Article | Jul 2022

A Time Series Analysis of Committee Chair Pay

Data and context on the relationship between historically premium pay for the audit committee chair compared to other committee chairs.

As Driven by Evolving Pay and Governance Practices

We have observed a continuing evolution in certain nonemployee director pay practices. One of those practices where we have observed some continual evolution is the pay structure for serving as a committee chair. Of the conventional standing board committees, historically, pay for audit committee chairs was highest, followed by pay for compensation committee chairs, and then finally pay for chairing the nominating and governance committee, which was lowest. Over time, we have observed some compression in committee chair pay levels as driven by two primary factors:

- Desire for increased simplicity in nonemployee director pay structures, which has resulted in increased parity in chair pay between compensation committees and nominating and governance committees; and

- An increased workload for the compensation committee and nominating and governance committee relative to the audit committee as driven by evolving governance standards and practices.

At the same time, boards are determining the right approach to structure their oversight responsibilities across the increasingly complex environmental, social, and governance (ESG) landscape. In practice, companies have implemented various ESG oversight structures, including:

- Maintaining some or all oversight of ESG at the full board;

- Assigning some or all oversight of ESG to existing board committees;

- Creating a new committee, with responsibility for oversight of some or all of ESG; and/or

- Some combination of the above.

There are some elements of ESG that naturally fit within the purview of certain board committees, and we often see oversight for these topics assigned to specific committees. Events of the past few years have driven an expansion of the role of the compensation committee (now called the human resources committee at an increasing number of companies) to encompass various people-related topics including culture, employee engagement, and diversity and inclusion. At the same time, many companies have assigned ESG oversight to the nominating and governance committee, because ESG did not neatly fit with any other committee or there were company-specific ESG risks that aligned with the nominating and governance committees’ oversight responsibilities (e.g., environmental risk).

Time-series analysis of pay for committee chairs at companies in this year’s Director Compensation Report provides some more context on evolving trends as it relates to the relationship between pay for the audit committee chair and other committee chairs.

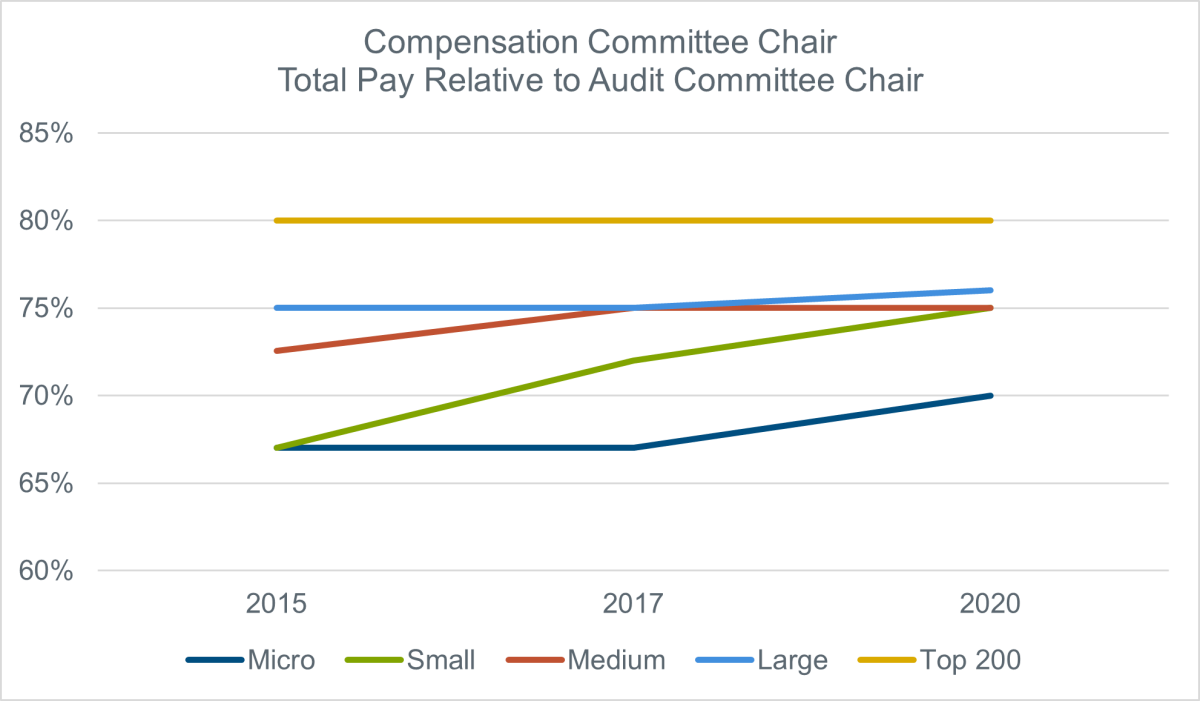

Data in the chart below shows compensation committee chair pay relative to audit committee chair pay going back to proxies filed in 2015. The data indicate that the smallest companies have been most aggressive with pay increases for the compensation committee chairs. This is not surprising, as many of the evolving governance practices that impacted large companies coming out of the Great Recession were not incorporated by smaller companies until the last few years. This increased workload for smaller companies has been reflected in more aggressive pay adjustments for compensation committee chairs.

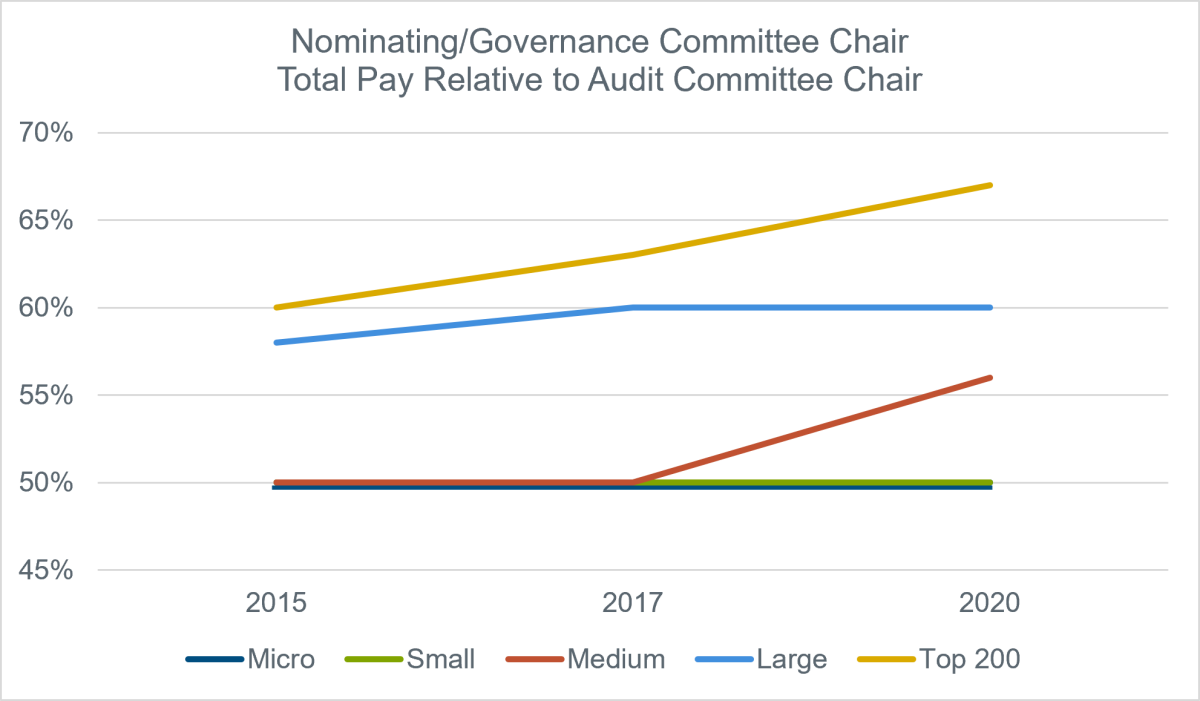

The same analysis was completed on nominating and governance committee chairs. The data indicate that the largest companies have more frequently increased pay for the nominating and governance committee chairs versus the smaller companies, where nominating and governance committee chairs continue to be paid 50 percent of what audit committee chairs are paid. The data also reaffirm differences in pay for compensation committee chairs relative to nominating and governance committee chairs.

As practices at larger companies have been adopted by smaller companies with a three- to five-year lag, one might expect increases in pay for nominating and governance committee chairs to accelerate over the next few years.

It has long been viewed that audit committee chairs have a more complex and higher-risk role than that of other committee chairs, and it was therefore appropriate to pay audit committee chairs a premium. This data set seems to indicate that this view may be evolving in part as many companies pursue simplicity in nonemployee director pay design and as ESG oversight is likely to become a formal responsibility for compensation committees and nominating and governance committees before it becomes a responsibility for the audit committee. It will be interesting to see over the next few years if the trend continues and the difference in pay between audit committee chairs and other chairs becomes smaller, or if the trend slows and differences in pay between audit committee chairs and other committee chairs persists.