Article | Apr 2019 | NACD Governance Challenges

The Compensation Committee’s Role in Strategic Succession Planning

Effective succession planning is more than just naming a new CEO; here’s how boards can help foster long-term leadership development.

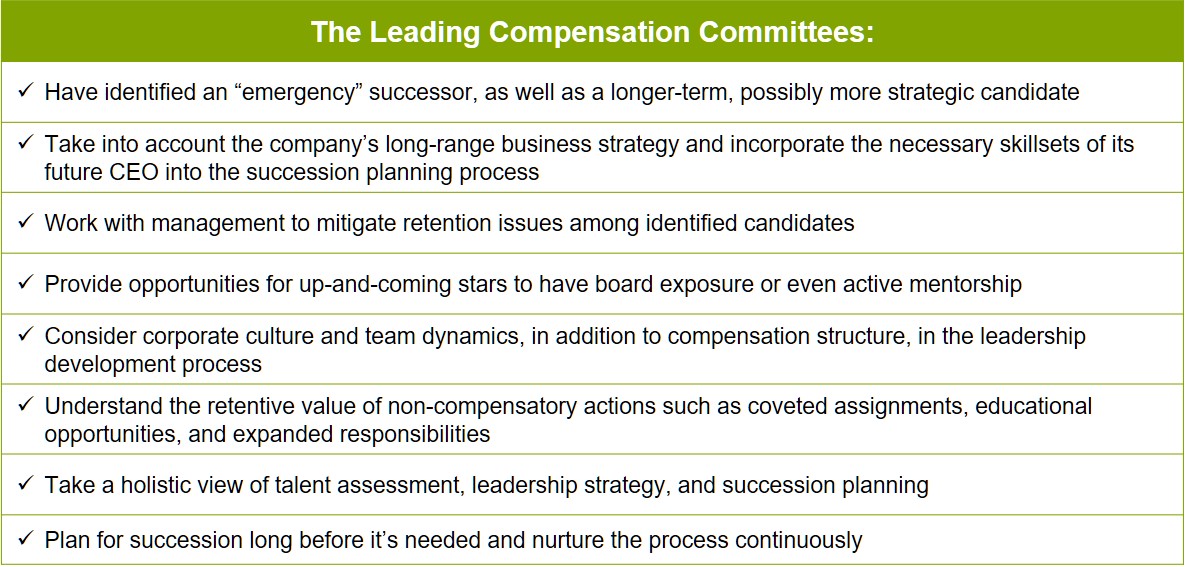

Naming a successor to the CEO is one of the board’s primary functions. However, boards can do more than simply identify a single next-in-line successor. More strategically minded boards actively guide the organization’s leadership development process and focus on recruiting, motivating, and retaining high performers on a broader scale than just the chief executive’s office.

The compensation committee increasingly bears much of that responsibility. Through its primary function, it can effectively serve the company’s leadership strategy by structuring and managing pay programs relative to both planned and unplanned CEO changes, as well as by taking into account a longer-term and a more holistic view of the company’s talent management philosophy.

The Inherent Risks in the C-Suite

We are seeing more turnover than usual among CEOs in recent years. This trend is both voluntary and involuntary and driven by internal issues of performance, as well as by issues of individual behavior. It is exacerbated by the current economy and employment rates, which have provided a certain level of freedom for executives to move. In this current environment, the already tough endeavor of naming a successor is even more uncertain.

While each presents a unique set of challenges, there are two types of transitions that the board should be preparing for: expected and unexpected.

First, it is vitally important for a board to identify its plan of action for an unanticipated executive departure. This may be what immediately comes to mind when thinking of succession planning. There should be at least one individual in whom the board has confidence to step in and run the company successfully in its current state. Retention of this individual is key; therefore, how they will be compensated for assuming the helm should be planned by the compensation committee in advance. Structuring the compensation plan that kicks in with this kind of transition should reward the individual for a willingness and ability to “save the day,” as well as acknowledge the potential short-term nature of the assignment and the possible lack of a long-term CEO role, if that is indeed the case. The discussion about backfilling any key role left open is also part of this process.

The second category—the planned-for succession—is notably more strategic and works hand in hand with the organization’s business strategy. It’s highly likely your strategic CEO replacement will not be the same individual as has been identified for your “emergency” plan. In preparing for a planned succession, the committee will be thinking about such things as how a shifting product mix, a geographic expansion, or an anticipated merger or acquisition will reshape the company. How does that affect the profile for the ideal executive who will lead what may be a very different organization than what exists today?

Looking carefully at both scenarios ensures boards are not going through a simple check-the-box exercise.

The danger to your succession planning, however, may go beyond your top executives. Consider that by the time someone has reached the C-suite, they likely have a lucrative and at least somewhat long- term compensation structure that provides the company with a certain level of protection against their voluntary departure. (The organization will, of course, have other compensation-based protections in place designed to thwart behavior-related departures, such as change-in-control provisions and clawback policies.) It is in the ranks below senior management where there is considerable risk of departure for more clear advancement opportunity.

Companies can mitigate the risk of a potentially weak C-suite pipeline by recruiting and developing high-potential employees in a manner that builds a strong executive team several levels below the most senior. This is the talent pool from which, in time, you can begin to pull up those with demonstrated talent, considerable institutional knowledge across a variety of functions, and a commitment to the organization.

The Role of the Compensation Committee

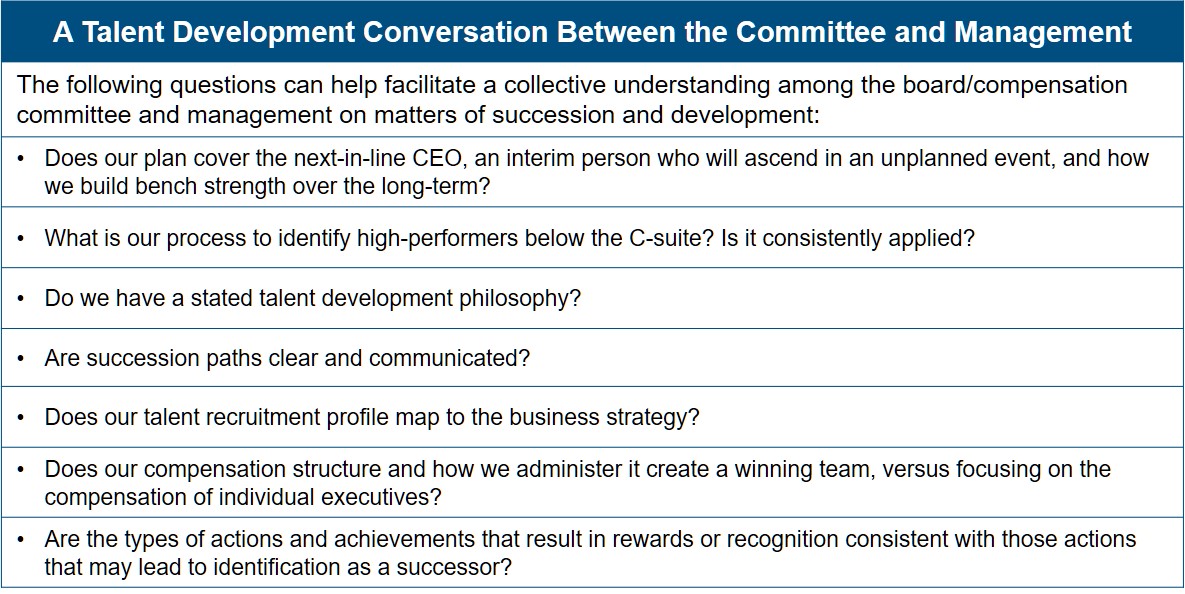

The compensation committee has clear responsibility for guiding development of the pay philosophy and the specific compensation tools that enable a company to retain and motivate high performers. While it’s unrealistic—and potentially overstepping—to expect to have a considerable amount of input below the named executive officer level, the board can be appropriately involved in a deeper discussion of the succession pipeline overall.

The compensation committee can be active in ongoing discussions with management about the kinds of programs that are put in place to encourage development and retention among the next ranks. Providing board oversight of the process, more than tracking individuals, helps management to maintain a consistent level of focus on the issue and to incorporate ongoing identification and nurturing of high performers into processes and the culture at large.

There are several probing questions that will help the compensation committee understand what the organization is doing to identify, develop, and reward future leaders. Because it must be clear how the company supports career progress, the board can guide management toward ensuring employees understand what it takes to be successful in general and, if so inclined, how one moves up the career ladder.

Fundamental Compensation Considerations

Compensation committees should have a strong sense of all the forms of recognition—monetary and otherwise—that matter to and motivate its particular employee base, both at a broad and executive level. Generally speaking, it’s important for the compensation opportunity to be reasonably competitive. This frees employees to focus on what really matters to them and the company—performing personally rewarding work, contributing to the positive aspects of the corporate culture and the working environment, improving the quality of their leadership, and uncovering future opportunities for the business and themselves.

Beginning with base pay, the salary level as compared to market sets the tone for how competitive the pay package will be. Regular salary increases over time that recognize growth and progress in their position are extremely important in signaling to high performers that they are moving ahead and viewed as successful in the organization. In fact, it is the regular cadence of the increases and the clear communication that those increases are a result of the individual’s rising star that can be more important than the specific amount.

When it comes to incentive programs, a level of variability is important, not just organizationally when the company does well (which is a plus), but also across individuals where it makes sense in order to clearly differentiate and reward identified leaders. The amounts, vesting, and payout periods can be tailored to address a particular succession need. For example, they can be structured to address retention risk among those identified as possible successors, or conversely to accelerate retirement. Some compensation-plan components that could be used to achieve succession objectives include these:

- Multiyear performance periods for long-term incentives

- A regular cadence of equity grants that vest over time (such as restricted stock), which can reward executives for long-term share price growth

- Supplemental equity grants that vest over multiple years can offer additional retention hooks

- Judicious use of above-market compensation elements, including base salaries, long-term incentive grants, and/or supplemental executive retirement benefits, can signal the recognition of an employee’s importance to the organization

- Clear and simple cash retention programs that pay over a defined time period

Benchmarking pay also has a role to play. Ensuring high performers are paid at or above market overall can hedge against them leaving the organization for better compensation elsewhere. Consistent compensation program design further down into the organization can also reinforce the company’s succession planning efforts by ensuring “ready-soon” employees who begin attaining leadership roles within the company are rewarded appropriately given their performance and future potential with the organization.

Of course, all of this is within the context of understanding that money alone will never hold a key employee; if and when another company wants your player, they will pay what they need to. There must always be reasons beyond pay that create loyalty and retention.

Thinking Broader and Long-Term: Leadership Development, Retention, and Motivation

Boards—and particularly the compensation committee—should be conducting an annual assessment of the “ready-now” and “ready-soon” leaders in key management positions throughout the company. An organization-wide skills matrix may help in this determination and is even more useful if it is arranged to look at current business conditions and operations, as well as at the skills needed to support the future state of the company.

In this age of Big Data, there are likely analytics tools and related insights that can be made available to the compensation committee. Look for information in aggregate at the more senior levels, such as turnover and promotional statistics. (Your board may already be looking at this in the context of diversity and inclusion endeavors.) What does the data say about the company’s ability to retain high–potential employees? Is the turnover wanted or unwanted? How is management handling the unwanted departures? In this data-based exploration of the leadership pipeline, you may also focus on building a diversified set of future leaders based on gender, race, age, and/or background.

For those future leaders, developing mentoring relationships, offering regional or global assignment opportunities, or supporting executive education programs can both signal their value and offer important non-pay-based retention hooks. Evaluating how the company encourages and values innovation and ensuring high performers are included in that process is another key learning experience and reward.

While inside promotions are generally less expensive and more likely to succeed than outside hires, do be planful in thinking about inside talent versus outside. There may be some positions that, under examination, don’t require internal bench strength and may be better served by an influx of new ideas and fresh perspectives.

Finally, what do you do for the also-rans? In the age of transparency, the succession is often a fairly public process. Ensure the committee has thought about how to minimize the unintended consequences when there is a need to retain key talent that may not be just right for the top role.

Conclusion: Culture and Compensation

While a structured compensation philosophy doesn’t typically have detail on leadership development or even succession planning, this is something for the committee to weigh. Given the expanding role of compensation committees’ responsibilities— that, for many companies, now go beyond a focus on pay programs for named executive officers to include oversight of the organization’s human- capital strategy—documentation of the approach to leadership development may help boards organize and explain their roles in a more coherent way.

Compensation programs best serve the corporate culture when they focus on the foundational goals of compensation: attract, retain, and motivate—and then reward. This holds true for leadership development and succession as well.