Client Alert | Aug 2022

Pay Versus Performance Rules Finalized and Effective for Next Proxy Season

After 13 years and much debate, the SEC has finalized its guidance for one of the most complex executive compensation disclosures required under the Dodd-Frank Act.

In a surprise end-of-summer release, the SEC has—after 13 long years—finalized guidance for one of the most complex compensation disclosures required under the Dodd-Frank Act: pay versus performance. The final rules come after two rounds of proposals (one in 2015 and another in 2022), two comment periods, and a review of hundreds of public comment submissions. The SEC largely tracked the contours of provisions in the 2015 Proposal and 2022 Reopened Proposal.

While many are familiar with the suggested guidance, it comes as a surprise that the new rule (Item 402(v) in the proxy statement) will be implemented in the 2022 proxy for the 2023 proxy season. Therefore, companies must not only refamiliarize themselves with the final rules, but also take immediate action to collect the data and create the narratives around this data-heavy requirement.

Snapshot Overview

The lengthy guidance can be grouped into three main categories:

New Pay Versus Performance (PVP) |

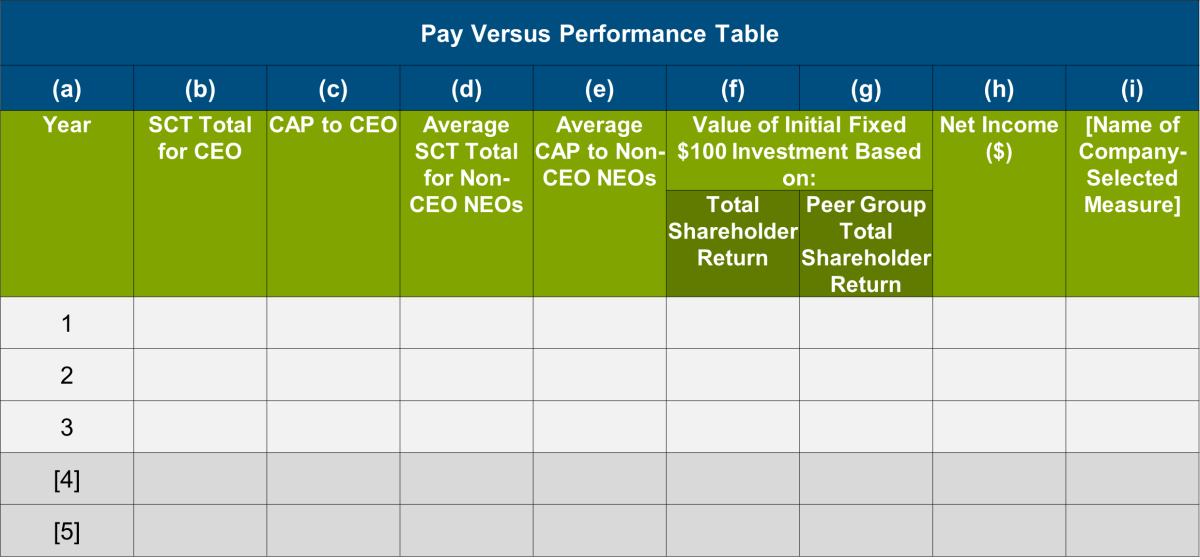

A completely new table will be required in the proxy statement containing the following columns covering five years of data:

Detailed footnotes will be required to name each NEO covered in each year, how adjustments were made to equity and pension values, and any other assumptions made. |

Disclosure Explaining the PVP Table |

Narratives and/or graphical disclosures must provide a clear description of the relationships between data provided in the PVP Table, including:

|

Tabular List(s) |

| Companies must provide a Tabular List of at least three, but not more than seven, of the most important company measures used to determine NEO pay. At least three of these measures must be financial measures. One or more Tabular Lists may be provided. |

Detailed Analysis

General Information

Effective Date: New Item 402(v) will be required in proxy statements filed with respect to fiscal years ending on or after December 16, 2022 (i.e., in the 2023 proxy statement).

Companies Covered: All public reporting companies will be required to include the new Item 402(v) PVP disclosure, but the rule excludes emerging growth companies, registered investment companies, and foreign private issuers not subject to proxy rules. Smaller reporting companies (SRCs) have reduced reporting requirements.

Discretionary Location in the Proxy: The PVP Table and associated new mandated disclosures are not required to be in any particular location in the proxy or information statement.

XBRL Reporting: Companies must separately tag each value in the PVP table and footnotes, all in Inline XBRL (with SRCs not required to comply until the third filing in which they provide PVP disclosure).

Pearl Meyer Observation: An immense amount of new information and data points will now be easily accessible to the public, investors, and proxy advisors. Over time, investors and proxy advisors are likely to incorporate this new data into their various tests and screens.

Pay Versus Performance Table

Years Covered (Column (a)): The new PVP Table requires information for the five most recently completed financial years, but in the first year of disclosure, only three years are required, with an additional one year required for each subsequent year (e.g., in 2023, 2024, and 2025 (and beyond) there will be three, four, and five years of data, respectively). Newly public companies do not need to report for years prior to the last completed year, and SRCs will only need to report for the three most recently completed fiscal years, beginning with two years in the first filing.

Executives Covered: The PVP Table must include SCT Total and CAP data for each CEO in each year reported in the table. If there are multiple CEOs in any year, the PVP Table must include separate columns for each CEO, with footnotes including the name of each CEO. It must also include average SCT Total and CAP data of all other NEOs for whom disclosure is or was required in the SCT.

Pearl Meyer Observation: Over multiple years, there may be many NEOs that come and go into the PVP Table, so reporting on average is intended to simplify the reporting and perhaps neutralize large swings in data.

Summary Compensation Table Total for CEO and Other NEOs (on average) (Columns (b) and (d)): These columns reflect the “total” column from the SCT for the relevant year for the CEO(s), and the average total for the other NEOs. These are numbers that can easily be pulled from the SCT once it is finalized.

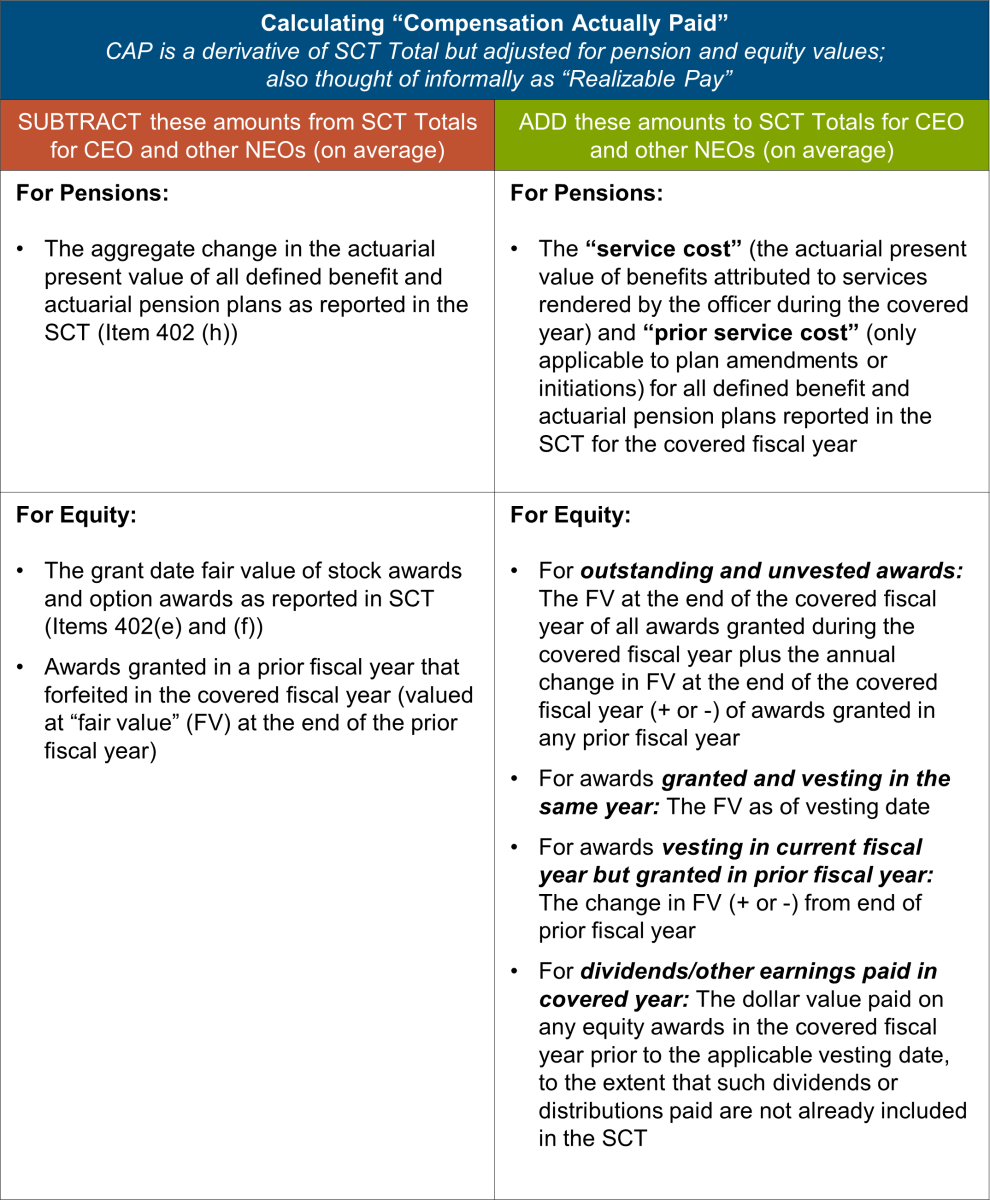

Compensation Actually Paid to CEO and Other NEOs (on average) (Columns (c) and (e)): Companies will likely spend a fair amount of time calculating CAP, as this is the first time this type of compensation aggregate is required to be presented in a proxy statement. The chart below presents a formula for calculating CAP.

For purposes of the equity adjustment, “fair value” is methodology used by companies in their financial statements based on GAAP; for performance-based awards, it should include probable outcome (i.e., typically target) at the end of the relevant year.

Pearl Meyer Observation: Essentially, the fair value of equity awards is calculated in the year of grant, and then adjusted each year based on updated fair values until the awards vest. It is not adjusted once it vests.

Pearl Meyer Observation: This aspect of the new rules will likely be one of the most cumbersome data collection exercises in an entirely new system of compensation reporting. Experts from accounting, finance, human resources, and outside valuation advisors will need to provide input on collection and presentation of this data. While some of these numbers may be calculated for financial reporting purposes, some (e.g., those based on market conditions) may not be part of the usual data collection and will require significant outside expertise to calculate for each award, in each year. Also keep in mind that when a new CEO or NEO enters the table in any of the five years, historical fair values will need to be calculated and considered, further complicating the process.

Total Shareholder Returns for the Company and Peer Group (columns (f) and (g)): These columns will include company TSR and peer group TSR (weighted based on the issuers’ stock market capitalization at the beginning of each period for which a return is indicated). TSR is reported as calculated based on an initial fixed investment of $100. The peer group may either be that which is included in the stock price performance graph in the annual report or a peer group used for compensation benchmarking purposes from the company’s Compensation Discussion and Analysis (CD&A). SRCs are exempt from providing peer group TSR.

If the peer group is not an industry or line-of-business index, the identity of the companies in the group must be disclosed in a footnote. If the company changes its peer group in a given year, the company must disclose the peer group TSR for the new peer group for all years in the PVP Table (including prior years). It must also explain in a footnote the reasons for the peer group change and compare the company’s TSR to that of both the new peer group and the peer group used in the immediately preceding year.

The “Measurement Period” used for cumulative TSR is the period that commences on the market close of the last trading day to occur before the earliest fiscal year reported in the PVP Table and ends on (and includes) the last day of the most recent covered fiscal year. For example, if the company’s PVP Table covers fiscal years ending December 31, 2020, 2021, and 2022, the cumulative TSR reported for 2022 will have a three-year measurement period, commencing on the last trading day to occur before January 1, 2020, and ending on December 31, 2022.

Pearl Meyer Observation: Companies should carefully decide how to pick a peer group, as any sort of change over the required three to five years of reporting may exponentially increase required peer group disclosure and TSR reporting. We anticipate many companies may rely on an industry or line-of-business index as compensation peers tend to change somewhat more frequently over time.

Net Income (column (h)): The company’s reported net income for the relevant year.

Company-Selected Measure (column (i)): This is a “financial performance measure” that the company decides is the most important measure to link CAP during the year to company performance (other than net income and TSR). It must be any measure determined and presented in accordance with the accounting principles used in preparing the company’s financial statements, any measures that are derived wholly or in part from such measures, and stock price and TSR. This financial performance measure need not be reported in the company’s financial statements. If, however, it is a non-GAAP financial measure, the company must provide disclosure as to how the number is calculated from audited financial statements.

A company can include additional financial or non-financial selected measures in new columns to the right of the table, but it must be clear what the company’s most important measure is. If the company changes the Company-Selected Measure from a prior year, it must show the multiple-year performance against the previously used measure in addition to the newly selected company measure.

Under certain circumstances, this column may not need to be reported. If the company did not use any financial performance measures in setting compensation in the last completed fiscal year, or if the company only uses financial performance measures that are already included in the PVP Table (i.e., TSR and/or net income), the company is not required to include a Company-Selected Measure in the table or describe it in the narrative. SRCs are exempt from reporting a Company-Selected Measure.

Footnotes: Extensive footnotes are required to clarify the PVP Table. Among other requirements (some noted above), the footnotes must disclose:

- Each CEO in each year covered by the PVP Table, as well as all NEOs included for each year

- All additions, subtractions, and assumptions made to arrive at the CAP

- Any assumption made in the valuation of equity awards that differs materially from those disclosed as of the grant date of the equity awards

- If the peer group is not an industry or line of business, the names of the specific companies comprising the peer group

- Explanations for any peer group changes along with a comparison of the company’s TSR to that of both the new peer group and the peer group in the immediately preceding year

Disclosure Explaining the PVP Table

The SEC also requires disclosure incorporating the data presented in the PVP Table. Specifically, a clear description of the relationship between certain amounts in the table for the five (or three or four during the transition years) most recently completed fiscal years must be provided, as follows:

Required Descriptions of Relationships | ||

| CEO CAP | versus |

|

| NEO CAP | versus |

|

| Company-Culture TSR | verses | Peer Group-Cumulative TSR |

The descriptions may be in narrative or graphical form, or a combination of the two.

Tabular List(s)

Three to Sevent Most Important Measures for Determining NEO Pay |

| Measure 1 |

| Measure 2 |

| Measure 3 |

| [Measure 4] |

| [Measure 5] |

| [Measure 6] |

| [Measure 7] |

Companies (other than SRCs) must include a Tabular List (as illustrated above) of the most important financial performance measures used by the company in setting executive compensation for the most recently completed fiscal year.

The Tabular List should include at least three and not more than seven performance measures, in no particular order, and must include the Company-Selected Measure from the PVP Table. However, if fewer than three financial performance measures are related to the determination of CAP during the year, the company will be required to disclose only the number of measures it actually considers (which in fact could be zero). Companies must make the determination of which measures are “most important” on the basis of the most recently completed fiscal year, rather than over the number of years included in the PVP Table.

Companies may include non-financial performance measures in the Tabular List only if (i) they are among the company’s three to seven most important performance measures, and (ii) the company has also disclosed at least three (or fewer, if the company only uses fewer) financial performance measures in the list.

The SEC provides three different ways to present the Tabular List: As one list, two lists (one for the CEO and one for the remaining NEOs), or as separate lists for the CEO and each NEO. If multiple Tabular Lists are used, each list must include at least three (or fewer, if fewer than three are considered) and up to seven financial performance measures.

Actions To Take Now

Gathering all of the data needed to meet the requirements—data which has never before been presented in this format in proxy statements—will take a good deal of time this fall, as will assembling the right teams to discuss and provide narratives that will likely have several rounds of edits to ensure an appropriate story that aligns with the rest of the proxy messaging about executive pay.

- Establish your team and timeline. While your core proxy team will be a good starting point, more players and time will be needed to gather the data, discuss narratives, and review strategy than ever before. This may not only involve the compensation committee, but members of finance, accounting, human resources, and investor relations, as well as outside compensation, audit, and valuation experts.

- Identify all individuals likely to fall in the table. This will include all CEOs for the periods covered (in the first year, a three-year period, and building up to five years), and all NEOs for the periods covered.

- Identify Company-Selected Measure and any Tabular List measures. Companies will need to spend time identifying between three and seven of the most important company measures used to determine executive compensation which will be included in the Tabular List. From that list, it will need to identify the most important measure that will be listed in the PVP Table. The most important measure will be the one that will require in-depth explanation, so it should be chosen with that narrative in mind. Companies should also think about how these measures may overlap or be different from those provided in the CD&A discussion, the latter of which requires companies to address “material elements” relating to executive compensation.

- Calculate Compensation Actually Paid.

- Pension Service Cost: Actuaries will likely need to be involved to calculate each executive’s service cost for each year.

- Equity Year-End and Vesting Date Fair Value: We anticipate that this will be a time-intensive and data-heavy exercise that should begin as soon as possible. Companies will need to separately run fair value calculations for: (i) awards that are outstanding at the end of each year to calculate fair value change during each year; (ii) awards that were granted and vested in any of the years; and (iii) those that vested in the current year but were granted in a prior year. While companies may have tools and systems in place to track fair value, the data will be need to calculated and tracked in a more complex manner and companies should consider setting up comprehensive systems to do so going forward.

- Identify the company peer group. Companies should discuss whether it is more appropriate to use the CD&A peers or the peer group/index in the Performance Graph. Companies may want to draft the disclosure using both groups to see where alignment makes the most sense.

- Discuss the strategy for relationship disclosures—narratives or graphic or both? Companies are given discretion as to how to make this disclosure, but it should be consistent with other messages conveyed in the CD&A.

- Discuss placement of disclosure. The SEC rules do not prescribe location of Item 402(v), so companies should consider the most logical place to insert the new information. We suspect that most companies will not include the disclosure within the contours of the CD&A if the committee did not consider this information in making its decisions.

At the very least, we would suggest that companies immediately begin to draft the PVP Table for previous two years (e.g., 2021 and 2020) as most of the data will be currently available or may be estimated for draft purposes. This should facilitate a working draft of the required relationships to get started. A fulsome discussion around the most important measure as well as other measures should also be on the agenda of the next compensation committee meeting.

Regardless of the disclosure, committees should keep in mind whatever the outcome of Item 402(v), it is unlikely that it will completely align with the performance measures utilized by a company’s compensation committee in designing and awarding executive compensation, especially in the first year of disclosure. While it is of little solace in light of the herculean new task on the agenda, committees should not forget that the new disclosure is essentially an after-the-fact review of whether and how “compensation actually paid” aligns with the measures of corporate performance prescribed under the rule, if at all.