Advisor Blog | Apr 2025

2025 Proxy Season Early Returns in the Oil & Gas Sector

New data for oilfield services and exploration and production companies provide insight on CEO base salary changes and incentive plan trends.

Introduction

Based on early public company proxy filers within the oilfield services (OFS) and exploration and production (E&P) industries, we summarized the impact of the sector’s strong performance on recent CEO compensation. The most recent fiscal year’s data was collected from 17 OFS companies with revenues ranging between $300 million and $36 billion. Separately, we also looked at findings for 10 exploration and production (E&P) companies with a median revenue of $4.0 billion and a median market cap of $9.6 billion.

This brief report will cover changes in base salaries for CEOs, trends in annual and long-term incentives, and the current outlook for the balance of 2025.

Base Salaries

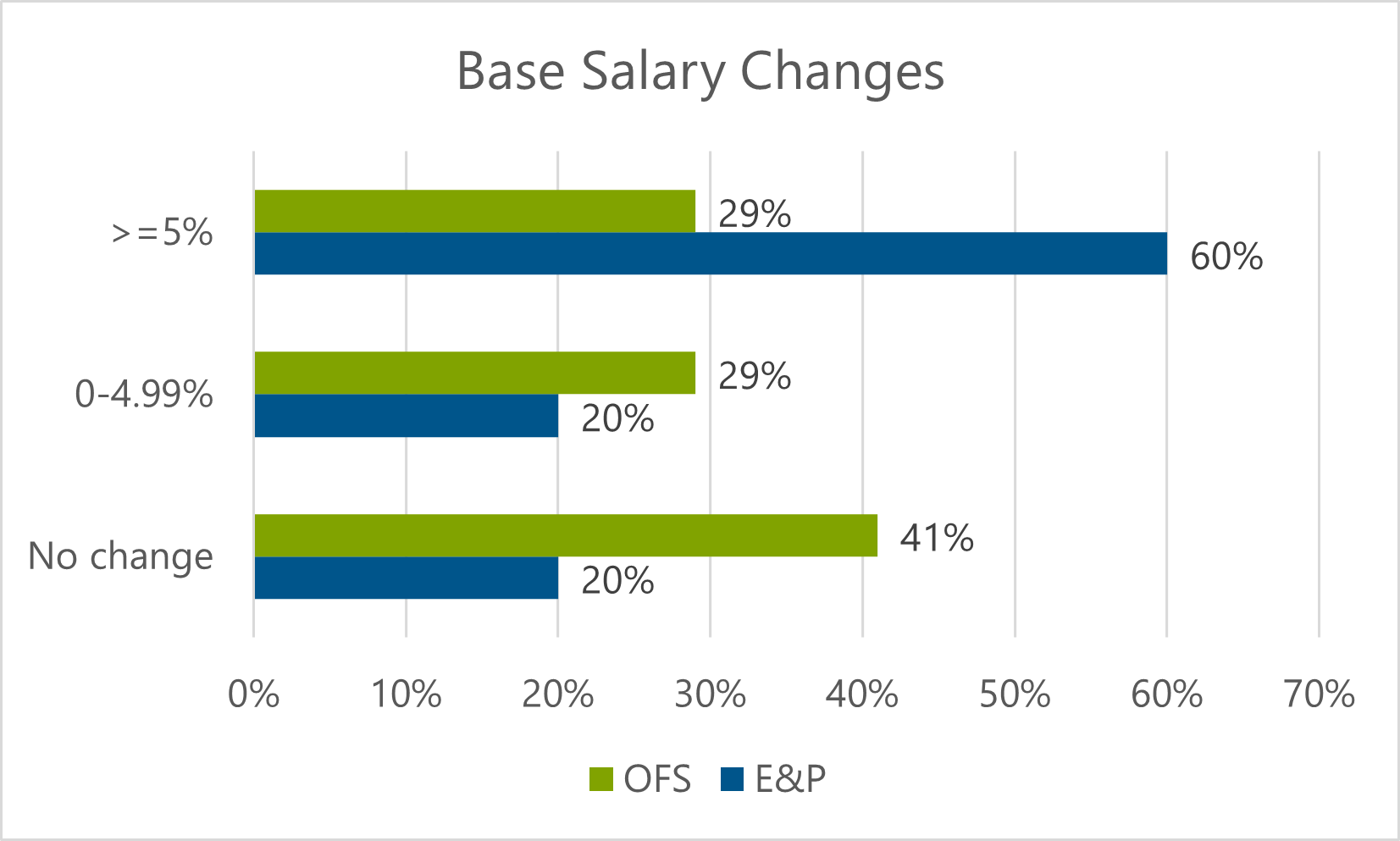

In 2024, CEO base salaries in the OFS sector saw a modest increase of 3.1% at median, with 41% of companies keeping CEO salaries flat from 2023. The median increase is more conservative than what we’ve seen in the recent past (5% in 2023), but similar to our forecast for 2025 (3.5%).

CEOs in the E&P sector received more aggressive base salary increases, with a median increase of 5%. Fewer CEOs were held flat in the E&P space (20%), and notably, 30% saw significant increases of 13% or more.

Annual Incentives

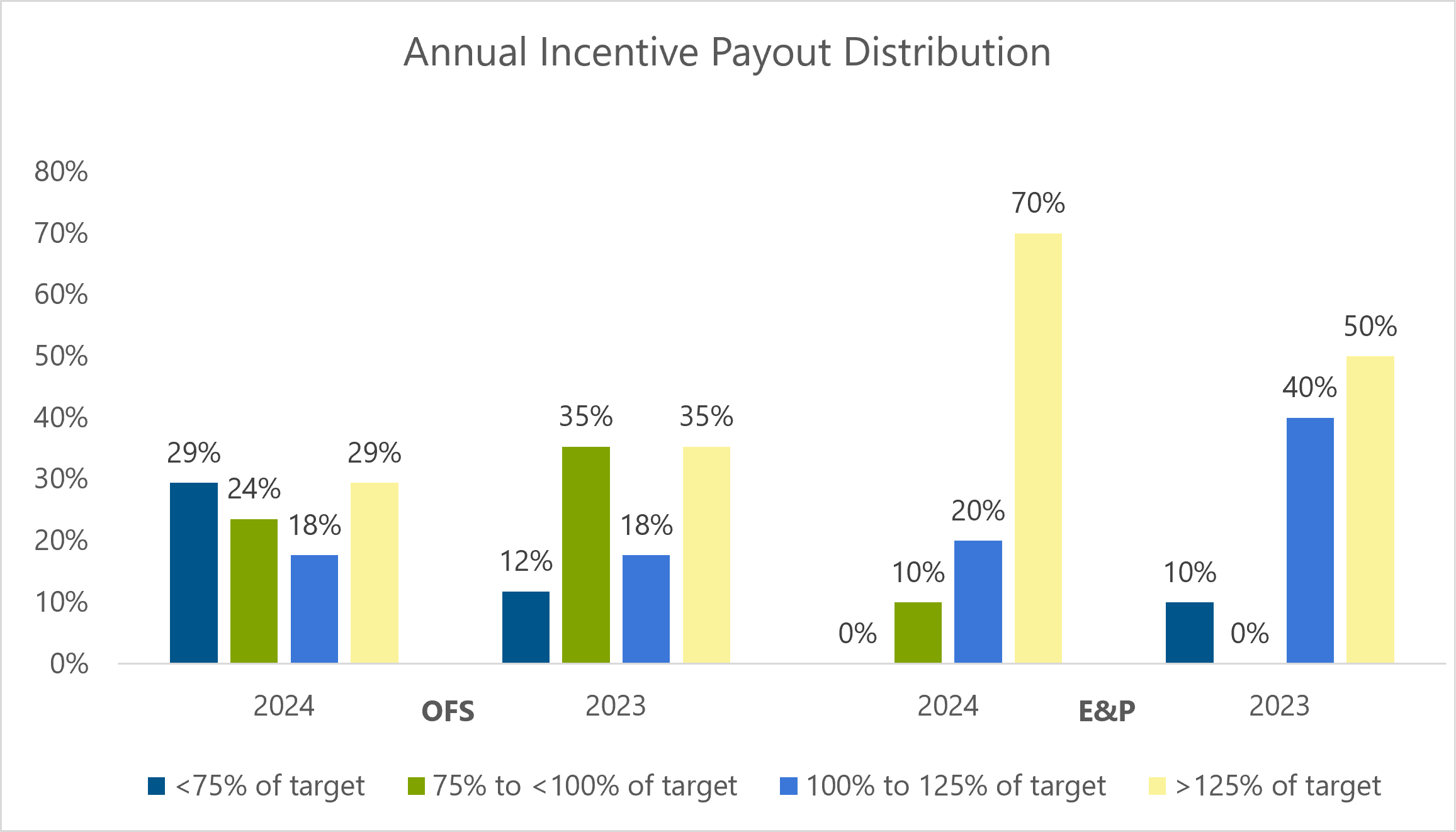

Annual incentive payouts for oilfield services companies in 2024 decreased relative to 2023 levels, with a median payout of 95% of target, down from 101% in the previous year. However, there were significant differences in payouts based on firm size. Larger OFS firms, with revenues above $5 billion, had median payouts of 120% of target, while smaller firms paid just below target (90% of target at median).

E&P firms paid better annual bonuses relative to last year, with the median climbing from 128% of target in 2023 to 144% in 2024. Unlike the OFS group, there was very little variation amongst E&P companies, with 90% reporting above-target payouts and 80% achieving payouts of 120% or greater.

Long-Term Incentives

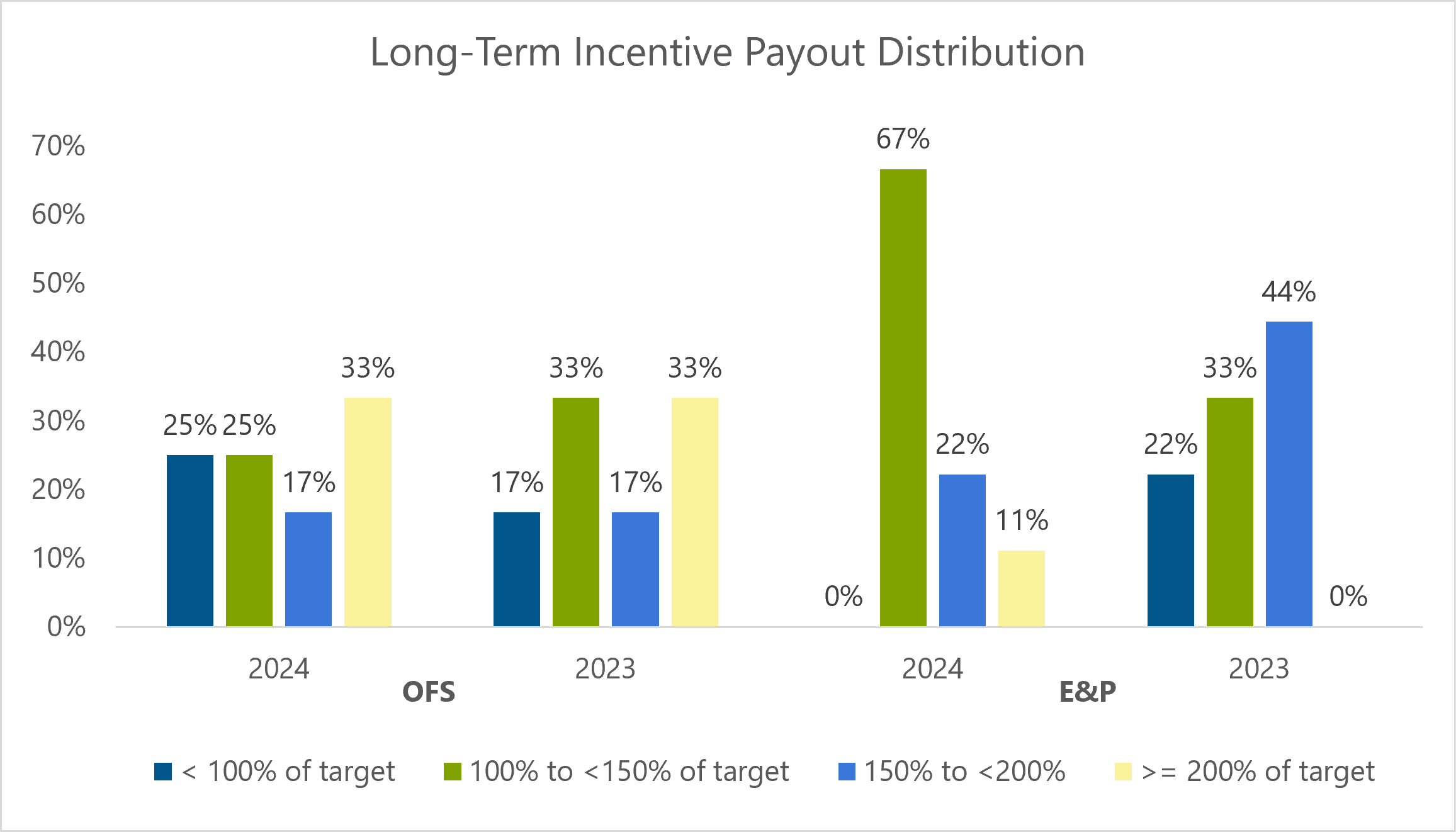

Long-term incentive (LTI) awards for OFS firms increased by a modest 2.1% in 2024, which is lower than expected and likely due to declining share prices for 47% of the group relative to last year. The need to manage equity dilution was likely a key factor. Among the twelve firms with performance-based LTI cycles ending in 2024, 75% paid above-target, with a median of 152%. This reflects an increase from 145% of target for cycles that ended in 2023.

E&P firms experienced more substantial increases in LTI levels, with a median rise of 4.7%. Despite 100% of performance-based LTI plans for these E&P companies paying at or-above target in 2024, the median payout of 125% was below that of the OFS group.

Conclusion and Outlook for 2025

Given current levels of economic uncertainty, we believe that many oil and gas firms will continue a modest approach to compensation adjustments in 2025. Modifications to the design of incentive programs will likely be minor, but could come in the form of increased weightings for non-financial metrics to address uncertainty in financial goal-setting. For some companies there will be “room” in the plan for non-financial criteria, as we see continued movement away from ESG-related criteria.

With the outlook of the industry being uncertain, we encourage clients to look back at the goals established for 2025 in their annual and long-term incentive plans and begin to discuss what adjustments can be made and what the process might be should there be an extended downturn in the market. Looking further into the future, making sure incentive plans are resilient and ensuring performance criteria consider business and strategic goals, shareholder interests, and industry cyclicality will be needed to balance pay-for-performance and retention in an everchanging industry.