Article | Apr 2025

The 2025 IPO Market and Compensation Considerations

For boards and executive teams overseeing pre-IPO compensation strategy, readiness and timing are paramount.

The landscape for Initial Public Offerings (IPOs) has certainly been bumpy in recent years. While the early 2020s saw a surge in IPO activity, driven by favorable market conditions and Special Purpose Acquisition Companies (“SPACs”), the past couple of years has been marked by a notable decline. The number of IPOs in the US stock market dropped from a record high of 1,033 in 2021 to just 181 in 2022, and 154 in 2023. There was an uptick to 238 in 2024. The decline trend can be attributed to several factors, including the increasing popularity of private markets, the high cost and complexity of the IPO process, and the volatility and uncertainty of the stock market.

Despite the recent ups and downs, the IPO market remains a critical avenue for many companies seeking to raise capital and achieve growth. However, the current economic environment presents unique challenges and opportunities for companies considering going public.

2025: Resurgence of IPO Activity or Increasing Uncertainty?

As of the first quarter of 2025, there were 75 IPOs on the US stock market, marking an approximate 74% increase compared to the same period in 2024, which had 43 IPOs by the end of Q1. This resurgence in IPO activity could be attributed to interest rate cuts, stronger equity valuations, and anticipated regulatory policy changes, which have encouraged companies to return to the public markets. Sectors like artificial intelligence, cybersecurity, and fintech have seen new offerings, which had previously been on pause pending more favorable conditions.

While early-year optimism suggests continued momentum throughout 2025, recent geopolitical and macroeconomic uncertainties—including tariff disputes, revived inflationary pressures, and potential recession concerns—have tempered expectations. Nevertheless, a considerable backlog of IPO-ready companies underscores a latent demand for public offerings. For compensation committees and executive teams overseeing compensation strategy, readiness and timing are paramount.

Compensation in Privately Held vs. Publicly Traded Companies

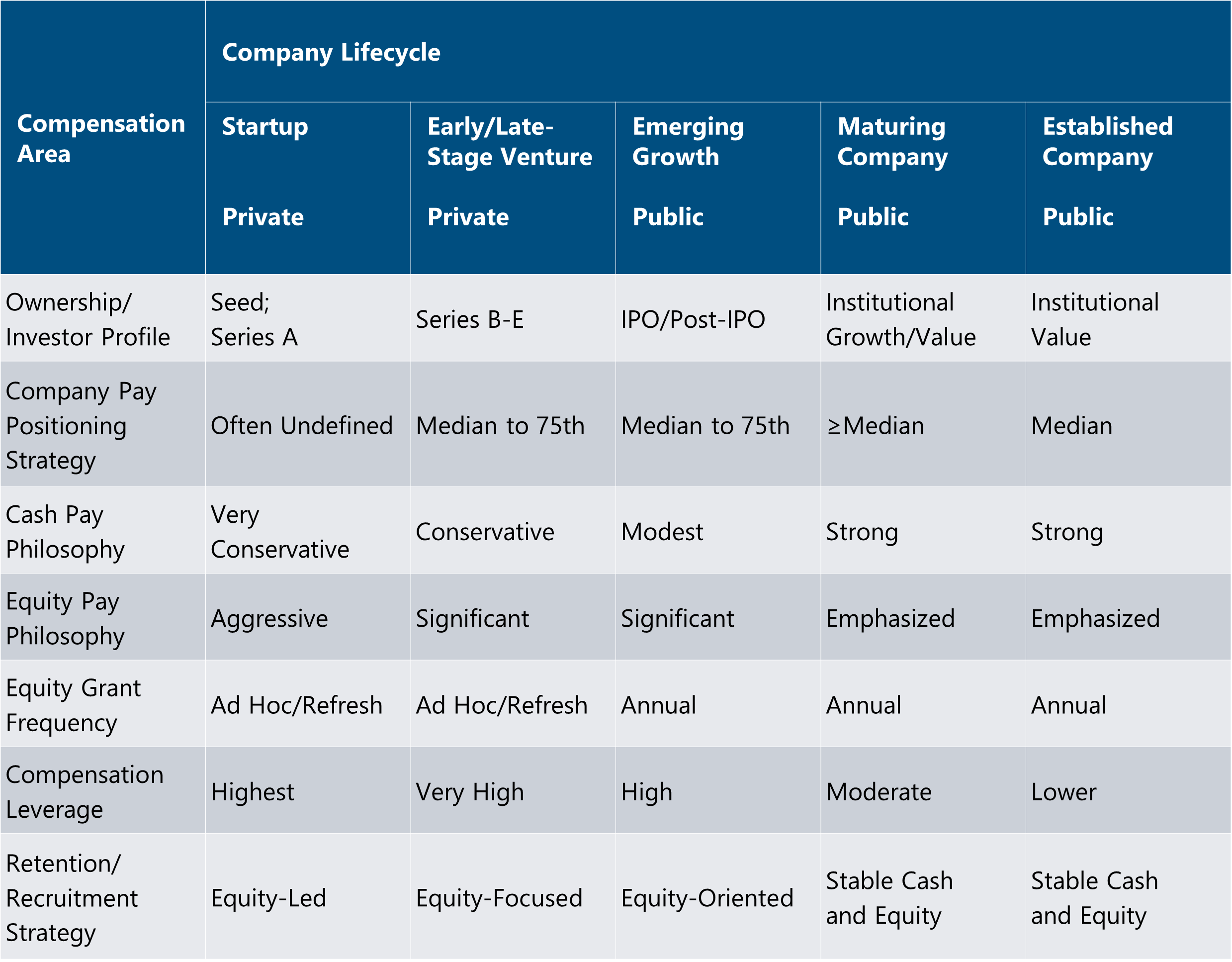

Our experience advising both privately held and publicly traded companies reveals notable distinctions in compensation structures as companies evolve. These differences are often pronounced across phases of growth, from seed-stage ventures to mature public companies. The following framework summarizes typical practices:

Interestingly, despite these historic differences, we now find that over time, later stage private companies are starting to adopt compensation practices that are more typical of public companies. This shift can be attributed to several factors, including the need to compete for talent with other public companies that offer stronger cash compensation and regular liquidity of equity, the anticipation of going public, and delays in finding the right window for the IPO process due to regulatory challenges and market volatility and uncertainty.

Forward-Thinking IPO Practices

The IPO surge of 2021 offers important lessons for today’s companies preparing to go public. Many firms issued oversized, front-loaded equity grants (often in the form of stock options and/or performance-based equity tied to stock price or profit hurdles) to executives, aiming to replicate pre-IPO gains and signal alignment with shareholders. However, these grants proved risky—highly dilutive and often underwater—leading to unrealistic future expectations. A more measured approach—aligning grant size with a consideration for the unvested value of pre-IPO equity at IPO—combined with a long-term equity philosophy and in line with peer norms (e.g., 50th–75th percentile share usage), offers greater sustainability and internal consistency.

Beyond equity grant size, companies should also reconsider the mix of equity vehicles and performance metrics used. Traditional stock options often lose retention power in volatile markets. Introducing performance-based equity—even with shorter performance periods than the typical three-year period—can balance accountability and flexibility, aligning with investor expectations while recognizing the forecasting challenges of a newly public company. However, to the extent that performance-based equity is contemplated, consider balancing the equity portfolio with time-vested restricted stock, to provide for a hedge against any initial volatility in the first few years as a public company and provide for executive retention/holding power.

In addition to traditional financial-based metrics, there may be an opportunity to consider strategic business milestone goals that are key components of a company’s business strategy as metrics in a performance-based equity plan. All the above considerations should be deliberated within the context of the company’s business strategy, its ability to forecast long-term results, and its unique industry dynamics.

Finally, as the possibility of an IPO begins to take shape, it is equally important to assess leadership readiness. Not all executives thrive in a public environment, and many don’t have experience running a publicly traded company, or even a strong grasp of how different the myriad requirements of public company management will be. A structured evaluation of existing talent helps identify development needs and succession plans, ensuring the team is equipped for the transition. Taking this same anticipatory approach in assessing directors on the board may also be beneficial.

Companies that take a forward-thinking, disciplined approach—calibrating equity, innovating plan design, and strengthening leadership—will be better positioned for long-term success in today’s evolving IPO landscape.

In Summary

When preparing the compensation plans and processes of your company for an IPO, plan early and thoughtfully. Depending on the long-term strategy of your organization, it may make sense to model your company’s compensation policies and arrangements based on typical practices at publicly traded companies (based on a thoughtfully developed peer group) and do this considerably in advance of the planned IPO. Having well-designed compensation plans in place ahead of time can contribute to your company’s success as it becomes subject to the scrutiny of a broader shareholder group and the public.