Advisor Blog | Aug 2025

Bank Board of Directors’ Pay, Policies, and Practices in 2025

Highlights and data from the bi-annual survey on bank directors’ compensation levels and practices.

In May of this year, Pearl Meyer published the biannual Bank Director Compensation and Governance Practices Survey. The continued increase in participation, from 69 institutions in 2019 to 181 in 2025, shows a growing interest in competitive board of directors’ compensation and the associated pay practices and governance issues. This year’s survey presents data on current practices for compensating effective board leadership, as directors take on growing responsibilities in overseeing bank operations and staying informed on evolving regulatory developments. The survey’s participating banks include public banks, private banks, and mutual savings banks. Below are a few highlights from the 2025 report.

Board Compensation

Most institutions establish director compensation programs by reviewing and benchmarking to peer market data. One challenge is determining the proper mix of compensation to attract board members and compensate them properly for their service (including the risks and time commitment involved) while also aligning with shareholder interest.

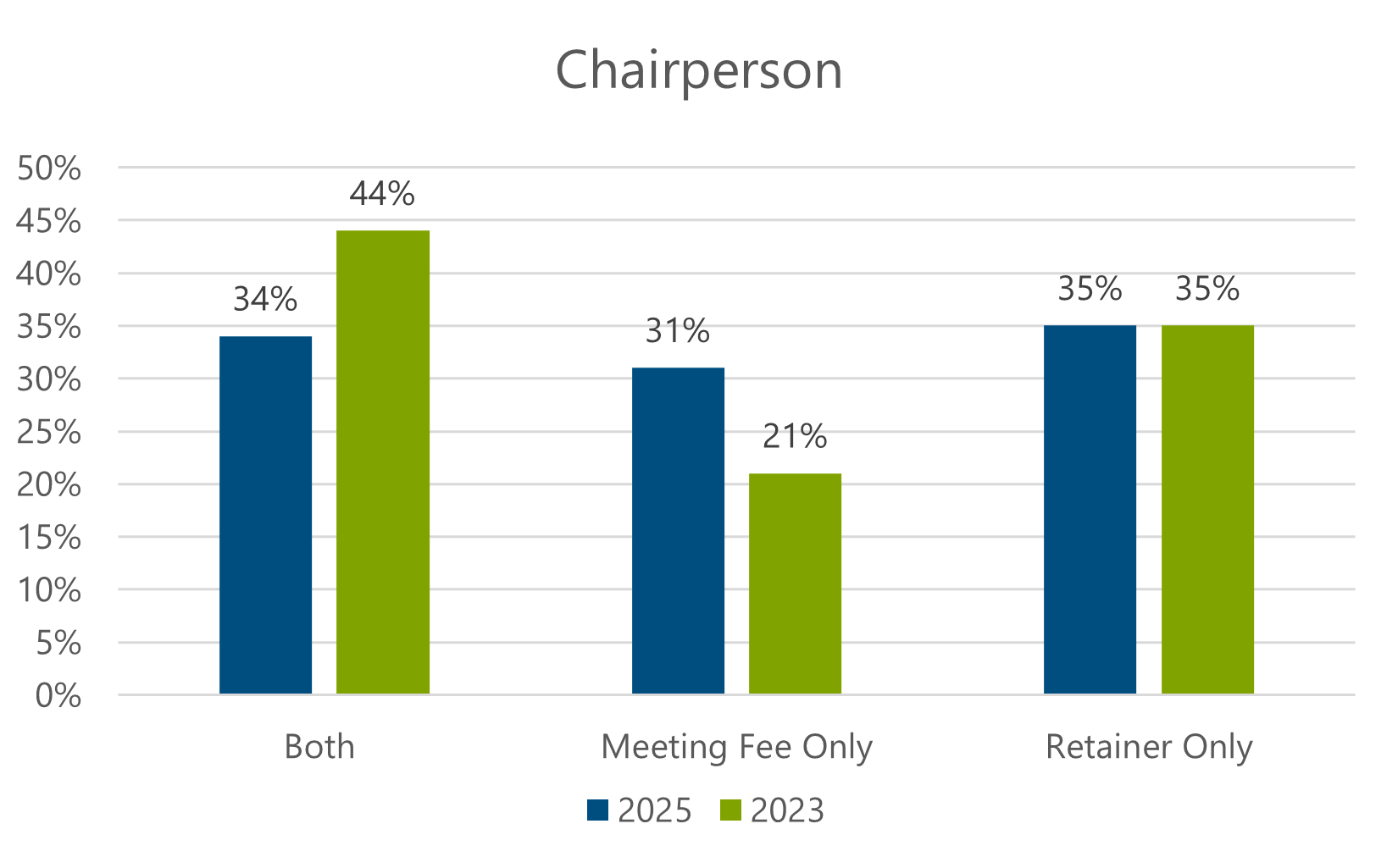

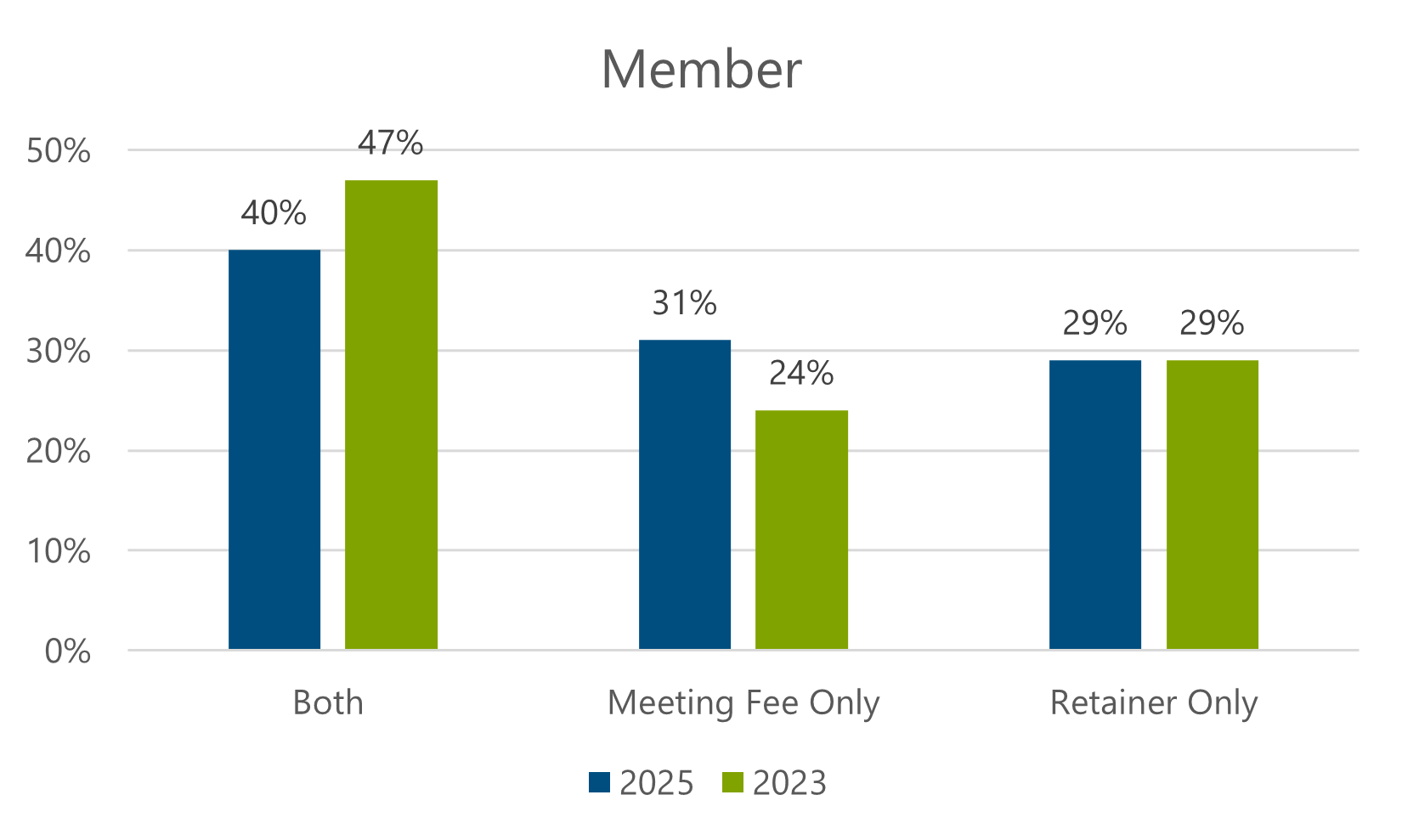

In our survey, director compensation is reported for the following components: annual retainer, board and committee meeting fees, equity, and benefits. Typically, a cash retainer and/or cash meeting fees are the core compensation elements for directors, although we are seeing an increasing prevalence of equity awards. Thirty-four percent of all institutions pay the chairperson both a retainer and a per-meeting fee for service, and forty percent pay board members the same two fees. Both percentages are down since 2023.

The survey offers additional in-depth data on board retainers, meeting fees, and committee compensation broken down by asset size, form of ownership, and board structure. In this year’s report, average cash compensation per director ranged from $17,141 to $75,775 and average total board cash compensation ranged from $148,101 to $845,328, increasing with asset size.

Board Evaluation

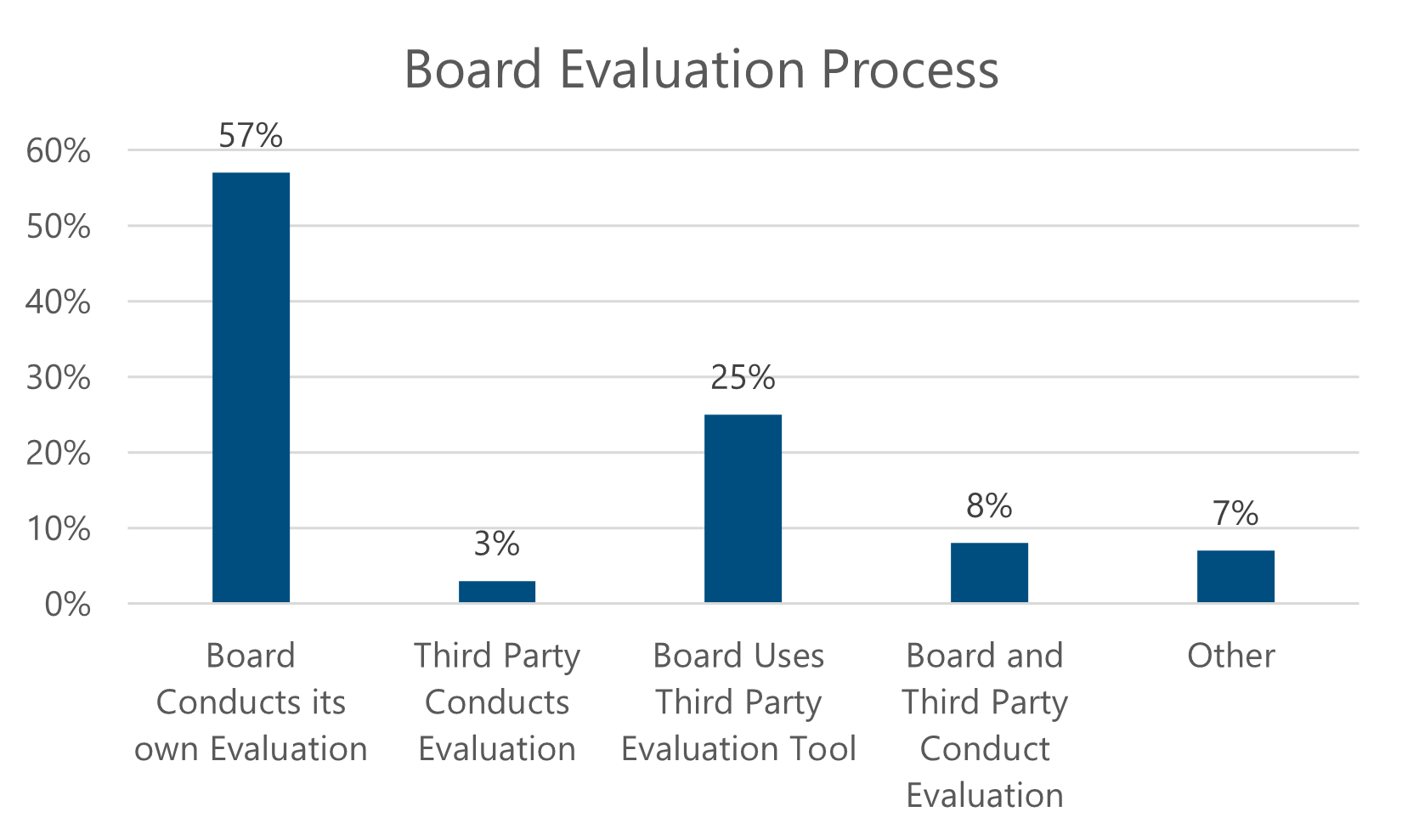

Increasingly complex regulatory guidelines are putting pressure on boards to be effective and achieve a multitude of goals. Board evaluations are a tool designed to review corporate governance practices and the effectiveness of the board and its committees. When conducted properly, board evaluations benefit stakeholders, directors, and the institutions by strengthening boards to be a strategic asset to the bank and its management. Forty-three percent of participants conduct a formal evaluation of the board, and of these institutions, over half (57 percent) conduct the evaluation themselves instead of using a third party (3 percent) or an evaluation tool developed by a third party (25 percent). Eight percent opt for both self-evaluation and that of a third party.

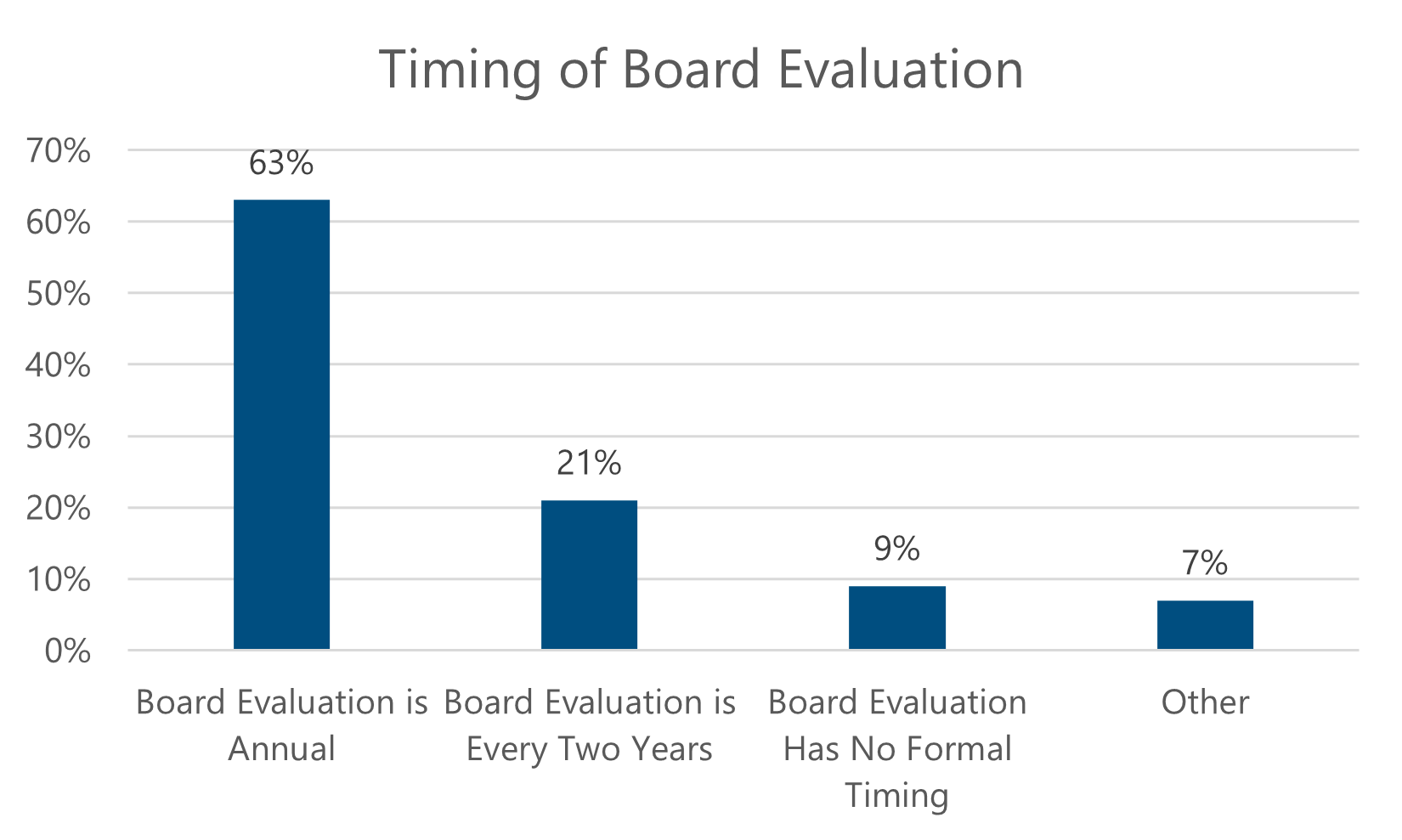

As might be expected, most of the institutions conducting board evaluations do so annually (63 percent) and individual directors are evaluated at only 20 percent of the participating institutions.

Each board should have a unique set of objectives and goals used to evaluate each director. Evaluations can be a full board activity or fall under the purview of the compensation committee, which increasingly covers leadership development and talent management and sets board pay. An outside party can objectively assist the board in identifying their strengths and weaknesses and improving board performance. Pearl Meyer Vice President Randy McGraw, who often conducts bank board evaluations said, “We have seen a significant increase in compliance with governance policies since board evaluations have become more common.”

Diversity in the Boardroom

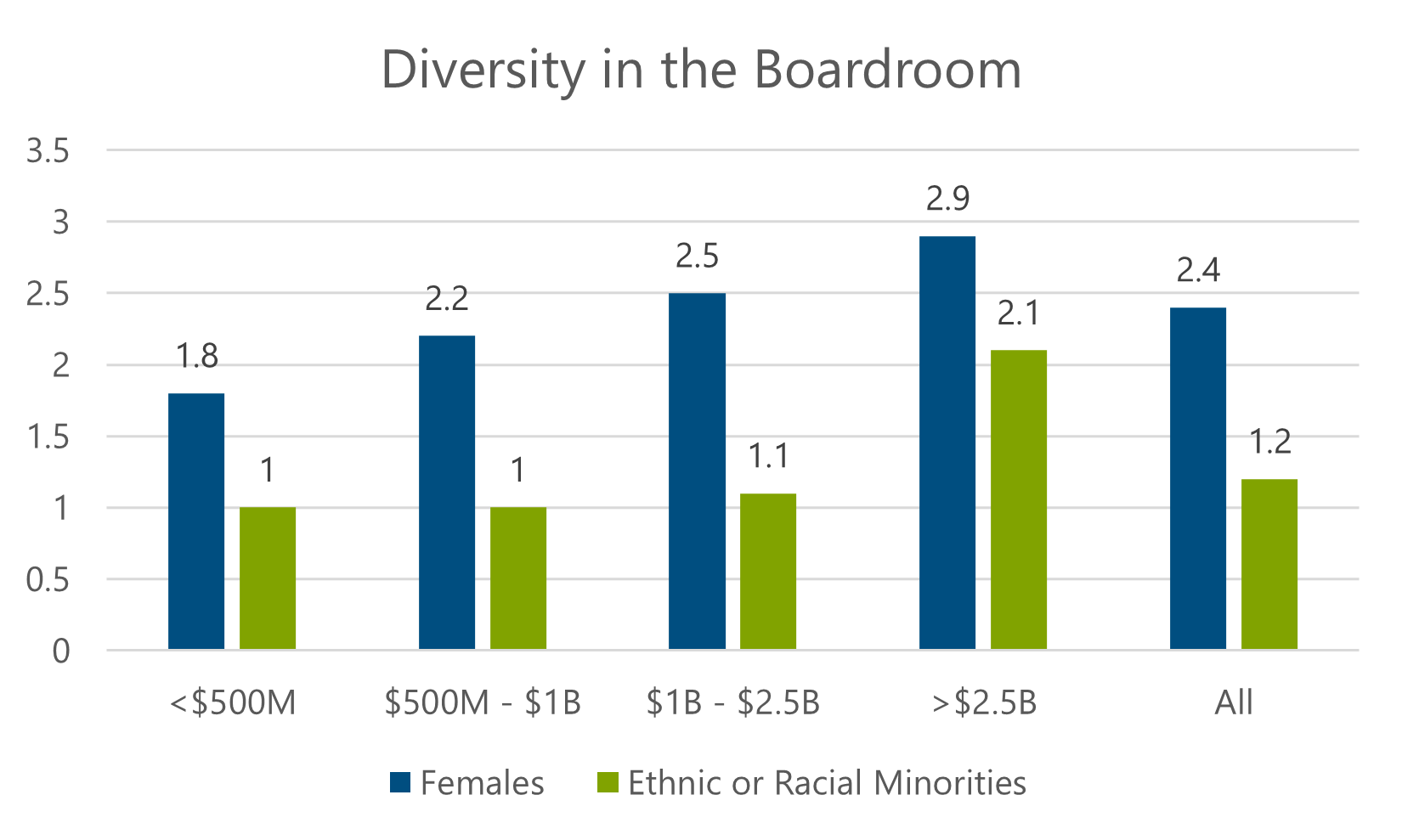

Although diversity, equity, and inclusion (DE&I) may no longer be as prominently featured in customer-facing communications as it once was, institutions and boards remain mindful of the importance of fostering diverse representation in the boardroom. “This is one of the many areas of focus when conducting board evaluations,” said McGraw. Further, McGraw went on, “diversity is still an important criterion in recruiting new directors, supporting effectiveness and board refreshment.” Our 2025 survey reports on board representation by gender and ethnic or racial minority. While there is clear room for improvement, 99 percent of participating institutions reported an average of two female board members, and 95 percent reported at least one board member of an ethnic or racial minority. The chart below details the average number of female and minority board members by asset size.

Summary

Every institution is unique, and banking is an ever-evolving business. Successful banks require quality directors with a varied range of knowledge, skills, and abilities to navigate unpredictable circumstances. Developing a compensation program that fits your board’s needs and attracts knowledgeable directors can be a challenge. The Pearl Meyer 2025 Banking Board of Directors Compensation and Governance Practices Survey is a valuable resource and provides the most comprehensive look at board data, trends, and practices.

For information on purchasing the 2025 Banking Board of Directors Compensation and Governance Practices Survey please contact Jordan Gagnon or Rhonda Snyder.

In addition to providing board of director data, we strive to be your trusted resource as you gather information to properly compensate and reward your most valuable asset, your employees. Pearl Meyer’s portfolio of banking surveys also includes the following reports:

- Banking Benefits and Human Resources Policies Survey: This biannual survey, most recently published in May of 2024, provides data on PTO programs, health and wellness plans, flexible spending accounts, life insurance, retirement, and much more.

- Banking Compensation Surveys: Currently open for participation. Our portfolio of state and national banking compensation surveys provides participants with the information needed to assess the competitiveness of their compensation plan and evaluate their plan’s effectiveness. In addition to collecting officer and non-officer compensation data for over 300 positions, this survey also presents policies and practices reports for salary administration, short-term incentive, and long-term incentive plan design. Reports include asset, national, regional, and state breakouts. Jordan Gagnon or Rhonda Snyder will be happy to assist with information for these surveys as well.