Advisor Blog | Mar 2022

Trending Topics in Board Composition and Compensation

Survey data answering two key questions: How are boards approaching diversity and has the stock market sell-off impacted equity compensation for directors?

The director’s role is evolving with unprecedented speed. Boards are working to ensure a diversity of voice, experience, and talent among their ranks while balancing the traditional responsibilities of guiding the CEO and the business strategy, ensuring compliance, and providing audit, compensation, and governance expertise. As it stands today, a director’s responsibilities and pressures go far beyond the traditional expectations, as basic operations and workforce issues present real enterprise risk. How directors are compensated can factor heavily on a board’s ability to attract and retain the right talent for the times.

On a recent webcast with the NACD, my colleague Ryan Hourihan and I talked about the most recent data collected for the annual NACD/Pearl Meyer Director Compensation Report. This report is remarkably consistent year over year in that we typically see about a 3% increase in total direct compensation for the board. There are pay increase anomalies here and there, most frequently seen at the micro- and small-cap company sizes, but for the most part, the steady pay increase is predictable.

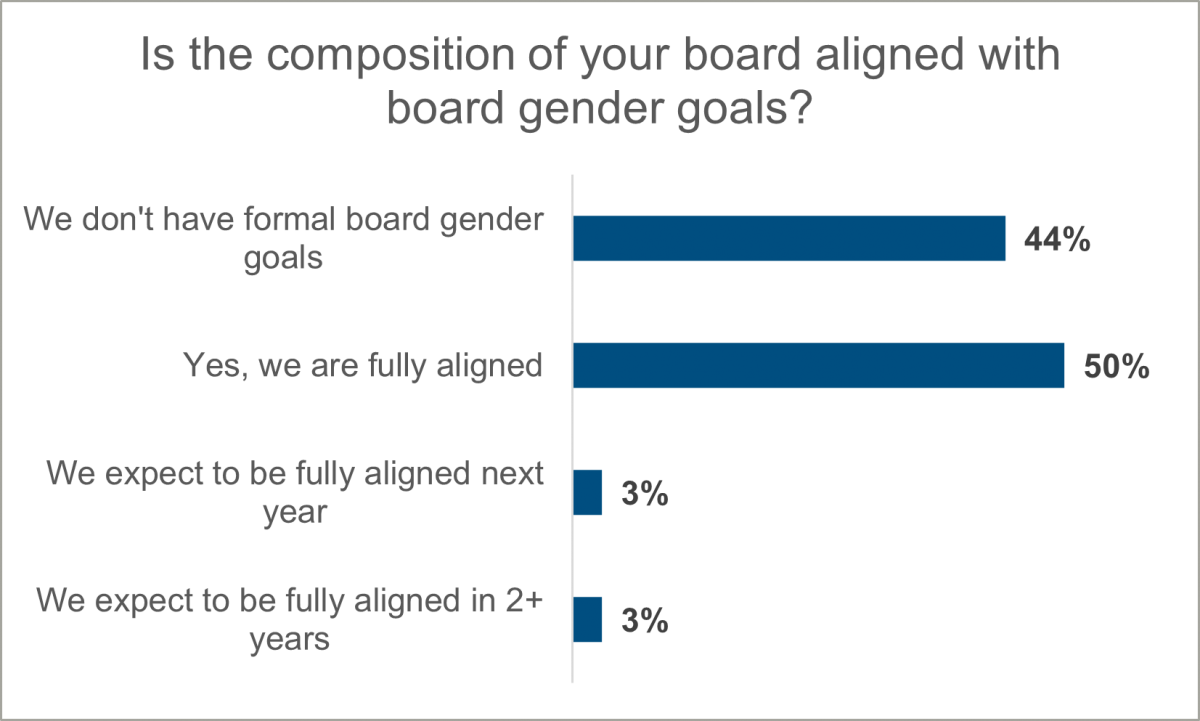

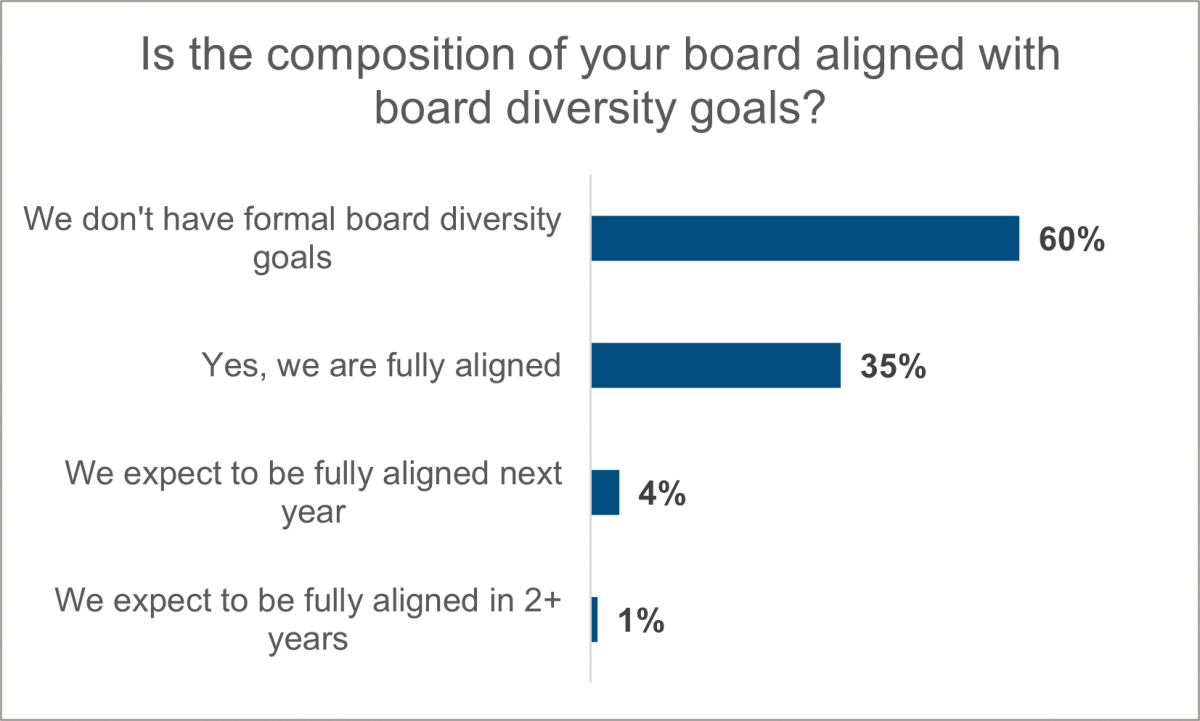

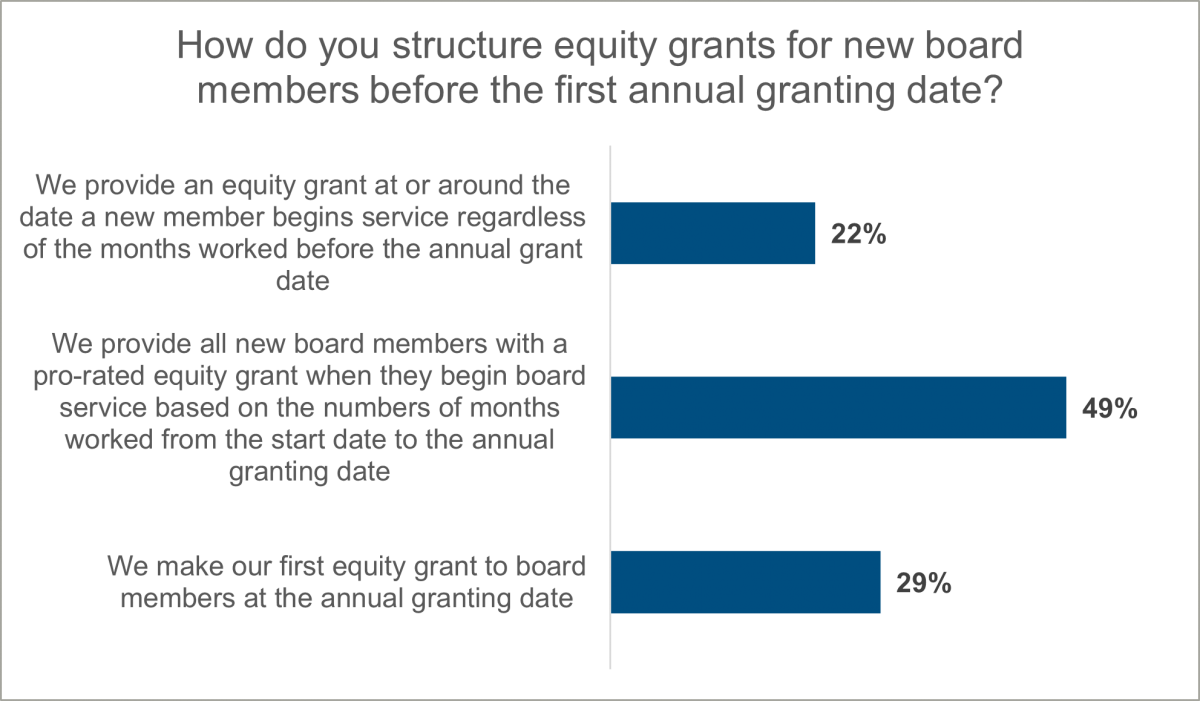

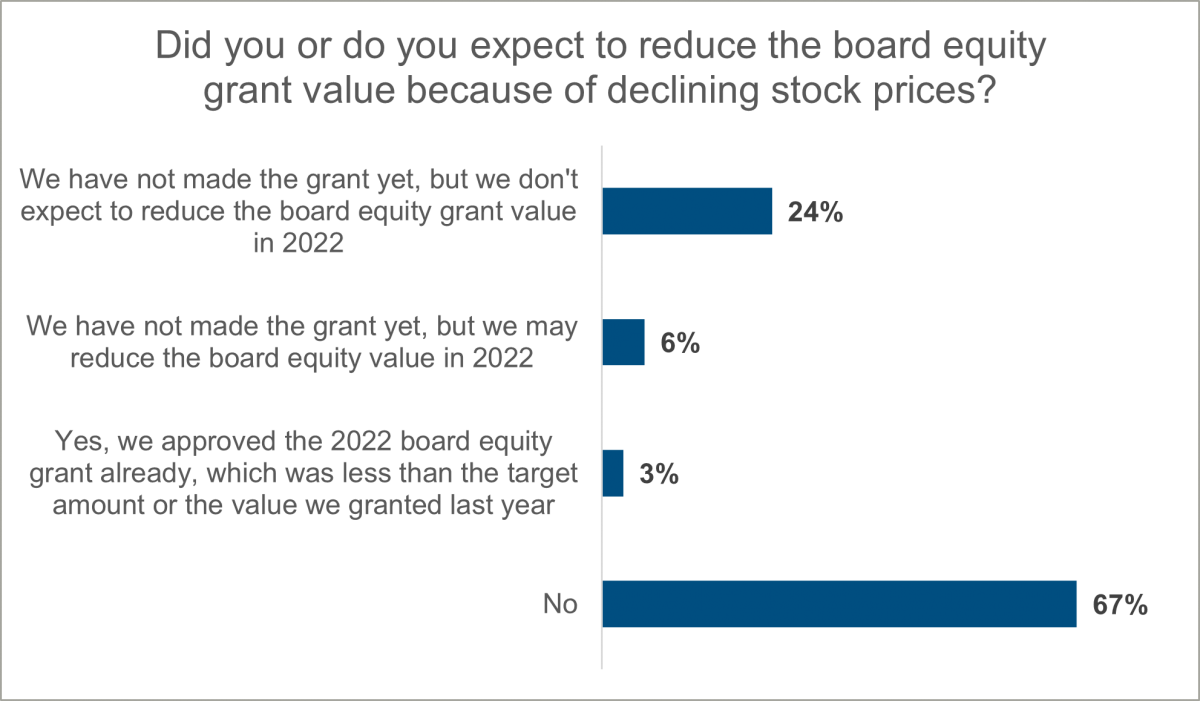

Although it is important for boards to understand pay trends, our clients have been asking two important questions this year: How boards are approaching diversity and whether the broad stock market sell-off impacted the board’s approach to equity compensation. We asked these questions of the 148 directors attending the webcast:

Here’s our takeaway from that data and our advice for boards.

First, our survey shows boards are making significant progress towards their gender and racial diversity goals, with an insignificant minority expecting to reach their goals within two years. Still, many boards don’t have formal diversity policies, and boards should consider the merits of having formal diversity policies in place and tracking their progress towards these goals.

Next, less than 10% of boards have or may reduce the value of the board equity grant due to economic conditions, suggesting the drop in stock prices had minimal impact on boards’ equity compensation policies. Regarding equity compensation for new board members, 29% said they don’t make their first equity grant until the annual granting date. During a time when the search for diversified and specialized board talent remains challenging, should boards consider adopting at-appointment equity grants to recruit difficult-to-fill positions? Well, yes. If it is okay to offer inducement equity grants to fill executive positions, why not institute this approach at the board level?