Advisor Blog | Jan 2025

Why a Strong CD&A Narrative Matters for Oil and Gas Companies

The oil and gas industry faces unique challenges and scrutiny, making it essential for companies to use the CD&A to clearly communicate executive pay strategies.

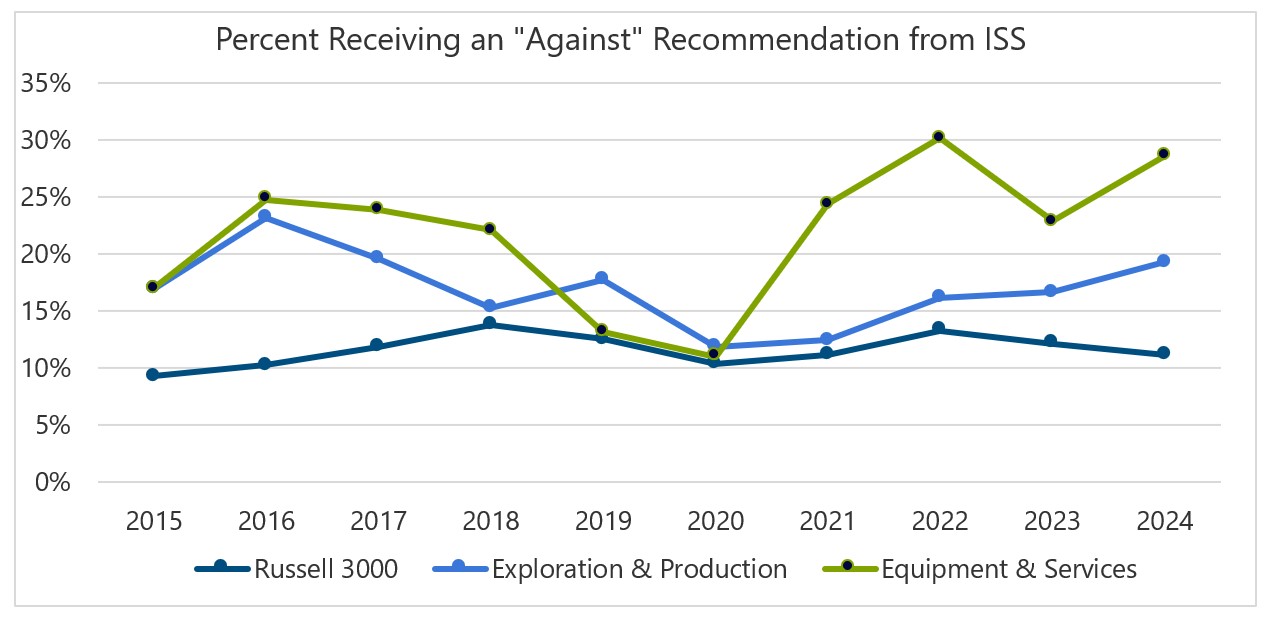

The oil and gas (O&G) industry operates in a uniquely dynamic environment characterized by high-risk, capital-intensive projects with long investment horizons, unpredictable commodity cycles, evolving regulations, and heightened scrutiny. The reality is O&G companies—particularly in subsectors like oilfield services (OFS) and exploration and production (E&P)—are far more likely to receive “Against” say-on-pay recommendations from Institutional Shareholder Services (ISS) than companies in the broader market. These trends underscore the harsher lens through which O&G pay programs are evaluated and why your Compensation Discussion & Analysis (CD&A) narrative should be viewed not just as a compliance exercise, but as an essential tool to proactively tell your executive compensation story.

A strong CD&A narrative can help your company demonstrate the rigor of your goal-setting process, the alignment of pay practices with long-term value creation, and a commitment to retaining the executive leadership necessary to navigate volatility and seize opportunities. Without a cohesive and transparent narrative, O&G companies risk having their pay programs misunderstood or unfairly penalized. In an industry that exists outside typical market cycles and has operating models that can be unclear to outsiders, effectively communicating the rationale behind performance metrics and goals is critical to shaping perceptions and maintaining stockholder trust.

The following examples offer a hypothetical perspective on common CD&A drafting challenges faced by O&G companies and illustrate how to emphasize the right messages in specific situations.

Example 1: Booming Markets and Perceived Low Goals

Operating during a period of high commodity prices, Company ABC exceeds its performance goals by a mile, resulting in maximum annual and long-term incentive award payouts. Without supporting rationale in its CD&A, investors may perceive the performance targets as too soft. In order to get ahead of any potential criticism, Company ABC might consider emphasizing the following in its narrative by:

- Reinforcing the relevance of performance metrics. Summarize how the incentive plans incorporate performance metrics that are aligned with the company’s financial, operational, and strategic objectives, ensuring the metrics appropriately measure success and keep executives focused on achieving short-term goals and creating long-term stockholder value, no matter the business conditions.

- Demonstrating rigor in goal-setting. Highlight the thorough processes and methodologies used to establish incentive plan performance targets that strike the right balance between being achievable and appropriately challenging over the short and long term.

- Addressing commodity price volatility and long investment cycles. Acknowledge the high cyclicality and historical fluctuations in commodity prices, as well as the challenges posed by the industry’s long investment cycles. Underscore the importance of mitigating the risks associated with setting overly aggressive or unattainable goals. Highlight how the compensation committee evaluates total pay and performance over time to manage the effects of volatile performance and payouts across these extended cycles, rather than focusing solely on annual target-setting. This approach demonstrates a commitment to managing pay effectively in a highly cyclical industry, even when payouts deviate significantly from target levels.

Example 2: Awarding Performance for Non-Financial Goals Above Target

At Company XYZ, the compensation committee approves payouts for non-financial goals above target under its annual incentive plan, even though stock performance has lagged behind peers and financial performance has been below expectations. This decision reflects a deliberate effort to recognize critical achievements beyond financial metrics—such as operational performance and progress on strategic priorities—despite external challenges. However, this approach could raise concerns among stockholders about the overall balance of performance-based pay. To address these concerns and maintain transparency in the CD&A, Company XYZ should consider:

- Providing a clear rationale. Explain that rewarding non-financial goals above target reflects the executive team’s success in achieving key strategic objectives outside of financial performance, including advancements in operational efficiency, sustainability milestones, or enhanced safety standards. Emphasize how these achievements strengthen the company’s long-term positioning and create value for stockholders over time, even when relative financial performance faces pressure.

- Reinforcing retention and accountability. Highlight that the decision reflects the compensation committee’s commitment to retaining critical leadership talent by recognizing exceptional performance on non-financial goals and ensuring that leadership remains accountable for delivering on critical objectives that support the company’s long-term strategy and drive stockholder value, even in a challenging environment.

- Emphasizing robust committee oversight. Reinforce that the compensation committee follows a rigorous process for setting, reviewing, and approving performance metrics and payouts, ensuring alignment with the company’s compensation philosophy, objectives, and stockholder interests. Highlight that the committee conducts holistic reviews of performance across multiple dimensions to ensure outcomes are thoughtful, fair, and aligned with long-term goals.

Example 3: Including Sustainability Metrics

Company 123 ties a portion of executive compensation to sustainability metrics. While this reflects the company’s commitment to sustainability and responsible business practices, it also introduces potential questions from stockholders about the selection and relevance of these metrics. To address this effectively, the company could focus on:

- Articulating strategic importance. Explain how the chosen metrics align with the company’s long-term strategy, such as its commitment to reducing emissions and focusing on safety, while driving sustainable value creation.

- Outlining relevance and measurability. Be clear about how these metrics are selected, monitored, and measured, and reinforce their relevance to the company’s industry, strategy, and broader market expectations. Highlight how these metrics are weighted relative to the other financial, operational, and strategic goals in the incentive plans, demonstrating a thoughtful balance of objectives.

- Reinforcing responsiveness to investor expectations. Summarize how the metrics address key areas of interest for stockholders, reflecting alignment with investor priorities.

As you draft and review your CD&A narrative for your upcoming proxy filing, think about your company’s unique circumstances and how your executive compensation narrative needs to carefully balance the “what” (i.e., how much executives got paid) with the “why” (i.e., demonstrating pay for performance) in the context of the current landscape and stockholder expectations. In an industry where executive compensation continues to face intense scrutiny, crafting a compelling CD&A should be a top priority.