Article | Dec 2022

ASHA 2022 Compensation Survey Results: Five Key Takeaways

The data point to clear trends in base salaries, use of incentive pay, and bonuses.

In seniors housing, 2022 has proven to be an extraordinarily challenging year for the industry. Covid-related issues continue to cause ongoing disruption, serving to complicate operations, dampen occupancy, and create issues with respect to staffing and continued rising operational expenses at the site level. Layered on are material rises in the cost of insurance and staffing at the regional levels. Thus, even the most well-run companies are being challenged. Furthermore, ongoing occupancy issues, the rise in interest rates, and construction costs have significantly dampened the demand for new development and put redevelopment projects on hold.

Given the year’s immense challenges, this year’s ASHA-sponsored Pearl Meyer 2022 Seniors Housing Compensation Survey remains an increasingly valuable reference and planning tool for talent management. In a year filled with so much uncertainty, the survey results provide a solid indicator of where the industry is moving and can help formulate a market-competitive approach to compensation.

Participation in this annual survey continues to increase, with an 11% jump in participation this year. Data was collected between May and September 2022. The survey collects data on 170 different positions across all organizational levels, from the junior-most analyst through the c-suite. It covers both core real estate and related operational and support functions.

We have identified five clear trends in the industry based on this newest dataset.

Despite challenging operating conditions, base salary increases materially outpaced 2021.

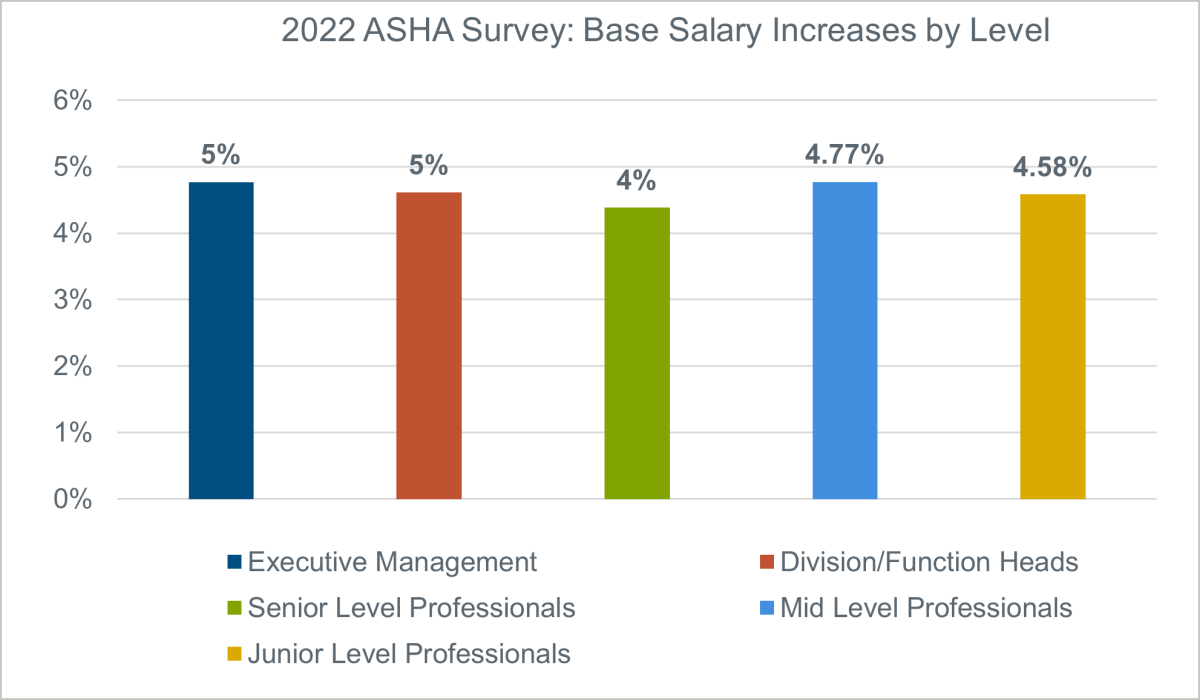

Despite the continued occupancy challenges and increased costs directly and indirectly related to the ongoing pandemic, salary increases for 2022 are projected to rise to between 4% and 5% across the industry, a material increase over 2021’s 3% average increase.

Both executive management and mid-level professionals see the largest increase at 4.77%, followed by division/function heads at 4.61%, junior level professionals at 4.58%, and senior level professionals at 4.38%. This is consistent with the rest of the real estate industry (excluding ASHA companies), with executive management seeing a 4.11% increase, division/function heads seeing a 4.55% increase, senior level professionals seeing a 4.62% increase, mid-level professionals seeing a 4.59% increase, and junior level professionals seeing a 4.48% increase. Including ASHA companies these figures go to 4.18%, 4.47%, 4.59%, 4.61%, and 4.49% respectively.

In short, seniors housing firms are taking increasingly material financial measures to better ensure the retention of their professional staff. Those exiting the seniors housing industry to pursue opportunities within the broader real estate industry has become an increasingly problematic development, and the demand for quality professional and support staff at all levels is increasing rapidly. As a result, many firms are recognizing that there is a need to, within their current economic framework, move the needle on base compensation.

Regional director of operations and site-level executive director positions are both up in 2022.

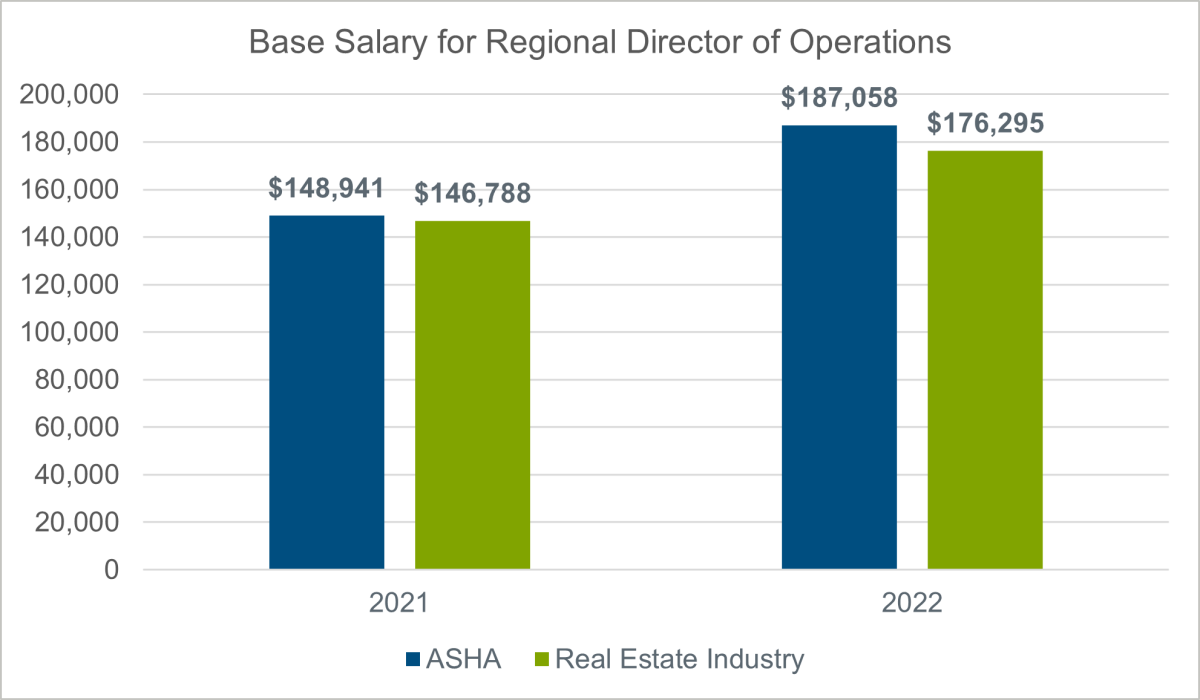

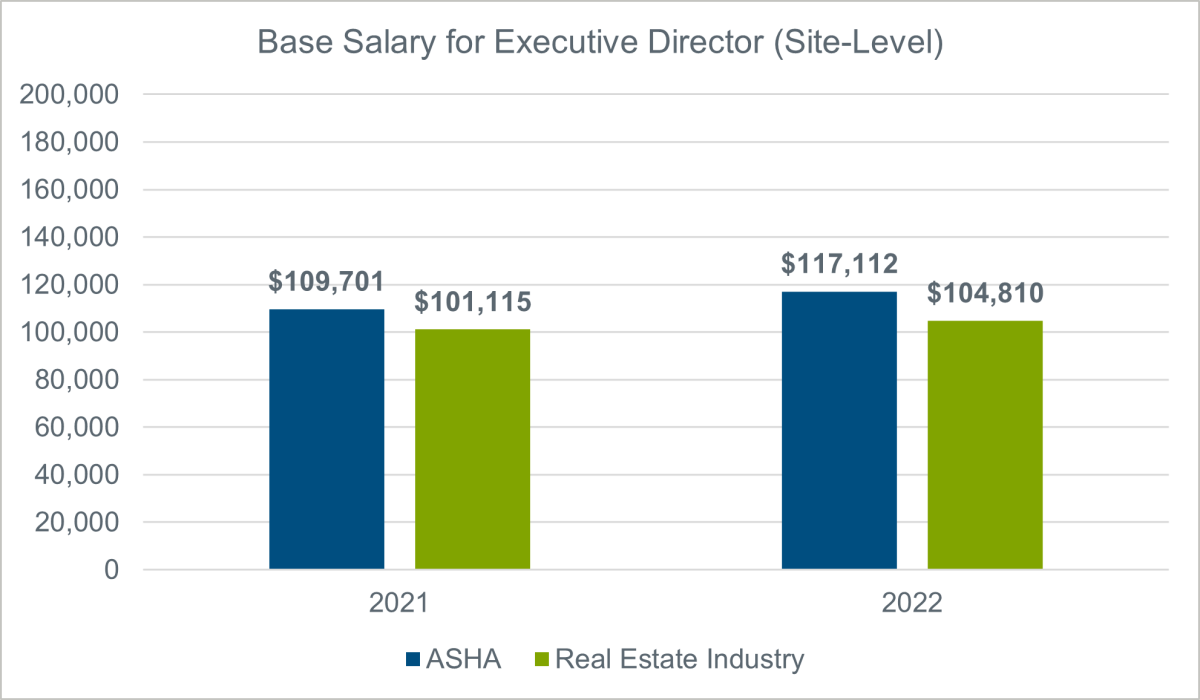

In 2021, survey participants reported regional directors of operations had an average base salary of $148,941. In 2022 that has increased to $187,058, representing a very large year-over-year increase in base salary of more than 25.5%. The executive director position also shows a large year-over-year increase, with a one-year jump of 6.76%. In 2021, executive directors in ASHA-member companies had an average base salary of $109,701. In 2022 this figure rose to $117,112.

There has been massive attrition in the industry among executive director and regional operations director talent. Many are leaving the seniors housing industry for the promise of better pay and more relative stability within multifamily owner/operators in the broader real estate industry.

Furthermore, many seniors housing firms are identifying personnel in these functional disciplines as increasingly valuable members of the company. These roles are viewed as having the ability to directly influence the performance of the asset.

Expect firms to become increasingly aggressive in their efforts to improve at these critical positions, further driving the pricing for these roles in 2023.

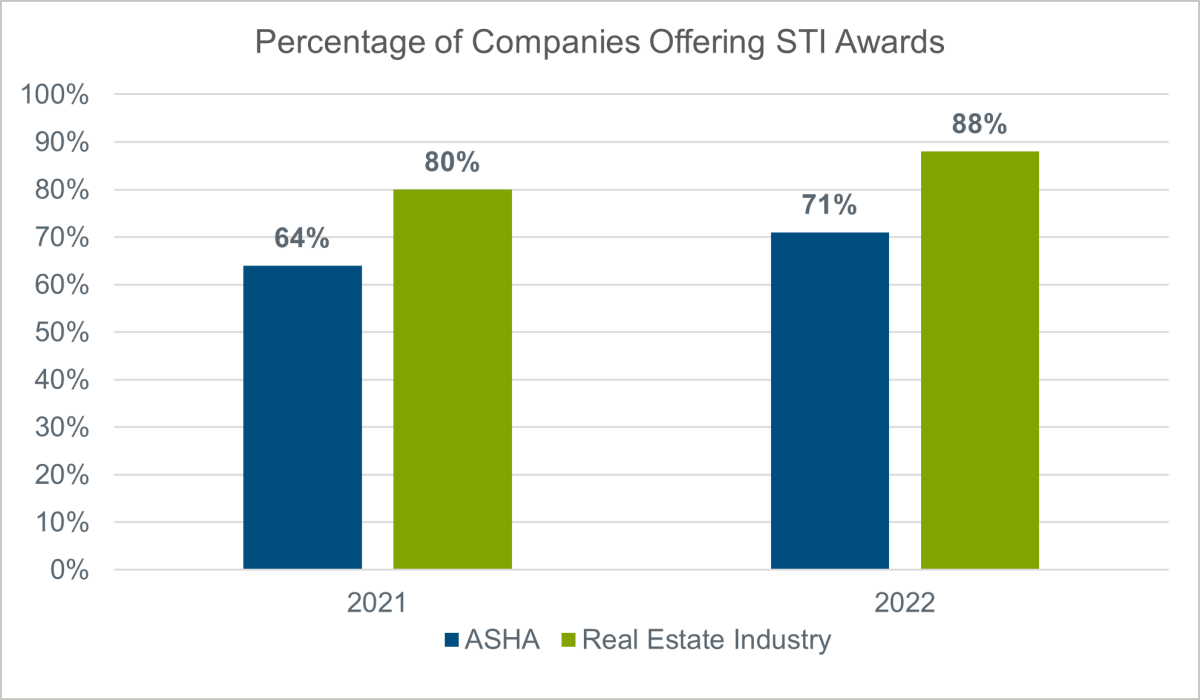

ASHA member companies have increased their short-term incentive (STI) offerings over last year, but still trail the broader real estate industry by a similar margin.

In 2021, 64% of ASHA member companies offered short-term incentive (STI) awards to their professional teams. In 2022 that number jumped by 7% to 71%. In 2021, 80% of broader real estate companies offered STI and in 2022 that number jumped to 88%, a year-over-year increase of 8%. Although ASHA companies increased their STI offerings this year, they trail the broader real estate industry by an even greater margin that they did last year.

Given the state of the industry and squeeze on operating margins, an increasing number of seniors housing operators will be forced to become more selective about the eligibility and granting of incentive compensation awards. But with nearly nine out of 10 firms in the broader real estate industry offering short-term incentive awards to at least a portion of their workforce, there will be increasing pressure again for firms in seniors housing to remain competitive with this compensation vehicle. As firms push against what is economically feasible to retain the difference-making professional staff, there will be increased pressure in 2023 to keep these teams intact.

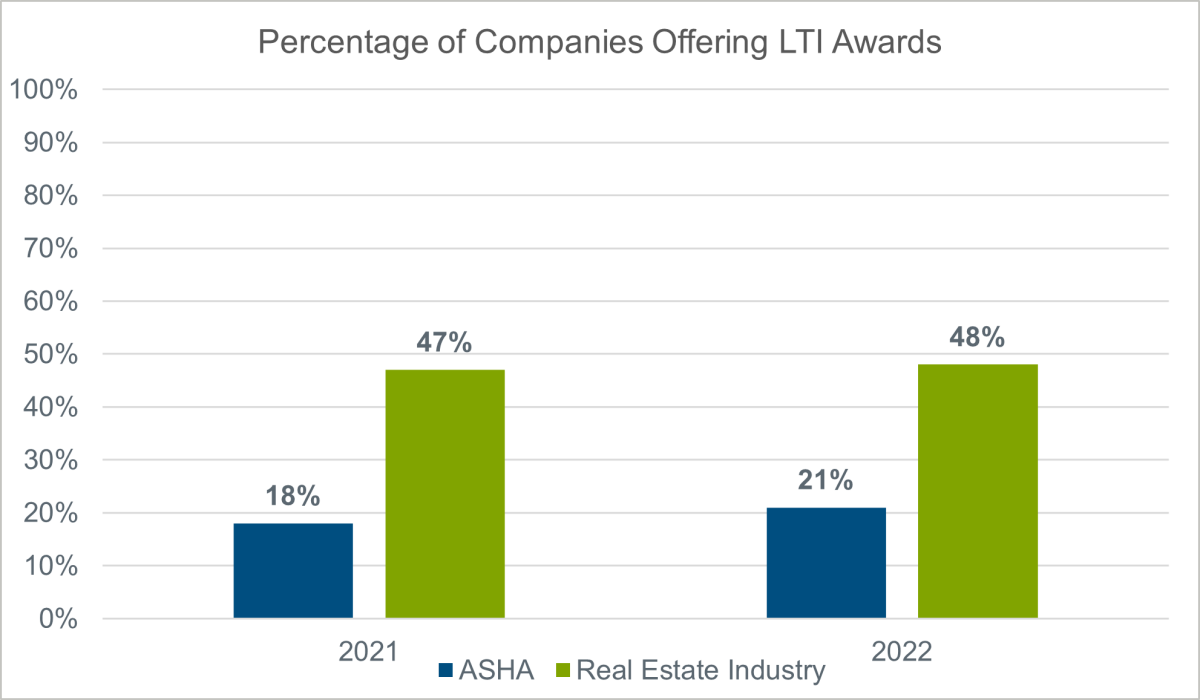

LTI offerings have increased slightly for ASHA member companies, which keeps pace with the increase seen in the broader real estate industry.

In 2021, 18% of ASHA survey participants offered a long-term incentive (LTI) program to select members of their professional teams. In 2022, that increased 3% to 21%. Compared to the broader real estate industry, ASHA made up some ground. In 2021, 47% of real estate companies offered an LTI program and in 2022 there was just a 1% increase to 48% of companies offering LTI.

Again, through this data we see more evidence of a common theme emerging: That seniors housing firms are doing what they can to better increase their odds of retaining talent, particularly at the senior to executive level. An increase in LTI in the current climate is notable in this regard.

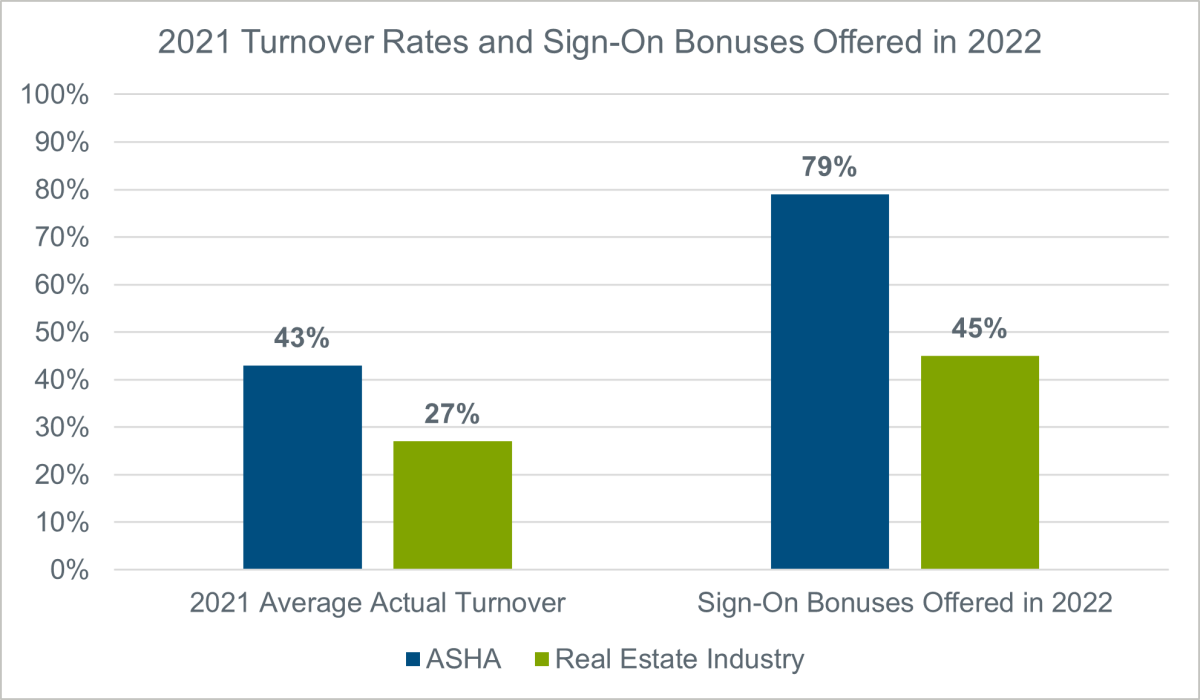

ASHA member companies offer sign-on bonuses, ostensibly with the intention of maintaining staffing levels at a far higher rate than the broader real estate industry does. But it isn’t working.

This year’s survey results revealed that 79% of ASHA member companies offer sign-on bonuses. This is a common tool to increase or at least maintain current management/staffing levels. In contrast, just 45% of companies in the broader real estate survey do this, a 34% difference. Given the shortage of available, ‘difference-making’ talent available in seniors housing vs. the broader real estate industry, solving for staffing shortages through a more aggressive ‘front-loaded’ total pay package has proven to be an effective tool to solve for staffing in the short-term.

The ongoing, and increasingly problematic issue for seniors housing is turnover. Average actual turnover for companies in the broader real estate industry was 27%, but among ASHA companies it was 43%. Unless the industry can do a better job retaining their increasingly valuable (and costly) staff, the money spent on the front end to augment staff may, over time, go to waste.

The largest gap by level in firms experiencing higher than normal turnover rates is found at the site-level staff. Sixty-two percent of ASHA survey participating companies were experiencing higher than usual turnover at this level while the broader real estate industry is only at 35%.

With capital at a premium, our suggestion is for seniors housing firms to save liquidity and plan to reward financial and strategic performance rather than continue to pour money into sign-on bonus arrangements.

In conclusion, despite considerable operational headwinds, there are opportunities for seniors housing companies to adopt a strategic compensation philosophy and carefully aligned programs that attract, retain, and reward their teams. Having the right people in the right seats can help the industry manage challenges in 2023 more efficiently.