Advisor Blog | Feb 2022

Kicking the Dust Off of Outstanding Dodd-Frank Compensation Rules

Two languishing executive compensation-related Dodd-Frank Act rules which were never finalized are active again. Here’s what you need to know.

The new administration and new Securities and Exchange Commission (SEC) chair have been busy reviving two languishing executive compensation-related Dodd-Frank Act rules which were never finalized. In the first instance, Section 954 (the Clawback proposal), the comment period was reopened with minimal change proposed and frankly little for companies to update from what they have been doing in practice.

However, the second, Section 953(a) (the Pay-versus-Performance or PVP proposal), contains significant and material suggested updates that could have a dramatic impact on current disclosures. We provide a summary of both below.

Section 954—The Clawback Rule

As described in detail in our Client Alert, the SEC’s original proposed rule required that listed companies adopt a clawback policy mandating recovery of “incentive-based compensation” from current and former Section 16 executive officers who “received” such compensation during the three fiscal years preceding the date on which the listed company is required to prepare an accounting restatement to correct a material error. “Incentive-based compensation” was defined broadly to include any compensation that is granted, earned, or vested based wholly or in part on the attainment of a financial reporting measure, including stock price or total shareholder return (TSR). Recovery is on a “no fault” basis, without regard to whether any misconduct occurred or an executive officer had responsibility for the misstated financial statements. The amount of the recovery must be the amount received by the executive officer in excess of the amount that would have been received if the calculation was based on the restated financial statements and the policy must be attached as an exhibit to the annual report. Noncompliant companies are subject to delisting.

In the original round of comments, including our comment letter, the primary criticisms were aimed at both inclusion of not only financial reporting measures, but also compensation tied to stock price performance or TSR. Commentators also noted the general inflexibility of the proposal and lack of a board’s ability to exercise discretion.

In October, 2021, instead of addressing these issues, the SEC reopened the comment period and posed a few additional questions about the proposal, including whether to expand the type of restatement that may trigger the clawback. The comment period closed in November and final rules are expected to be released in 2022.

As nearly six years have passed since the proposal was released, many companies have already either established recoupment policies or promised to amend to comply with Section 954 once finalized. As such, most companies will not have too much more work once this rule is finalized, even if the restatement trigger is broadened.

Pearl Meyer Guidance: Given this renewed interest in finalizing the clawback rule, companies may want to inventory their incentive-based compensation plans and the terms of any existing clawback policies arrangements to ensure compliance with the rules as proposed.

Section 953(a) Pay-versus-Performance (PVP)

Even more recently, this January the SEC issued a release reopening the comment period for the PVP rule initially proposed by the SEC in 2015 to implement Section 953(a) of the Dodd-Frank Act. In the reopening release, the SEC seeks comment on the 2015 rule in its entirety, along with comment on the additional disclosure requirements under consideration by the SEC as it finalizes the rule. The comment period currently runs through March 4, with final rules anticipated in 2022.

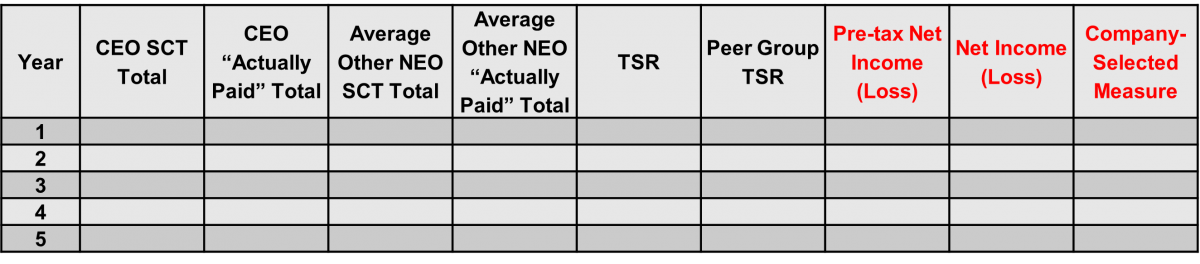

As described in detail in our previous Client Alert, the SEC’s 2015 PVP proposal would require companies to disclose, for each of the five prior fiscal years in tabular format:

- The Summary Compensation Table (SCT) total and the total “executive compensation actually paid” to the CEO;

- The average SCT total and the average total “executive compensation actually paid” to the company’s other named executive officers;

- The company’s cumulative total shareholder return (TSR); and

- TSR for a peer group (using either the peer group included in the stock performance graph in the company’s annual report or the peer group used for compensation benchmarking purposes as disclosed in the Compensation Discussion and Analysis).

In this context, “executive compensation actually paid” means the total compensation reported in the SCT with two adjustments:

- Equity is valued at vesting rather than when granted; and

- The actuarial present value of pension benefits will only include changes that are attributable to an additional year of service.

Narratives to the table would require a clear description of (1) the relationship between executive compensation actually paid to the NEOs and the cumulative TSR of the company, and (2) the relationship between the company's TSR and the TSR of a peer group chosen by the company, in each case over the company's five most recently completed fiscal years.

The original round of comments, including our comment letter, were generally critical of a one-size-fits all approach to analyzing pay for performance, including the narrow focus on TSR as an exclusive measure to assess the pay for performance relationship.

The SEC now is seeking comment both on the 2015 proposal (again) and on three additional disclosure requirements that may be incorporated into the final PVP rule, including:

- The company’s pre-tax net income;

- The company’s net income; and

- A measure selected by the company that represents the most important performance measure used to link compensation actually paid during the fiscal year to company performance.

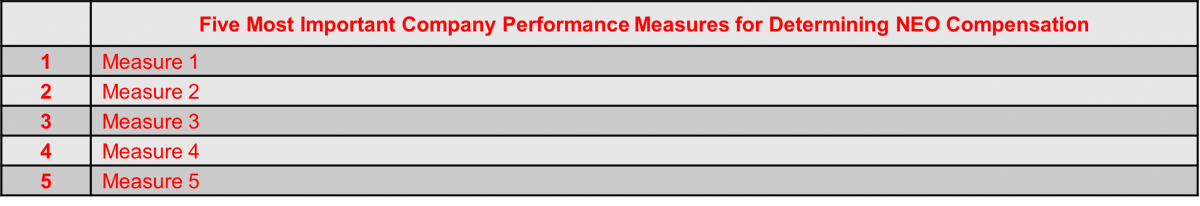

The SEC is also considering whether to require another table listing the company’s top five (or fewer, if applicable) most important performance measures used to link compensation actually paid to company performance.

The combined proposal potentially results in two new tables under Item 402(v) (red denoting additional proposed items):

Companies will be required to include PVP disclosure in the first proxy or information statement they file after the final rule becomes effective, with a phase-in for the number of years of data that must be included (starting with two years for smaller reporting companies and three years for other companies subject to the rule). That said, for fiscal filers it is unlikely to be applicable for the upcoming proxy season, but high on the agenda for 2024 meetings.

Pearl Meyer Guidance: In the meantime, companies may want to consider the following actions:

- Submitting a comment letter on the proposed PVP rules;

- Discussing the implications of the proposed rules with the compensation committee;

- Identifying and evaluating the most important measures used to determine executive compensation;

- Developing processes to capture the additional information annually; and/or

- Considering how to provide clear narratives around these new measures.