target executive total direct compensation (the sum of salary plus short-term and long-term incentives) at the 50th percentile, or median, than private, for-profit organizations (34 percent, with 35 percent positioning pay between the 50th and 75th percentile market values). This reflects the impact of greater external scrutiny on public company policies, as well as a difference in compensation philosophy and pay mix.

Among private, for-profit companies, retention concerns were the most prevalent factor impacting current compensation philosophy, with 75 percent of respondents listing it among their top three choices, followed by company performance and market practice, with 45 percent selecting each. Meanwhile, the most commonly cited impacts for public companies were market practice (65%) and company performance (63%). Private for-profit organizations were also slightly more likely than public companies to have recently increased targeted executive pay positioning versus the market to improve pay competitiveness (18 percent and 16 percent, respectively). When it comes to exercising discretion for 2021 short-term incentive awards for executives, 71 percent of public company respondents did not anticipate making any adjustments, compared to only 38 percent of private, for-profit company respondents.

Public companies often feel pressure to conform to shareholder advisory group policies, with external scrutiny often leading to a cookie-cutter approach to compensation plan design. Despite their relative “freedom” from this pressure, many private companies have lacked the formal compensation philosophies and governance processes typically found at publicly traded companies.

However, these circumstances are changing. According to the survey, there appears to be some beneficial convergence in the ways that both private and public companies structure their executive pay programs, particularly in incentive programs and governance practices.

Goals and Metrics

As public companies begin to incorporate more qualitative, nonfinancial incentive metrics (often focused on environmental, social, and governance issues) into executive pay plans, private companies are gradually increasing their focus on long-term incentive awards. This is bringing private company pay practices more in line with the public companies that are competing for the same talent.

According to the survey, 100 percent of public company respondents said their organizations provide senior executives with a long-term incentive opportunity. Private, for-profit companies aren’t far behind at 76 percent. In fact, private, for-profit organizations were twice as likely as public companies—30 percent of respondents versus 15 percent, respectively—to have recently increased (or be planning to increase) long-term incentive participation levels.

In addition to improving recruiting and retention, this shift ties a portion of pay to longer-term sustainable performance and value creation, further aligning executive and ownership interests. An increased focus on long-term incentive programs can also bring about additional sophistication for private companies in terms of goal-setting, strategic planning, and reporting, leading to a virtuous cycle of increasing effectiveness for such programs.

Structure and Governance

To further improve their executive pay programs’ effectiveness, private companies are increasingly adopting broader market corporate governance practices. These include having formal, documented compensation philosophies, adopting clawback policies, using tally sheets, and having oversight from a truly independent compensation committee with a charter that clearly outlines its role and authority.

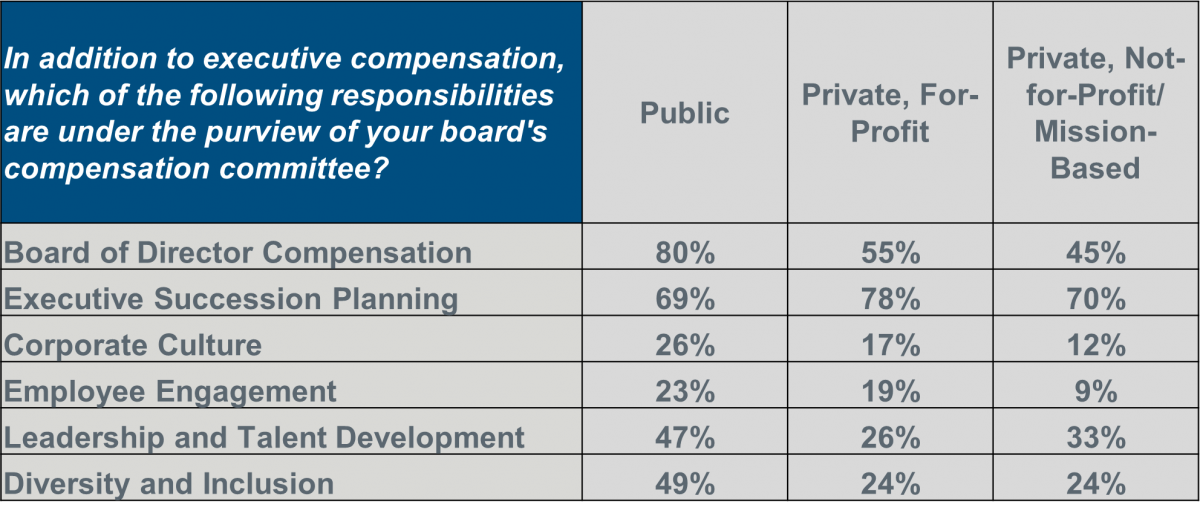

Both public and private compensation committees are also facing myriad responsibilities beyond executive pay. The data indicate that private company boards are not far behind their public counterparts in addressing issues such as culture and employee engagement, and we expect to see increased oversight in these areas across both ownership types going forward. In fact, private company compensation committees are more likely than public company compensation committees to focus on a key board responsibility: executive succession planning.

Ultimately, the goal of sound executive compensation design is to align an organization’s business and talent management strategies to help promote competitive advantage and long-term value creation.

A structured framework with clearly defined program objectives that, in many cases, mimic public company governance practices will help private companies reinforce key strategic objectives, promote internal equity, align executive pay with sustainable performance and value creation, and become more effective in talent attraction and retention.