Advisor Blog | Oct 2022

Salary Compression Driven by Tight Labor Market and Higher Starting Pay

Data from Pearl Meyer show increasing rates paid to college graduates and unique methods companies are deploying to combat salary compression.

Salary compression, which occurs when new hires are paid a higher wage than existing employees, has historically been one of the most difficult challenges that compensation departments face, and it’s not going away. External forces like the surging US inflation rate and high demand for labor at all levels are exerting even further pressure on the ever-present threat of salary compression, and competition for newly graduated entrants to the job market is higher than ever.

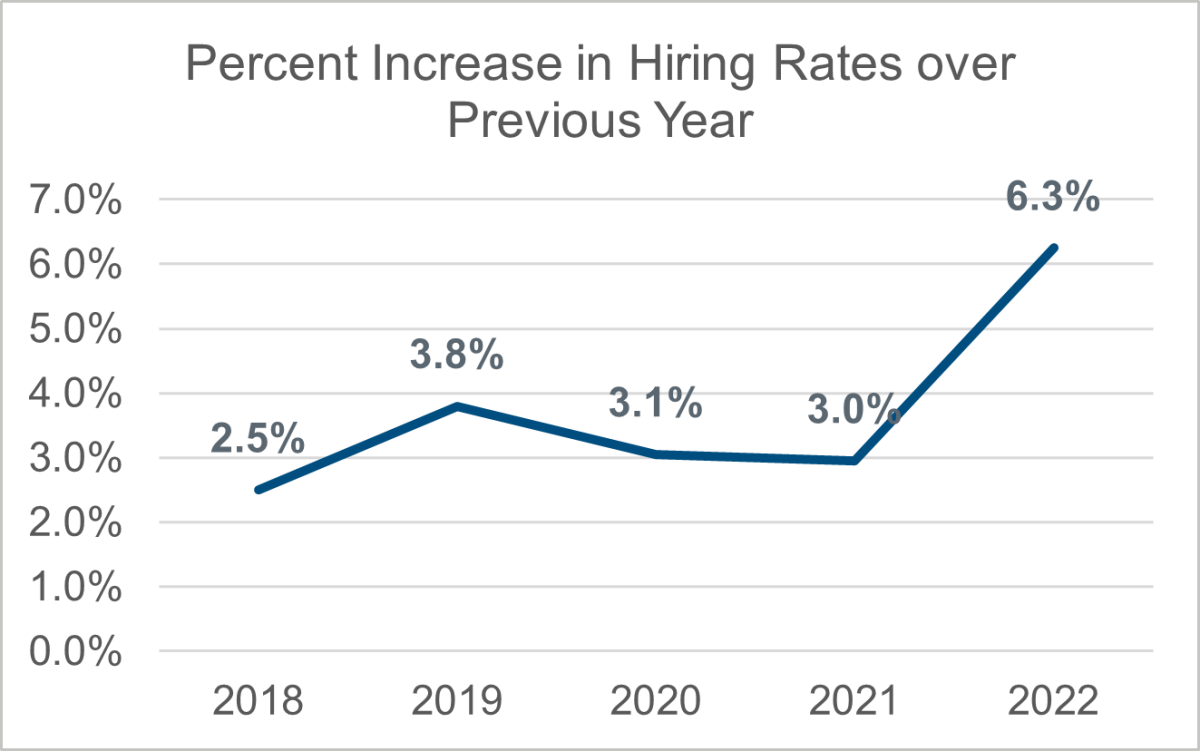

Findings from Pearl Meyer’s 2022 College Graduate and Intern Survey reveal that after a dip in the number of firms experiencing salary compression in 2021, that number is increasing once again, with 60.9% of organizations in 2022 saying they are experiencing compression. Also in the last year, the year-over-year increase in hiring rates paid to recent graduates with a bachelor’s degree has more than doubled to 6.3%, after seeing consistent but relatively small increases since 2018. This increase speaks to the overall competitiveness for talent and is evidence to the fact that in this competitive job market companies are paying a premium to attract and retain talent.

Looking at where demand is highest, as one might expect, technical bachelor’s degrees continue to be the highest paid, with computer science, electrical and computer engineering, and chemistry securing average base salaries of $83,997, $82,621, and $79,688 respectively. These figures represent increases in base salary rates compared to 2021 as well. Interestingly, the highest jump in base salary rates among graduates with bachelor’s degrees compared to 2021 is in education at 23%, demonstrating that upward forces on compensation for recent graduates is taking place across the board and is not just limited to those in technical fields.

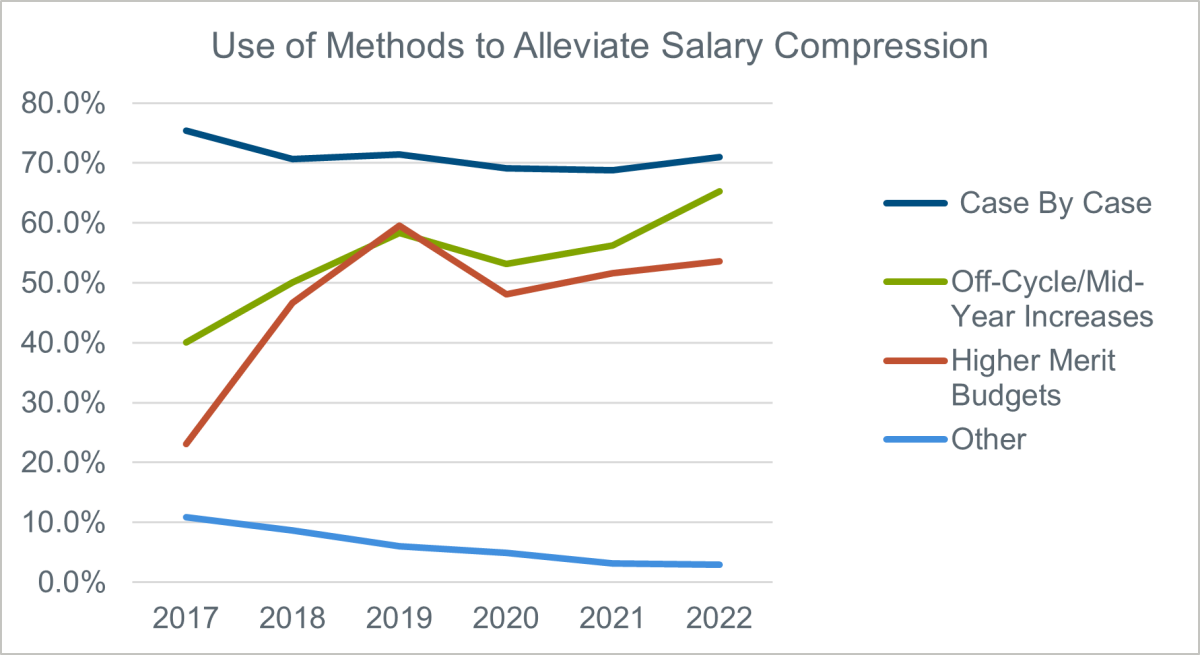

Our survey also shows that organizations are trying to combat salary compression in numerous ways. Among the most popular approaches is simply handling each instance of compression on a “case-by-case” fashion, offering off-cycle or mid-year salary increases, and increasing merit budgets. In fact, since 2017, the use of off-cycle or mid-year salary increases has steadily increased and we have seen the highest year-over-year increase in usage within the last year.

Similarly, since 2017 we have seen a significant rise—over 30%—in organizations increasing their merit budgets to combat salary compression. Although this figure is roughly 5% larger than the use of off-cycle or mid-year increases, the rate at which companies employ off-cycle increases has grown at a more stable rate.

Further, the use of mid-year increases is not just evident in the firms surveyed in the College Graduate and Intern report, as several other Pearl Meyer reports have found similar results pointing to a widespread strategy of mid-year increases across organizations. In response to recent labor market trends, Pearl Meyer conducted a special poll regarding 2022 base salary increases. Over 330 organizations participated and about one third of those organizations indicated that they are considering or planning to provide mid-year salary increases in 2022. Additionally, in a compensation planning survey of leading biotech and pharmaceutical companies published in September of 2022, Pearl Meyer found that over 25% of participating firms are currently, will in the future, or are considering providing mid-year increases. For a historically seldom-used compensation method, this is a noteworthy trend in the marketplace to watch.

As we enter the fall budget planning cycle, monitoring these metrics and noting how salary compression is affecting talent retention and internal pay equity will continue to be crucial for compensation professionals across industries. The 2022 Pearl Meyer College Graduate and Intern Compensation Survey includes the most up-to-date compensation planning data and offers a broad look at what other organizations are experiencing and how they are addressing the issues. It can be a valuable tool and provide data to back a well planned compensation strategy.