Client Alert | Nov 2019

ISS Releases 2020 Policy Updates—Details on Incorporation of EVA Forthcoming

The anticipated incorporation of EVA into ISS’ pay-for-performance test will be a significant change for 2020.

In mid-November, ISS released two documents summarizing its annual policy updates applicable to shareholder meetings held on or after February 2, 2020[1]. While compensation-related changes were relatively light, the incorporation of Economic Value Added (EVA) into the secondary screen on the Pay-For-Performance (PFP) test will be a significant, albeit anticipated, change for next year.

Highlights of Compensation Policy Changes

Confirmation that EVA Will be Used in the Financial Performance Assessment (FPA) Secondary Screen

ISS uses the PFP test to measure alignment of CEO pay and company performance. The test is conducted on a multiple-step quantitative and qualitative basis. The quantitative basis considers a company’s CEO pay compared to: (i) three-year total shareholder return (TSR) performance compared to peers (the Relative Degree of Alignment (RDA)); (ii) the median of peer CEO pay (the Multiple of Median (MoM) in the past year); and (iii) the change in the value of an investment in the company over a five-year period (the Pay-TSR Alignment (PTA)).

ISS uses these three measures to determine if there is a low, medium, or high level of concern. If a company has (i) an overall medium concern result, or (ii) an overall low concern result but with any one measure bordering on medium, ISS will apply the Financial Performance Assessment as a secondary quantitative screen which may either help or hurt ISS’ ultimate assessment of the pay and performance alignment. If a company has a low, bordering on medium concern, a poor FPA may result in a final medium concern category. Conversely, if a company starts out with a medium concern, a strong FPA may result in a final low concern category. The higher the ultimate level of concern, the more likely that ISS will then engage on a qualitative review of the program before making a determination about how it will vote on the company’s advisory say-on-pay.

Up until now, the FPA test included certain GAAP performance measures depending on the company’s industry, including ROIC, ROA, ROE, EBITDA growth, and cash flow growth. Starting in 2020, ISS will substitute certain EVA measures (EVA Margin, EVA Spread, EVA Momentum vs. Sales, EVA Momentum vs. Capital) for those GAAP performance measures. ISS will continue to include GAAP measures in their reports, and while such measures will not be used in the quantitative assessment, they may nonetheless be included in the overall ISS evaluation of the pay and performance alignment. Detailed methodology should be available in a white paper anticipated in early to mid-December 2019.

Quantitative Triggering Thresholds Raised and Three-Year MoM Information

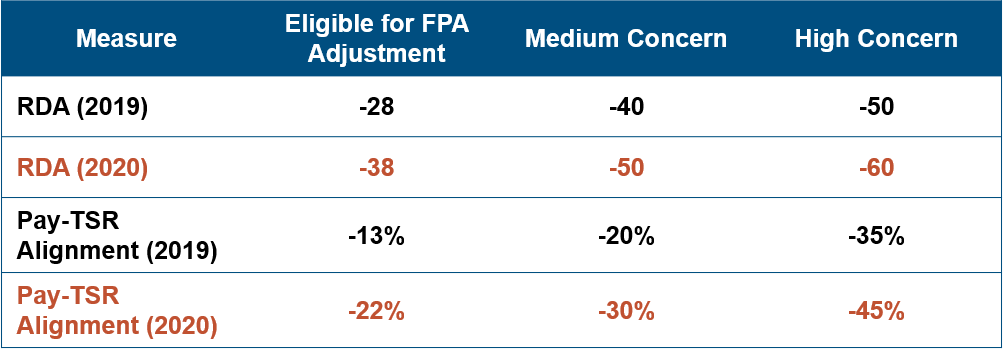

In the PFP test, ISS provides certain thresholds for the low, medium, and high levels of concern. For 2020, these triggers have been somewhat relaxed, which would result in more companies “passing” on the quantitative review (therefore lowering the likelihood that a qualitative review would be necessary). Changes to the RDA and Pay-TSR Alignment triggers are listed below.

While no changes were made to the MoM test for 2020, ISS will now include information about three-year MoM, although such information will not be incorporated into the quantitative screen.

Evergreens Make the Naughty List in Equity Plan Scorecard Review

In its assessment of equity plans put forth for shareholder approval, there are certain factors that could result in an “override” or automatic recommendation against, including provisions that permit: (i) liberal change in control definitions; (ii) repricing without shareholder approval; (iii) excessive dilution; (iv) other problematic pay practices/features that have a negative impact on shareholders. This list will now be expanded to include evergreens, or automatic share replenishment features. It appears this provision was added as a result of elimination of the performance-based tax deduction under 162(m), which required shareholder approval of plans every five years. ISS indicates it felt that without the five-year requirement, automatic share replenishment would circumvent regular shareholder approval of plans and could perpetuate plans with shareholder-unfriendly features. We understand that there will be no other material changes to the Equity Plan Scorecard test this year, including current “passing” cutoff scores.

Request for Pay Data Report Considerations Expanded

ISS currently has a policy to vote on a case-by-case basis on proposals requesting reports on a company’s pay data by gender; considering whether gender has been the subject of recent controversy, litigation, or regulatory action; and whether the company is lagging behind its peers on reporting such factors. This year, pay reports may be similarly requested and evaluated by ISS based not only on gender, but also on race and ethnicity.

Highlights of Non-Compensation Policy Changes

Board Gender Diversity

ISS’ previously announced policy to recommend against the chair of the nominating committee (or other directors on a case-by-case basis) at companies with no women on the board is effective for the 2020 proxy season. In addition, ISS clarified a commitment to achieve gender diversity from a board with no prior women directors will only be a mitigating factor for 2020, not beyond. In addition, going forward, a company that had board gender diversity in the previous year but not in the current year will need to acknowledge the current lack of a gender-diverse board, and provide a firm commitment to re-achieving board gender diversity by the following year in order to avoid a withhold/against recommendation. To constitute a “firm commitment,” there must be a plan, with measurable goals, outlining how the board will achieve gender diversity.

Independent Board Chair

ISS does not mandate a separation of the CEO and chair roles nor an independent chair. Nonetheless, it has codified factors that will increase the likelihood it will support a shareholder proposal requiring an independent board chair, including: (i) a weak or poorly defined lead independent director role; (ii) the presence of an executive or non-independent chair in addition to the CEO, a recent recombination of the role of CEO and chair, and/or departure from a structure with an independent chair; (iii) evidence that the board has failed to oversee and address material risks facing the company; (iv) a material governance failure, particularly if the board has failed to adequately respond to shareholder concerns or if the board has materially diminished shareholder rights; or (v) evidence that the board has failed to intervene when management’s interests are contrary to shareholders’ interests. ISS has indicated that its evaluation of independent board chair proposals will remain a holistic process and that it will not “ignore” company performance. However, it has eliminated from the guidelines the previously explicit statement that one-, three-, and five-year performance may be a mitigating factor. Further details are expected in the mid-December release.

Share Repurchase Proposals

ISS typically votes in favor of management proposals to institute open-market share repurchase plans in which all shareholders may participate on equal terms. However, this year certain factors may warrant an “Against” vote, including: (i) the use of buybacks as greenmail or to reward company insiders by purchasing their shares at a price higher than they could receive in an open-market sale; (ii) the use of buybacks to boost earnings per share or other compensation metrics to increase payouts to executives or other insiders; and (iii) repurchases that threaten a company’s long-term viability. Absent these “abusive” practices, ISS generally will continue to vote in favor of management proposals to institute share repurchase programs.

Problematic Governance Structures for Newly Public Companies

ISS’ position has been clarified in two policies:

- Problematic Governance Structures: Generally recommend voting against or withholding votes from the entire board if, without a sunset provision, the company has provided for: (i) supermajority vote requirements to amend the company’s organizational documents; (ii) a classified board structure; or (iii) other “egregious” provisions (with no further explanation of the word “egregious”). A “reasonable” sunset provision will be a mitigating factor.

- Multi-Class Shares with Unequal Voting Rights: Generally recommend voting against or withholding votes from directors of newly public companies if, without a sunset provision, the company has provided for a multi-class capital structure with unequal voting rights among the classes. A “reasonable” time-based sunset provision will be viewed as a mitigating factor. When evaluating the reasonableness of a sunset period, ISS will consider the company’s lifespan, its post-IPO ownership structure and the board’s disclosed rationale for the specific duration selected. However, no sunset period of more than seven years from the date of the initial public offering will be considered to be reasonable.

Conclusions

This year’s compensation policy changes really hold no surprises. The important compensation-related changes—incorporation of EVA into the secondary screen, as well as application of the previously-delayed non-employee director excessive pay test—have been anticipated for quite some time. The addition of an evergreen provision to the list of “egregious practices” was not anticipated, although in practice we understand that ISS has frowned upon use of these provisions in equity plans. That being said, the mid-December releases may still contain some nuanced surprises.

With the backdrop of SEC proposed regulations taking a closer look at proxy advisory services, it will be interesting to see how, or if, ISS recommendations and reports are in any way impacted this year.