Advisor Blog | Oct 2022

Navigating Dodd-Frank Disclosure Requirements if You’re a Smaller Reporting Company or Emerging Growth Company

What to know about pay vs. performance and other disclosure rules if your company is an SRC or an EGC.

Since the SEC dropped its surprise gift of new and onerous pay vs. performance (PvP) disclosure requirements in August, many public companies have been scrambling to understand the rule and begin collecting new data. However, some filers will get a few breaks. Specifically, “Emerging Growth Companies” are completely exempt from the new mandate and “Smaller Reporting Companies” have scaled disclosure requirements.

The PvP requirement, as well as many of the Dodd-Frank compensation related mandates, have special rules for companies that are not large filers. This article provides a snapshot of the scaled requirements. Please see our Client Alert which provides a more in-depth discussion of the PvP rules.

Definitions

First, it is important to know which companies qualify for the limited or exempt disclosures.

Smaller Reporting Company (SRC)

A company qualifies as a “Smaller Reporting Company” (SRC) if it has:

- A public float of less than $250 million; or

- Less than $100 million in annual revenues; and

- No public float or

- Public float of less than $700 million.

“Public float” is generally calculated by multiplying the number of the company’s common shares held by non-affiliates by the market price, and is measured at the end of the second fiscal quarter.

Emerging Growth Company (EGC)

A company qualifies as an “Emerging Growth Company” (EGC) if it has total annual gross revenues of less than $1.07 billion (increased to $1.235 billion as of the end of 2022) during its most recently completed fiscal year and, as of December 8, 2011, had not sold common equity securities under a registration statement.

- A company continues to be an emerging growth company for the first five fiscal years after it completes an IPO, unless one of the following occurs:

- Its total annual gross revenues are $1.07 billion (increased to $1.235 billion as of the end of 2022) or more;

- It has issued more than $1 billion in non-convertible debt in the past three years; or

- It becomes a “large accelerated filer,” as defined in Exchange Act Rule 12b-2. A large accelerated filer has:

- Public float greater than $700 million;

- Has been filing periodic reports for at least 12 months;

- Has filed at least one 10-K; and

- Is not a smaller reporting company.

PvP Disclosure

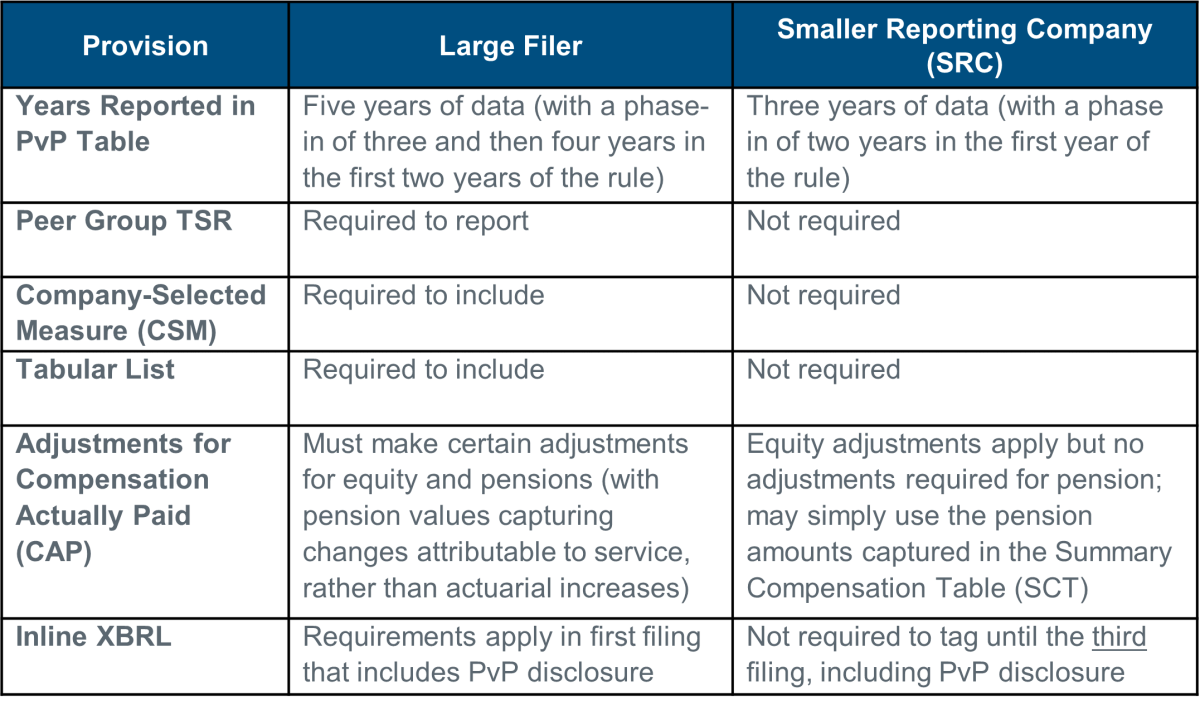

Take a look specifically at what this means for the new PvP rule. The chart below summarizes the major differences in PvP provisions required for large and smaller reporting companies.

While at the outset, the scaled disclosures may give some companies a welcome reprieve, it may also give rise to an inconsistent or incomplete message for smaller companies. For example, in many smaller companies (that may not qualify as EGC), Net Income and Company TSR may not tell the full or even partial story of how pay aligns with performance. As such, SRCs may consider voluntarily providing a company-selected measure or listing other measures that align with their pay program in a tabular list and/or providing some narrative around measures that otherwise drive pay and performance. For a further discussion of how certain growth stage companies may address these issues, please see this article.

Comparison of Other Executive Compensation Related Disclosures

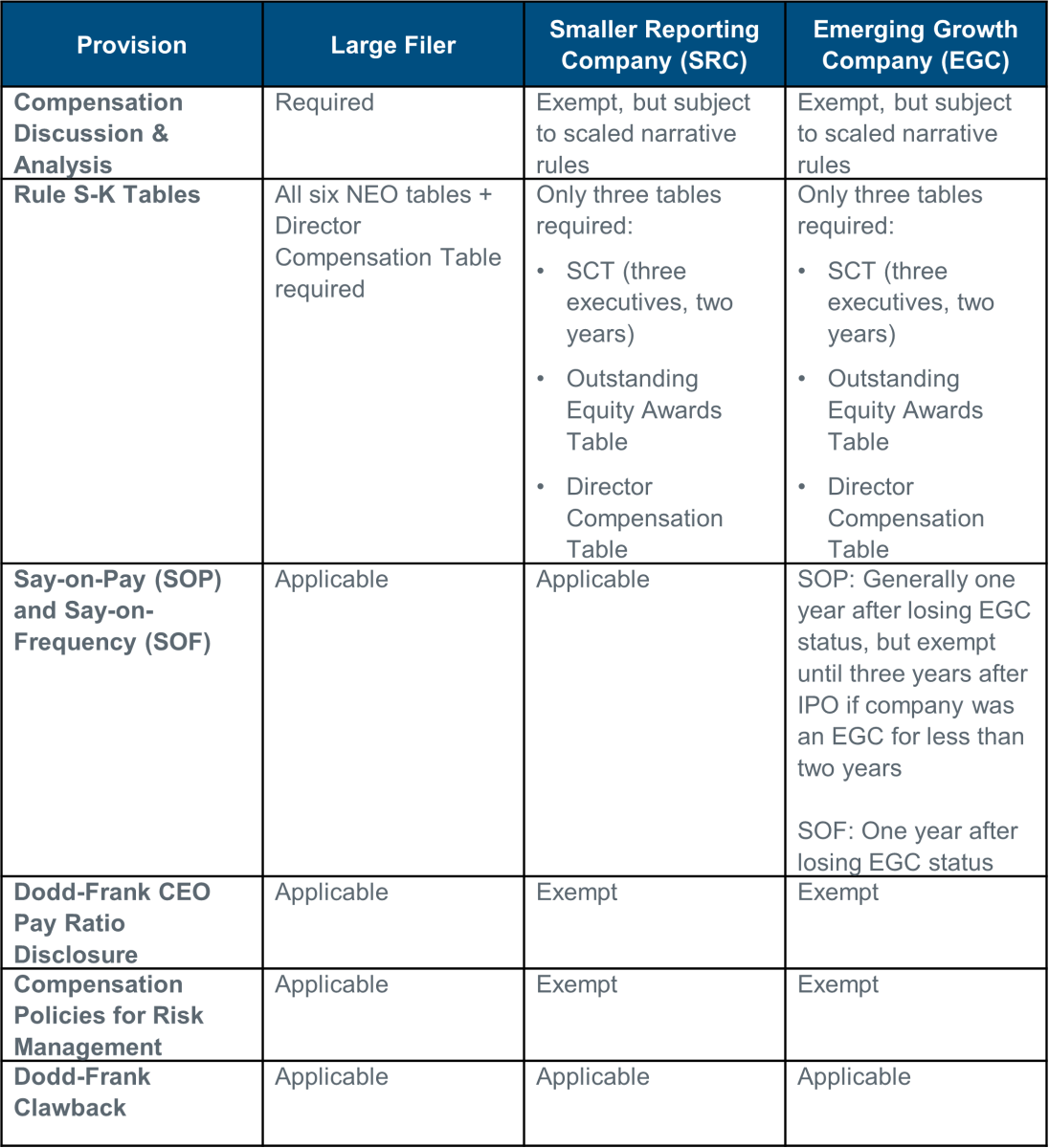

Scaled disclosure has been permitted for SRCs and, in 2012, the Jumpstart Our Business Startups (JOBS) Act further reduced executive compensation reporting requirements for companies that qualify as EGCs. Please see our Client Alert which includes an in-depth discussion of the specific requirements for EGCs. The chart below provides a comparison of the major executive compensation provisions applicable under Dodd-Frank (other than the PvP requirement) for each type of filer.

Conclusion

It’s important for newly public and smaller reporting companies to understand the disclosure breaks they are getting and when those reprieves phase out. While on the surface the PvP disclosure rules provide some relief by requiring fewer data points, it may also obligate some of these filers to provide additional information around the relationship between pay and performance that may not be obvious from the required tables.