Advisor Blog | Jan 2024 | American Seniors Housing Association

Compensation Trends in Seniors Housing

For firms that can demonstrate a clear path to future professional growth, it can be a buyer’s market for select strategic roles and positions.

While 2023 has proven to be another challenging year for the industry, there are signs that proactive, forward-looking seniors housing platforms are taking the steps necessary to strengthen bonds with their current staff. They are also, through compensation strategies among other methods, increasingly seeking to augment staff with key talent from competing platforms and even other sectors within the broad real estate industry.

These firms are also utilizing the Pearl Meyer 2023 ASHA Seniors Housing Industry Compensation Survey to help their respective human resources teams, senior management, and boards position their companies competitively. For the firms that can demonstrate a clear and evident path for future growth at both the corporate and individual professional level, it can be a buyers’ market for select positions. With this backdrop, there is much to gain from investing time in understanding the latest industry-specific compensation survey results.

The survey collects data on over 100 different positions across all organizational levels—from the junior analyst through the c-suite. It covers both core real estate and related operational and support functions, and reveals trends in base pay and short- and long-term incentive compensation plans that can provide context for 2024 decisions and compensation philosophies overall.

Base Salary

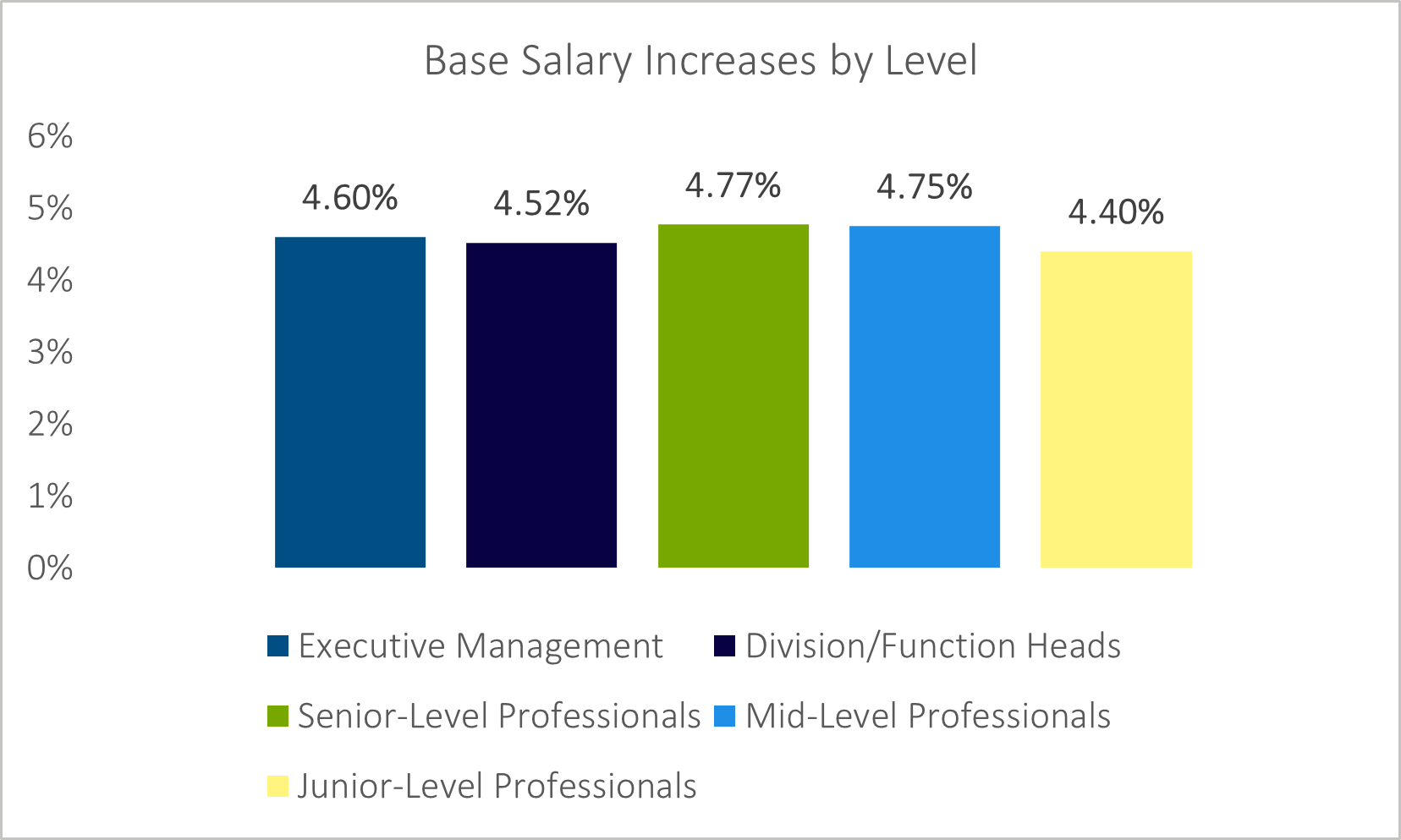

Despite the challenges, salary increases for 2023 are projected to rise to between 4% and 5% percent almost mirroring 2022 and representing a material jump over 2021’s 3% average increase.

Senior- and mid-level professionals are set to see the largest increases at 4.77% and 4.75% respectively, followed by executive management at 4.6%, division/function heads at 4.52%, and junior-level professionals at 4.4%. This is generally consistent with 2022 survey results that anticipated base salary year-over-year increases within a similar range.

Retention concerns based on executive opportunities in other industries or in other real estate sectors, coupled with the inflationary climate, have pushed an ongoing demand for meaningful increases to base salaries wherever and as much as reasonably possible.

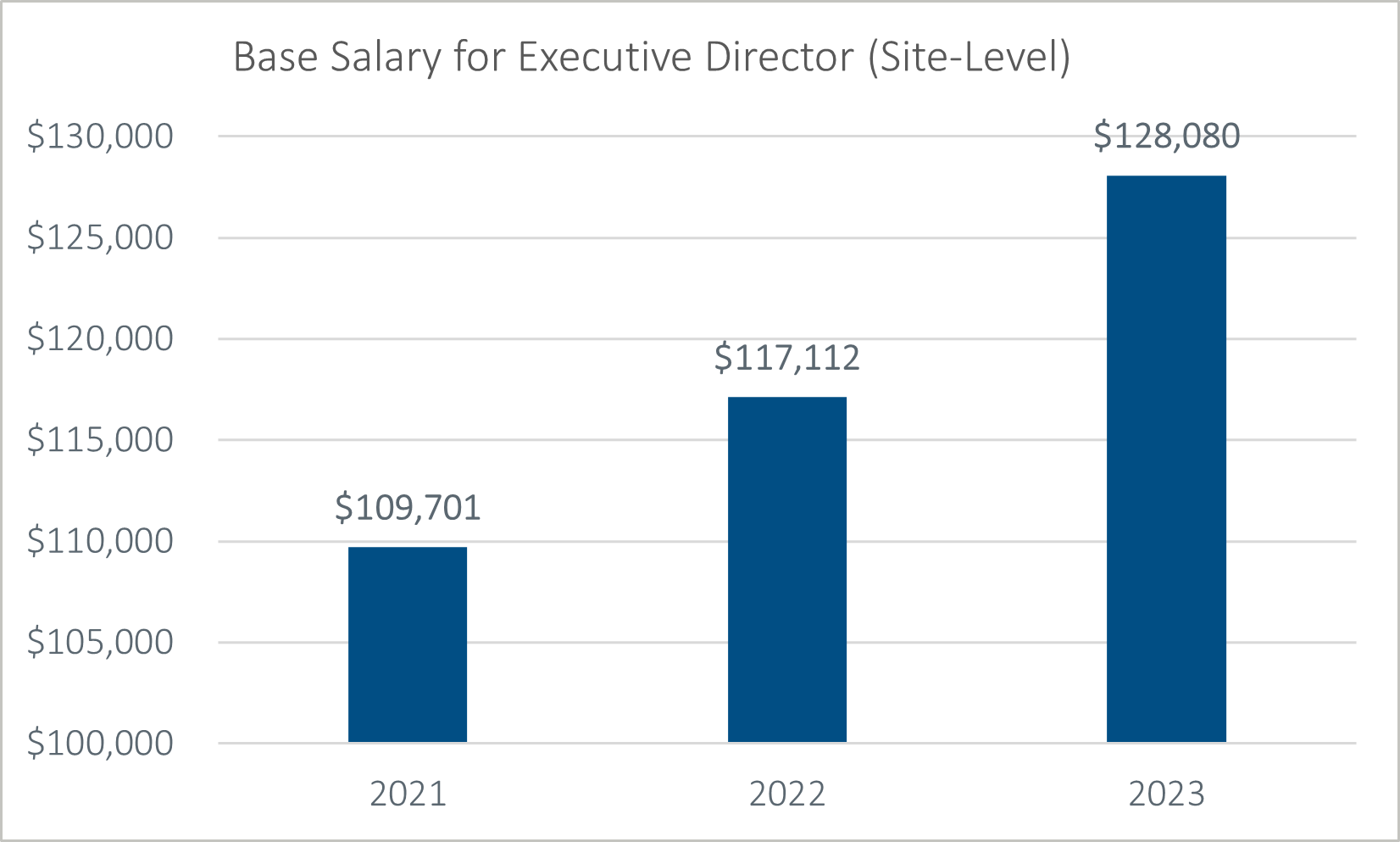

This is particularly true as professionals grapple with their personal decisions to stay committed to their company—and to the seniors housing industry in general—versus exploring like-kind opportunities in other sectors of real estate such as multifamily or hospitality. This is an important issue in certain functional disciplines such as site executive directors, who are increasingly recognized as critically important and valuable members of the company that can directly and materially influence the performance of the asset. Firms are therefore paying an increasing premium to recruit and retain for this particular position in a manner that out-paces the more standard year-over-year base salary increases. This is a trend that shows no sign of abating in 2024. For seniors housing platforms to retain their teams, remaining market-competitive on base salary compensation is a (and perhaps the) key metric to focus on.

Short-Term Incentives

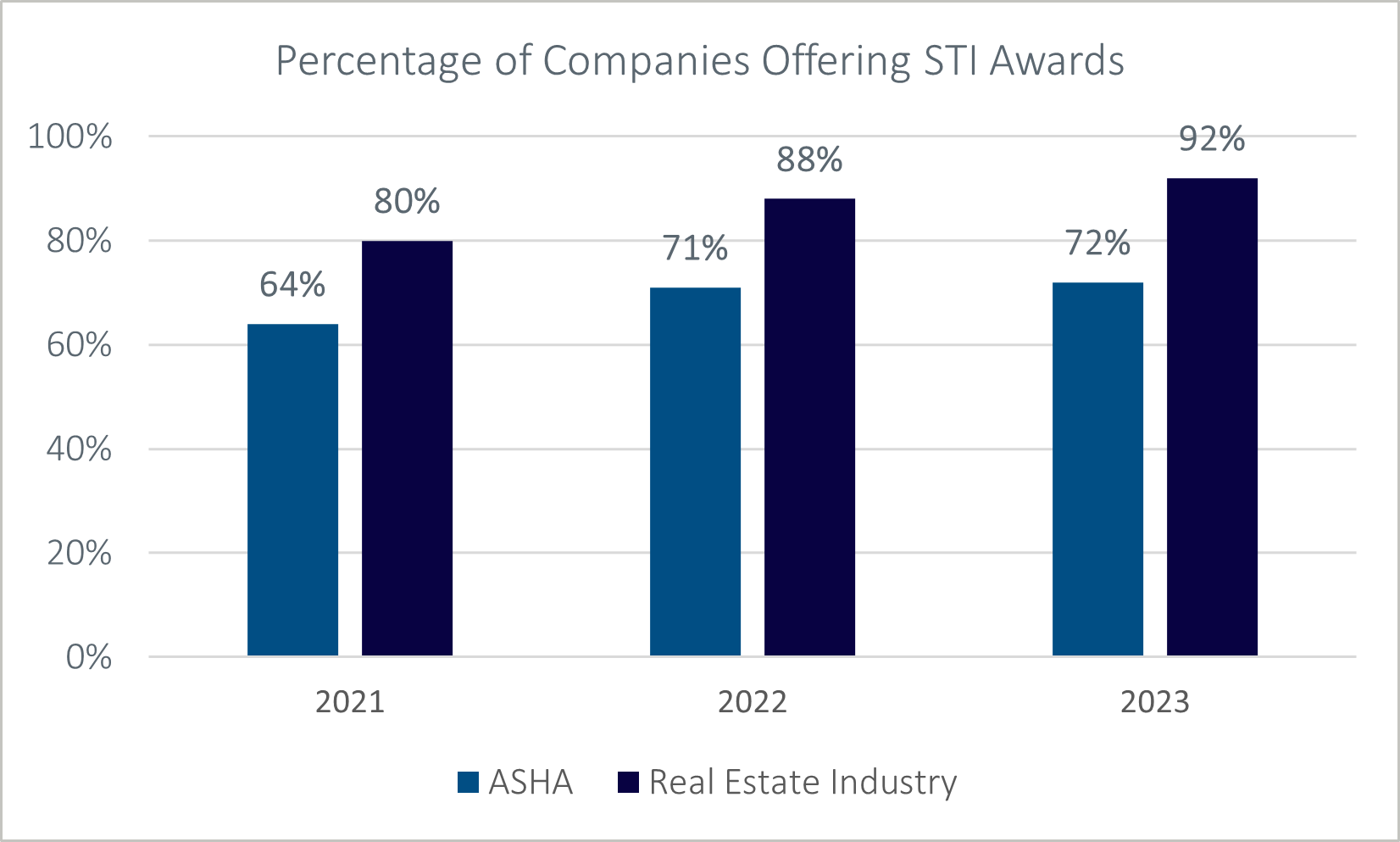

The number of ASHA companies offering STI rose very slightly (1%) over 2023 and continues to lag the broader real estate industry and by a larger margin than last year at 20%.

Given the ongoing expenses incurred by operators, the results from the survey, namely the widening of the gap between seniors housing short-term incentive award pay and that opportunity as found in the broader real estate marketplace, is not surprising. It does and will, however, complicate the ability of firms to remain competitive in the market for both new and replacement talent.

Firms that economically cannot offer an STI program will need to draw on other important compelling aspects of their platform. Culture, mission, and purpose all become increasingly important differentiators when seeking to retain or add to a firm’s talent base. Furthermore, employees are paying increasing attention professional development opportunities. Still others seek platforms with attractive benefits packages or flexible work schedule opportunities.

In short, while making up the gap between seniors housing and the general real estate industry may be impactable, it does not, nor should not inhibit creative firms with demonstrating a ”quality of professional life” attribute that can be effective in retaining staff and creating a culture that is seen from the broader marketplace as desirable.

It can help companies better withstand the competitive talent market and competing compensation packages that are more aggressive and/or multifaceted.

Long-Term Incentives

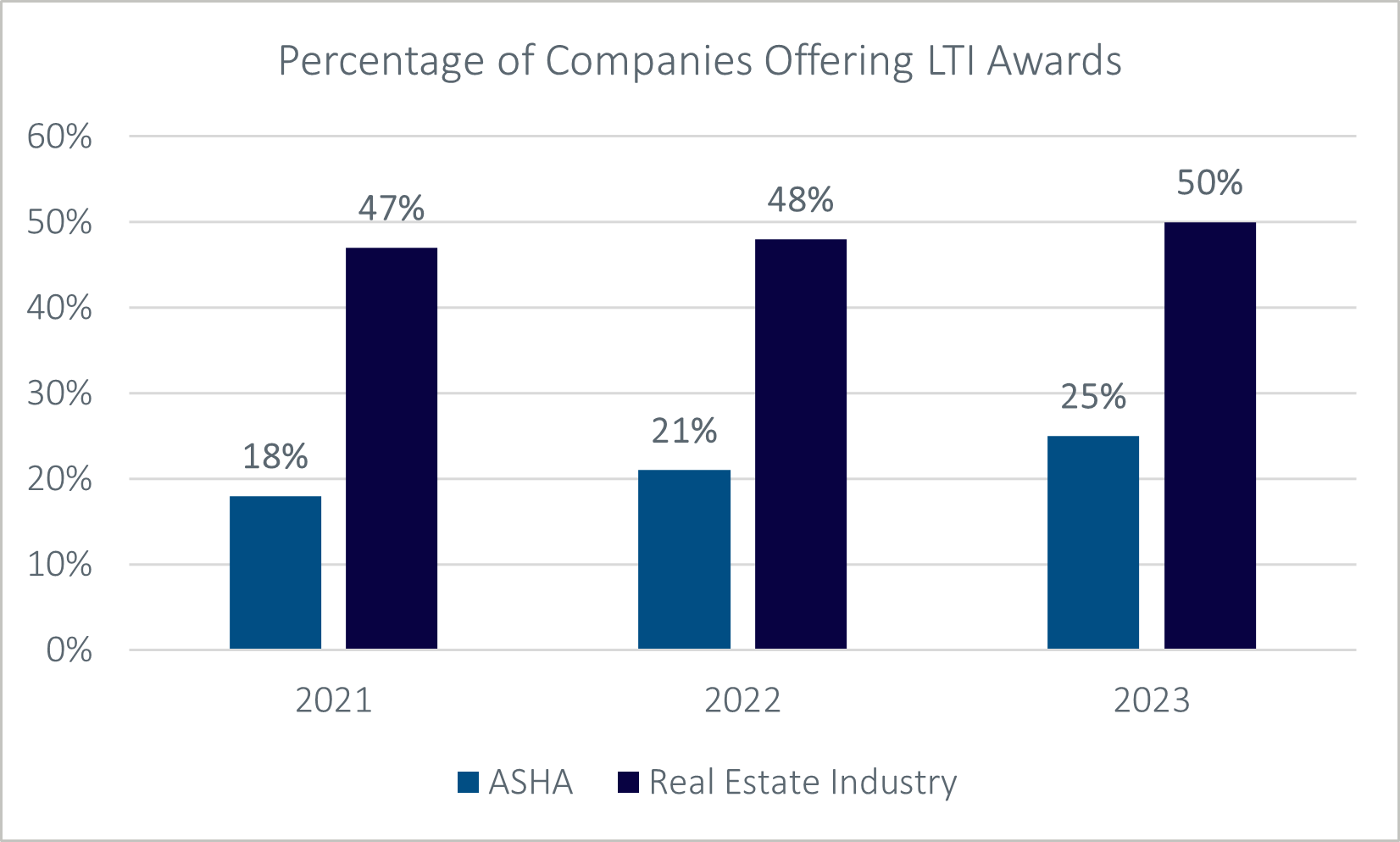

In 2023, one quarter of ASHA survey respondents offered LTI to select employees, up 4% from last year and 7% compared to 2021. Compared to the broader real estate industry, seniors housing made up some ground, though very slight.

Where ASHA companies are expanding LTI awards significantly is in the inclusion of division/function heads in the programs at a greater rate. Citing the ever-increasing value of this role to drive operational performance, seniors housing firms are providing a broader variety of compensation in their senior professionals’ total pay mix with the expansion of long-term incentive opportunities. Last year, 28% of division/function heads received LTI consideration as a component of their pay opportunity and in 2023 that number jumped to 36%. This is strong recognition of its retentive value.

Moving into 2024

Despite considerable obstacles—labor shortages, higher turnover levels, an inflationary climate, and continued occupancy challenge—seniors housing firms are recognizing the value of a well-designed compensation plan to attract and retain difference-making professionals. As they find success based on teams or an individual executive’s performance, beginning to purposefully incorporate formal development plans and creating long-term succession plans will be the next logical step.