Advisor Blog | Jul 2024

Midstream Oil and Gas: Executive Compensation Data from 2024 Proxies

Many midstream companies maintained significant levels of cash flows from operations in 2023; here is data on how that affected CEO pay.

Introduction

The US oil and gas sector performed quite well in 2023, even as it was slightly down from 2022 and faced ongoing changes in governance. During 2023, midstream oil and gas companies outperformed the broader energy sector as they were less impacted by weaker commodity prices and, further, many companies were able to maintain significant levels of cash flows from operations.

Based on early public company proxy filers, we summarized the impact of the industry’s strong performance on recent CEO compensation disclosures in the midstream subsector. We have consolidated the compensation data for the industry’s earliest public filers, a group representing 16 midstream companies with revenues ranging from approximately $400 million to $48 billion over the last 12 months (and market capitalizations between $90 million and $42 billion), and compared their target compensation figures to the 2022 data of the same firms. Topics covered include:

- Base salary changes;

- Annual and long-term incentive trends (target and actual payout); and

- The performance of larger industry players versus the broader midstream sector.

We also analyzed a subset of the aforementioned 16-company group consisting of the five largest constituents. These firms have a median revenue of $18 billion over the last 12 months and a median market cap of $40 billion as of December 31, 2023.

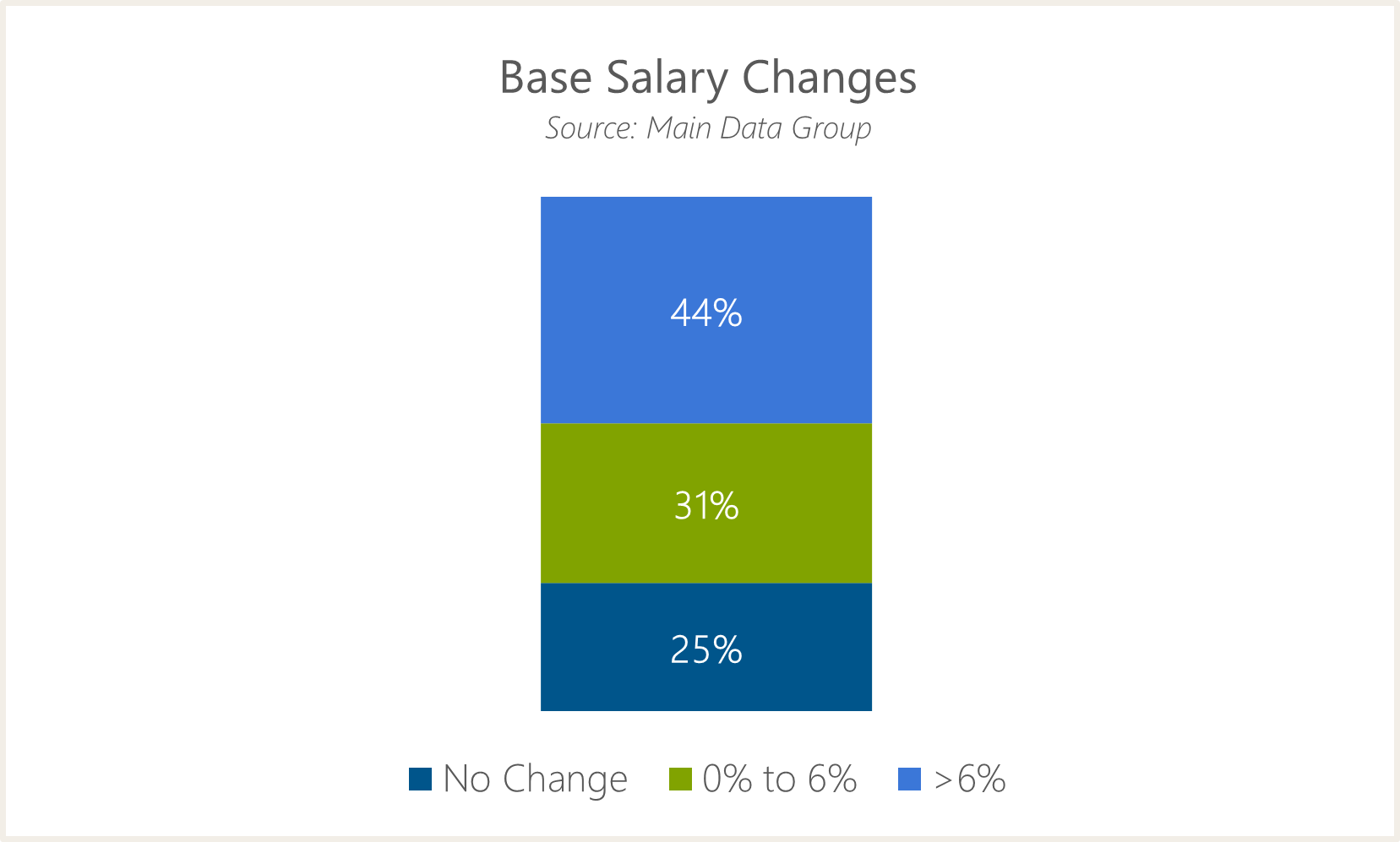

Base Salaries

Base salaries continue to grow at a steady pace, particularly for the CEO position, with a median increase of 5.1% with roughly 75% of the group increasing their CEO’s salary.

We also analyzed a subset of the aforementioned 16-company group consisting of the five largest constituents. These firms have a median revenue of $18 billion over the last 12 months and a median market cap of $40 billion as of December 31, 2023. This subset had a median of 4.5% growth in base salary, which is in line with, but slightly less than, the broader group median.

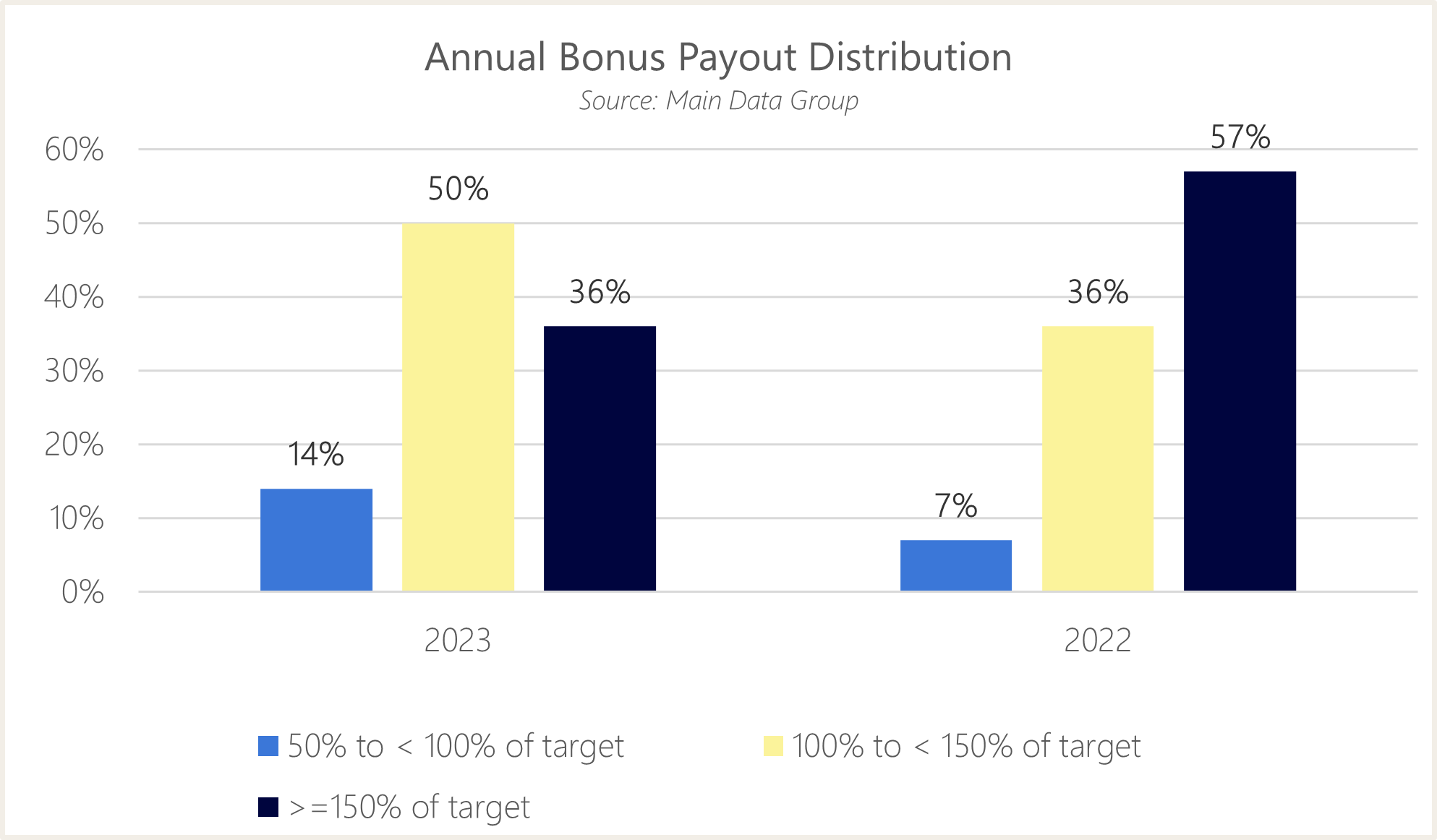

Annual Incentives

Annual incentive payouts for 2023 performance were distributed well above target with a median payout of 147% of target. Payouts declined by approximately 12% compared to 2022 median performance of about 159% of target for this same group. Roughly half of the companies paid out between 125% of target and 175% of target. The range of outcomes vary widely with this group, ranging from 74% to 200% of target (excluding two companies with discretionary plans whereby payouts were determined by the compensation committee), with payouts generally trending a bit higher as firm size increases.

For the largest five companies in this group, annual incentive payouts were slightly higher, with a median payout of 149% of target and with a range of 127% to approximately 200% of target.

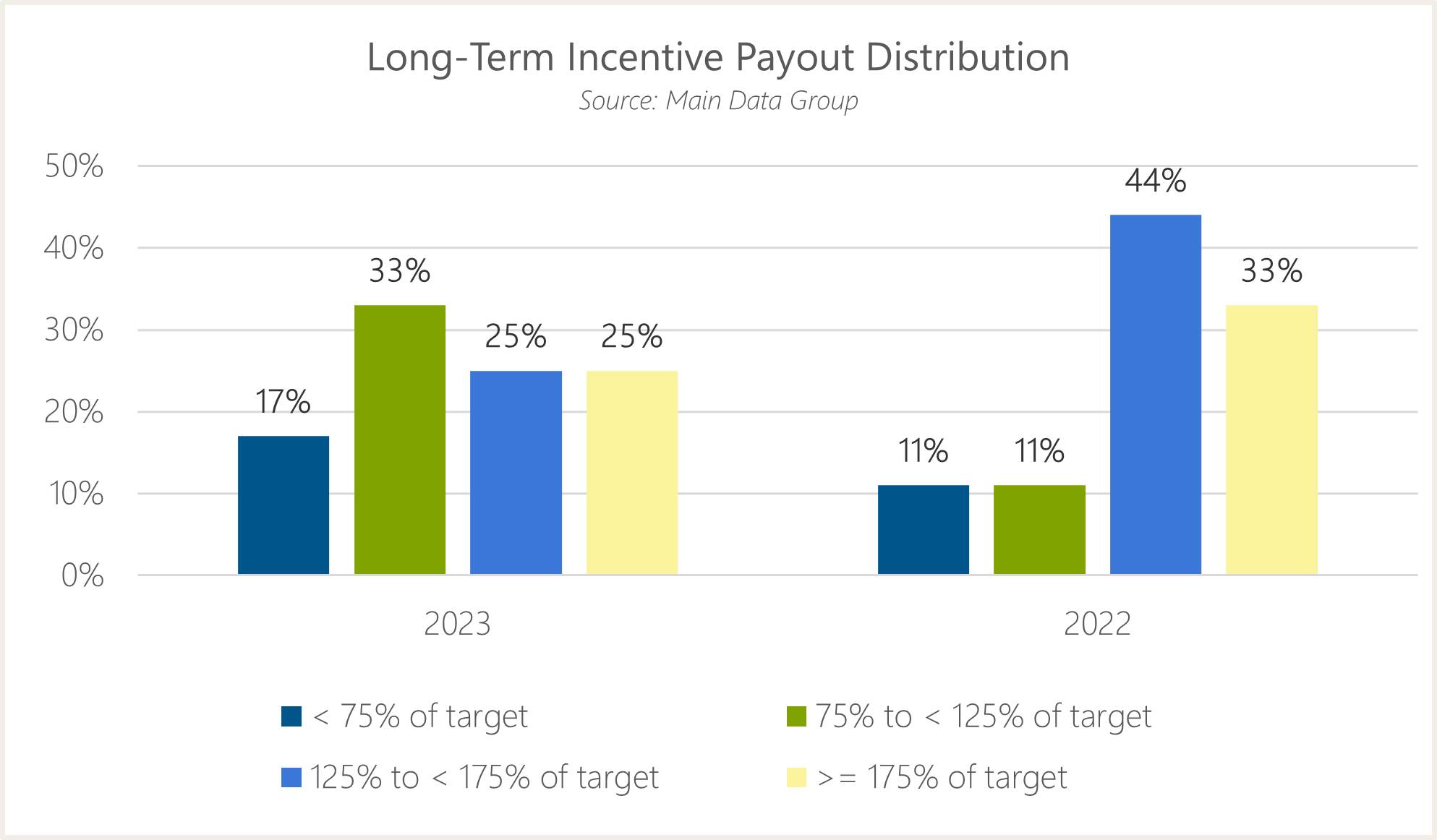

Long-term Incentives

Long-term incentives (LTI) targets grew significantly, with the median moving up 11% and many increasing by more than 15%. Interestingly, those companies with the highest base salary increases tended to have the highest LTI increases as a percent of base (resulting in significant increases to total compensation).

Furthermore, payouts for LTI plan cycles ending in 2023 generally performed well, with only two firms paying out below target, a median payout of about 132% of target, and over 25% of the group paying out at or above 200%.

The largest five companies’ long-term incentive values grew at a slower pace than the broader group, with the median increasing 9% versus 2022 grant levels. However, LTI plan payouts were at the higher end of the group and paid well above target with a median payout of 200% of target.

Conclusion and Outlook for 2024

2024 is likely to be a strong year for CEO compensation at midstream companies, both in terms of target level increases and incentive plan payouts above target. This includes potential increases to target performance-based compensation levels, especially LTI targets. Incentive design changes will likely be minimal.

Our guidance to clients across the oil and gas industry is to take a good look at the competitiveness of their executive compensation programs, including the target levels for incentive plans. Ensuring your goal-setting process is sound, and keeping sight of the relationship between compensation and corporate performance over a number of years will help you maintain resiliency in a fast-changing market.