Advisor Blog | Apr 2025

The Ultimate Checklist: Responding to Weak, But Not Failed, Say-on-Pay Results

Committees can effectively deal with weak shareholder support with these seven steps to demonstrate committee responsiveness.

It’s tempting for a compensation committee to downplay a say-on-pay (“SOP”) result that didn’t outright fail. If the company still received majority support, it’s easy to rationalize the outcome as an anomaly rather than a signal—especially if there was a plausible explanation like a one-time award or unusual circumstances. But ignoring a weak vote can set the stage for real trouble in the following year.

Even when say-on-pay passes, any vote result below 80% is increasingly seen as cause for concern. Proxy advisors and shareholders alike expect a clear, thoughtful response. ISS, for example, flags companies with less than 70% support, while Glass Lewis uses a more stringent 80% threshold. Both expect companies to demonstrate how they’ve addressed shareholder concerns—and if they don’t, opposition often escalates.

In short, a weak vote may not feel like a crisis, but it is a warning shot. Committees that fail to act often find themselves scrambling a year later in the face of sharper criticism, lower support, and broader reputational risk. The good news: A proactive, transparent response can go a long way toward rebuilding trust.

Here’s a practical checklist for how to respond, and how to get ahead of investor concerns before they escalate:

1. Understand the Root Causes of the Weak Vote

Before making any changes, companies must first understand why support declined. Start by identifying the most common drivers of shareholder opposition:

- Pay-for-performance misalignment: Are pay outcomes inconsistent with company performance? Is target compensation significantly above peer benchmarks without a clear rationale?

- Problematic pay practices: Have investors raised concerns about discretionary bonuses, excessive perquisites, or significant one-time equity grants?

- Proxy advisor recommendations: Weaker vote results are often driven by ISS and/or Glass Lewis recommending votes against SOP. If this is the case, what were the key objections? Are these issues also top of mind for shareholders?

2. Establish the Shareholder Engagement “Dream Team”

The compensation committee chair, CHRO, and head of investor relations are best suited to engage with institutional shareholders and proxy advisory firms. The chair discusses executive compensation philosophy and its alignment with the company's strategy. The CHRO is the program expert, and the head of investor relations ensures clear shareholder communication.

3. Keep the Full Board in the Loop

The board must understand the intensity of the outreach process and the reason for this approach. It's crucial to gain their support, allow questions, and receive feedback. You want to ensure the board demeanor remains calm and committed, and you want to keep them up to date on the process.

4. Develop a Targeted Outreach Plan Covering at Least 50% of the Vote

Shareholders and proxy advisory firms will view this level of interaction to be meaningful and responsive. Before setting up meetings or calls, make sure you have a solid understanding of your major institutional investors—the size of their holdings, which proxy advisory firms they follow, and how they’ve voted on say-on-pay in recent years.

A disappointing SOP vote requires deliberate, structured engagement with key investors, not just routine outreach. Companies should:

- Prioritize engagement with shareholders who voted “Against” or abstained;

- Be prepared to discuss specific concerns, rather than offering a generic defense of pay practices; and

- Clarify how feedback will inform future decisions.

Some feedback may be too general to act on. When that happens, don’t hesitate to press for more specificity.

Keep prepared materials brief. Cover background issues, the evolution of executive compensation, and recent shareholder interactions, but leave time for open dialogue. Be well-versed in the issues, as some investors may prefer a free-flowing discussion.

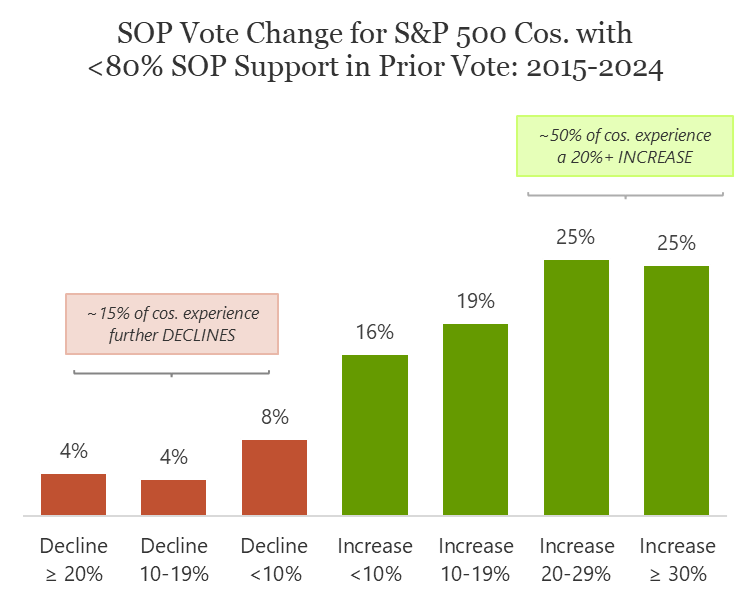

Companies that take investor feedback seriously and demonstrate a thoughtful, well-documented response tend to fare better in subsequent SOP votes. As shown below, nearly half of companies with less than 80% support over the last 10 years saw their vote improve by 20 percentage points or more in the following year. In contrast, about 15% experienced further declines—likely those that were less deliberate in their engagement or failed to clearly articulate their response.

Note: Graph reflects 492 observations from the S&P 500 over the 10-year period from 2015–2024.

5. Stick to Your Guns (When It Matters)

Taking the path of least resistance by reacting to every critique and adopting every requested change may seem like the easiest way to address shareholder and advisory firm concerns, but that approach can create bigger problems down the line. When a design feature is central to your strategy, for example the metrics in your incentive plans, holding your ground may require some intestinal fortitude. The committee and management team are best positioned to determine how pay aligns with long-term value creation, even if it means diverging from proxy advisor preferences. Nobody knows your business better than you do. In these cases, acknowledge the feedback and clearly explain why the committee chose not to implement certain changes.

6. Swing at the Soft Pitches

While significant program changes require more fulsome evaluation and deliberation, some critiques may be relatively minor or easy to address. Where advisory firms have flagged problematic elements in their qualitative reviews, consider which ones can be resolved with minimal disruption. For example, updating hedging and pledging policies is often straightforward. Likewise, if the executive team already holds a significant amount of stock, enhancing share ownership guidelines to better align with advisory firm best practices can strengthen the policy without adding new pressure. These changes may not be material to participants, but they demonstrate responsiveness and help build credibility with shareholders.

7. Strengthen Your Proxy Disclosure

Investors and proxy advisors scrutinize the Compensation Discussion & Analysis (CD&A) for clarity and rationale. Use plain English, avoid legalese, and lead with a clear, visually engaging executive summary that includes relevant charts and graphs. Highlight the negative shareholder feedback you received and the changes you made based on this feedback.

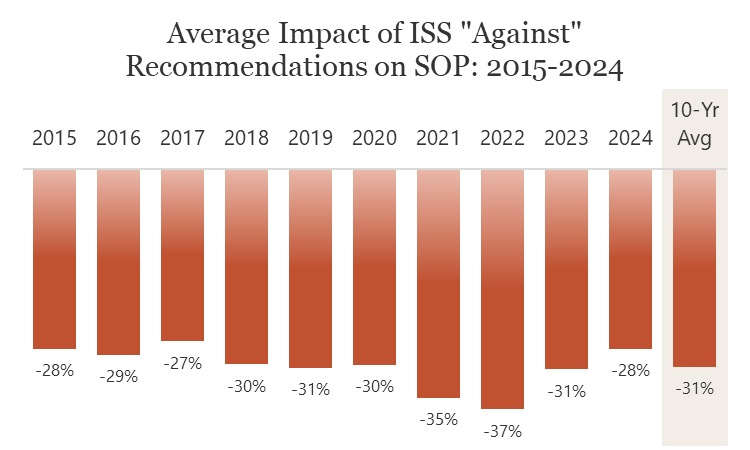

ISS is particularly strict about ensuring companies demonstrate responsiveness following a weak SOP vote. If they deem the response to be inadequate, they will recommend against the proposal, which has historically reduced support by roughly 30 percentage points on average. Based on our experience, ISS is likely to recommend against SOP if:

- The disclosure does not directly state the involvement of the committee chair in the investor outreach; and

- Specific details of the engagement process, including the number of shareholders contacted, the timing, and frequency of engagements, are not disclosed.

Be sure these points are clearly and explicitly addressed in your CD&A to receive credit for the thorough engagement process you’ve undertaken.

Note: “Average impact” reflects the difference in average say-on-pay support between S&P 500 companies that received an ISS “Against” recommendation versus those that received a “For” recommendation in each year.

Conclusion: A Weak Vote is a Call to Action

While a disappointing SOP result may not necessarily be a failure, it is a clear warning sign, and how a company responds matters. Those that take a structured, data-driven approach to engagement and disclosure will be in the strongest position to regain shareholder trust in future votes.

Ultimately, one weak result won’t define a company’s governance track record—but ignoring it might. Investors have long memories when it comes to compensation concerns, and repeated weak votes can lead to greater risk of votes against compensation committee members, increased scrutiny of future plan design changes, and greater vulnerability to activist pressure.

Boards that act decisively and communicate clearly will be best positioned to turn a weak vote into a governance success story.