Advisor Blog | Aug 2018

Yes, Your Compensation Committee Should Talk about ESG Performance Measures

Are ESG metrics appropriate for your executive compensation plan? Results from our Quick Poll show boards and management teams may not be fully aligned.

But within the context of these other, broader diagnostics!

ESG (environmental, social and governance) issues are in the spotlight. There is a growing consensus among investors that good ESG practices correlate with investor returns. This has provided proxy advisors with a mandate to spend more time and energy on attempting to measure and score how well companies are actually doing with respect to their ESG practices (a Sisyphean task depending on company stage and sector).

At any rate, it seems logical to ask “if investors and proxy advisors believe ESG initiatives can unlock shareholder value, ought executive incentives be tied to these initiatives?”

We are curious to understand the extent to which this issue is driving the agenda for compensation committees. In other words, will committees be spending time this year reviewing the appropriateness of ESG measures for inclusion in their executive compensation programs?

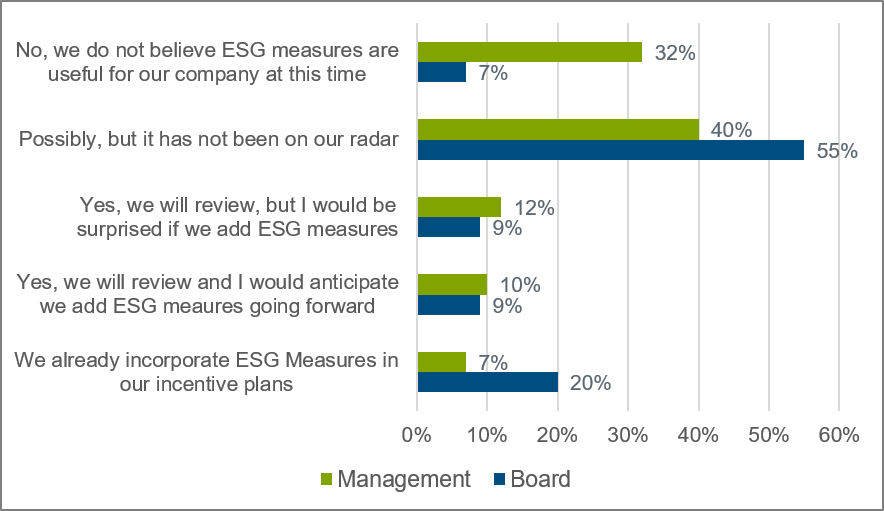

Fortunately, our Quick Poll series Setting the Compensation Committee Agenda is designed to challenge and explore whether items that appear to be capturing public attention—for good or ill—translate into actual time spent in review and discussion at compensation committee meetings. This summer we asked participants a simple question: Will your compensation committee review the appropriateness of environmental, social, and governance (ESG) measures for your executive incentive plans this year?

We received 147 responses , detailed below:

We find it interesting that:

- The vast majority of respondents indicate that they neither already incorporate ESG measures, nor anticipate adding such measures going forward. This squares with our experience that ESG measures remain a minority incentive design practice in most sectors.

- There is a stark contrast between the percentage of management respondents (32%) vs. board respondents (7%) who do not believe that ESG measures are useful for their company at this time. This may demonstrate tension between management teams who have difficulty in seeing obvious and material value chain links to ESG measurement and boards who nevertheless feel they are under pressure from the investor community to at least explore the topic.

We believe that the role of ESG measures in company performance assessments will grow over time, and that compensation committees ought to explore whether such measures are appropriate at their companies (though we also recognize that for many companies the answer remains “no”).

For December fiscal year-end companies, now is a fine time to discuss such issues. We have found that Q3 meetings work well for reviewing materials germane to the following, each of which lends itself to consideration of ESG issues:

- Evaluating the overall compensation philosophy to confirm it continues to send the right signals to shareholders, employees and potential candidates about the type and level of performance on which the company is focused and how results will be reflected in compensation. ESG measures may have a role to play as companies evolve their performance priorities over time.

- Assessing the prevalence of incentive compensation design practices among peers and the broader market. If sector-relevant companies are clearly shifting their incentive designs to include consideration of ESG measures, they may merit closer investigation (as would be the case for any shift in peer practice). Peer practices may also provide specific examples of how such a shift may be implemented.

- Pay-for-performance assessments. While such assessments typically focus on financial categories of performance, investors have indicated that they have found positive correlations between sustainability or “good governance” ratings and shareholder value creation in certain sectors. Companies considering implementation of ESG performance measures may wish to supplement traditional pay-for-performance assessments with an examination of whether there is in fact such a relationship between ESG and shareholder value creation among their peers.

We recognize that committee members have limited time and much to do. We believe that committees will find incorporation of ESG measures within the context of the above diagnostics—which are cornerstones of many annual committee agendas—is an efficient approach.