Article | Apr 2024

Biopharma IPOs: Trends in Executive Compensation Planning and Design

A review of exec pay trends and data from newly public biopharmas.

Interest in biopharma IPOs has been ticking up over the last few months. Since July of 2023 through the end of the first quarter of 2024, we’ve seen 15 biopharmas go public, which is the most in any nine-month period since 2021. While investors remain cautious, with their focus primarily shifting to later-stage companies with validated biology and clinical data, the significant amount of capital that still sits on the sidelines has led many industry insiders to expect a healthy IPO class in 2024 and into 2025.

Considering this, Pearl Meyer has evaluated recent biopharma IPOs to better understand what new trends, if any, are emerging in compensation planning and program design as companies transition to the public markets. As the basis for our analysis, we used information from Main Data Group to examine 14 of the 15 biopharmas that went public between July 1, 2023 and March 31, 2024 (one company, a foreign private issuer with limited disclosure, was excluded from the dataset). At median, our sample of companies raised $152M in capital at IPO and had a market capitalization of $578M at the time of its IPO.

| Capital Raised at IPO $M | Market Cap at IPO $M | |

| 75th Percentile | $296 | $876 |

| Median | $152 | $578 |

| 25th Percentile | $100 | $369 |

We looked at common areas of compensation planning prior to an IPO including new equity pool sizes, evergreen provisions, executive cash adjustments at IPO, and other equity plan provisions including the ability to reprice or exchange options and the scope of clawback policies.

New Equity Pool Sizes

A critical component of IPO compensation planning is establishing a new equity plan under which the company can grant stock-based awards to its employees, non-employee directors, and contractors. The new pool should be sufficiently large to allow the company to have enough shares available to attract and retain top talent for the first two or three years after going public. While equity philosophy and future headcount are important considerations for understanding how large the pool should be, most companies also consider implied overall dilution and overhang relative to market norms.

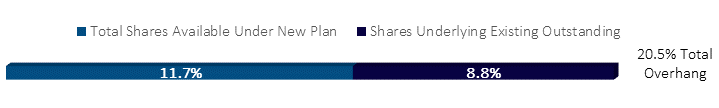

At median, we found that the recent IPOs we reviewed made 11.7% of common shares (that is, the total number of common shares outstanding immediately after the offering, before the exercise of underwriters’ options) available for grant under their equity plan. When added to a median of 8.8% of shares underlying existing outstanding equity, this resulted in a post-IPO equity overhang of 20.5% which is higher than what’s typical at late-stage private companies, but about in line with what we’ve seen at newly public biopharmas in recent years.

Evergreen Provisions

An evergreen feature, which allows a public company to automatically authorize new shares to its equity plan each year without shareholder approval, continues to be commonplace among biopharma IPOs. While public investors are understandably concerned about the potential for excess dilution created by evergreens, they remain highly popular as a flexibility tool for newly public companies. Indeed, over the last two years, when access to capital became harder to secure and equity valuations fell, the value of an evergreen feature for emerging biopharmas was undeniable. Of the 14 biopharma IPOs we reviewed, all of them included an evergreen feature in their equity plan, with all but one setting it at 5% of common shares outstanding at year-end. As a note to dual-listed companies, while the NASDAQ and NYSE permit the use of evergreens, some non-US exchanges prohibit their use.

NEO Cash Compensation Adjustments at IPO

In general, there is a step-up in cash compensation levels as companies transition from private to public. Increased visibility, regulatory, and legal pressures, as well as a stronger emphasis on investor relations, are just some of the factors which contribute to this “public company premium.” Of the 14 biopharma IPOs that we reviewed, 71% (10 of 14) disclosed adjustments for their named executive officers (NEOs) at the time of the IPO. Not surprisingly, the median increase in cash compensation among those that disclosed was higher for the CEO (30%) than for non-CEO executives (16%).

| Executive Level | Median Percentage Adjustment at IPO | ||

| Base Salary | Target Bonus % Increase | Target Total Cash | |

| CEO | 22% | 8% | 30% |

| Other NEOs | 12% | 3% | 16% |

Other Equity Plan Provisions

Prior to an IPO, there are numerous provisions to consider when crafting the new equity plan, including director compensation limits, incentive stock option award limits, minimum vesting period on equity awards, and treatment of equity under a change-in-control. We’ve focused on two areas which have garnered the most interest recently: option repricings or exchanges and the scope of clawback policies.

A stock option repricing or exchange is considered a “third rail” tactic by many public investors and viewed to be at odds with a pay for performance philosophy. Despite this, a provision in the equity plan which expressly permits a company to conduct a repricing or exchange without shareholder approval remains prevalent. Almost 80% of the IPOs reviewed (11 of 14) included a provision in their equity plan to facilitate a repricing or exchange. Without this carveout, NASDAQ and NYSE rules require companies to obtain shareholder approval prior to effecting an exchange or repricing, and such approvals can be very difficult to achieve. A repricing or exchange should not be taken lightly, but they are a potential path for companies stuck between a proverbial rock and hard place—that is a high balance of significantly out-of-the-money options outstanding, and the inability to access new shares for grant. In biopharma, where the path to commercialization is long and sometimes bumpy, it’s inevitable that some companies will find themselves in this difficult position.

On the regulatory front, beginning in 2023, all public companies are required to adopt a clawback policy that is, at a minimum, compliant with the SEC’s final rules. While the policy per se is not part of the equity plan, the plan should refer to the clawback policy so that investors understand the conditions under which compensation can be recovered. (A full discussion of the clawback rules is beyond the scope of this article but can be found here.) However, an open question for public companies is whether they should adopt a policy which minimally complies with the SEC’s rules, or whether they should opt for an expanded policy that would satisfy proxy advisory firms’ requirements (ISS, for example, will only give full credit to clawback policies which pertain to both performance- and time-based awards; the SEC rules effectively limit the scope of clawbacks to performance-based awards). Of the 14 recent IPOs under review, we found that 13 adopted policies which were minimally compliant with the SEC rules, with just one providing for the potential recovery of time-vested awards.

In Conclusion

The circumstances surrounding strategic and compliant compensation design is always evolving and companies that are pursuing an IPO would be well advised to stay ahead of the latest developments. Indeed, over the next six to 12 months, we expect to see many more biopharma IPOs enter the public markets and so these trends will continue to take shape. While you may not need to address each of these areas, making decisions with a view to maximizing flexibility as a public company is important, particularly as the IPO may be your last best chance to do so.