Article | Jul 2020

IRS Releases Proposed Regulations on Non-Profit Compensation Excise Tax

What organizations need to know about proposed IRS regulations covering the excise tax for certain executive compensation arrangements.

On June 5, 2020, the Internal Revenue Service (IRS) issued proposed regulations covering the excise tax under Internal Revenue Code (IRC) Section 4960, which applies to executive compensation arrangements of tax-exempt organizations.

Section 4960, passed in December 2017 as part of the Tax Cuts and Jobs Act, imposes a 21% excise tax on two categories of executive compensation paid by applicable tax-exempt organizations (ATEOs), as follows:

- Remuneration paid to “covered employees” in excess of $1 million per year (the “excess remuneration” excise tax); and

- “Excess parachute payments” paid to covered employees that are contingent upon their separation of employment (referred to as the “excess parachute” or “separation pay” excise tax).

The proposed regulations are expansive and tackle many highly technical and nuanced topics on how the rules are intended to operate, some of which were not fully addressed in the preliminary guidance provided in December 2018 in IRS Notice 2019-09 (the Notice). (Please see our January 2019 article on the Notice.) However, some additional exceptions and clarifications are provided such as:

- New exceptions to the definition of “employee” and “covered employee” to avoid unintended applications of the excise tax;

- A new exception to the definition of a related organization to alleviate concerns over “accidental control”;

- Clarification that imputed interest on a below-market loan (such as a split dollar loan) is treated as remuneration; and

- An exclusion from the imposition of excise taxes on excess parachute payments made by a related organization.

Section 4960 is effective for an ATEO’s first taxable year beginning after December 31, 2017. Until release of the final regulations, organizations may base their positions on the excise tax on the proposed regulations, the Notice, “good faith reasonable interpretations” of the statute, or a combination of the three.

Some of the new exceptions and clarifications along with some additional key concepts found within the proposed regulations are highlighted below.

Covered Employees

The Section 4960 excise tax applies only to an ATEO’s covered employees which include:

- Anyone who is one of the top five (5) highest paid employees of the tax-exempt organization; and

- Anyone considered a covered employee of the organization in a preceding year beginning after December 31, 2016.

Many issues in the new guidance address identifying an ATEO’s covered employees and are outlined below.

Definition of Employer and Employees

Since only an ATEO’s employees can be “covered employees”, the definitions of “employer” and “employee” are critical to understand.

The proposed regulations define “employer” and “employee” consistent with the definitions of the terms used for federal income tax withholding under IRC Section 3401, except without the benefit of the special rules for third-party payors.

The rules also confirm that a non-employee director of a corporation is not considered an employee, but an officer would be so considered (except in limited cases where the officer performs no more than minor services).

Pearl Meyer Comment: Since the “payor” of wages is not relevant for determining who is the employer under IRC Section 4960, an entity will not be able to avoid status as an employer by using a third-party to pay remuneration.

Once a Covered Employee, Always a Covered Employee

The proposed regulations confirm what is provided in the statutory language of IRC Section 4960 that once an individual is a covered employee, he or she remains a covered employee for subsequent tax years, regardless of the amount of pay received. Many commenters had requested the IRS to adopt a sunset rule; however, the proposed regulations do not include one.

Covered Employees in Related Organizations

The proposed regulations also provide that for a group of related organizations:

- Each ATEO must separately identify its top five employees;

- An employee can be a covered employee for more than one entity in a group; and

- Remuneration paid to an individual by an ATEO is aggregated with the remuneration paid to that individual by any related organization, including any for-profit or governmental entity for services performed for that related organization.

Thus, a group of related tax-exempt organizations may collectively have more than five covered employees for any given tax year. (See below for how the proposed regulations define related organizations.)

Pearl Meyer Comment: Since covered employees will keep their status indefinitely, organizations with multiple related entities should track covered employees at each separate ATEO. This, coupled with the requirement to aggregate pay from all related entities, will significantly increase administrative time and complexities.

Volunteer Services and Similar Exceptions

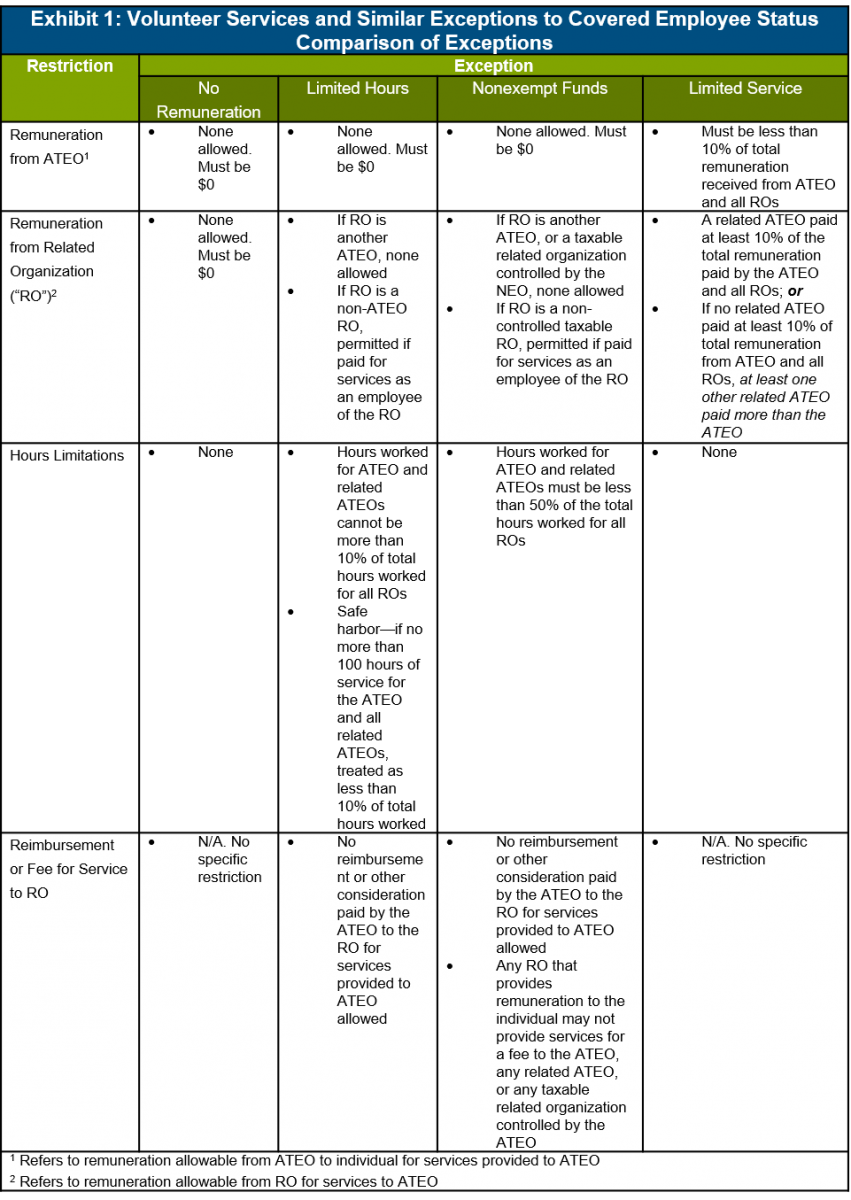

Many commenters had expressed concerns that people with limited involvement in an organization could end up triggering the excise tax—for example, individuals who work for corporations but volunteer at a related charity, or individuals who do limited work at a nonprofit. While the IRS specifically declined to provide any minimum dollar threshold for determining who might be a covered employee, the proposed regulations do provide some helpful exceptions intended to address these concerns. The following provides an overview of the exceptions. Exhibit 1 provides a comparison of the various exceptions.

- No Remuneration Exception

When determining the top five highest paid employees of an ATEO for a taxable year, employees who receive no remuneration from an ATEO or a related organization for services performed as an employee of the ATEO or a related organization may be disregarded.

Pearl Meyer Comment: This exception will apply only if an employee is not paid by any organization within a related group.

- Limited Hours Exception

Under the “limited hours exception” individuals are disregarded for purposes of determining an ATEO’s top five highest paid employees for a taxable year if:

- The individual was not paid or granted a legally binding right to nonvested remuneration by the ATEO or any related ATEO for his or her services;

- The ATEO does not reimburse a related organization that also employs the individual; and

- The individual only performs services as an employee of an ATEO and all related ATEOs for no more than 10% of the total hours the individual worked as an employee of the ATEO and all related organizations.

- There is a “safe harbor” exception, which will treat an individual who performs no more than 100 hours of service for the ATEO and all related ATEOs during the applicable year as performing those services for no more than 10% of the employee’s total hours.

- In addition, instead of tracking hours, the ATEO may use a percentage of the total days worked by the employee, provided that any day that the employee works at least one hour for the ATEO is treated as a full day worked for the ATEO.

- Non-Exempt Funds Exception

The “nonexempt funds exception,” is similar to the limited hours exception, but the services provided by the employee can be more substantial. With this exception, however, there is an added requirement that there may be no other business between the related organization that pays the employee and the ATEO. The nonexempt funds exception is met if:

- The individual was not paid or granted a legally binding right to nonvested remuneration by the ATEO, any related ATEO, or any taxable related organization controlled by the ATEO and its related ATEOs, for his or her services;

- The ATEO does not reimburse a related organization that also employs the individual;

- A related organization paying the employee remuneration must not provide services for a fee to the ATEO, to any related ATEOs, or to any taxable related organization controlled by the ATEO; and

- The individual performed services for less than 50% of the total hours worked for the ATEO and all related organizations.

Pearl Meyer Comment: This exception, along with the limited hours exception, is expected to provide relief for most for-profit organizations whose employees serve as volunteer officers for related ATEOs. However, it will not provide relief when the individual is employed by a taxable related subsidiary.

- Limited Services Exception

For related organizations, there is a limited services exception. It generally provides that an individual is not a covered employee of an ATEO if:

- The ATEO did not pay 10% or more of the employee’s total remuneration for services performed as an employee of the ATEO and all related organizations; and

- The ATEO had at least one related ATEO and one of the following conditions apply:

- A related ATEO paid at least 10% of the remuneration paid by the ATEO and all related organizations; or

- No related ATEO paid at least 10% of the total remuneration paid by the ATEO and all related organizations and the ATEO paid less remuneration to the employee than at least one related ATEO.

Definition of Related Organizations and Accidental Control

The definition of a related organization is a key issue when identifying the top five highest paid employees, for calculating an individual’s total remuneration, and for allocating excise tax liability.

A person or government entity is considered related to an ATEO if it: (a) controls or is controlled by the ATEO; (b) is controlled by one or more persons that control the ATEO; (c) is a supported organization of the ATEO as defined in IRC Section 509(f)(3); or (d) is a supporting organization described in IRC Section 509(a)(3) with respect to the ATEO. To define control, the proposed regulations utilize a ‘‘greater than 50%’’ standard that applies to stock, partnership interests, and voting control representatives on a nonprofit board.

A representative on a nonprofit board is defined as a trustee, director, officer, agent, or employee. Commenters had pointed out that, by using this definition, two or more organizations could unintentionally be considered related if more than half of their boards were made up of employees from the same company (i.e., “accidental control”). As a result, the proposed regulations include an exception such that a director or trustee of an ATEO that is a lower level employee of the potentially related entity (i.e., is not a trustee, director, officer, or employee with powers of a director or officer of the employer) is not considered a “representative” of his or her employer if the employee does not act as such in his or her service to the ATEO.

Where this position on lower level employees is taken, the supporting facts will need to be disclosed on the Form 990 for the taxable year involved.

Pearl Meyer Comment: If this exception is utilized, organizations should be aware that there is a new Form 990 reporting requirement.

Remuneration Issues

Section 4960 defines “remuneration” using the IRC Section 3401(a) (federal income tax withholding) definition but it excludes designated Roth contributions (under IRC Section 402A(c)) and includes compensation that is required to be included in income under the deferred compensation rules under IRC Section 457(f) (i.e., when the compensation is no longer subject to a substantial risk of forfeiture). Remuneration also specifically excludes the portion of any remuneration paid to a licensed medical professional (including a veterinarian) for the performance of medical or veterinary services by that professional.

The proposed regulations address many questions and issues about remuneration as discussed below.

Remuneration and Excise Tax Measurement Year

The statute was unclear on the relevant tax year for measuring remuneration and excess parachute payments, and for determining covered employees. The Notice clarified that these amounts should be determined on a calendar year basis, using the calendar year that ends with or within the taxable year of the employing organization. The proposed regulations continue to use this approach and include special rules for allocating remuneration in short tax years such as in the initial or final tax years.

Pearl Meyer Comment: Use of the calendar year matches what is used for Forms-W2 and 990, which is helpful for administration. However, the definition of remuneration for Section 4960 purposes is not identical to what is used on those forms. Organizations should be mindful of this when determining and reporting excise taxes.

Remuneration Timing—Regular Wage Payments and 457(f) Plans

Consistent with the Notice, the proposed regulations generally treat the present value of all remuneration as paid when it is no longer subject to a "substantial risk of forfeiture" (i.e., upon vesting) under IRC Section 457(f). Under the proposed regulations this rule applies to all remuneration, not just deferred compensation.

Commenters had requested that the IRS adopt a “short-term deferral” rule similar to what is provided in IRC Sections 409A and 457(f), whereby remuneration that vests in one year but is paid out shortly following the end of that year avoids treatment as deferred compensation and is taxed in the year of actual payment. However, the proposed regulations do not include a similar rule. The IRS felt that this would permit the employer to determine the taxable year in which the amount is treated as paid and would be inconsistent with the statute. The concern was that ATEOs and related organizations could spread remuneration across multiple applicable years by delaying actual payment of an amount that is already vested, and, thus avoid or decrease the excise tax.

However, there is an exception for pay periods straddling calendar years. The proposed regulations allow "regular wages" (i.e., remuneration paid at a regular hourly, daily, or similar periodic rate for the current payroll period) to be treated as paid when actually or constructively paid rather than upon vesting. As an example, salary paid early in 2021 for services performed in the last week of 2020 would be treated as paid in 2021. However, a bonus that vested in 2020 but was paid in 2021 would be treated as paid in 2020.

Commenters had also requested the IRS consider allowing organizations with benefits amounts accruing under Section 457(f) plans and subject to “cliff vesting” (i.e., benefit amounts accruing based on services performed over a period of time with the right to the entire amount vesting only at the end of that period) be allowed to allocate remuneration ratably over the vesting period. This request was rejected, and the proposed regulations do not allow for this.

Pearl Meyer Comments:

- Without a short-term deferral rule, there may be a mismatch of when these amounts are considered when computing the Section 4960 excise tax and when they are taxed for federal income tax purposes.

- Cliff vesting in Section 457(f) plans increases the likelihood that remuneration treated as paid to a covered employee will exceed the $1 million threshold for that taxable year.

Remuneration—Interest on Split Dollar Loans under IRC Section 7872

The proposed regulations clarify that amounts includible in gross income as compensation from IRC Section 7872, such as the imputed interest on below market split dollar loans, are considered remuneration. The guidance indicates that while there is no federal tax withholding on the interest, the amounts are not specifically excluded from wages under IRC Section 3401(a).

Remuneration and the Medical Services Exclusion

Under Section 4960, remuneration does not include the portion of any remuneration paid to a licensed medical professional that is paid for the performance of medical services. As with the Notice, the proposed regulations adopt a narrow interpretation of this exclusion. The proposed regulations define “medical services” as services directly performed by a licensed medical professional for the diagnosis, cure, mitigation, treatment, or prevention of disease in humans or animals; services provided for the purpose of affecting any structure or function of the human or animal body; and other services integral to providing such medical services.

Under the proposed regulations certain administrative services may be integral to directly providing medical services, such as keeping patient records; however, managing an organization’s operations, including scheduling, staffing, appraising employee performance, and other similar functions are not integral to providing medical services.

The proposed regulations provide that an entity can use a reasonable method of allocating compensation between medical and other services. A reasonable method may follow an allocation in an employment agreement or proportional time spent on medical and non-medical services, but other reasonable allocations may exist as well. The proposed regulations include various examples for determining how to allocate remuneration for medical services and non-medical services.

Remuneration—Coordination with IRC Section 162(m)

In cases where an ATEO’s covered employee is also a covered employee of a related publicly held corporation, remuneration for which a deduction is disallowed under IRC Section 162(m) is considered when determining an ATEO’s top five highest paid employees. However, the disallowed compensation is not considered when determining amounts subject to the excise tax.

Remuneration Excise Tax and Excess Parachute Payments

Consistent with the statute and the Notice, the proposed regulations indicate that any “excess parachute payment” (see discussion below) is excluded from the remuneration that is subject to the excess remuneration excise tax, so that this remuneration will not be taxed twice.

Governmental Entities can be ATEOs

Commenters had requested clarification on the status of governmental entities as ATEOs.

Under IRC Section 4960(c)(1), an ATEO is an organization that (a) is exempt from taxation under IRC Section 501(a); (b) is a farmer’s cooperative organization under IRC Section 521(b)(1); (c) has income excluded from taxation under section 115(1); or (d) is a political organization described in IRC Section 527(e)(1).

The proposed regulations indicate that:

- Federal instrumentalities that are exempt from tax under IRC Section 501(c)(1) and governmental entities, such as public universities, that have applied and received recognition of tax exempt status as IRC Section 501(c)(3) organizations, are governmental entities exempt from tax under IRC Section 501(a), and therefore are ATEOs;

- A governmental entity that excludes all or part of its income from gross income under section 115(1) is an ATEO regardless of whether it has a private letter ruling to that effect; and

- A governmental entity (including a state college or university) that does not have a determination letter recognizing its tax exempt status under IRC Section 501(a) and does not exclude income under section 115(1) is not an ATEO; however, a governmental entity may be liable for excise tax if it is a related organization with respect to an ATEO.

As in the Notice, the proposed regulations indicate that governmental entities that have IRC Section 501(c)(3) letters can relinquish this status to become exempt from IRC Section 4960.

Pearl Meyer Comment: The Preamble to the proposed regulations requests further comments on the application of Federal instrumentalities that are not states, political subdivisions, or integral parts thereof.

Excess Parachute Payments

For the most part, the proposed regulations follow the guidance in the Notice for determining excess parachute payments under IRC Section 4960. These rules are modeled after the rules outlined in IRC Section 280G covering payments that are contingent upon a change-in-control (“CIC”) of a corporation, except that the tax-exempt rules will generally apply to payments contingent upon a separation from employment.

An “excess parachute payment” is the amount by which any “parachute payment” exceeds a covered employee’s “base amount.”

- A “parachute payment” is generally any compensatory payment made by an ATEO (or predecessor or related organization) to (or for the benefit of) a covered employee that is contingent on the employee’s separation of employment for which the aggregate present value equals or exceeds three times the employee’s “base amount.”

- A covered employee’s “base amount” is generally the average annualized compensation includible in the employee’s gross income for the five taxable years ending before the date of the employee’s separation from employment.

However, the proposed regulations depart from the guidance in the Notice with respect to excess parachute payments made by related organizations. While the proposed regulations consider all amounts that are contingent upon a separation from service from all related organizations when computing base amounts and total parachute payments (similar to what was provided in the Notice), only excess parachute payments made by the ATEO are subject to the separation pay excise tax. Excess parachute payments made by a non-ATEO are not subject to the excise tax. However, the IRS may reallocate excess parachute payments to an ATEO if it is determined that the payments were made by a non-ATEO for the purpose of avoiding the Section 4960 excise tax.

Pearl Meyer Comment: Generally speaking, the excess parachute payment rules are impactful only when the individual’s pay does not exceed $1 million.

Key Effective Dates and Reliance on Prior Guidance

Section 4960 is effective for an ATEO’s first taxable year beginning after December 31, 2017.

Taxpayers may rely on the proposed regulations until the final regulations are published. Until release of the final regulations, organizations may base their positions on the excise tax on the proposed regulations, the Notice, “reasonable, good faith interpretations” of the statute, or a combination of the three. The preamble to the proposed regulations identifies four examples of positions that the IRS does not consider to be reasonable, good faith interpretations including that:

- A related for profit or governmental entity is not liable for its share of the excise tax under Section 4960;

- A covered employee ceases to be a covered employee after a period;

- Remuneration for medical services is included in the pay used to identify the top five highest paid employees of ATEOs; and

- A group of related ATEOs has only five covered employees amongst all related ATEOs.

Comments on the proposed regulations may be submitted through August 10, 2020.

Closing Thoughts

As with the Notice, the proposed regulations, which are detailed and highly technical, provide much needed guidance for tax exempt employers.

While they offer some favorable taxpayer guidance for mitigating Section 4960 exposure, organizations will need to implement extensive recordkeeping systems to take advantage of the exceptions.

As a result, tax exempt organizations should take the time now to evaluate how/whether they have the systems to adequately monitor compliance with Section 4960.