Article | Dec 2024

Seniors Housing Grapples with Maintaining a Market-Competitive Approach in an Inflationary Climate

ASHA 2024 Compensation Survey Takeaways

The inflationary climate of 2024 has presented a new set of challenges to a seniors housing industry already facing ever-thinning margins and a rocky path toward profitability. In these current conditions it is more important than ever to study and understand trends related to the cost of attracting and retaining a stable workforce. Up-to-date survey data can help you gain insight about how to best position your organization competitively in an increasingly expensive marketplace for talent.

The 2024 Pearl Meyer ASHA Seniors Housing Industry Compensation Survey provides data on more than 100 unique positions across all organizational levels, from junior analyst through the c-suite. The survey covers both core real estate positions and related operational and support functions, while revealing trends that can provide valuable context when making compensation-based talent decisions.

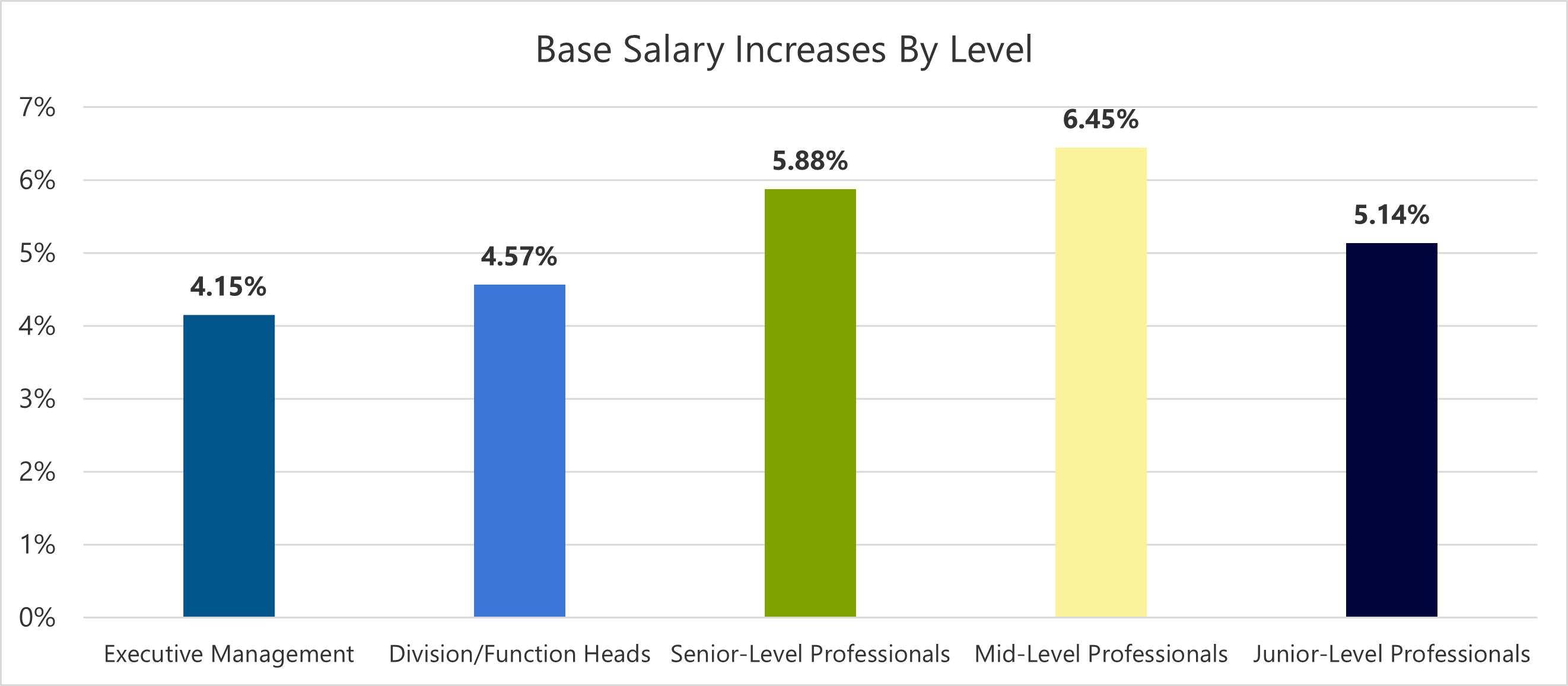

Base Salaries are Aggressively Moving Higher

This is particularly true among the senior and mid-level ranks. Our 2024 survey results show that base salary upward movement is dramatic across all levels among participating companies. There has been a year-over-year spike at the middle level, where base salaries increased 6.45% on average. Senior-level professionals also saw a healthy year-over-year bump with base salaries rising 5.88% on average. These same two organizational levels also demonstrated the highest year-over-year jumps in the 2023 survey, although this year the percentage increase for both levels is greater.

The data indicate that the cost to retain the core employee base is becoming an industry-wide issue. Many have left the industry altogether post-pandemic, and many companies find themselves increasingly turning to recruiting from competitors and offering aggressive compensation packages to induce movement between firms. On a broader scale, given the rise of operational expenses and ongoing industry expense-line challenges, the greater-than-5% annual base salary increases we are seeing will put additional pressure on companies to produce stronger profit margins.

In addition to compensation, organizations that can provide opportunities for professional growth and development may be able to dissuade valuable employees from “testing the market” and thus maintain a competitive edge via a stable workforce.

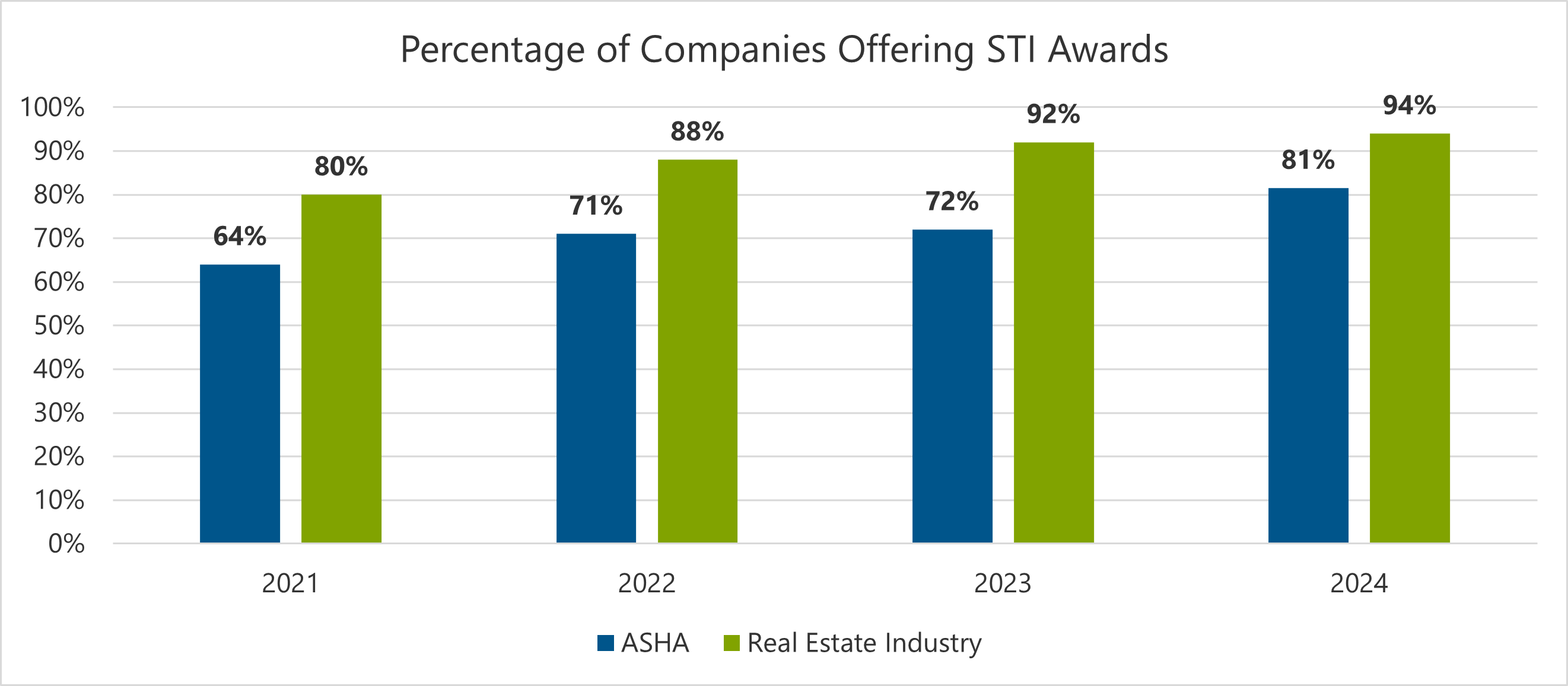

Annual Bonus Awards are Increasingly Prevalent in Seniors Housing

The number of ASHA survey participant companies offering annual bonuses or short-term incentive (STI) awards rose a whopping 9% in 2024, materially closing the gap between the seniors housing industry and the broader commercial real estate sector, where 94% of companies offer STI.

Narrowing the gap is important as it makes things easier for the seniors housing industry to compete economically with the pay packages typically found in the commercial sector. Companies that can continue to draw on the more compelling natures of their organization by manifesting a sense of distinctive culture, mission, and purpose—when combined with compensation packages that more closely reflect market reality—can create a potent and effective acquisition and retention strategy. Showing incumbents that they work at a fair, equitable, and market-competitive company that values their employees and seeks to pay market-rate compensation is vital.

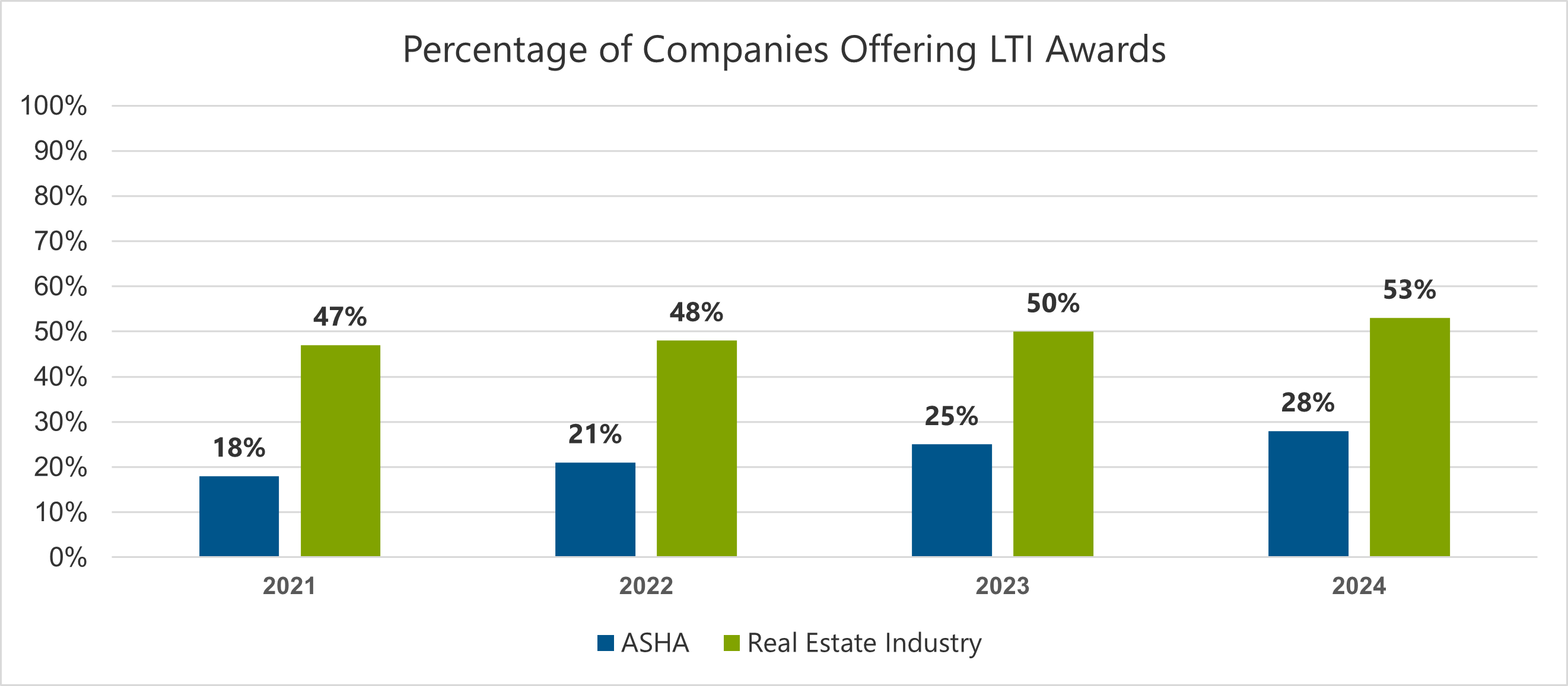

The Adoption of LTI Programs Continues to Rise

In 2023, one quarter of ASHA survey respondents offered long-term incentive (LTI) awards to select employees. In 2024, that number has risen to 28%. The industry also continues to expand participation for LTI awards by increasingly including division/function heads in the LTI program.

Increasing the variety of compensation offered to a greater percentage of the overall employee base can create a “golden handcuff” and add material incentive for employees to remain with the organization. LTI as a retention strategy is a proven and effective deterrent to pursuing other opportunities. Applied strategically, the continuity of increasingly productive and experienced leaders within a company can provide meaningful value that helps offset the LTI component of the compensation package.

We expect the continued adoption of LTI as an increasingly integral element of an employee’s pay mix within the seniors housing industry.

Moving into 2025

This year’s survey demonstrates that the market requires firms pay close attention to the rise of base pay and the increasing adoption of both STI and LTI awards as part of a competitive pay package.

In 2025, seniors housing organizations may be challenged to address pay mix, determine how to allocate increases, and outline the population eligible for STI and LTI programs. Keeping difference-making professionals is an increasingly expensive proposition, and as the 2024 compensation survey suggests, it will take more than culture and an effective mission statement to ensure retention of the best and brightest talent.