Article | Jan 2026 | NAHMA

NAHMA 2025 Survey: The Compensation Divide Widens

How incentives and leadership strategy are reshaping pay in affordable housing.

Compensation in affordable housing companies is evolving—fast. In 2024, organizations were reacting. Inflation, labor shortages, and intense retention pressures led to broad-based salary increases across the board, particularly among junior and mid-level professionals. But 2025 tells a different story. Organizations are using their pay dollars more deliberately, rewarding the roles that truly move the business forward and stabilizing pay elsewhere. In short, the sector has moved from “making sure everyone’s okay” to ensuring that “leaders can keep us going.”

Data from the recently completed Pearl Meyer 2025 Affordable Housing survey, sponsored by NAHMA, provides information on more than 100 unique positions, as well as a sense of industry trends and movement with respect to compensation-related issues affecting affordable housing companies.

Key Takeaway 1: Base Salary Growth Moderates—Except at the Top

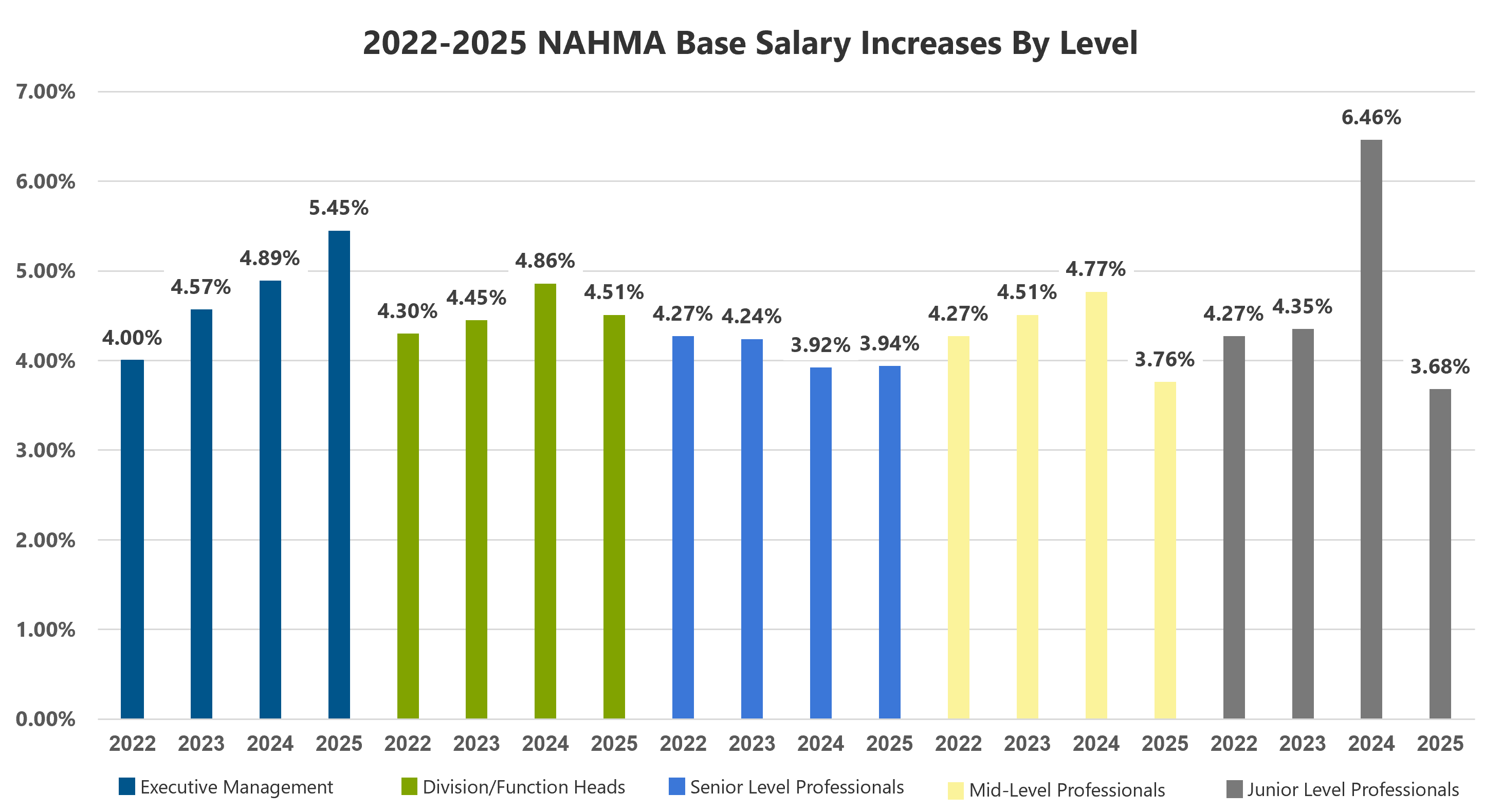

Across the industry, base salary growth cooled to around 3.8% on average in 2025, a clear slowdown from the robust increases of the previous year. But this average masks an important reality: not everyone experienced the same change.

Leadership compensation rose sharply, with the Executive Management average base increase at 5.45%, well above the 2022–2024 range of 4.00%–4.89%. The increase was especially pronounced for CEOs and CFOs, marking one of the biggest jumps in years. The data indicate that organizations are deliberately investing in executive continuity, recognizing the disruption caused by leadership turnover.

Executive retention is now a strategic priority, and companies are putting serious dollars behind continuity—and behind the leaders who drive performance.

By contrast, base pay growth for mid-level and junior employees has tapered off, reflecting the end of last year’s “catch-up” phase. In 2024, the average base salary increase for Junior Level Professionals rose from 4.35% to 6.46%, an increase of nearly 50% compared with 2023 increases. Perhaps unsurprisingly, the average base increase for this group was a more modest 3.68% in 2025, the lowest we have seen during the 2022–2025 period. The broader pattern is one of discipline: smaller across-the-board increases, but targeted investment in high-impact leadership and specialized roles.

Looking ahead to 2026, this focus on leadership and scarce technical talent is expected to deepen. The question now is: who truly moves the needle, and how do we ensure they stay?

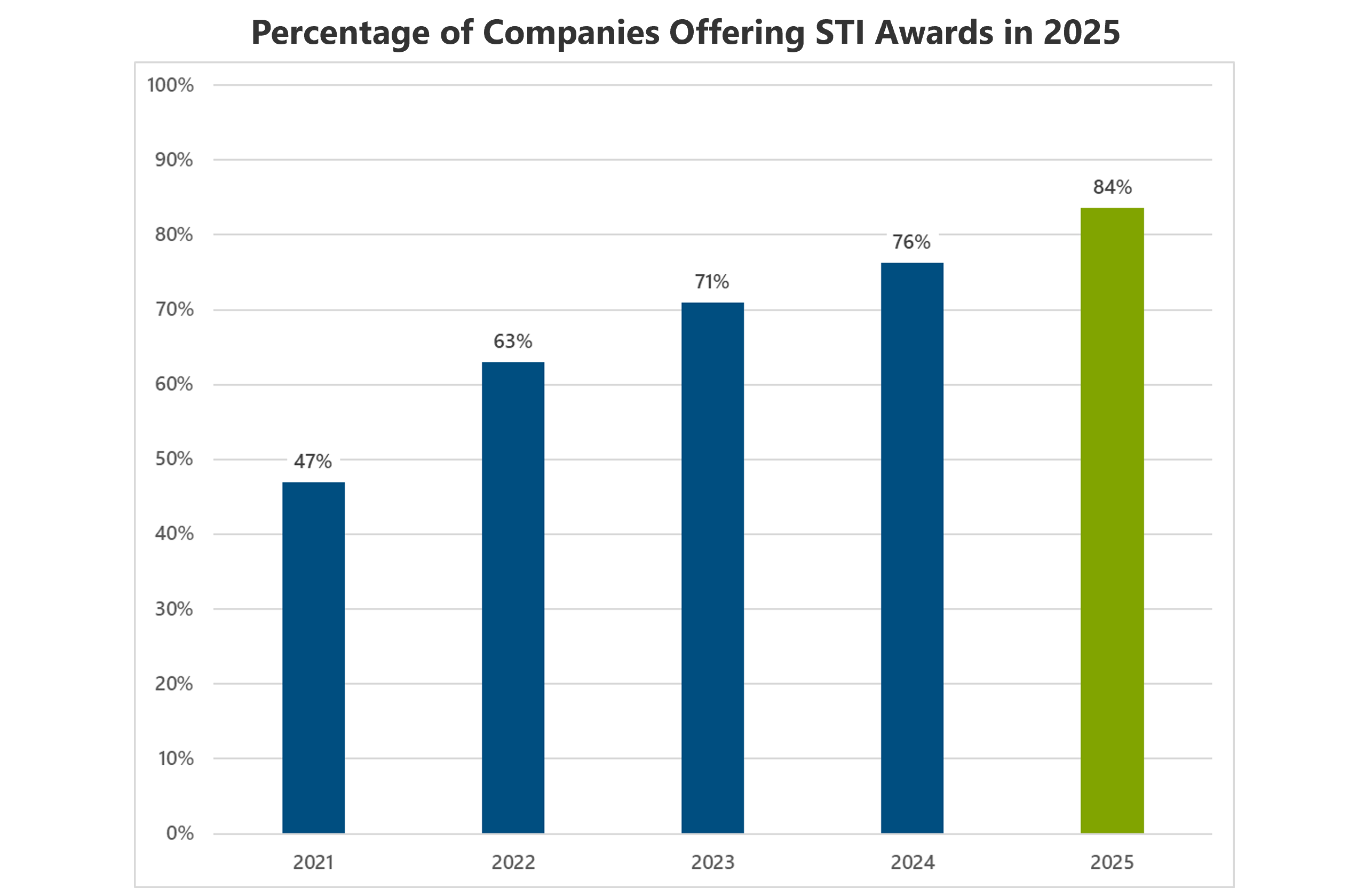

Key Takeaway 2: Short-Term Incentives Gain Power and Precision

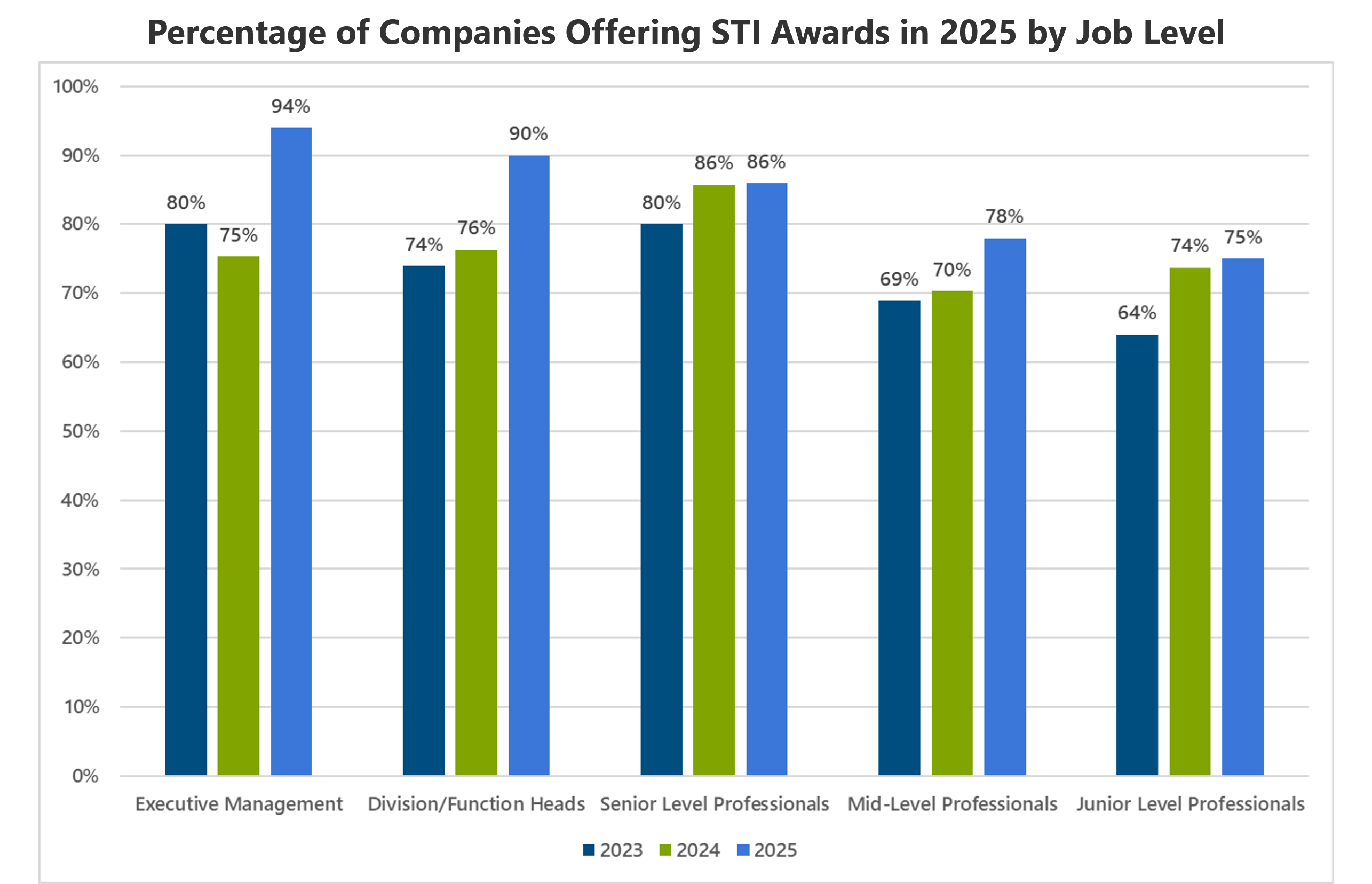

While salary growth has cooled, the use of short-term incentives (STIs) is on the rise. More than 84% of affordable housing firms awarded annual bonuses in 2025, continuing the trend in recent years and representing a dramatic rise from less than half (47%) in 2021. The sector is closing the gap at a remarkable pace with market-rate multifamily companies. In the broader real estate industry, short-term incentive awards are offered at 93% of companies.

What’s new in 2025 is not the expansion of eligibility—that happened last year—but the increase in award value, particularly for executives and senior leaders. It’s less about how many people participate, but more about the magnitude of the reward for those who deliver results.

Executives are being measured on increasingly complex goals: operating margin, portfolio growth, efficiency, culture, and retention. Their annual bonuses now represent a significantly larger share of total compensation.

Meanwhile, participation at mid- and junior levels remains strong but stable, with 78% and 75% of companies offering STI awards to such employees in 2025, respectively. Firms are using STI programs as both a performance lever and a retention tool, particularly to defend against private equity and market-rate multifamily competitors who are targeting experienced affordable housing talent.

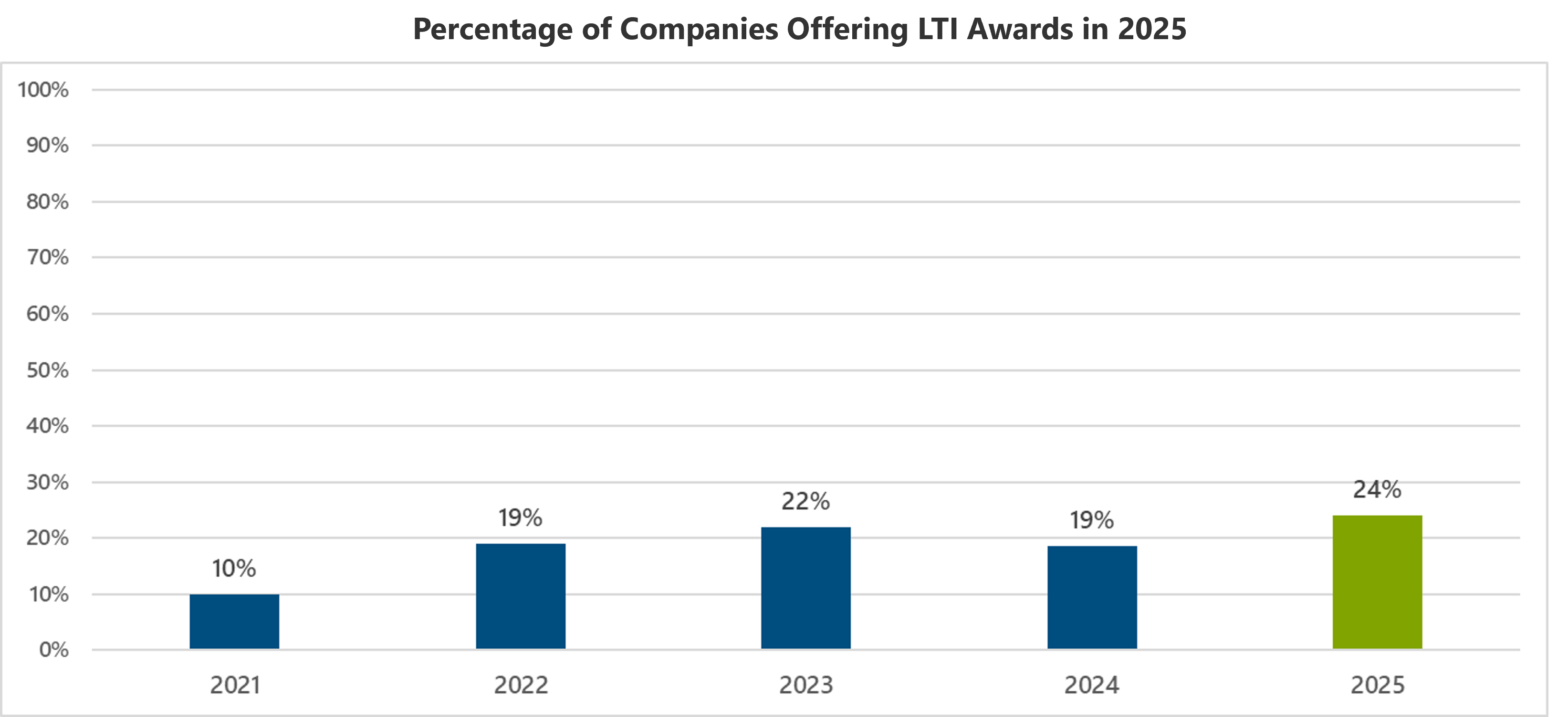

Key Takeaway 3: Long-Term Incentives Make a Strategic Comeback

After a temporary retreat in 2024, long-term incentive (LTI) programs have made a strong return in 2025, with the highest number of companies offering such incentives (24%) during the 2022–2025 period.

Companies are once again granting equity or multi-year performance-based awards, primarily at the C-suite level. The message is clear: long-term leadership stability matters. In a business where success unfolds over years—development, financing, compliance, operations—leaders need to think long term. LTIs are one of the clearest ways to reinforce that mindset.

While participation is still limited below the executive tier, the trend is unmistakable. Affordable housing firms are gradually closing the LTI gap with their market-rate peers, where roughly 65% of firms offer long-term awards. This shift also signals a maturing compensation philosophy: moving beyond one-year retention tactics to sustainable, performance-aligned leadership rewards.

Key Takeaway 4: Sharper Differentiation Among Leadership Roles

Another defining trend in 2025 is role-specific pay differentiation at the top. CEOs, CFOs, and Chief Administrative Officers all saw meaningful increases across base, annual, and long-term components. Other executive roles, such as General Counsel positions, remained steady.

This reflects a more sophisticated pay philosophy of investing in leadership functions most critical to business performance—finance, operations, capital markets, and development—while being steady elsewhere.

It’s not about creating winners and losers; it’s about aligning pay with strategic impact. That’s what mature compensation design looks like.

A Rebalanced Compensation Landscape

A more segmented and strategic compensation ecosystem is emerging as the affordable housing industry heads into 2026. Firms are moving away from one-size-fits-all pay structures and toward systems that deliberately reward impact, leadership, and encourage retention.

The sector is also showing clear signs of professionalization, adopting practices once seen only in the broader real estate and investment worlds.

The rebalancing we’re seeing isn’t temporary; it’s structural. If you move the needle, you’ll be paid for it—and relative to your peers, paid well.