Article | Feb 2024

CEO Succession Planning: Fortune Favors the Prepared

Six tangible steps boards can take to maximize value and minimize CEO succession risk

The Challenge: Overcoming a False Sense of Security

Almost all boards talk about succession planning—at least on occasion—and recognize that this is a key responsibility. However, there can be wide divergence of opinion about what “good” CEO succession planning looks like and what is required to achieve it. For example:

- For many boards, an emergency succession plan is the extent of their focus. An interim replacement from the Board or management provides adequate cover to address long-term CEO succession more thoroughly when the time comes.

- Other boards are satisfied when the company has one clear internal successor in the form of a COO or executive in another significant leadership role.

- In other companies that have no viable internal candidates, the Board and CEO assume they will conduct an outside search for the next CEO, in which case they will prepare communications and choose their executive search resource when required.

Each of these scenarios partially help the company prepare, but each fails in some way to go the distance and provide true risk mitigation.

"...badly managed CEO and C-suite transitions in the S&P 1500 is close to $1 trillion a year."

It Pays to Be More Fully Prepared

The cost may be significant for those who are not prepared: Research published in Harvard Business Review indicates at a macro level that the cost of “badly managed CEO and C-suite transitions in the S&P 1500 is close to $1 trillion a year.”[1]

It is easy to see the risks in a sudden- loss-of-leadership scenario, when health issues, investor activism, scandals or other circumstances require an immediate, unplanned replacement. Yet there are other, less obvious risks that can likewise result in diminished value, such as losing projected internal candidates that the company bets on in the medium- to long-term, or a CEO who continually resets their intended succession timeline, leaving the company exposed to the retention challenges of a stifled flow of opportunities for future stars.

The reality is that you never know what can happen. What is “prepared enough”? In our view, boards have a responsibility to maximize value and minimize transition risk by being ready for three scenarios: immediate unplanned change, a planned transition in the one- to three-year timeframe, and strategic succession over the long term (four or more years).

How Ready is Your Board?

In recent NACD studies, 63% of boards believe it is important to improve their succession planning process, and 37% reported that “their board did not allocate sufficient meeting time to CEO succession planning over the past 12 months.”

Since so many boards see room for improvement, individual directors have the opportunity to engage their fellow directors in the pursuit of greater preparedness against CEO transition risk. The question is how to kick-start frank conversations about why greater preparedness is needed and how to move the board forward on its responsibility. We encourage directors to have a candid discussion about how ready the company is under each CEO succession scenario, and then develop a plan to mitigate risk.

In recent NACD studies, 63% of boards believe it is important to improve their succession planning process.

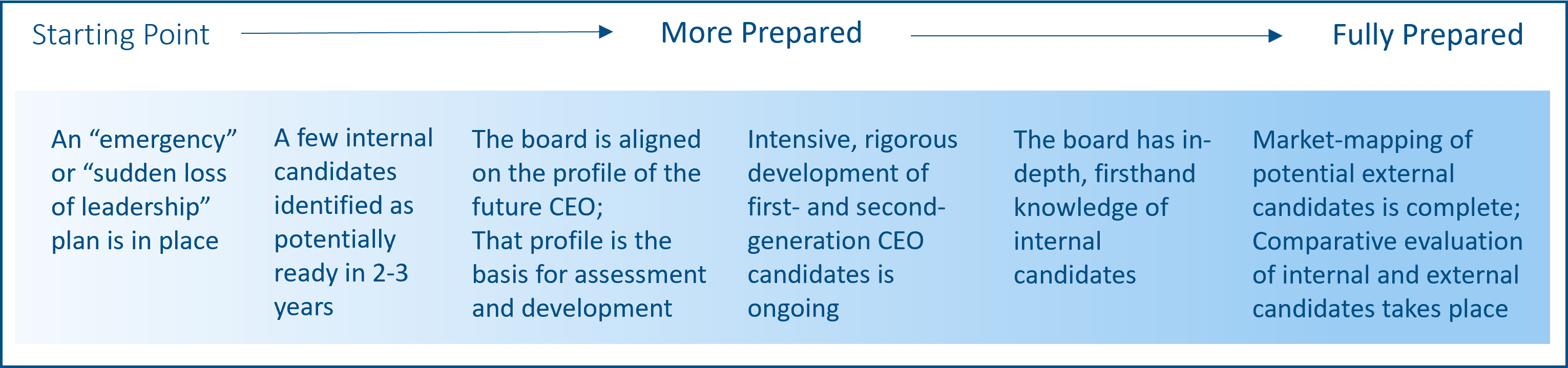

We see readiness as an evolving journey, with each company in their own unique situation. Honestly assessing the current state and agreeing on what "fully prepared" looks like is the first step to moving further along this continuum. We offer the framework below as an aid to the board's discussion. Moving the company further to the right towards full preparedness increasingly reduces risk and maximizes the potential for a successful, value-adding CEO transition.

What Tangible Steps Move Boards Along the Journey?

Know What You Need. As the board and management collaboratively discuss future business strategy, creating a success profile based on that strategy and what the company needs in its future enterprise leaders can be a natural entry point for building a stronger succession plan. This profile should answer the question “Given our vision and strategy, what skills and experiences will our top leaders need in the future to sustain and grow the company?”

Rigorously Develop What You Have. We can’t overstate the importance of this strategy, which is often the most overlooked. Internal leadership pipeline development has high return on investment. The key is thorough assessment, then ongoing coaching, and ultimately specific experiences that can prepare leaders for increasing responsibility and new roles. Business turnaround assignments, new market development projects, or other strategic initiatives can pay off both short-term and long-term. The key is to build a robust, diverse, and experienced pool of leaders across the company. This is not an area in which to take shortcuts. A leading executive search firm published S&P 500 data in 2023 that indicate 82% of new CEOs in 2022 were internal promotions.

Measure Leadership Impact. It’s common that at the C-suite level and one below, most executives require intensive 360-degree feedback with hands-on coaching in order to break through long-standing habits and transform into enterprise-level leaders. Basic assessments and off-the-shelf programs are not usually enough. CEO candidates frequently need to address difficult development challenges, some of which they may have been avoiding for years. Reconciling conflict aversion, navigating rocky peer relationships, or deepening self-awareness can lead to breakthroughs that will improve their understanding of their leadership impact and potential.

Get to Know Your Leaders. It is critical that the board have first-hand knowledge of potential successors and not rely solely on depth charts or the incumbent CEOs’ view of readiness. Directors should get to know high-potential executives beyond their occasional presentations in the board room, which are important, but rarely reflect any “real life” or nuance. Provide mentoring opportunities where possible and encourage board members to interact with executives in multiple managed, but less formal processes.

Know the External Market. It’s not enough to know which executive search firm to hire when the time comes. On a periodic basis the board can look outside to evaluate executives in other companies or related industries that might fit well with their future CEO profile. Search firms call this process “market mapping,” where external targets are identified but not approached, and it can provide some context for the stated profile and talent readiness—internal and external.

Maintain the Planning Mindset. Even when successfully executed, the planning is never finished. The key to reducing succession risk and creating long-term value is ongoing, sustained preparation that is continually keeping pace with an evolving business strategy and talent pool.