Article | Sep 2020

The Case for Longer Vesting and Simpler LTI Programs

Two separate circumstances are indicating the time may be right to re-evaluate long-term incentive plans and consider restricted stock with longer vesting periods.

Two separate circumstances are indicating the time may be right to re-evaluate long-term incentive (LTI) plans and consider restricted stock with longer vesting periods. First, the COVID-19 pandemic has highlighted potential weaknesses in what are considered market-prevalent plan designs, specifically around retention and continued engagement of plan participants. Many companies across industries have been negatively impacted and face some of the following challenges:

- Bonus awards and performance shares units (PSUs) that were otherwise on track to pay out, in some cases above target, are now tracking to pay below target or zero;

- It is difficult to keep plan participants motivated and engaged in performance priorities if participants won’t see any value from their three-year PSU plan cycles; and

- There is uncertainty around setting new three-year PSU cycles and annual incentive plan goals for 2021 so long as there is potential for waves of illness by region and shutdowns to enforce social distancing.

Even positively impacted companies are uncertain about setting new annual and three-year performance goals for 2021. Restricted stock with longer-term vesting as an alternative (i.e., five years or longer) provides the retention needed to weather a once in a lifetime event (or, as companies in cyclical industries understand, business downcycles) and avoids the need to establish performance goals that may quickly become obsolete. Stock options can then fill the role of the performance element as they provide direct alignment with shareholders. (However, we recognize that stock options may increase the burn rate and may be otherwise unaffordable.)

While periodic or one-time retention awards may seem like a good answer in this situation, proxy advisory firms have begun to criticize this approach. They have noted the need to make such grants as a potential failure of plan design. Creating more retention as part of the ongoing program could reduce the need for making ad hoc retention awards. And as an additional way to strengthen plan design in the eyes of external critics, requiring longer vesting, even into retirement (rather than accelerating vesting) requires executives to make decisions as future long-term shareholders and focus on long-range goals such as capital investment decisions or succession planning and transition, that may go far beyond three-year cycles.

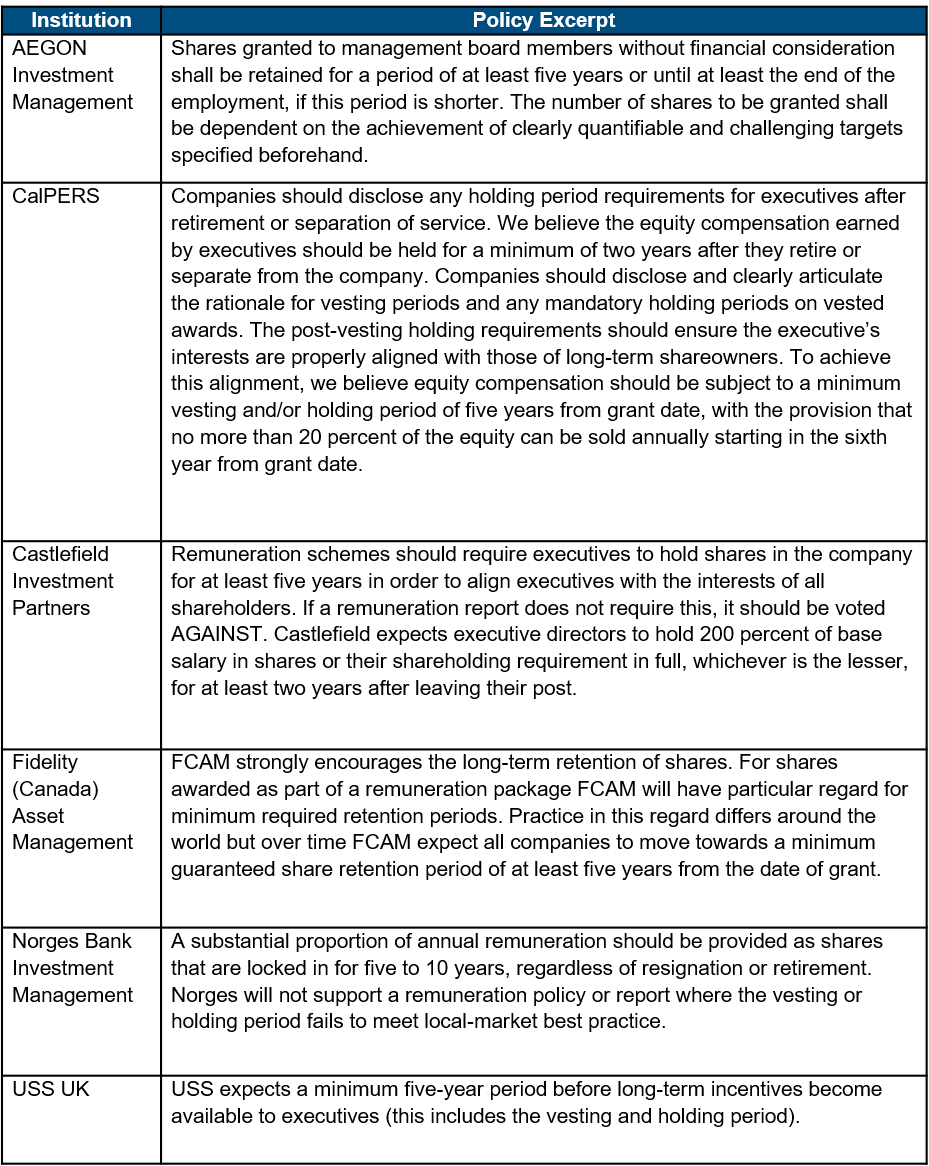

The second trend we have observed is recent policy changes among investors to support longer vesting periods. In 2019 the Council of Institutional Investors overhauled their policy on executive compensation to support longer vesting and, specifically, to adopt simpler plans comprised of base salary and restricted stock that vests over five or more years.

Other institutional investors have also updated their proxy voting policies to support longer vesting. We identified six institutional investors that support longer vesting periods.

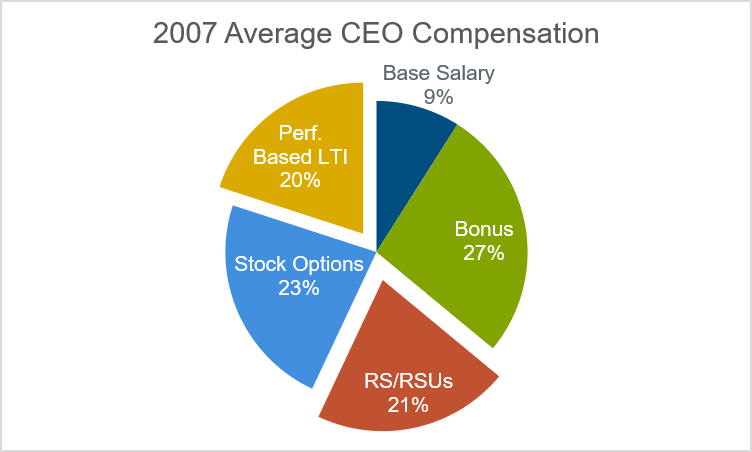

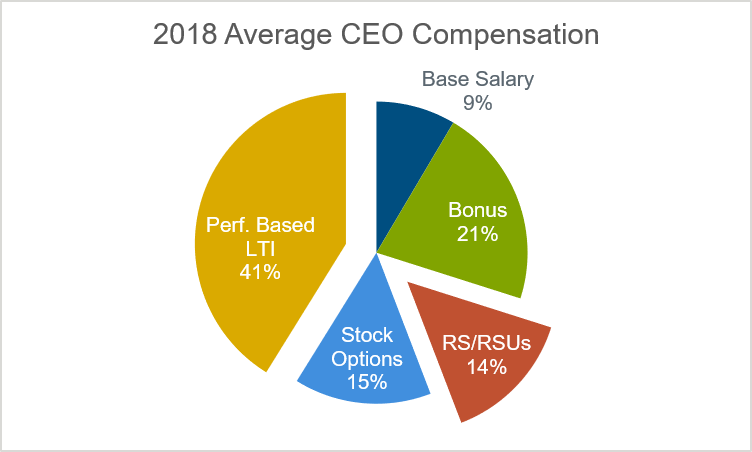

While this move toward longer vesting and simpler design promoted by the Council of Institutional Investors better aligns executives to longer-term strategies and is responsive to issues highlighted by the pandemic, it is different from prevalent market practices. Most large companies grant at least 50 percent or more of a senior executive’s annual LTI award in PSUs and the remainder in restricted stock and/or stock options. This practice is largely a result of the advent of say-on-pay in 2006/07 and the increasing influence from proxy advisory firms, which is evident in the charts below comparing the CEO’s total pay mix in 2007 and 2018 among the top 200 largest companies by revenues. Performance-based LTI increased from 20 percent to 41 percent, while stock options and restricted stock decreased from roughly 20 percent to 15 percent.

Top 200 Largest Companies by Revenue:

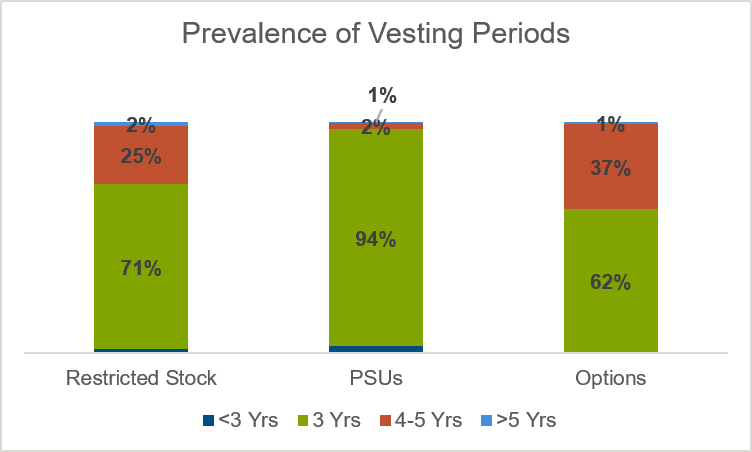

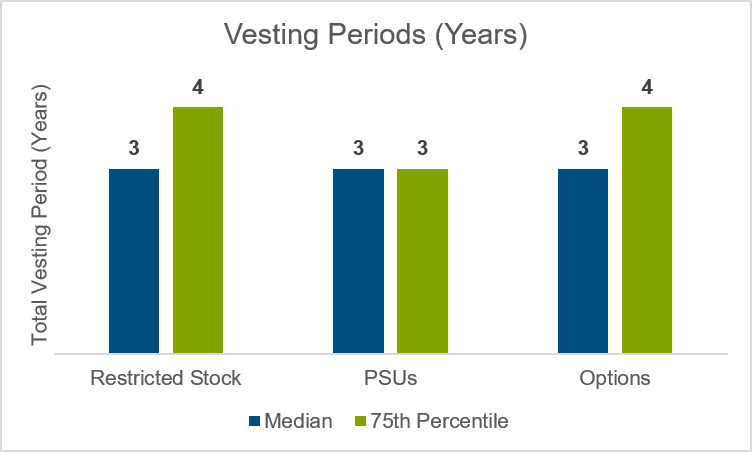

Three-year vesting for each of PSUs, restricted stock, and stock options is the most prevalent vesting schedule among these companies.

Conclusion

Because of the pandemic and related economic uncertainty, companies are in unchartered territory with respect to planning for 2020 payouts (and whether to use discretion to exclude the impact of the pandemic) and establishing the 2021 program and new performance targets. Traditional, market-prevalent compensation programs may not support retention objectives. Furthermore, there may not be enough visibility to establish new one- and three-year performance goals for the 2021 program.

A focus, at last temporarily, on retention may be the best course of action in 2021. Vesting longer than the market-prevalent three years would support retention objectives and may help to garner support from investors that are skeptical of time-based restricted stock.

Coincidently, recent changes to selected institutional shareholder proxy voting policies and the Council of Institutional Investors’ guidance suggest a potential early sea change in the way in which investors think about executive compensation overall. It further suggests an open mind for 2021 plan design should companies choose to temporarily change their LTI plan design in response to the pandemic.