Article | Feb 2026 | NACD

Director Equity Award Vesting Practices

Modern director equity programs reflect a governance-driven philosophy centered on alignment, independence, and simplicity.

Corporate governance standards continue to evolve, and with them the design of nonemployee director compensation programs. Although director equity awards often resemble executive awards on the surface, the rationale, structure, and expectations behind them are materially different. One clear example is the shift away from stock options toward full-value shares for director equity awards. Because stock options are inherently performance-based and tied to the upside of management decisions, they can blur the distinction between the board’s oversight role and management’s operational role. To support independence, most companies now use full-value shares for director awards rather than instruments that could be viewed as incentivizing management-like behavior.

This same principle—reinforcing independence—also guides vesting requirements. For directors, equity is not a retention tool; instead, it is a mechanism for aligning directors’ interests with those of the shareholders they represent. Directors occupy a fundamentally different role from employees or executives: they provide independent oversight, guide long-term strategy, and serve as fiduciaries for shareholders. Equity awards therefore exist primarily to mirror shareholders’ economic experience. By holding company stock or equivalent units, directors share directly in the gains and losses experienced by investors.

Because of this alignment purpose, the multiyear vesting common in employee equity plans is typically not considered appropriate for directors. Retention-based vesting, while useful for employees, can create the wrong incentives for directors by implying that continued board service is necessary to “earn” compensation intended to accompany their election. Directors should not feel compelled to remain on the board simply to satisfy vesting requirements, nor should vesting conditions create even the appearance that management could influence a director’s tenure.

The widespread move to annual director elections has also played a major role in shaping vesting practices. As boards transitioned away from staggered three-year terms, the natural alignment point for vesting became a director’s one-year service cycle. Because equity grants are typically made at the annual shareholder meeting, directors effectively “earn” their compensation by serving the ensuing year, making one-year vesting a logical and governance-sound choice. Directors who step down at the end of their elected term receive the full year’s equity as intended, and the structure avoids the unintended retention implications that accompany longer vesting periods.

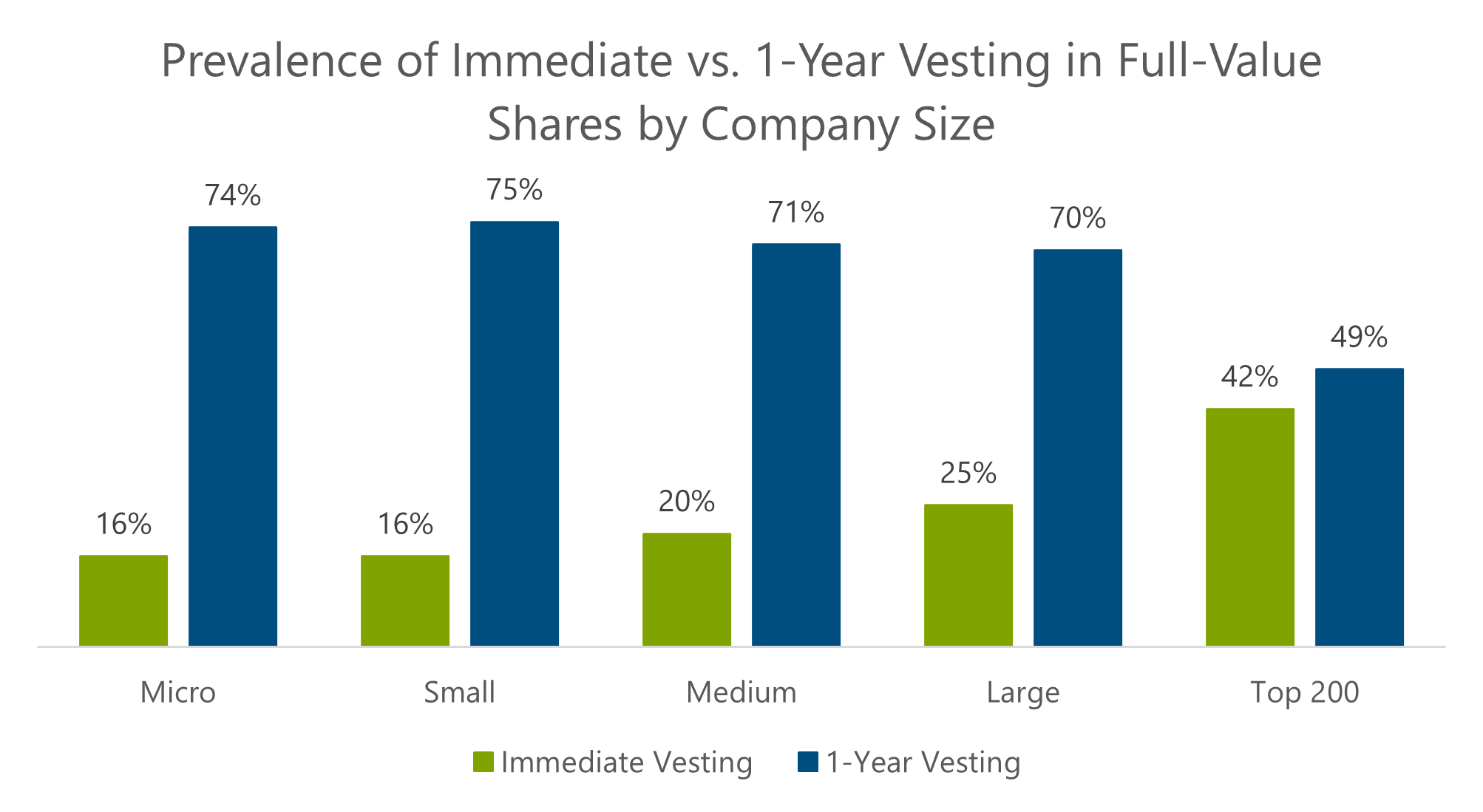

These governance drivers are evident in the market data. Across all revenue sizes, 69 percent of companies now use one-year vesting for full-value director equity awards. The second most prevalent design is immediate vesting, which appears among 22 percent of companies overall. Notably, the prevalence of immediate vesting increases as company size increases. As shown in the accompanying graph, among the Top 200 companies, immediate vesting (42 percent) is nearly as common as one-year vesting (49 percent), whereas for all other size groups, one-year vesting is overwhelmingly more common (>70 percent). This progression with company size demonstrates a shift toward structures that maximize director independence.

Immediate vesting is typically paired with mandatory deferred settlement. Under this approach, awards vest immediately, while settlement (i.e., delivery of shares) is deferred until separation from board service. This ensures that directors remain economically aligned with shareholders throughout their term, while preserving complete independence: a director can leave at any time without forfeiting compensation already earned through service.

In addition to vesting design, many boards enhance alignment and provide tax-planning opportunities by offering voluntary deferral programs for cash retainers and equity awards. Directors may elect to defer compensation into Deferred Stock Units (DSUs), converting cash or equity into stock-denominated equivalents that settle at a future date. These programs must comply with Internal Revenue Code Section 409A, which imposes strict requirements on the timing of deferral elections—typically before the start of the year in which compensation is earned—and on permissible distribution events, most commonly separation from service. Within these rules, companies often allow directors to choose between a lump-sum payment at separation or installment distributions over several years, helping smooth the tax impact and support long-term planning. Deferral programs continue to expand, especially among companies that place a strong emphasis on director–shareholder alignment.

In conclusion, modern director equity programs reflect a governance-driven philosophy centered on alignment, independence, and simplicity. Market practices overwhelmingly support vesting structures tied to the one-year board term, the avoidance of multiyear vesting that resembles employee retention tools, the growing use of immediate vesting with deferred settlement among larger companies, and the availability of voluntary deferral programs. Together, these practices ensure that director equity programs remain aligned with shareholder interests, while upholding high standards of board independence.